What

made America great was her unsurpassed ability to innovate. Equally

important was also her ability to rapidly adapt to the change that this

innovation fostered. For decades the combination has been a self

reinforcing growth dynamic with innovation offering a continuously

improving standard of living and higher corporate productivity levels,

which the US quickly embraced and adapted to.

What

made America great was her unsurpassed ability to innovate. Equally

important was also her ability to rapidly adapt to the change that this

innovation fostered. For decades the combination has been a self

reinforcing growth dynamic with innovation offering a continuously

improving standard of living and higher corporate productivity levels,

which the US quickly embraced and adapted to.

This in

turn financed further innovation. No country in the world could match the

American culture that flourished on technology advancements in all areas

of human endeavor. However, something serious and major has changed across

America. Daily, more and more are becoming acutely aware of this, but few

grasp exactly what it is. It is called Creative Destruction.

It

turns out that what made America great is now killing her!

Our political leaders

are presently addressing what they perceive as an intractable cyclical

recovery problem when in fact it is a structural problem that is secular

in nature. Like generals fighting the last war with outdated perceptions,

we face a new and daunting challenge. A challenge that needs to be

addressed with the urgency and scope of a Marshall plan that saved Europe

from the ravages of a different type of destruction. We need a modern US

centric Marshall plan focused on growth, but orders of magnitude larger

than the one in the 1940�s. A plan even more brash than Kennedy�s plan in

the 60�s to put a man of the moon by the end of the decade. America needs

to again think and act boldly. First however, we need to see the enemy. As

the great philosopher Pogo said: �I saw the enemy and it was I�.

THE

PROBLEM IS NOT CYCLICAL, IT IS SECULAR.

The dotcom bubble

ushered in a change in America that is still reverberating through the

nation and around the globe. The Internet unleashed productivity

opportunities of unprecedented proportions in addition to new business

models, new ways of doing business and completely new and never before

realized markets. Ten years ago there was no such position as a Web

Master; having a home PC was primarily for doing word processing and

creating spreadsheets; Apple made MACs; and ordering on-line was a quaint

experiment for risk takers. The changes in ten short years are so broad

based that a whole article would be required to even frame the magnitude

of the changes. What needs to be understood is that this is precisely what

is destroying America. Let me explain.

The process of Creative

Destruction is the essential fact of capitalism. It is what capitalism

consists in and what every capitalist concern must survive within. America

as the birth place of modern capitalism was rooted in a clear

understanding of this process and the indisputable reality of survival of

the fittest.

�CREATIVE DESTRUCTION: � the competition from the new commodity, the new

technology, the new source of supply, the new type of organization �

competition which commands a decisive cost or quality advantage and which

strikes not at the margins of the profits and the outputs of the existing

firms but at their foundations and their very lives�.

Joseph A. Schumpeter

From Capitalism,

Socialism and Democracy (New York: Harper, 1975) [orig. pub. 1942], pp.

82-85:

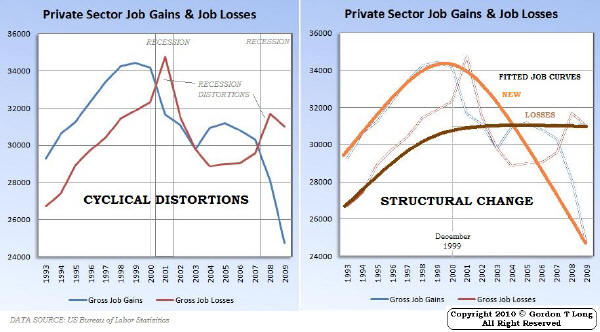

In 1997 prior to the

�go-go� Dotcom era unfolding, America�s unemployment was less than half of

what it is today at 4.7%. At that time the US added 3 Million net jobs

which reflected the creation of 33.4 Million new positions while

obsolescing or cutting 30.4 Million old positions. Job losses occurred in

old vocations such as typists, secretaries, filing clerks, switchboard

operators etc. Hired were new occupations such as C++

programmers, web

masters, database managers, network analysts etc.

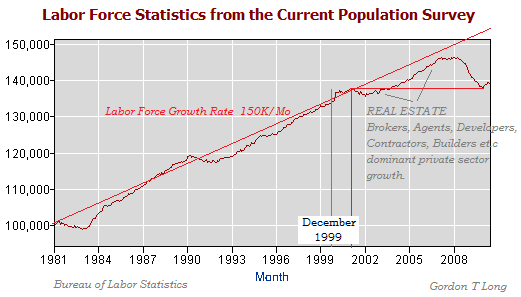

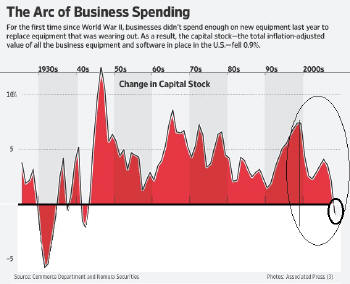

As the chart above

illustrates however, the additions have fallen off precipitously while the

job losses have stayed relatively flat. In 2009 job

losses were 31.0M and

only slightly larger than 1997 which would be expected with further

internet application development. New job creation however was only 24.7M

which is dramatically lower than the 33.4 in 1997.

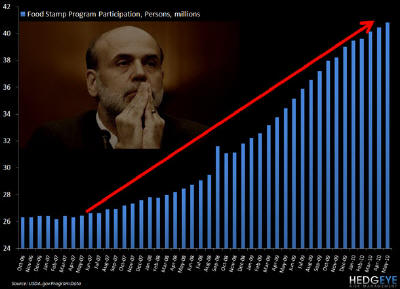

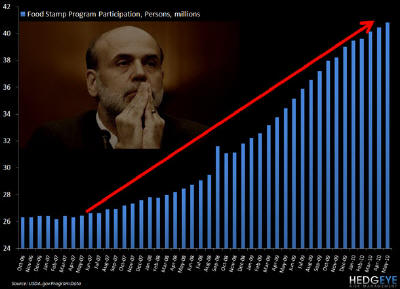

The result is 40.8M

people on food stamps in the US, as seen below.

This net creative destruction chart reflects closely the US economic

output gap.

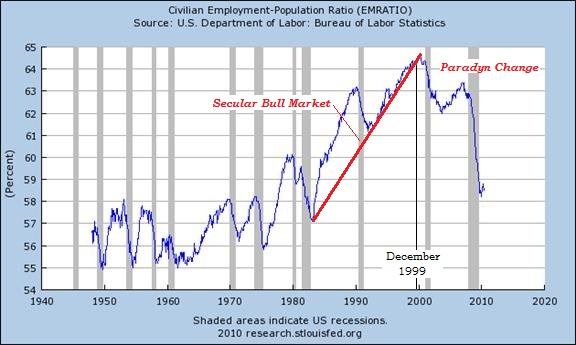

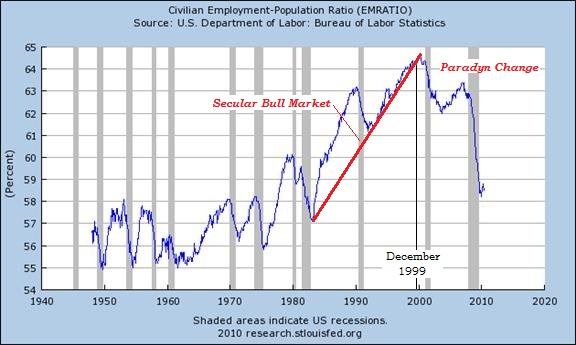

Employment levels at

58.5% are now near 30 year lows and do not show any signs of significant

improvement. This is despite nearly $13T in artificial stimulus to restart

an economy that appears to refuse to restart or unarguably is minimally a

�jobless recovery�.

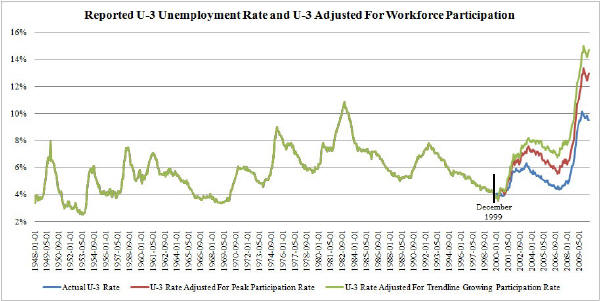

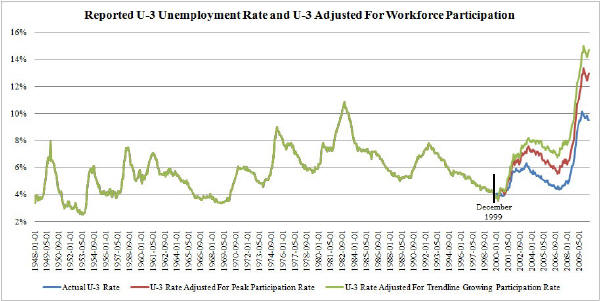

Once again Tyler Durden

and the folks at Zero Hedge did an excellent analysis of the

July unemployment numbers by correctly adjusting for shifts in

workforce participation. It is surprising that no one other than Zero

Hedge understands how to properly assess the monthly labor rate. Their

analysis, using government BLS numbers, is shown below and reflects an

unemployment rate of 14.7% adjusted for workforce participation.

Is it any wonder

Christina Romer as head of Obama�s Council of Economic Advisors resigned

the day before the July Non-Farm Payroll numbers were released, when she

once again would have had to spin and justify the unemployment rate to the

media?

ITS STRUCTURAL, NOT THE

FAMILIAR CYCLICAL BUSINESS CYCLE

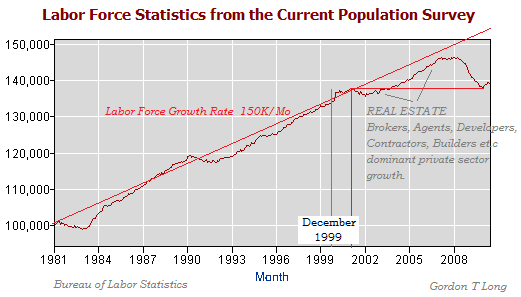

All the preceding

graphics have been labeled with a December 1999 vertical bar. In every

instance it shows a major cusp occurring near that point in time. The

dotcom market bubble finally popped 3-4 months later. There are anomalies

that create some distortions after this period, such as the explosion in

both the residential and commercial real estate sectors that temporarily

fostered massive hiring from brokers, agents, contractors, trades

personnel, developers, etc. Much of this has subsequently been pulled

back.

WHAT HAPPENED?

The short answer is the

US is no longer innovating fast enough. Innovation needs to sustain

its exponential growth

to absorb the creative destruction job losses. It no longer can.

Mathematicians would have argued some time ago this was a certainty to

happen, but precisely when this would occur however was the unknown.

We have been cutting Research and Development expenditures in the US

dramatically. I warned of this in 2009 in my article:

America, Innovate or Die! It has only gotten

worse since. Corporations may be reflecting minor cuts on their balance

sheets in this area but it obscures the fact that the money is

increasingly being re-allocated and spent offshore. Jobs and innovation

follow R&D.

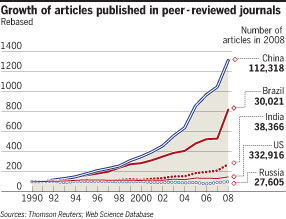

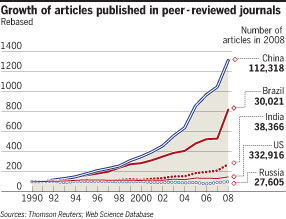

The Financial Times in

the UK featured this global analysis to the right, which to the best of my

knowledge never saw the light of day in any US publication. The rate of

growth in research papers in the US is not keeping up.

Total researcher share

is shrinking and falling further behind as the chart below demonstrates.

Even more alarming is

the number of US patents being filed. Other than IBM and Microsoft the

numbers are stunningly small. It needs to be fully appreciated that both

IBM and Microsoft now have large numbers of major world class research

facilities outside the US and the US filings numbers below are likely

reflecting this (see

America, Innovate or Die!).

�The numbers of engineering graduates in China and India far outpace that

of the United States. In China, it is 600,000; in India, 350,000; in the

United States, 70,000, and many of these are foreign students who, more

likely than not, will be returning to their home countries.�

Senator Edward

Kennedy --

10-25-05

Testimony - Senate Record

Let

me relate a personal story if I may. In the early 90�s I was a Vice

President of Engineering for a S&P 500 corporation in Massachusetts. This

engineering facility in Massachusetts consisted of over 900 engineers

supporting an enterprise with 28 facilities and over 10,000 employees.

Today it is all gone. The towns in the immediate area of this enterprise

also had major facilities of two other S&P 500 corporations. They are also

both gone. There were companies in Massachusetts at that time by the name

of DEC, Data General, Prime, Wang to name but four, that employed hundreds

of thousands of highly skilled personnel. They are likewise gone. So where

are the jobs to replace them?

Let

me relate a personal story if I may. In the early 90�s I was a Vice

President of Engineering for a S&P 500 corporation in Massachusetts. This

engineering facility in Massachusetts consisted of over 900 engineers

supporting an enterprise with 28 facilities and over 10,000 employees.

Today it is all gone. The towns in the immediate area of this enterprise

also had major facilities of two other S&P 500 corporations. They are also

both gone. There were companies in Massachusetts at that time by the name

of DEC, Data General, Prime, Wang to name but four, that employed hundreds

of thousands of highly skilled personnel. They are likewise gone. So where

are the jobs to replace them?

Communities in this area

now reflect those who have temporarily found jobs as a result of the over

building of retail stores and malls during the last ten years in almost

every available piece of land that could conceivably be built on. I walked

into yet another Home Depot and found one of my former employees working

in the electrical department who happened in the �90s to be one of the

world�s best power supply design engineers. He told me there was one other

with him from his old department. Both as I recall had Master�s degrees in

electrical engineering.

The new technology in

the area is now Bio-Tech. These new Bio-Technology corporations however

only employ in the 5 and 10 thousand range of employees. Not the 100s of

thousands that the four corporations I mentioned above once did.

These Bio-Tech

players additionally have an extremely high percentage of Master�s and PhD

level employees. What about the high school and/or college grads? Few

need apply. I personally see this demographic lined up for Dunkin Donuts

application forms each morning while relaxing after my morning jog. More

also out of work PhDs due to reduced teaching positions is not the solution. This is the state of affairs in

R&D that our politicians don�t see nor fully comprehend.

IS IT GOING TO CHANGE?

I

told you the above personal story as a way of leading into one of my

primary goals in the early 90s as VP of Engineering of this particular

operation. It was something called Cycle Time reduction. This is the

process of shortening the time to market of products from concept to

revenue generation. The chart to the right shows a graphical

representation of this.

I

told you the above personal story as a way of leading into one of my

primary goals in the early 90s as VP of Engineering of this particular

operation. It was something called Cycle Time reduction. This is the

process of shortening the time to market of products from concept to

revenue generation. The chart to the right shows a graphical

representation of this.

We were so successful at

reducing this through computerization such as the implementation of CAAD-CAM-CIM,

JIT, Kanban, TQM and a host of other acronyms that we were at levels

approaching 80% of the following years revenue being forecasted to be

derived from products still on the engineering concept boards. Margins and

room for error were absolutely razor thin. The strategy was like the old

three legged race at the community picnic. The faster some tried to run

the more they tripped themselves up. It was a strategy where speeding up

the process left unprepared competitors with a fatal competitive

disadvantage. The fight for market share was intense. Though I had moved

on, when the internet arrived and supply chain management was reinvented

and overlayed onto the previous advancements, the enterprise was rapidly

shuttered and moved to the far east. It is one, of no doubt, thousands of

similar stories in America. America�s ability to innovate and adjust to

that innovation killed this American based organizational unit. The highly

skilled, intense and motivated employees innovated themselves out of a

job.

THE LESSON IS THIS

America used the rate of

innovation as a foundation for its competitive advantage. Like the

tortoise and hare however, the US can no longer maintain this rate and

hence the advantage has temporarily shifted to the previous followers who

are presently less impacted. America must once again innovate and change

but now in a manner more fitting for the realities of this new decade.

The product today is no

longer the widget that comes off a manufacturing line and is stuffed into

a box to be shipped to distribution centers for sale. The product today

with short product life cycles and hundreds of new products is

Intellectual Capital. Intellectual Capital is the knowledge of knowing how

to do something. How to design and build something � not the actual �doing

of it�. Until America forces corporations to account for Intellectual

Property properly, the multi-nationals will continue to fully exploit this

tax loophole. Even worse, America�s innovation will continue to be used

against her. The cost of manufactured products today are less and less in

labor & production and increasingly in materials and innovation. Capital

is likewise shifting to be more intellectual versus financial. A major

overhaul of accounting standards must be driven by our legislators or it

will not be changed. It is not to the multi-nationals advantage to allow

such a debate and shift to occur.

Unfortunately our law

makers allowed this American asset to leave the US unrestricted, untaxed

and without recourse. It was America who knew how to design and build a

PC. It is fine for the product to be built where it is cheapest as part of

free trade, but only when the cost of the knowledge or Intellectual

property is priced in. Amortization of research & development must include

the Intellectual property value as well. The Intellectual Capital was an

American asset, not a corporate asset which left. Massive royalties should

now be flowing to the US taxpayer today which would offset many state and

local services cuts. Instead we are left with underfunded corporate legacy

pension plans that the government in the years to come will no doubt pick

up the tab for by likely hyperinflating the currency. Though it is too

late to revisit the horrendous US failure of public policy in the past, it

is not too late to prepare for tomorrow.

A STARTING POINT FOR CHANGE � Gordon�s Top Ten

As I said in the

beginning the US needs a bold new �Marshall� plan to fight the new

destruction of creative destruction. Here is a starting point for public

debate:

1 � If

we can spend $165B bailing out AIG, then we can spend $100B (4 years of

college @ 50K/year X 500,000 students) and guarantee everyone in America

a college education to compete in the 21st century. Parents

will start to spend immediately instead of presently being almost

financially paralyzed with skyrocketing education costs.

2-

Obama says we need to be leaders in Energy. OK. Where are the programs?

Where are the 50,000 new university teaching and research positions (

50,000 X 75K = $3.8B)? At $3.8B this is a rounding error compared to the

banks TARP program.

3- 99%

of all jobs in America are created by small business with less than 500

employees. Stop treating them like they are last on the �to help� list

after the banks, financial institutions and S&P 500 but first on the

taxation list. S&P 500 paid almost net zero taxes, reduced US

hiring, yet received the bulk

of the governments bailouts. Small business is the golden goose that

every administration seems determine to cook. What has the government

done for small business other than burden them with Obamacare and the

potential removal of the Bush tax cuts (most small business are directly

affected proprietorships)? If you can�t immediately recite what the government

has done to help small business as THE US employer (versus what they

have done for the bank and financial lobby), then you understand the

problem.

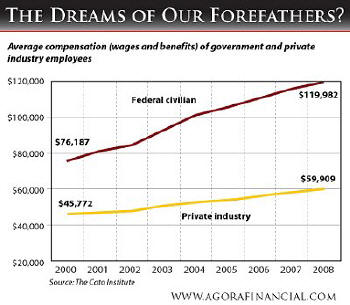

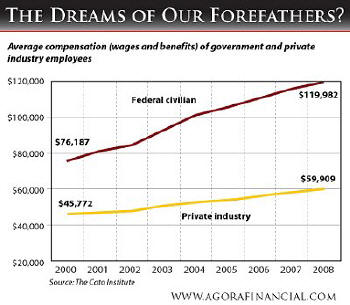

4-

The number of Government employees, in addition to their salaries and

benefits (federal, state & local) can best be described as out of

control. According to a new study from the Heritage Foundation, U.S.

government workers earn 30 to

40 percent more money

than their private sector counterparts on average. So, in essence, the

�servants� make substantially more money than the taxpayers who employ

them. Isn�t the system great? In fact, according to the study, if you

add in retirement and health care benefits, the average federal employee

now earns nearly twice as much as the average private sector employee.

4-

The number of Government employees, in addition to their salaries and

benefits (federal, state & local) can best be described as out of

control. According to a new study from the Heritage Foundation, U.S.

government workers earn 30 to

40 percent more money

than their private sector counterparts on average. So, in essence, the

�servants� make substantially more money than the taxpayers who employ

them. Isn�t the system great? In fact, according to the study, if you

add in retirement and health care benefits, the average federal employee

now earns nearly twice as much as the average private sector employee.

5- Make Social Security and Medicare financially sound so Americas can

believe and budget that it will be there for them. The public will spend

and invest if they know they have a nest egg that really exists. The

government is fooling no one. Kids learn that Social Security and

Medicare is unfunded before their college freshman year today.

The stark reality of the shift from defined benefits to contributory

benefits over the last decade is just now sinking in with the US

consumer. They now have no retirement like their parents had. Retirement

savings is something when added to college costs is leaving them

frightened. Worried people don't spend money and when the economy is 70%

consumer spending you have an economic crisis. Political denial

and the government attempting to paper it over with policies of extend

and pretend are misplaced and will make the inevitability even more

difficult to effectively address.

6- When

did the American people decide to fund military operations in over 130

countries around the world? With 40.8M people on food stamps, something

is seriously out of balance here but there is no public debate thought

to be required by either party.

7- The

US has no full scale strategic growth programs being initiated by the

present administration. We have only financial stimulus or austerity

programs. There is a big difference that seems wasted on Washington.

8-

Washington and the lobbyists that control it have taken control of our

government. Obama campaigned to stop earmarks which ranged in the area

of approximately 10,000 annually prior to his presidency. In his first

year they increased to the 11,000 range. This is not the change he

promised as more pork increasingly flows.

9- For

those that actually read it, Obamacare is not a solution for healthcare.

It is a stealth income tax we will all soon get hit with. The Dodd-Frank

Act is not a fix to what caused the 2008 financial crisis but rather is

the most dramatic shift in centralized US government planning and

control since the 1930�s. Both these bills were over 2000 pages compared

to landmark bills historically being 25 � 45 pages. Indications are that

few of our elected representatives actually read either of these

documents. They simply voted party lines. As Sarbanes-Oxley dictates,

CEOs must sign their corporate 10-Q reports to the government and are

liable for it. It is a felony not to. Every elected official should also

sign that he or she has personally read the entire act prior to being

allowed to vote on it or it likewise will be a felony.

10- The

Supreme Court recently over-turned major elements of the Campaign

Contribution Reform bill. Washington and the media have now gone

completely mute on this subject as politicians scramble for mid-term

campaign money for media expense coverage. Maybe our elected officials

should vote with the same urgency on this matter as they are presently

on giving billions of �candy� away almost daily to every financial

disruption, state budget problem, unemployment benefit problem or sign

of increasing housing default and foreclosure rates during this run up

to the fall elections.

I could go on, but I

think you get the message. America is afraid to be bold! We have no

strategy, no plan, no funding and no leadership! In my days as a VP of

Engineering you were fired for just one of these shortfalls.

Maybe we the public need

to start doing some firing!

�The biggest political change in my lifetime is that Americans no longer

assume that their children will have it better than they did. This is a

huge break with the past, with assumptions and traditions that shaped us.�

Peggy Noonan: America Is at Risk of Boiling Over

Feature Wall Street Journal Op-Ed article - 08-07-10

For the

complete research report go to:

Tipping Points

Sign Up for the next release in the

Preserve & Protect series:

Commentary

Gordon T Long

Tipping Points

Mr. Long is a former senior group executive with two Fortune 500

international corporations, a

principal in a high tech public start-up and founder of a private venture

capital fund. He is presently involved in private equity placements

internationally along with proprietary trading involving the development &

application of Chaos Theory and Mandelbrot Generator algorithms.

Gordon T Long is not a registered advisor and does not give investment

advice. His comments are an expression of opinion only and should not be

construed in any manner whatsoever as recommendations to buy or sell a

stock, option, future, bond, commodity or any other financial instrument

at any time. While he believes his statements to be true, they always

depend on the reliability of his own credible sources. Of course, he

recommends that you consult with a qualified investment advisor, one

licensed by appropriate regulatory agencies in your legal jurisdiction,

before making any investment decisions, and barring that, you are

encouraged to confirm the facts on your own before making important

investment commitments.

� Copyright 2010 Gordon T Long. The information herein was obtained from

sources which Mr. Long believes reliable, but he does not guarantee its

accuracy. None of the information, advertisements, website links, or any

opinions expressed constitutes a solicitation of the purchase or sale of

any securities or commodities. Please note that Mr. Long may already have

invested or may from time to time invest in securities that are

recommended or otherwise covered on this website. Mr. Long does not intend

to disclose the extent of any current holdings or future transactions with

respect to any particular security. You should consider this possibility

before investing in any security based upon statements and information

contained in any report, post, comment or recommendation you receive from

him.

Fair Use

Notice

Fair Use Notice

This site contains

copyrighted material the use of which has not always been specifically

authorized by the copyright owner. We are making such material available in

our efforts to advance understanding of environmental, political, human

rights, economic, democracy, scientific, and social justice issues, etc. We

believe this constitutes a 'fair use' of any such copyrighted material as

provided for in section 107 of the US Copyright Law. In accordance with

Title 17 U.S.C. Section 107, the material on this site is distributed

without profit to those who have expressed a prior interest in receiving the

included information for research and educational purposes.

If you wish to use

copyrighted material from this site for purposes of your own that go beyond

'fair use', you must obtain permission from the copyright owner.

I

told you the above personal story as a way of leading into one of my

primary goals in the early 90s as VP of Engineering of this particular

operation. It was something called Cycle Time reduction. This is the

process of shortening the time to market of products from concept to

revenue generation. The chart to the right shows a graphical

representation of this.

I

told you the above personal story as a way of leading into one of my

primary goals in the early 90s as VP of Engineering of this particular

operation. It was something called Cycle Time reduction. This is the

process of shortening the time to market of products from concept to

revenue generation. The chart to the right shows a graphical

representation of this.