|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Fri. Dec. 18th, 2015

Follow Our Updates

onTWITTER

https://twitter.com/GordonTLong

ARCHIVES

| DECEMBER | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | ||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | 15 | 16 | 17 | 18 | 19 |

| 20 | 21 | 22 | 23 | 24 | 25 | 26 |

| 27 | 28 | 29 | 30 | 31 | ||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?We have analyzed & included

these in our latest research papers Macro videos!

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

|

|||

FLOWS - Liqudity, Credit & Debt

|

12-04-15 | THEMES | |

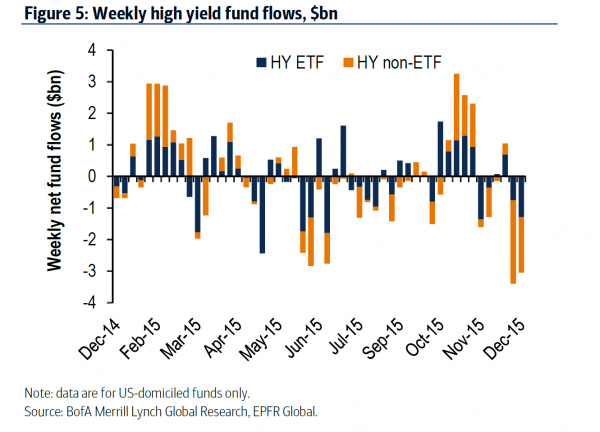

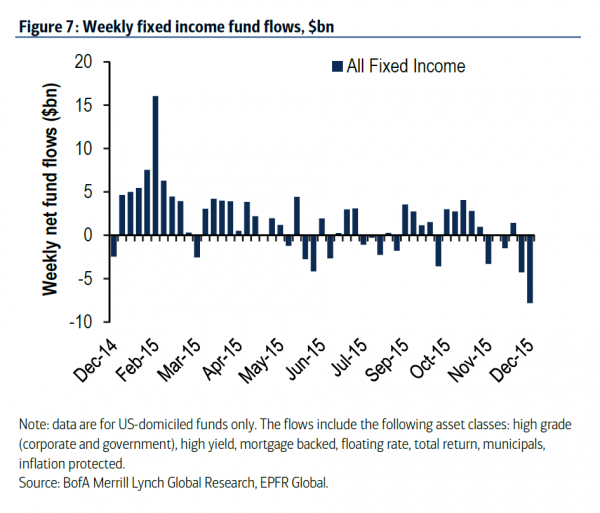

Submitted by Tyler Durden on 12/17/2015 Markets Brace For More Fund Liquidations As Record Outflows Slam Debt FundAmong the fixed income community, this week's most important number, more so than the pre-telegraphed 25 bps increase in the Fed's interest rate, was the weekly report of capital flows in and out of bond funds by Lipper/EPFR, which came out moments ago and which following last week's junk bond fund fireworks involving Third Avenue and several other gating or liquidating funds, was expected to be a doozy. It did not disappoint: in the words of Bank of America, there was "Carnage in Fixed Income" as a result of the largest outflows from bond funds since Jun’13 ($13bn) with outflows concentraing, as expected, in illiquid & low-quality assets. The details showed a broad revulsion to all aspects of the fixed income space, from Investment Grade, to Junk to bank loans. To quote Bank of America:

Bloomberg, which cited BofA numbers, and yet which had different totals was nonetheless close enough. It reported that investors "pulled $3.81 billion from U.S. high-yield bond funds in the past week, the biggest withdrawal since August 2014, according to Lipper." The FT's numbers were even more different:

Whatever the real number, the result is clear: investors have launched a feedback loop where lower bond prices lead to more redemptions which force more selling, leading to more redemptions and so on. As Bloomberg reminds us, the average yield on junk bonds jumped to more than 9 percent on Dec. 14 for the first time since 2011, according to Bank of America Merrill Lynch indexes. And yet despite endless laments that there is "not enough yield", investors couldn't get out fast enough. It appears investors aren't "starved for yield"... they are simply "starved for safety in numbers." "The negative headline feeds upon itself," Ricky Liu, a money manager at HSBC Global Asset Management told Bloomberg. "And if you are in a poorly performing retail fund, there is also the concern that there could be more pain to follow. The commodities space is still a pretty big part of high yield and there is no relief there yet." The visual breakdown: junk bonds.

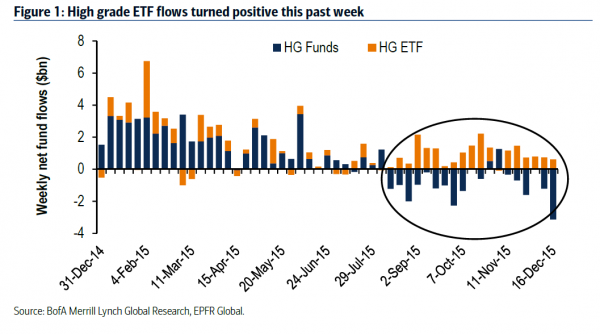

Bad news for buybacks: Investment Grade outflows soared in the last week to the highest in over a year driven entirely by redemptions from mutual funds, and offset by a small injection in IG ETFs.

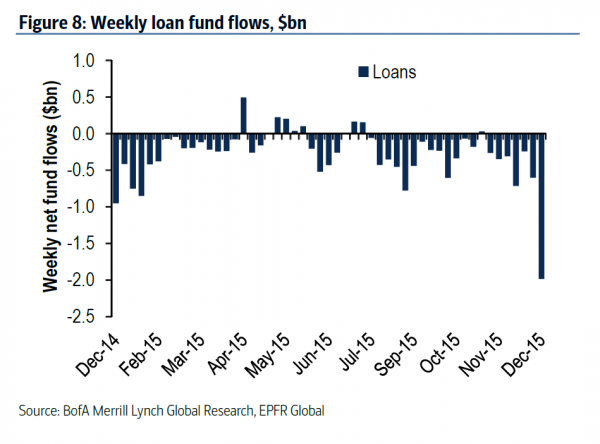

Total fixed income fund flows. But the one category that was certainly the most interesting, is the one we highlighted earlier today when we said "the one asset class that has so far slipped through the cracks, but which will be very closely scrutinized in the coming weeks now that rates are rising: leveraged loans." The reason: the underperformance in leveraged loans so far this year is on par if not worse than that of junk bonds.

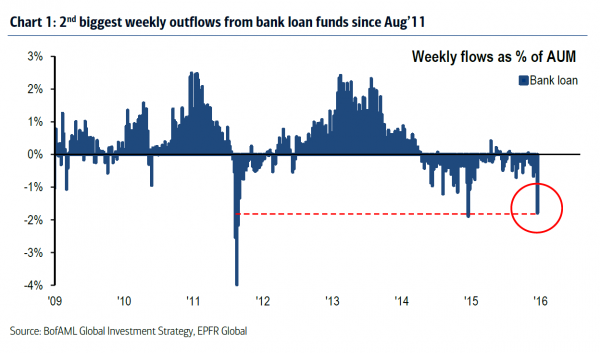

Result: bank loan funds just recorded their 2nd biggest outflow since August 2011.

And longer term.

The bottom line: as new investor liquidity evaporates and as billions are redeemed first from the junk bond universe, then investment grade and then loans, the debt crisis which was unleashed in anticipation of the Fed's rate hike, is about to get much worse, and lead to even more prominent hedge fund "gates" and liquidations, while in the equity space, the lack of Investment Grade dry powder means that buybacks are about to grind to a halt.

|

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK -Dec 13th, 2015 - Dec 19th, 2015 | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

INTEREST & INFLATION PRESSURES What The Market Chose To Ignore In Yesterday's Fed Announceent Submitted by Tyler Durden on 12/17/2015 - 05:45 Submitted by Tyler Durden on 12/17/2015 - 05:45

The hard part now is how to ween the market away from the old narrative, the one which has pushed the S&P to record highs over the past 7 years on bad economic news, and to renomralize the market's own "reaction function" to that of the Fed. The problem is that from day one there is a major discrepancy between the two: as previouslly observed, the Fed did not deliver the desired dovish hike, and kept its 2016 year-end fed funds rate unchanged at 1.4% suggesting 4 rate hikes in the coming year, and which as Breslow notes means "being less dovish than the meeting previews suggested is now a sign of bullishness on the economy." This sets the Fed on a collision course with the market because "with the market pricing fewer hikes than the Fed suggests, someone is going to end up being wrong." In First Post-Hike Reverse Repo, Fed Removes $105Bn Liquidity From 49 Banks Submitted by Tyler Durden on 12/17/2015 - 13:35 Submitted by Tyler Durden on 12/17/2015 - 13:35

In what appears to be an orderly process, The NY Fed's first Reverse Repo operation since The FOMC 'raised' rates released $105.185 billion of Treasury collateral to 49 banks at a rate 25bps, draining the same amount of system liquidity. This is being greeted as good news by many as no major disprutions appear to have occurred... aside from, of course, a 6bps plunge in long-end bond yields, 250 point drop in The Dow, and notable weakness in high-yield bonds. While some had feared up to $1 trillion would need to be withdrawn to achieve The Fed's goals, the size of this initial RRP suggests there is considerably less excess liquidty in the system than many would believe... indicating a notably more fragile system than we are being led to believe.

|

12-17-15 | 32 |

|

Submitted by Tyler Durden on 12/16/2015 Fed Reveals Rate Hike "Plumbing" Details: Removes Cap On Reverse Repos, Limits Each Counterparty To $30 BillionPerhaps even more important than the actual rate hike announcement, the one statement the market was particularly focused on was the Fed's "implementation note", which lays out the Fed's thought process on how it will actually raise rates in order to maintain the Fed Funds in the 0.25%-0.50% range. What it reveals is

What is missing from the analysis is how the Fed will approach the fact that securities pledged to the Fed remain outside of the traditional repo pathway, and thus the liquidity shortage among the treasury market is likely to continue if not worsen. Most of these are in line with expectations. Now it remains to be seen if these theoretically necessary measures will also be practically sufficient. The full details from the FED:

And from the NY Fed:

|

|||

INTEREST & INFLATION PRESSURES |

12-16-15 | 32 |

|

Submitted by Tyler Durden on 12/16/2015

Fed May Have To Drain As Much As $1 Trillion In Liquidity To Push Rates 25 bps HigherIt's 2:00:01 pm and the Fed has just announced it will hike rates by 25 bps while using very dovish language to convey that just like "tapering was not tightening" in 2013, so "tightening isn't really tightening", and unleashing a massive buying order. So far so good. But the real question is what does this mean for post-kneejerk market dynamics, and the one most important variable of all: liquidity. The all too crucial, and overdue, answer to this question will be delivered when the Fed releases its "implementation note" concurrently with the FOMC statement which should explain all the nuances of just how the Fed will adjust the IOER-Reverse Repo piping that will be crucial to pull of the rate hike in practice, something which has been stumping Two weeks ago, we cited repo-market expert E.D. Skyrm who calculated that moving general collateral higher by 25bps would require the Fed draining up to $800 billion in liquidity:

That may be conservative. According to Citigroup's latest estimate, the liquidity drain could be substantially greater. Here is the take of Jabaz Mathai

Putting this liquidity drain in context, the entire QE2 injected "only" $600 billion in liquidity in the span of many months, suggesting that as of tomorrow, the Fed may drain as much as 166% of its entire second quantitative easing operation overnight. Whether that liquidity is inert and can be easily released by banks, and more importantly, non-banks without resulting in any additional risk tremors is the first $640 billion question that the Fed is facing. The second, third and fourth? Assuming a linear relationship and another 3 rate hikes until the end of 2014, this means that by the time short term rates hit 1%, the Fed may have soaked up as much $4 trillion in liquidity. Here one thing is certain: a $1 trillion drain may not have a material impact when starting from a $2.6 trillion excess reserve base. $4 trillion, however, will leave a mark (the Fed's entire balance sheet is $4.5 trillion) especially once the market starts to discount just how the rate hike plumbing takes place.

|

|||

INTEREST & INFLATION PRESSURES |

12-15-15 | 32 |

|

Submitted by Tyler Durden on 12/14/2015

Will The Fed Hike Rates This Week?The Only 'Data' That MattersThis is the real "data" that The Fed is "dependent" on... As Deutsche Bank notes, The Fed is “right” to be raising rates. If they had done it earlier all the problems they now have to face, they wouldn’t have had to. If they do it later, those same problems will be even worse. Of course had they done it earlier there may well have been other problems. Like for example, no growth and a much higher unemployment rate. But that’s all water under the bridge. Fact is this Fed is ready to go. And markets know it! But, what would it take for the Fed not to hike this coming meeting?

And then what... It looks like the market is already pricing in the next inevitable round of QE. |

|||

Submitted by Martin Armstrong via ArmstrongEconomics.com,

Those in power never understand markets. They are very myopic in their view of the world. The assumption that lowering interest rates will “stimulate” the economy has NEVER worked, not even once. Nevertheless, they assume they can manipulate society in the Marxist-Keynesian ideal world, but what if they are wrong? By lowering interest rates, they ASSUME they will encourage people to borrow and thus expand the economy. They fail to comprehend that people will borrow only when they BELIEVE there is an opportunity to make money. Additionally, they told people to save for their retirement. Now they want to punish them for doing so by imposing negative interest rates (tax on money) to savings. They do not understand that lowering interest rates, when there is no confidence in the future anyhow, will not encourage people to start businesses and expand the economy. It wipes out the income of savers and then the only way to make and preserve money becomes ASSET investment, as in the stock market — not creating business startups. So lowering interest rates is DEFLATIONARY, not inflationary, for it reduces disposable income. This is particularly true for the elderly who are forced back to work to compete for jobs, which increases youth unemployment. Since the only way to make money has become ASSET INFLATION, they must withdraw money from banks and buy stocks. Now, they are in the hated class of the “rich” who are seen as the 1% because they are making money when the wage earner loses money as taxation rises and the economy declines. As taxes rise, machines are replacing workers and shrinking the job market, which only fuels more deflation. Then you have people like Hillary who say they will DOUBLE the minimum wage, which will cause companies to replace even more jobs with machines. Democrats, in particular, are really Marxists. They ignore Keynes who also pointed out that lowering taxes would stimulate the economy. Keynes, in all fairness, did not advocate deficit spending year after year nor never paying off the national debt. Keynes wrote regarding taxes:

Keynes obviously wanted to make it clear that the tax policy should be guided to the right level as to not discourage income. Keynes believed that government should strive to maximize income and therefore revenues. Nevertheless, Democrats demonized that as “trickle-down economics.” Keynes explained further:

This is the logic employed by those in power. They are raising taxes and destroying the economy; when revenues decline, they raise taxes further. The evidence that politicians are incompetent of managing the economy is simply illustrated here. Now, we have Hillary claiming that she will raise taxes on corporations, but that will reduce jobs for she will only attack small businesses and never the big entities and banks who fund her campaign. So when it comes to sanity on interest rates or taxes, we really need to throw out of office anyone who is a professional career politician before they wipe out everything. The balance sheet is, as Keynes said, “ZERO on both sides.” |

|||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

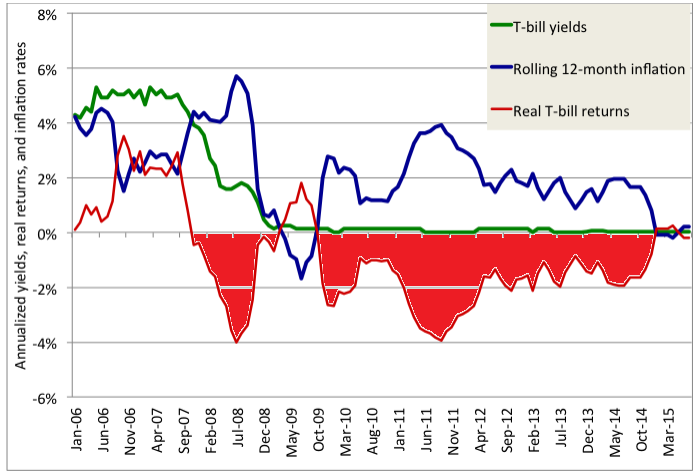

PROF. THOMAS COLEMAN & LARRY SIEGEL: The Hidden Cost of Zero Interest Rate Policies – $1 TRILLION or 5% per Year Taken From US Savers |

|||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

| STANDARD OF LIVING - SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| THEMES - 2016 RECESSION | 11-26-15 |

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP