Both

came to an end at the same time: the administration�s policy to Extend &

Pretend has run out of time as has the patience of the US electorate with

the government�s Keynesian economic policy responses. Desperate last gasp

attempts are to be fully expected, but any chance of success is rapidly

diminishing.

Both

came to an end at the same time: the administration�s policy to Extend &

Pretend has run out of time as has the patience of the US electorate with

the government�s Keynesian economic policy responses. Desperate last gasp

attempts are to be fully expected, but any chance of success is rapidly

diminishing.

Whether an unimpressed

and insufficiently loyal army general, a fleeing cabinet budget chief or

G20 peers going the austerity route, all are non-confidence votes for the

Obama administration�s present policies. A day after the courts slapped

down President Obama�s six month gulf drilling moratorium, the markets

were unpatriotically signaling a classic head and shoulders topping

pattern. With an employment rebound still a non-starter, President Obama

as expected was found to be asking for yet another $50B in unemployment

extensions and state budget assistance to avoid teacher layoffs. However,

the gig is up: the policy of Extend and Pretend has no time left on the

shot clock nor for another round of unemployment benefit extensions. A

congress that is now clearly frightened of what it sees looming in the

fall midterm elections is running for cover on any further spending

initiatives. The US electorate has been sending an unmistakable message in

all elections nationwide.

The housing market is rolling over as fully expected and predicted by

almost everyone except the White House and its lap-dog press corp. Noted

analyst Meredith Whitney says a double dip in housing is a �no brainer�

with the government�s HAMP program clearly a bust as one third of

participants are now dropping out. The leading economic indicator (ECRI)

has abruptly turned lower, signaling the economy is slowing rapidly

without the $1T per month stimulus addiction, which has kept the extend

and pretend economy on life support.

The gulf oil spill that

was initially stated as 1000 barrels per day has been revised upwards

faster than the oil can reach the surface. It now appears to be north of

100,000 barrels per day. A 100 percent miss is about in line with the miss

on how many jobs the American Recovery and Reinvestment Act of 2009 (ARRA)

was going to create. Also, it appears the administration can�t even get

its hands around the basics of administration management during any crisis

event. Teleprompter politics doesn�t work when real problems must be

resolved. There is no credibility left for Extend & Pretend nor for this

president and his congressional majority.

In foreign policy the

Chinese decided to �unpeg� the Yuan from the US dollar, days prior to the

G20 summit in Toronto, taking the wind out of the US administration�s

attack plan. Congress had been expectantly raising the rhetoric levels and

making the Chinese Yuan the culprit. The market sold off hard the day the

Chinese made the announcement, which tells you all you need to know about

this administration�s understanding and abilities to formulate effective

foreign and domestic public policy.

White House policies are

unmistakably in shambles. We are rudderless with terribly outdated

Keynesian zealots at the helm as the storm continues to worsen. Stage I

of Extend & Pretend is over � RIP!

REPORT CARD:

AMERICAN RECOVERY & REINVESTMENT ACT OF 2009 (ARRA)

Before we can identify what needs to be done, what the administration is

likely to do and how we can preserve and protect our wealth through it, we

need to first determine where we are going wrong. Surprisingly, no one has

assessed the results of the American Recovery & Reinvestment Act 2009 (ARRA)

which was this administration�s cornerstone program to place the US back

on the post financial crisis road to recovery. Let�s briefly review it.

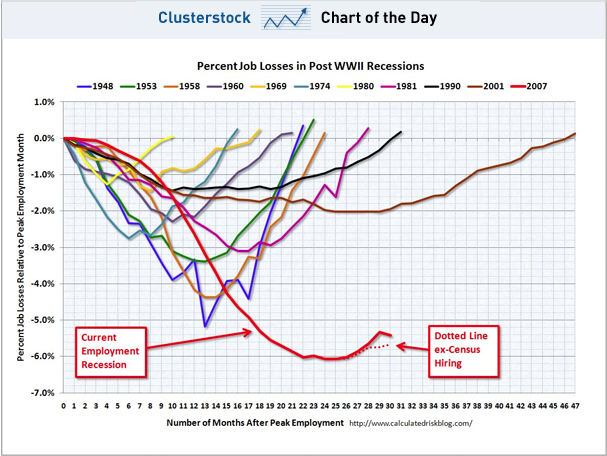

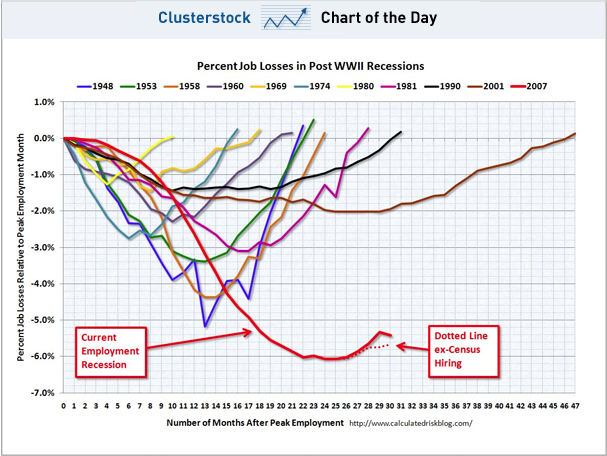

EMPLOYMENT

The chart above was one of the central charts used in persuading the

public that the ARRA was absolutely necessary. This chart assisted in

convincing the public that something they would previously have never

accepted was the required course of action. I tried to find this chart on

the ARRA�s touted Recovery.gov web site and found that it has disappeared,

including the links to the original discussion papers. Is it any wonder?

It was like a school child telling his parents the dog ate his report

card. Fortunately, I had a copy in my database.

Click to Enlarge

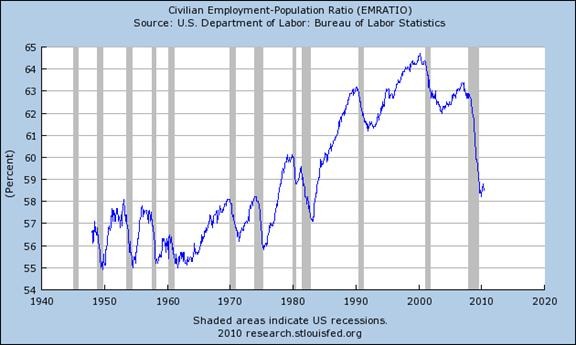

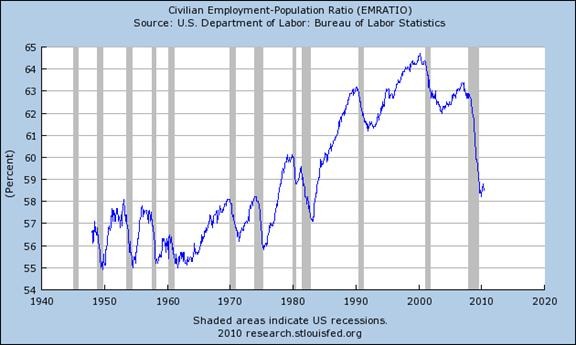

It isn�t just the failure to achieve the zero line in the second chart

above that should be frightening. The failure to achieve the required 150K

to 200K level which adds the new entrants from college, immigration,

military personnel returning to civilian work force etc. indicates we are

still in seriously rough waters. The falling Civilian Employment rate

below is the correct way to assess the ARRA�s results.

GRADE FOR EMPLOYMENT:

FAILURE E-

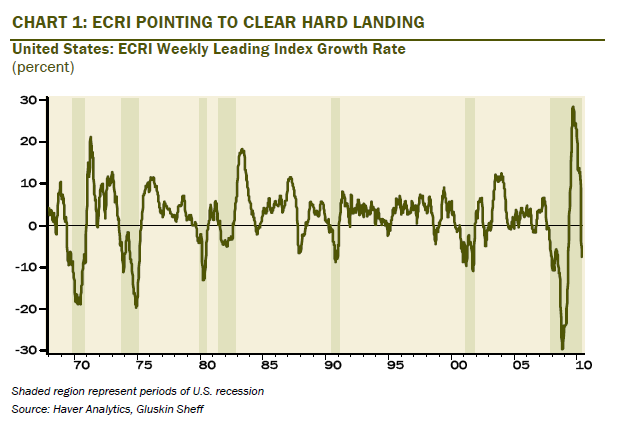

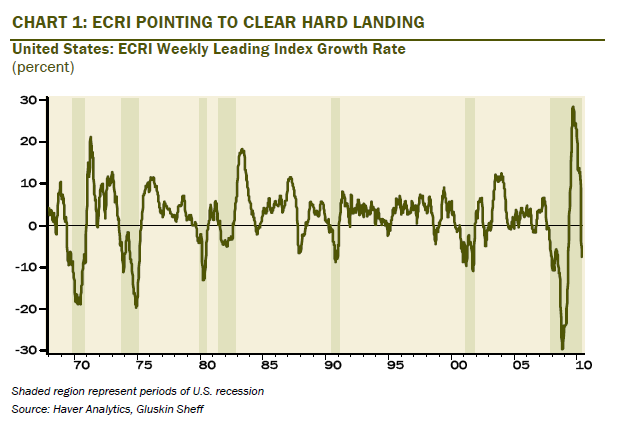

ECRI

As analyst David Rosenberg at Gluskin-Scheff reports:

�the ECRI index moved closer to fully discounting a recession. The spot

index fell 0.6% in the June 25th week to 122.2 � the lowest

level since the week of July 29th of last year when the S&P

500 was 975, so please, do not tell us that 1,000+ is still somehow a

�cheap� level. The growth rate in the ECRI index dropped further, to

-7.7% from -6.9% on June 18th and -5.8% on June 11th

� this was the eighth week in a row of deterioration. It may end up

being different this time, but never before has a -7.7% print sent off a

�head fake�. In fact, the only two false signals occurred at levels that

were not as negative as what we have on our hands today: the -4.5% print

in 1998 after the LTCM debacle and -6.8% in the aftermath of the crash

of �87.�

GRADE FOR ECONOMIC REBOUND:

MARGINAL D+

We can safely conclude either:

-

1-

The administration

completely under estimated the extent of the economic crisis, even

though we were well into it when the ARRA was introduced.

-

2-

The administration was

unable to secure the actually required stimulus amount which was likely

4-5 times that approved.

-

3-

The administration

failed to implement the program in a timely manner.

-

4-

The administration

failed to diagnose the problem correctly and that in fact it is a

structural problem versus a cyclical and liquidity problem, as they

still insist it to be.

I personally believe it is all four of the above.

OVERALL GRADE: FAILED

E

PUBLIC POLICY

CHOICES

The recent G20 meeting in Toronto may very well have been a historical

cusp. For the first time at a major summit the leaders refused en mass to

follow US leadership. G20 leaders chose �austerity�, while the US firmly

advocated �stimulus spending�.

The politically crafted joint release outlined �austerity, once the

recovery was in place�. How this will be determined is conspicuously

missing, and to me it says no agreement was reached.

Ironically, political pressures from a disgruntled electorate in the US

indicates further stimulus spending is not likely to fly, while in Europe

the austerity cuts are threatening the very fabric of the European social

net which the public has begun rioting against. We have both conflicting

approaches between G20 camps while in turn they have conflicts with their

own electorate base. Maybe we should give Obama to the Europeans and we

take Cameron or Merkel?

This is absolutely not the time for a failure to reach a fully agreed to

and globally coordinated policy initiative that will arrest the current

financial malaise. The lack of a clear understanding of what will work,

what needs to be done and how it is to be done with an agreement amongst

country leaders does not bode well for a successful outcome.

We must conclude that the first post-globalization crisis has been met

with a resounding failure of coordination. Similarly, this was also the

earmark of the political wrangling during the early stages of the 1930�s

Great Depression.

ELECTORATE WON�T

ACCEPT MORE SPENDING � AUSTERITY �IS IN�

Keynesianism has failed! Somewhat unknowingly there is a sense growing

that these are not cyclical problems but rather are in fact structural

problems - a belief that the financial crisis was not an unexpected event

but rather a product of deeper and serious underlying strategic problems.

President Obama and his Economic team remain in a shrinking camp of

zealots who believe that further stimulus spending is still required.

There is an overwhelming shift towards austerity which was evident by the

recent G20 summit with one lone exception � the US.

When the Bank of International Settlements (BIS), ECB President Jean

Claude Trichet and even former Democratic cabinet faithful Robert Reich

come out publically strongly advocating austerity, you know opinion has

changed. The last spike however had to have been when Mr. Bubbles

himself, former Fed Chairman Alan Greenspan, wrote in a June 18th

Wall Street Op-Ed piece.

�OUR ECONOMY CAN NOT AFFORD A MAJOR MISTAKE IN UNDERSTANDING THE

CORROSIVE MOMENTUM OF THIS FISCAL CRISIS. OUR POLICY FOCUS THEREFORE MUST

ERR SIGNIFICANTLY ON THE SIDE OF RESTRAINT.

Alan Greenspan, former Chairman , Federal Reserve

Wall Street Journal 06-18-10

As the primary architect of stimulus and easy money to fight everything

that even remotely smelled of a slow down or problem from the 1997 Asian

Crisis, Y2K, the Tech Bubble through to 911 it is an amazing turnaround

and of significance from Alan Greenspan to go so publically on the record.

For former followers of �Green-Speak� it is unusually crystal clear!

Even CNBC recently had troubles corralling the lone voice of sanity

amongst its cadre of empty headed parrots when Rick Santelli in an off

CNBC private interview on an

Eric King interview

was heard saying:

On Spending Cuts: "Listeners, this is

going to be the most important thing I am going to say: we need to

maintain the focus on spending, the politicians in my lifetime always

spend. If we end up spending way more than we can take in, in essence

the deficit panel becomes a tax panel. We must stop spending before we

talk about VAT taxes or taxing Americans more, we need to get spending

under control. The ratings of congress are the lowest they have been in

history�.

On Austerity: "Nobody wants that. But there is a

silver lining - the UK have conditions in their economy worse than the

US, but they came up with an austerity plan, and we see that their

currency has been rewarded. The GDP has risen about 10% in a very short

period of time."

On Keynesianism: "The Keynesians are

both right and wrong. I don't think Keynes advocated the kind of

helicopter-Ben spending that many say he promoted. He promoted the kind

of stimulus that created jobs, that's more the medicine for a cyclical

downturn, we have a structural issue because of the bubble credit

scenario." �

SO WHAT IS TO BE

DONE?

Extend & Pretend was intended to give banks the time to restore their

balance sheets versus the very politically unpopular choice of

nationalization, which was debated during the height of the 2008 financial

crisis. It was also intended to give time for the massive stimulus

injections and the $13T of Lend, Spend and Bend (Guarantee) initiatives to

ignite a rebound in the economy. It didn�t and the gig is now up!

_small.jpg)

The problem is actually pretty simple. We have more debt than productive

growth can support. Debt has been losing its marginal productivity for

years now and it no longer increases GDP. Rather, we abruptly reached debt

saturation and now growth in debt reduces GDP. We have such levels of

mal-investment and excess balance sheet gearing that increased debt now

directly subtracts from productive money. Stimulus spending no longer will

add sustained job growth.

PEOPLE WILL WANT

SECURITY

The general public worries about two things: Having money to spend and

having a job with which to earn the money. Everything else evolves or

springs from having these first two. Politicians� foremost job, if they

are to get re-elected, is to deliver on this. Americans vote with their

pocketbook.

They say that in a depression everyone is a Keynesian. That may be true

until it is evident that it doesn�t work. Never have we had such debt

levels from which to test this saying. What hasn�t changed is that when

people are frightened they reach out to anyone that offers security or a

sellable chance of restoring pre-crisis status quo stability - a person or

administration that represents a chance to return things to the way they

were. What was once unacceptable, even deplorable, is suddenly seen to be

an option. The messenger of the solution is seen to be some sort of hero

or messiah. This was precisely what led to the ascent of Adolf Hitler and

many other now hated villains of history. They offered hope through new

policy initiatives when none other did. They are now villains because

their solutions turned out to be horribly wrong. Even if they were wrong

headed ideas, if they were expedient they were latched onto by a desperate

public. Are we fast approaching such a period over the next two years in

America or are we already there?

EXAMPLES:

A �GULF OF TONKIN� & FALSE FLAGS

Powerful countries have a tendency to solve inevitable political conflicts

and/or inabilities to persuade the electorate through the use of

geo-political events. These events act as catalysts that force a direction

to be taken and politically unpopular measures to be enacted.

There are many examples of this occurring, but one that is well documented

with recorded first hand testimony and achieved a major political

initiative is the Vietnam War era �Gulf of Tonkin� incident.

President Lyndon Johnson staged and manipulated this �false flag� event to

secure the dramatic escalation of troops and funding of the Vietnam War

against overwhelming public and political resistance. It gave the

administration the cover to execute its predetermined agenda. The public

was intentionally hoodwinked.

I fully expect something like this to occur within the next 90 days and

prior to the fall midterm elections. Whether it is Iran, Korea, a BP

triggered financial collapse, a cyber attack, or some other geo-political

event � expect the fallout to move public opinion towards further

�stimulus spending�.

The government must find an excuse to push another $5T (minimum) into the

US economy.

I suspect the Federal Reserve and White House Administration are now

convinced that without further massive stimulus, the US economy is headed

into a deflationary depression.

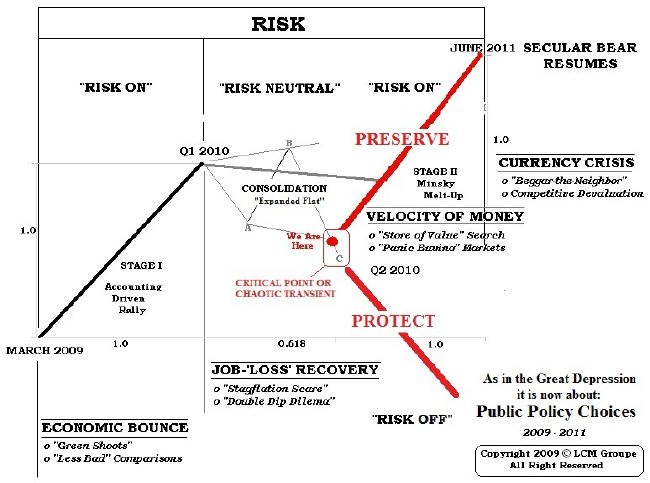

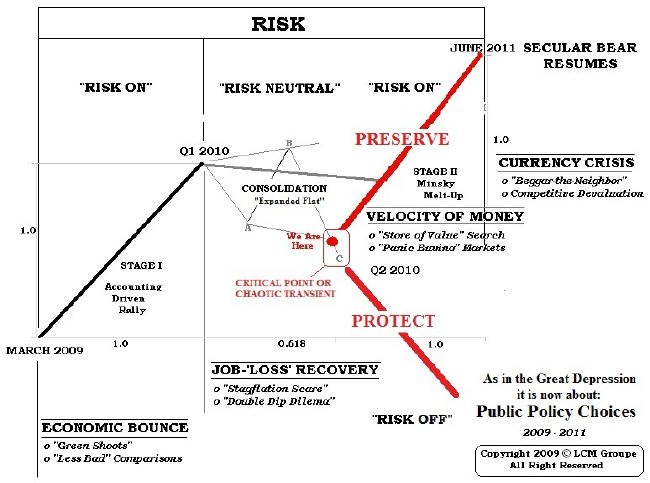

We are presently at the cusp as shown in the chart below, which I have

labeled as a �Critical Point� or more technically a �Chaotic Transient�.

We can go either way. The determination is a function of the public policy

initiatives which the administration chooses.

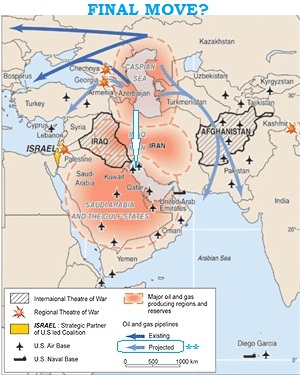

AUSTERITY & WAR

I would like to offer another illustration by SocGen's Dylan Grice in his

latest weekly piece "Double dips, siren calls and inflationary bias of

policy." It was recently published by

Zero Hedge.

I have inserted three charts and links to make the message clearer within

today�s geo-political tensions.

Margaret Thatcher, who came to power oddly enough on a "mandate to smash

inflation, smash the unions and downsize government", saw her popularity

immediately slide to 25% as people realized the very real pain associated

with austerity and a regime fighting run away government. On very rare

occasions, the people of a country do end up making the decision to take

on hardship, instead of kicking the can down the road. Yet they promptly

grow to regret their decision. So what was it that saved the government,

and allowed the Conservatives a second term in which to complete the

painful austerity project?

The

declaration of war by Argentina's General Galtieri over the Falkland

Islands. The result was soaring popularity for the Iron Lady, and the rest

is history.

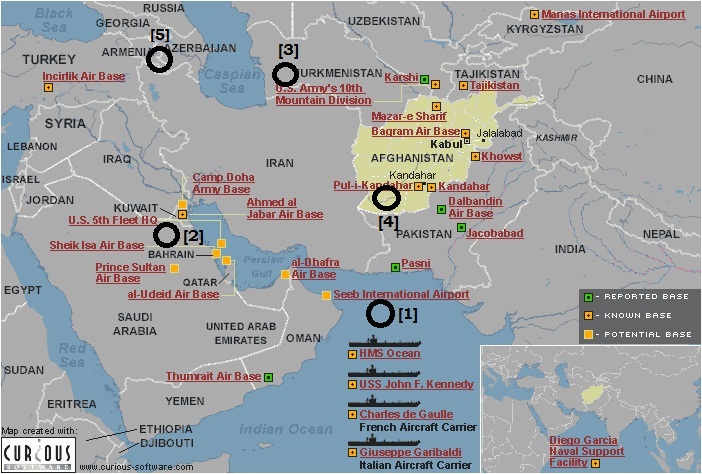

Looking forward, now that all of Europe is gripped in austerity, (and make

no mistake - this very same austerity is coming to the US on very short

notice with crashing popularity ratings for all political parties), has

the political G-8/20 elite focused a little too much on a Falkland war? Is

war precisely the diversion that Europe and soon America hope to use in

order to deflect anger from policies such as Schwarzenegger�s imposition

of minimum wage salaries? Is there a Gallup or some other polling

"unpopularity" threshold that the G-20 is waiting for before letting loose

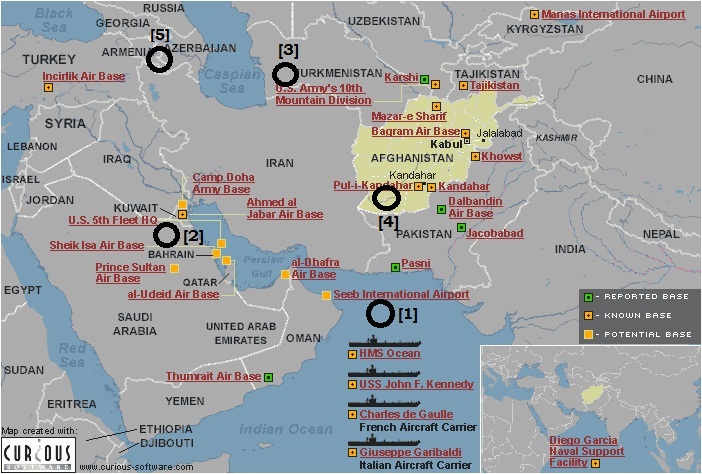

all those aircraft carriers

recently parked [1] next to the

Persian Gulf, the

Israeli jets in

Saudi Arabia [2] or the recent

US troop buildup [3] on the

Iran border? [4] (Italics is

my addition: see the charts I have added for [X] locations. I have also

added [5] for the highly symbolic July 4th weekend visit of Hillary

Clinton to Georgia, Azerbaijan and Armenia)

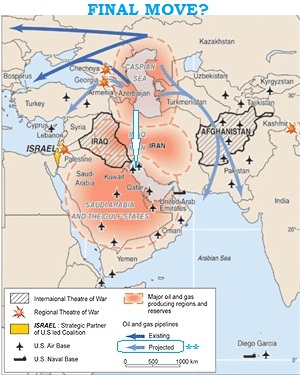

MID EAST PROVACATION MAP

US MILITARY FORCES IN MIDDLE EAST (circa 2002-2003)

Troops have been removed from Saudi Arabia and there are bases in Iraq

Like the World Cup, if you can goad your opponent into reacting, you may

be awarded the winning penalty shot.

Continuing from Mr. Grice:

The

Thatcher experience shows how fragile support for painful economic

policies can be even when the democratic mandate for those polices has

been won. Like the Canadian and Scandinavian austerity experience in the

1990s, the painful programs adopted succeeded as much by luck as by

political bravery. And this is what worries me. It's not that I'm

ideologically wedded to one side or the other, it's that the precedents

just aren't encouraging. The required austerity will be deeply painful and

politically risky. Policymakers won't make it happen, so the bond market

will make it happen instead.

EXTEND & PRETEND:

STAGE I ENDS

38.2% FIBONACCI RETRACEMENT

The financial market charts reflect the current geo-political situation

perfectly. The markets have now reached our targeted 38.2% Fibonacci

retracement projection, which I have been calling for in my monthly

newsletter.

What happens next? It is either one of the following alternatives, which

future political policy decisions and actions will determine.

1- A MINSKY MELT-UP & INCREASING VELOCITY OF MONEY

We will get a dramatic

insertion of new Federal Reserve stimulus in the amount of $5T. This will

be the last element required in the manufacturing of a Minsky Melt-Up

(see:

EXTEND & PRETEND - Manufacturing a Minsky Melt-Up).

An accelerating Velocity of Money will bring on inflation in the items we

�need to have� versus the things we think �we want�. It will be a time of

PROTECTING your wealth from the ravages of inflation or possibly

hyperinflation.

It is important to

appreciate, and contrary to popular perception, it isn�t solely the

printing of money that will bring on elevated inflation. It is also the

result of a stealth supply shock in basic necessities coupled with a

demand shock associated with population. Let me explain.

When the 2008 financial

crisis hit, businesses began immediately preserving cash. Capital

expenditures were slashed and new projects placed on hold or shelved

indefinitely. For industries with long lead times to bring on new and

increased production, such as is common in mining, food processing and

generally overall in basic commodity businesses, this crimps their

abilities to meet ramp ups for any near-to-intermediate term demand.

Meanwhile, the Asian and Emerging markets of the world continue to be able

to afford to eat better and consume larger quantities of the basic staples

of life. These economies have not been hit as hard as the developed

economies. This combination along with a future weakening US dollar is

going to seriously propel consumer inflation in the US and accelerate

Money Velocity when the Fed overlays QE II.

2- PLUNGING MARKETS AND ASSETS VALUES

If the government is not successful in its reflation efforts, then we can

expect a dramatic sell-off in financial assets. The market will retest and

break through the 2008 lows of 666 in the S&P 500. It will be a time to

PRESERVE your wealth from the onslaught of asset devaluation.

PRESERVE & PROTECT

BEGINS

We have now entered into

Stage II of Extend & Pretend or what I would prefer to call Preserve and

Protect. We must watch key events extremely closely as they unfold, but

with a clear understanding of the framework in which they happen.

Government policy initiatives, geo-political events and economic trigger

points must all be scrutinized.

For those wanting to

follow this PRESERVE & PROTECT stage, and to know which Tipping Points

will mark the way, then

sign-up

for e-mail notification of the releases of the Preserve and Protect

article series and follow daily developments at

Tipping Points.

It is going to prove to

be one of the most interesting times in history. Let it be one of the most

profitable for you and not the devastating period it will be for most.

The �dog ate my report card� didn�t work in school and it didn�t work

again!

UNFOLDING PRESERVE & PROTECT EVENTS ARE TRACKED DAILY ON THE

Tipping Points

WEB PAGE

Sign Up for the next release in the PRESERVE & PROTECT series:

Commentary

Gordon T Long

Tipping Points

Mr. Long is a former senior group executive with IBM & Motorola, a

principal in a high tech public start-up and founder of a private venture

capital fund. He is presently involved in private equity placements

internationally along with proprietary trading involving the development &

application of Chaos Theory and Mandelbrot Generator algorithms.

Gordon T Long is not a registered advisor and does not give investment

advice. His comments are an expression of opinion only and should not be

construed in any manner whatsoever as recommendations to buy or sell a

stock, option, future, bond, commodity or any other financial instrument

at any time. While he believes his statements to be true, they always

depend on the reliability of his own credible sources. Of course, he

recommends that you consult with a qualified investment advisor, one

licensed by appropriate regulatory agencies in your legal jurisdiction,

before making any investment decisions, and barring that, you are

encouraged to confirm the facts on your own before making important

investment commitments.

� Copyright 2010 Gordon T Long. The information herein was obtained from

sources which Mr. Long believes reliable, but he does not guarantee its

accuracy. None of the information, advertisements, website links, or any

opinions expressed constitutes a solicitation of the purchase or sale of

any securities or commodities. Please note that Mr. Long may already have

invested or may from time to time invest in securities that are

recommended or otherwise covered on this website. Mr. Long does not intend

to disclose the extent of any current holdings or future transactions with

respect to any particular security. You should consider this possibility

before investing in any security based upon statements and information

contained in any report, post, comment or recommendation you receive from

him.

Fair Use

Notice

Fair Use Notice

This site contains

copyrighted material the use of which has not always been specifically

authorized by the copyright owner. We are making such material available in

our efforts to advance understanding of environmental, political, human

rights, economic, democracy, scientific, and social justice issues, etc. We

believe this constitutes a 'fair use' of any such copyrighted material as

provided for in section 107 of the US Copyright Law. In accordance with

Title 17 U.S.C. Section 107, the material on this site is distributed

without profit to those who have expressed a prior interest in receiving the

included information for research and educational purposes.

If you wish to use

copyrighted material from this site for purposes of your own that go beyond

'fair use', you must obtain permission from the copyright owner.

_small.jpg)