�EXTEND

& PRETEND:�

An Accounting Driven

Recovery

��

SHOCK & AWE

Beginning

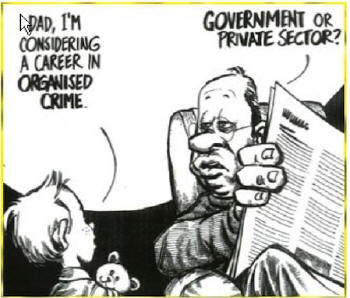

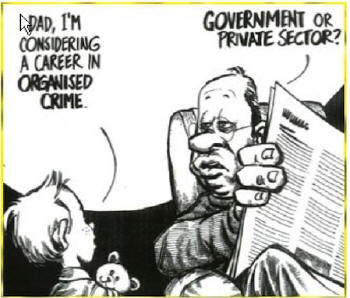

in October 2007, the world survived a Financial Crisis like no other in

modern times. It was the first truly Global Financial Crisis ever

experienced. This crisis brought to light a vast array of financial

instruments (CDO�s, CDS�s, CLO�s, etc.) being offered by murky financial

entities (SIV�s, VIE�s, SPE�s, QSPE�s etc.) that were completely

unregulated, often offshore, always off balance sheet and never traded

through any regulated exchange. Sovereign governments do not regulate

nor adequately understand them. Minimally, this is a recipe for fraud.

But definitely, it has been a modern day financial �wild west� for the

innovative and aggressive!

Beginning

in October 2007, the world survived a Financial Crisis like no other in

modern times. It was the first truly Global Financial Crisis ever

experienced. This crisis brought to light a vast array of financial

instruments (CDO�s, CDS�s, CLO�s, etc.) being offered by murky financial

entities (SIV�s, VIE�s, SPE�s, QSPE�s etc.) that were completely

unregulated, often offshore, always off balance sheet and never traded

through any regulated exchange. Sovereign governments do not regulate

nor adequately understand them. Minimally, this is a recipe for fraud.

But definitely, it has been a modern day financial �wild west� for the

innovative and aggressive!

�

�

LEND:�

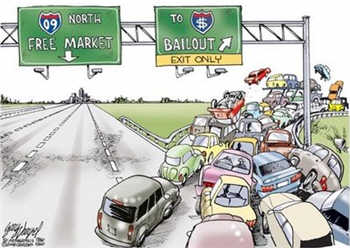

To pull the US and Global economies out of the abyss of the Financial

Crisis the authorities have been forced to accept the implementation in

the US of ZIRP (Zero Interest Rate Policy). A policy that has resulted

in a Fed Funds LENDING Rates of 0.25% but 30 to 90 day Treasury Bills

offered at absurd 3 � 7 basis points. With a +3.5% inflation rate we

have an unheard of -3.25% [0.25 � 3.50] Real Rate. The tax payer is

effectively paying the banks to borrow money!

�

BEND:�

Since the banks aren�t willing to pour this money back into the US

Economy and specifically into US expansion and consumer credit, the

Federal Reserve has additionally implemented the central bankers

�Nuclear Option� called QE (Quantitative Easing). As such the Fed has

purchased $1.4T in Agency Debt and Mortgaged Backed Securities (MBS) &

$300B in US Treasuries. This has contributed to effectively

disconnecting the US Debt market yields from any source of reality.

�

If

this is not enough, we have implemented the greatest experiment in

Monetary Policy in the history of the capitalist system with the

implementation of: 1) TARP, 2) TALF 3) PDCF 4) TAF 5) TDWP 6) TSLF 7)

CPFF 8) MMIF 9) AMLF and 10) Massive foreign currency SWAPS. All of

these initiatives were aimed at BENDING a failed system back into

operation through Government Guarantees that �temporarily� removed

inherent risk. It is to be seen just how temporary these programs will

become. Remember, Income tax was originally implemented to solve a

temporary funding crisis! These initiatives intentionally improve

banking profits by an extraordinary degree and the banks will no doubt

lobby to ensure some measure of the initiatives remain.

If

this is not enough, we have implemented the greatest experiment in

Monetary Policy in the history of the capitalist system with the

implementation of: 1) TARP, 2) TALF 3) PDCF 4) TAF 5) TDWP 6) TSLF 7)

CPFF 8) MMIF 9) AMLF and 10) Massive foreign currency SWAPS. All of

these initiatives were aimed at BENDING a failed system back into

operation through Government Guarantees that �temporarily� removed

inherent risk. It is to be seen just how temporary these programs will

become. Remember, Income tax was originally implemented to solve a

temporary funding crisis! These initiatives intentionally improve

banking profits by an extraordinary degree and the banks will no doubt

lobby to ensure some measure of the initiatives remain.

�

SPEND:�

Further to the above Monetary Initiatives, we have implemented Fiscal

SPENDING Policies based on the 1930�s Keynesian Economic doctrine of

Deficit Stimulus Spending as a framework in which to restore economic

growth. This has resulted in a 2009 deficit of $1.4 Trillion and a 2010

deficit expected to be closer to $1.8 Trillion. This will give the US a

national debt of $14 Trillion, which will be larger than 12% of GDP, not

including Federal Unfunded Liabilities of $62.5 Trillion (according to

the official government estimates).

�

The G-20 in total have now authorized 2.2 Trillion in stimulus programs

to restore growth. The Global economies together have Lent, Spent or

Bent $27 Trillion in financial assets. Meanwhile, despite this, total US

worker unemployment continues to rise.

�

EXTEND &

PRETEND: �An Artificial, Manipulated Recovery

�

All of the US $11

Trillion �Lend, Bend & Spend� Initiatives, on the US $12 Trillion economy,

could at best be described as �Triage� actions to stop the immediate

hemorrhaging & stabilize the Financial System. The next stage has focused

on the effective �Recovery�. Despite the $787 Billion �American Recovery &

Reinvestment Act�, �we have not achieved a real recovery. We have achieved

an artificial perception of a recovery through policies that simply �kick

the can down the road�! It is our view that since March 2009 we have

witnessed an �Accounting Recovery� driven by the implementation of the

modern Behavioral Economics theory of MOPE (Management of Perspective

Economics).� The prime objective has been the recapitalization of the

banks through asset appreciation and capital raising versus the unpopular

nationalization alternative debated at the onset of the financial crisis.

Currently, with an elevated stock market, the Fed has been very clear to

the banks that NOW is the time to increase capital. Consequentially in

recent secondary offerings, Citigroup has raised $21.1B, Bank of America

$12.2B and Wells Fargo $12.2B.

�

AN �ACCOUNTING�

DRIVEN RECOVERY

In March 2009 the market bottomed and suddenly began a dramatic recovery.

This occurred immediately after the reversal of FASB 157 in March 2009.

Congress placed such pressures, including potential legislative measures,

that it forced the Accounting Standards Boards to reverse the Level 1

Capital Ratio standards regarding the treatment of �Mark-to-Market� of the

massive �toxic� assets on the books of the banks.� This change took

insolvent banks and obscured problems by making them completely

non-transparent to any analysis. The government�s �stress tests� and

underlying economic assumptions, were subsequently never made public.

As Commercial Real Estate values plummeted and now approach 45 � 60%

declines, the government in July changed the accounting regulations so

banks and financial institutions would not have to reflect their true

market value. This problem is so huge it makes the Sub-Prime Crisis look

like child�s play but has been �removed� through accounting treatment.

This treatment would have been called �fraud� before the changes and was a

felony that involved prison time. This obscuring of the facts does not

take away from the reality that there is a $2.7 Trillion iceberg floating

�dead ahead�!

As the Housing foreclosures mounted the government additionally changed

the accounting, in this case on how non-performing mortgages could be

treated. As an example, many of the 8 Million homeowners who have

completely stopped paying their mortgages are presently being left alone

so that their mortgage loans can be accounted for at the original

loan-value book value by the banks and other financial institutions. In

December the FDIC further allowed the banks to defer FASB 166 /167 � even

more accounting games! What else is going on that we are not privy too? We

hear in the AIG Congressional

testimony some financial matters are to be considered to be of �national

security�. �What about investor security?

�

�

�

MARCH

2009

MARCH

2009

FASB 157

04-02-09 -

Summary -

FASB

Pre-Codification Standards

04-02-09 -

FASB

approves more

mark-to-market

flexibility - MarketWatch

�

03-18-09 -

UPDATE 2-FASB issues proposals on

mark-to-market

guidance s.�

Reuters

04-03-09 -

FASB

Eases

Mark-to-Market

Rules - WSJ.com

04-14-09 -

FASB

Looks to Expand

Mark

Rules - WSJ.com

�

OCTOBER 2009

BANK REGULATORS: PRUDENT COMMERCIAL REAL ESTATE LOAN WORKOUTS POLICY

10-31-09 -

Policy Statement on

Prudent Commercial Real Estate Loan Workouts

10-31-09 -

Bank regulators extend and pretend

10-31-09 -

Banks Get New Rules on Property�

WSJ�

�

NOVEMBER 2009

BANK REGULATORS: THREE �CAULDRONS� EASING

11-14-09 -

Bankers hold houses, manipulate market

Pittsburgh PG

11-11-09 -

Housing- 'Shadow Inventory' Dwarfs Loan Modifications�

CNBC

10-28-09 -

Strategic Non-Foreclosure����������������

��������������� ���������������

09-23-09 -

Delayed Foreclosures Stalk Market�

WSJ

�

01-15-10 -

Big Banks Accused of Short Sale Fraud

CNBC

�

DECEMBER 2009

FASB Financial Accounting Statements:

Standards Issued in January 2010

Nos. 166 (Transfers of Financial Assets)

Nos. 167 (Amendments to FASB Interpretation of No. 46(R))

�

12-15-09

FDIC Approves Giving Banks Reprieve from Capital Requirements�

�

JANUARY 2010

SYSTEM WIDE FEDERAL BANK EXAMINER

REINFORCEMENT TRAINING: �to underscore expectations�

�01-27-10

-

FRB: Testimony--Greenlee, Commercial Real Estate--January 27, 2010

�

�

WHAT THESE ACTIONS ATTEMPT TO OBSCURE

�

�

WHAT THIS MEANS:�

A �Back-of-the Envelope�

Analysis & Some Common Sense.

�

HOME

MORTGAGES

HOME

MORTGAGES

�

�

�

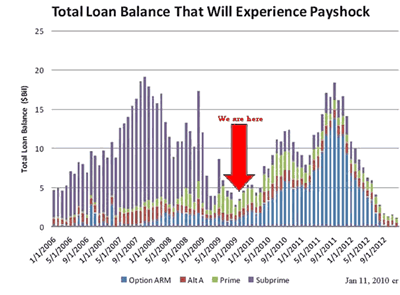

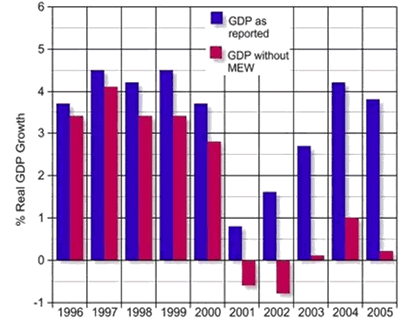

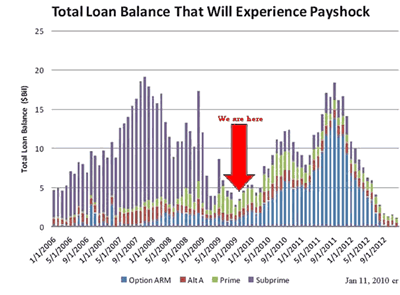

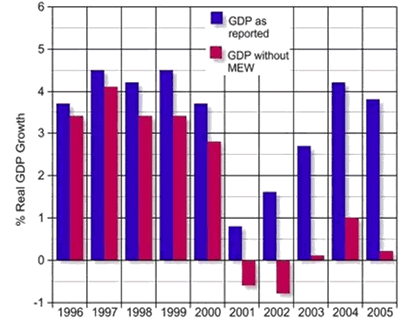

The banks have in addition to not yet accounting for Mortgage values in a

realistic manner, have not prepared for the next major wave in mortgage

resets & defaults!

�

The Case-Shiller 20 City Composite indicates a -7.3% drop in national

prices (1).�

�

Robert Shiller, co-founder of the composite, has indicated he would not be

surprised to see another 5% to 10% drop in the spring (2).

�

Is it any wonder he has this �suspicion� when you consider the chart to

the right?

�

�

�

�

�

�

�

�

�

�

�

�

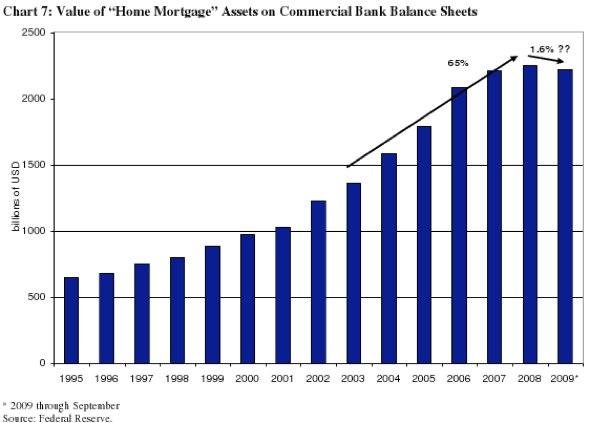

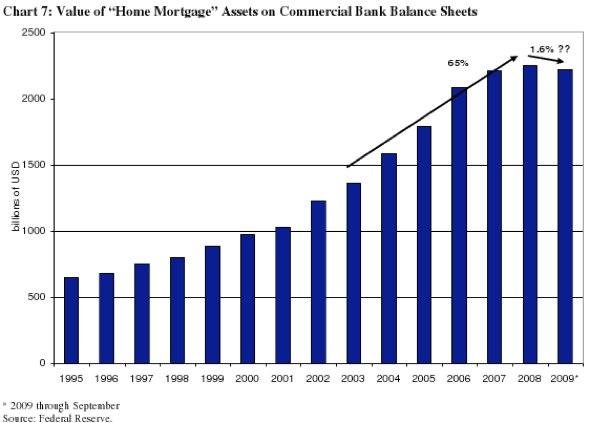

THE REALITY:����������������

����������� - 7.3% Composite 20 city Drop (1) & about to get much worse!

�

�����������������������

BANK ACCOUNTING:���������� - 1.5% Drop

in Home Mortgage Asset Values

�

�

From a recent report from Deutsche Bank's Bill Prophet, entitled

"Alternative Universe" (5)

�

�

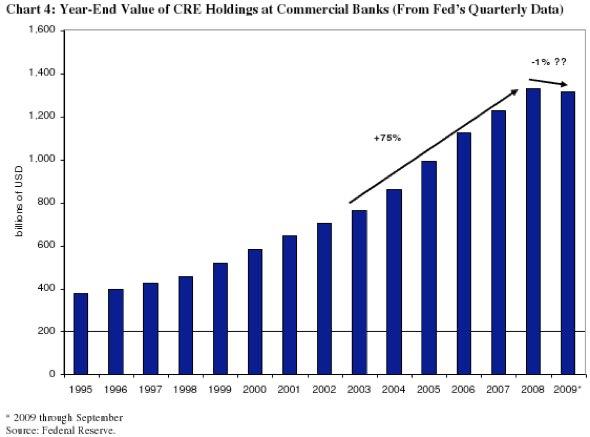

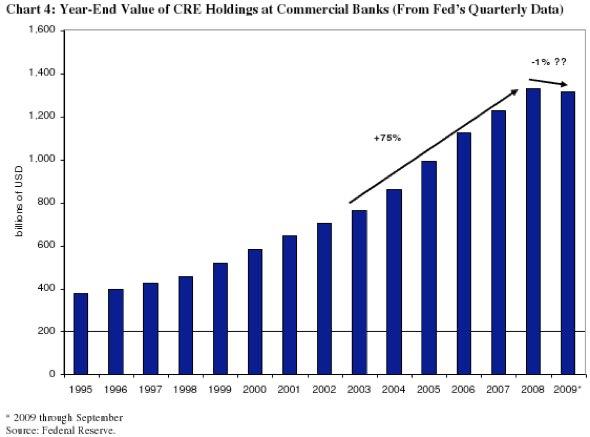

COMMERCIAL REAL ESTATE

�

�

�

�

�

�

�

�

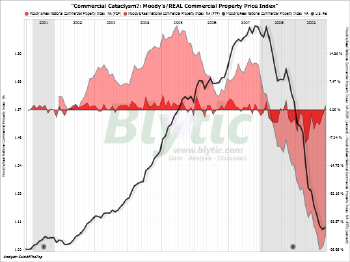

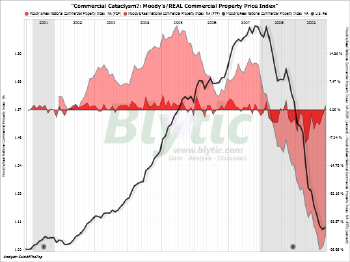

Does the chart to the right look like a 1% drop in Commercial Real Estate

Values to you?

�

�

�����������������������

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

THE REALITY:����������������

����������� - 40% + Drop in CRE Asset Values (3)

���������������

�����������������������

BANK ACCOUNTING:���������� - 1% Drop in

CRE Asset Value Holdings

�

�

From a recent report from Deutsche Bank's Bill Prophet, entitled

"Alternative Universe," (5)

�

�

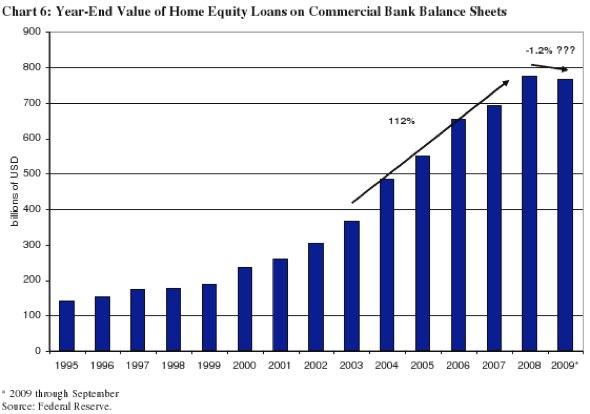

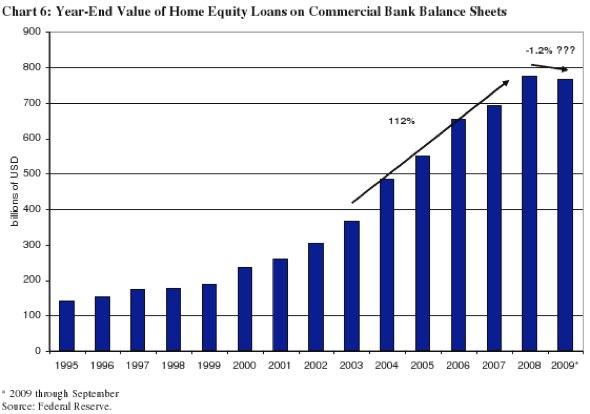

HOME EQUITY LOANS

�

�

Home Equity Loans dominated loan growth for years. Do we really believe

people are defaulting on their mortgages, going into foreclosure and yet

paying their Home Equity Loan?

�

Solid numbers that isolate the real levels versus bank reporting are

difficult to find.

�

Is it any wonder?

�

Do we really believe it is only the presently reported -4.3% rate, ever

mind the insignificant 1.2% the banks haven taken from an accounting stand

point?

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

�

����������������������������������������������� ����������� THE

REALITY:���������������� ����������� - 4.3 + Rate as of Q3 2009 and

getting worse (4)

�

�����������������������

BANK ACCOUNTING:���������� - 1.2% Drop

in Home Equity Loan Values

�

�

From a recent report from Deutsche Bank's Bill Prophet, entitled

"Alternative Universe" (5)

�

RESULTS

�

Considering:

Considering:

1- Mortgage Rates have started rising,

2- Prime Lenders are now defaulting,

3- The bulk of Option ARMS are now coming due,

�

SCENARIO I

If we only double what the banks have already taken (which is

insignificant compared to actual market values) we have additional write

downs of:

�

Home Mortgages: ��1.5% X 2.25T���� $34 B

Commercial RE:��� � 1.0% X 1.65T���� $17 B

HELCO�������������� ��� 1.2% X 0.76T���� $� 9 B

����������������������������������������������� �� ===

������������������������������������������������� � $ 60 B

�

SCENARIO II

A slightly more realistic, yet conservative exposure is:

�

Home Mortgages: �� 6.0% X 2.25T�� $135 B

Commercial RE:��� � 25% X 1.65T���� $413 B

HELCO�� ����������� ��� 4.0% X .76T���� $� 30 B

������������������������������������������������� � ===

�������������������������������������������������� $456

B

�

The above does not include the approximately $500B of troubled Off Balance

Sheet Assets that Barclay Bank suggests are not accounted for due to the

deferral of FASB 166 / 167 granted by the FDIC. (6)

�

For anyone buying Banking stocks or LONG the market ...��

Caveat Emptor!

�

�

Sign Up for the next

release in the Extend & Pretend series:�

Extend & Pretend

�

SOURCES:

�

(1)�������

12-29-09 -

S&P/Case-Shiller Home Price Indices

(2)����������

01-05-10 -

Get ready for another housing downturn?�

Boston Globe

(3)�������

10-19-09 -

Moody's- US Commercial Property Prices Down 40% from Peak

(4)�������

01-15-10 -

What If Everyone Stops Paying Their Mortgage?

(5)������� 01-15-10 -

Here's Why The Financial System Isn't Out Of The Woods, And Still Has A

Ton Of Deleveraging To Do

� ��������� ����The

Business Insider January 15, 2010

(6)������� 01-16-10 �

King World News Broadcast � Bill Laggner

(7)������� 12-15-09 -

FDIC Approves Giving Banks Reprieve from Capital Requirements

(8)������� 01-27-10 -

FRB: Testimony--Greenlee, Commercial Real Estate--January 27, 2010

�

�

The last Extend &

Pretend article:

EXTEND & PRETEND - An

Accounting Driven Market Recovery

�

FREE

Additional Research Reports at Web Site:

Tipping Points

�

Gordon T Long����

����

Tipping Points

�

Mr. Long is a former senior group

executive with IBM & Motorola, a principle in a high tech public start-up

and founder of a private venture capital fund. He is presently involved in

private equity placements internationally along with proprietary trading

involving the development & application of Chaos Theory and Mandelbrot

Generator algorithms.

�

Gordon T Long is not

a registered advisor and does not give investment advice. His comments are

an expression of opinion only and should not be construed in any manner

whatsoever as recommendations to buy or sell a stock, option, future,

bond, commodity or any other financial instrument at any time. While he

believes his statements to be true, they always depend on the reliability

of his own credible sources. Of course, he recommends that you consult

with a qualified investment advisor, one licensed by appropriate

regulatory agencies in your legal jurisdiction, before making any

investment decisions, and barring that, you are encouraged to confirm the

facts on your own before making important investment commitments.

�

� Copyright 2010

Gordon T Long. The information herein was obtained from sources which Mr.

Long believes reliable, but he does not guarantee its accuracy. None of

the information, advertisements, website links, or any opinions expressed

constitutes a solicitation of the purchase or sale of any securities or

commodities. Please note that Mr. Long may already have invested or may

from time to time invest in securities that are recommended or otherwise

covered on this website. Mr. Long does not intend to disclose the extent

of any current holdings or future transactions with respect to any

particular security. You should consider this possibility before investing

in any security based upon statements and information contained in any

report, post, comment or recommendation you receive from him.

�

�

�