|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Mon. Aug. 10th, 2015

Follow Our Updates

onTWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

ANNUAL THESIS PAPERS

FREE (With Password)

THESIS 2010-Extended & Pretend

THESIS 2011-Currency Wars

THESIS 2012-Financial Repression

THESIS 2013-Statism

THESIS 2014-Globalization Trap

THESIS 2015-Fiduciary Failure

WHAT WE ARE RESEARCHING

2015 THEMES

SUB-PRIME ECONOMY

PENSION POVERITY

WAR ON CASH

ECHO BOOM

PRODUCTIVITY PARADOX

GLOBAL GOVERNANCE

- COMING NWO

WHAT WE ARE WATCHING

(A) Active, (C) Closed

MATA

Q3 '15- Chinese Market Crash

(A)

Q3 '15- X

GMTP

Q3 '15- Greek Negotiations

(A)

Q3 '15- Puerto Rico Bond Default

MMC

OUR STRATEGIC INVESTMENT INSIGHTS (SII)

NEGATIVE-US RETAIL

NEGATIVE-ENERGY SECTOR

NEGATIVE-YEN

NEGATIVE-EURYEN

NEGATIVE-MONOLINES

POSITIVE-US DOLLAR

ARCHIVES

| AUGUST | ||||||

| S | M | T | W | T | F | S |

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 | 31 | |||||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar Weakness |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?We have analyzed & included

these in our latest research papers Macro videos!

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||||||||||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||||||||||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||||||||||

|

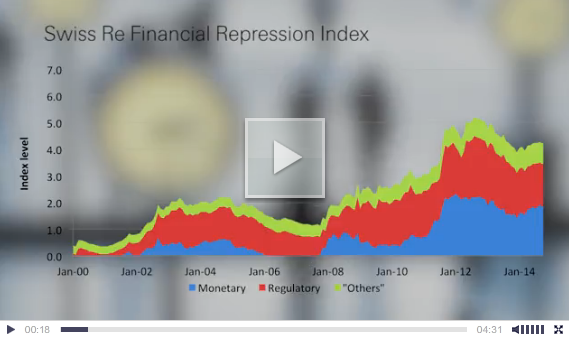

CHECK OUT OUR PAGE DEDICATED TO FINANCIAL REPRESSION The Financial Repression AuthorityTM

|

|||||||||||

| THESIS & THEMES | |||||||||||

FINANCIAL REPRESSION - UPDATE

The Disappearing Retirement Fund International Man's Jeff Thomas points to the unprecedented financial & economic challenges & crises in the indebted developed world .. Thomas is very pessimistic about the retirement situation for Americans, Canadians, Europeans .. he thinks their investments in their pension funds will diminish dramatically in value or disappear .. for example, on U.S. social security, "Ergo, each year, those working will need to be taxed more heavily if the system is to continue. Unfortunately, at some point, we reach the tipping point and the concept itself is no longer viable. After that point, benefits will be reduced and, possibly, eliminated altogether." .. in regard to private pension funds like 401Ks, Thomas sees the risks of a stock market crash as bringing down the value of these funds, even if the funds are so-called "diversified" .. but there's more - there are now new risks from governments desperately in search of funds to keep their operations & public pensions going .. "When governments find themselves on the verge of insolvency, they invariably react the same way: go back to the cash cow for a final milking. Each of the jurisdictions that is in trouble at present, has, in its playbook, the same collection of milking techniques. One of those will have a major impact on pensions: the requirement that pension plans must contain a percentage of government Treasuries .. Legislation will be created to ensure that a percentage be in Treasuries, which are 'guaranteed' .. Sounds good. And people will be grateful. Unfortunately, the body that is providing the guarantee is the same body that has created the economic crisis. And if the government is insolvent, the 'guarantee' will become just one more empty promise. Recently, the U.S. Supreme Court ruled that employers have a duty to protect workers invested in their 401(k) plans from mutual funds that perform poorly or are too expensive. By passing this ruling, the US government has the power to seize private pension funds “to protect pensioners”. It also has the authority to dictate how funds may be invested. The way is now paved for the requirement that 401(k)s be invested heavily in US Treasuries."

Financial Repression Will Intensify as Central Bank/Government Policy Options Become Limited Economist Satyajit Das sees increasing methods of financial repression being employed by governments as policy options become limited .. Introduced in 1973 by economists Edward Shaw & Ronald McKinnon, the term refers to measures implemented by governments to channel savings & funds to finance the public sector, lower its borrowing costs & liquidate debt .. Das sees new taxes, means testing, user pay surcharges all coming .. "Entitlement liabilities, such as retirement benefits, will be managed by increasing the allowable minimum retirement age, reducing benefit levels, linking to actual contribution by individuals over their working life, and eliminating inflation indexation. Many of these policies will be packaged as socially and ethically progressive initiatives, belying the financial imperatives." .. points out in a 2013 study, the McKinsey Global Institute found that between 2007 & 2012, interest rate & quantitative easing (QE) policies resulted in a net transfer to governments in the United States, Britain & the eurozone of $1.6 trillion (£1.03 trillion), through reduced debt-service costs & increased central bank profits - "The losses were borne by households, pension funds, insurers and foreign investors. Households in these countries together lost $630bn in net interest income, with the major losses being borne by older households with significant interest-bearing assets. Non-financial corporations in these countries also benefited by $710bn through lower debt service costs." .. Das also sees deliberate devaluation as another financial repression mechanism .. regulations are another mechanism: "Governments can legislate minimum mandatory holdings of government securities for banks, pension funds and insurance companies. New liquidity regulations already require increased holdings of government bonds by banks and insurers." .. wealth confiscation is yet another mechanism - seizing savings or pension fund assets like in 2013 when Spain drew €5bn (£3.5bn) from the state’s Social Security Reserve Fund, designed to guarantee pension payments in times of hardship .. nationalizations are yet another mechanism .. "Debt monetization and the resultant loss of purchasing power effectively represent a tax on holders of money and sovereign debt. They redistribute real resources from savers to borrowers and the issuer of the currency, resulting in diminution of wealth over time. This highlights the reliance on financial repression, explicitly seeking to reduce the value of savings. Ultimately, the policies being used to manage the crisis punish frugality and thrift, instead rewarding borrowing, profligacy, excess and waste."

Germany Replacing Bank Cards and Eliminating Cash Withdrawals: Financial Repression Gone Mad Martin Armstrong: "The game is afoot to eliminate CASH .. Already we see the cancellation of such cards and the issuing of new debit cards. Why? The new cards cannot be used at an ATM outside of Germany to obtain cash. Any attempt to get cash can only be an advance on a credit card .. Little by little, these people are destroying everything that held the world economy together .. This will NEVER END NICELY for they can only think about their immediate needs with no comprehension of the future they are creating .. This is total insanity and we are losing absolutely everything that makes society function .. Once they eliminate CASH, they will have total control over who can buy or sell anything." 16 June 2015 Swiss Re Meeting: "Sounding the Alarm on Financial Repression" Swiss Re video highlights the recent meeting they held with experts voicing concerns about the ongoing use of unconventional policies .. financial repression is causing financial market distortions & poses a serious risk to financial stability .. These unconventional policies have pushed institutional investors into holding government debt. As a result they have less money available for productive investment, such as infrastructure projects .. "It means that there's a global search for yield. That possibly leads to a misallocation of resources," says Douglas Flint, Group Chairman of HSBC .. Jean-Claude Trichet, Chairman of the Group of Thirty affirms the risks. |

|||||||||||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - August 09th, 2015 - August 15th, 2015 | |||||||||||

| BOND BUBBLE | 1 | ||||||||||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||||||||||

| GEO-POLITICAL EVENT | 3 | ||||||||||

| CHINA BUBBLE | 4 | ||||||||||

| JAPAN - DEBT DEFLATION | 5 | ||||||||||

EU BANKING CRISIS |

6 |

||||||||||

| TO TOP | |||||||||||

| MACRO News Items of Importance - This Week | |||||||||||

GLOBAL MACRO REPORTS & ANALYSIS |

|||||||||||

US ECONOMIC REPORTS & ANALYSIS |

|||||||||||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||||||||||

| Market | |||||||||||

| TECHNICALS & MARKET |

|

||||||||||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||||||||||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||||||||||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||||||||||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

||||||||

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|||||||||

|

2013 2014 |

|||||||||||

2011 2012 2013 2014 |

|||||||||||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||||||||||

I - POLITICAL |

|||||||||||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||||||||||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|||||||||

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |||||||||

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |||||||||

II-ECONOMIC |

|||||||||||

| GLOBAL RISK | |||||||||||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |||||||||

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |||||||||

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |||||||||

| - -GLOBAL GROWTH & JOBS CRISIS | |||||||||||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|||||||||

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

||||||||

III-FINANCIAL |

|||||||||||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |||||||||

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||||||||||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |||||||||

| GENERAL INTEREST |

|

||||||||||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||||||||||

|

SII | ||||||||||

|

SII | ||||||||||

|

SII | ||||||||||

|

SII | ||||||||||

| TO TOP | |||||||||||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP