|

JOHN RUBINO'SLATEST BOOK |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Weekend Feb. 8th, 2014

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images: Understanding the Conclusions

| FEBRUARY | ||||||

| S | M | T | W | T | F | S |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |

| Complete Archives |

||||||

KEY TO TIPPING POINTS |

| 1 - Risk Reversal |

| 2 - Japan Debt Deflation Spiral |

| 3- Bond Bubble |

| 4- EU Banking Crisis |

| 5- Sovereign Debt Crisis |

| 6 - China Hard Landing |

| 7 - Chronic Unemployment |

| 8 - Geo-Political Event |

| 9 - Global Governance Failure |

| 10 - Chronic Global Fiscal ImBalances |

| 11 - Shrinking Revenue Growth Rate |

| 12 - Iran Nuclear Threat |

| 13 - Growing Social Unrest |

| 14 - US Banking Crisis II |

| 15 - Residential Real Estate - Phase II |

| 16 - Commercial Real Estate |

| 17 - Credit Contraction II |

| 18- State & Local Government |

| 19 - US Stock Market Valuations |

| 20 - Slowing Retail & Consumer Sales |

| 21 - China - Japan Regional Conflict |

| 22 - Public Sentiment & Confidence |

| 23 - US Reserve Currency |

| 24 - Central & Eastern Europe |

| 25 - Oil Price Pressures |

| 26 - Rising Inflation Pressures & Interest Pressures |

| 27 - Food Price Pressures |

| 28 - Global Output Gap |

| 29 - Corruption |

| 30 - Pension - Entitlement Crisis |

| 31 - Corporate Bankruptcies |

| 32- Finance & Insurance Balance Sheet Write-Offs |

| 33 - Resource Shortage |

| 34 - US Reserve Currency |

| 35- Government Backstop Insurance |

| 36 - US Dollar Weakness |

| 37 - Cyber Attack or Complexity Failure |

| 38 - Terrorist Event |

| 39 - Financial Crisis Programs Expiration |

| 40 - Natural Physical Disaster |

| 41 - Pandemic / Epidemic |

Reading the right books?

No Time?

![]()

We have analyzed & included

these in our latest research papers!

![]()

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

TODAY'S TIPPING POINTS

| THIS WEEKS TIPPING POINTS | MACRO NEWS | MARKET | 2013 THEMES |

FLOWS: Liquidity, Credit and Debt

"BEST OF THE WEEK " |

Posting Date |

Labels & Tags | TIPPING POINT or 2013 THESIS THEME | |||||||

HOTTEST TIPPING POINTS |

Theme Groupings |

|||||||||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro |

||||||||||

|

||||||||||

| THESIS & THEMES | ||||||||||

|

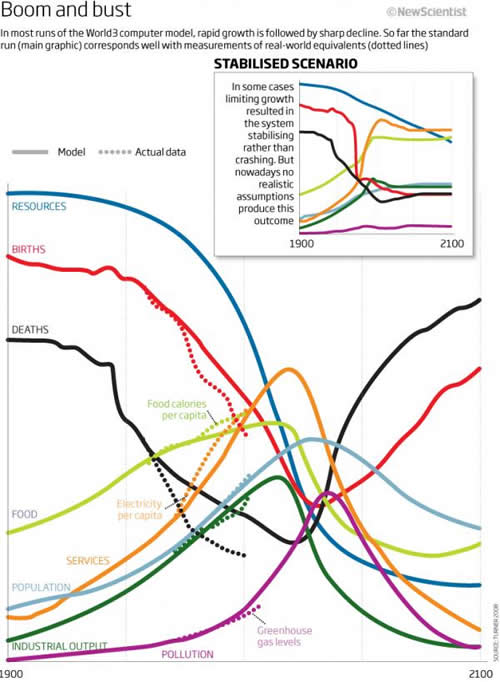

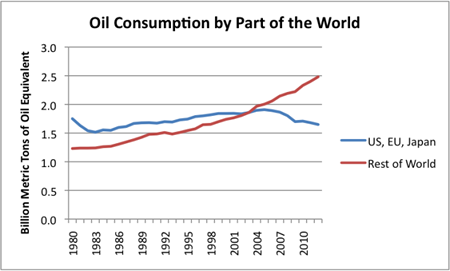

GLOBALIZATION TRAP - Resource Limitations & Shortages Limits to Growth - At Our Doorstep, But Not Recognized 02-06-14 Gail Tverberg via Our Finite World blog via ZH How long can economic growth continue in a finite world? This is the question the 1972 book The Limits to Growth by Donella Meadows and others sought to answer. The computer models that the team of researchers produced strongly suggested that the world economy would collapse sometime in the first half of the 21st century. I have been researching what the real situation is with respect to resource limits since 2005. The conclusion I am reaching is that the team of 1972 researchers were indeed correct. In fact, the promised collapse is practically right around the corner, beginning in the next year or two. In fact, many aspects of the collapse appear already to be taking place, such as the 2008-2009 Great Recession and the collapse of the economies of smaller countries such as Greece and Spain. How could collapse be so close, with virtually no warning to the population? To explain the situation, I will first explain why we are reaching Limits to Growth in the near term. I will then provide a list of nine reasons why the near-term crisis has been overlooked. Why We are Reaching Limits to Growth in the Near Term In simplest terms, our problem is that we as a people are no longer getting richer. Instead, we are getting poorer, as evidenced by the difficulty young people are now having getting good-paying jobs. As we get poorer, it becomes harder and harder to pay debt back with interest. It is the collision of the lack of economic growth in the real economy with the need for economic growth from the debt system that can be expected to lead to collapse. The reason we are getting poorer is because hidden parts of our economy are now absorbing more and more resources, leaving fewer resources to produce the goods and services we are used to buying. These hidden parts of our economy are being affected by depletion. For example, it now takes more resources to extract oil. This is why oil prices have more than tripled since 2002. It also takes more resource for many other hidden processes, such as deeper wells or desalination to produce water, and more energy supplies to produce metals from low-grade ores. The problem as we reach all of these limits is a shortage of physical investment capital, such as oil, copper, and rare earth minerals. While we can extract more of these, some, like oil, are used in many ways, to fix many depletion problems. We end up with too many demands on oil supply–there is not enough oil to both (1) offset the many depletion issues the world economy is hitting, plus (2) add new factories and extraction capability that is needed for the world economy to grow. With too many demands on oil supply, “economic growth” is what tends to get shorted. Countries that obtain a large percentage of their energy supply from oil tend to be especially affected because high oil prices tend to make the products these countries produce unaffordable. Countries with a long-term decline in oil consumption, such as the US, European Union, and Japan, find themselves in recession or very slow growth. Unfortunately, the problem this appears eventually to lead to, is collapse. The problem is the connection with debt. Debt can be paid back with interest to a much greater extent in a growing economy than a contracting economy because we are effectively borrowing from the future–something that is a lot easier when tomorrow is assumed to be better than today, compared to when tomorrow is worse than today. We could not operate our current economy without debt. Debt is what has allowed us to “pump up” economic growth. Consumers can buy cars, homes, and college educations that they have not saved up for. Businesses can set up factories and do mineral extraction, without having past profits to finance these operations. We can now operate with long supply chains, including many businesses that are dependent on debt financing. The ability to use debt allows vastly more investment than if potential investors could only the use of after-the-fact profits. If we give up our debt-based economic system, we lose our ability to extract even the oil and other resources that appear to be easily available. We can have a simple, local economy, perhaps dependent on wood as it primary fuel source, without debt. But it seems unlikely that we can have a world economy that will provide food and shelter for 7.2 billion people. The reason the situation is concerning is because the financial situation now seems to be near a crisis. Debt, other than government debt, has not been growing very rapidly since 2008. The government has tried to solve this problem by keeping interest rates very low using Quantitative Easing (QE). Now the government is cutting back in the amount of QE. If interest rates should rise very much, we will likely see recession again and many layoffs. If this should happen, debt defaults are likely to be a problem and credit availability will dry up as it did in late 2008. Without credit, prices of all commodities will drop, as they did in late 2008. Without the temporary magic of QE, new investment, even in oil, will drop way off. Government will need to shrink back in size and may even collapse. In fact, we are already having a problem with oil prices that are too low to encourage oil production. (See my post, What’s Ahead? Lower Oil Prices, Despite Higher Extraction Costs.) Other commodities are also trading at flat to lower price levels. The concern is that these lower prices will lead to deflation. With deflation, debt is strongly discouraged because it raises the “inflation adjusted” cost of borrowing. If a deflationary debt cycle is started, there could be a huge drop in debt over a few years. This would be a different way to reach collapse. Why couldn’t others see the problem that is now at our door step? 1. The story is a complicated, interdisciplinary story. Even trying to summarize it in a few paragraphs is not easy. Most people, if they have a background in oil issues, do not also have a background in financial issues, and vice versa. 2. Economists have missed key points. Economists have missed the key role of debt in extracting fossil fuels and in keeping the economy operating in general. They have also missed the fact that in a finite world, this debt cannot keep rising indefinitely, or it will grow to greatly exceed the physical resources that might be used to pay back the debt. Economists have missed the fact that resource depletion acts in a way that is equivalent to a huge downward drag on productivity. Minerals need to be separated from more and more waste products, and energy sources need to be extracted in ever-more-difficult locations. High energy prices, whether for oil or for electricity, are a sign of economic inefficiency. If energy prices are high, they act as a drag on the economy. Economists have missed the key role oil plays–a role that is not easily substituted away. Our transportation, farming and construction industries are all heavily dependent on oil. Many products are made with oil, from medicines to fabrics to asphalt. Economists have assumed that wages can grow without energy inputs, but recent experience shows the economies with shrinking oil use are ones with shrinking job opportunities. Economists have built models claiming that prices will rise to handle shortages, either through substitution or demand destruction, but they have not stopped to consider how destructive this demand destruction can be for an economy that depends on oil use to manufacture and transport goods. Economists have missed the point that globalization speeds up depletion of resources and increases CO2 emissions, because it adds a huge number of new consumers to the world market. Economists have also missed the fact that wages are hugely important for keeping economies operating. If wages are cut, either because of competition with low-wage workers in warm countries (who don’t need as high a wages to maintain a standard of living, because they do not need sturdy homes or fuel to heat the homes) or because of automation, economic growth is likely to slow or fall. Corporate profits are not a substitute for wages. 3. Peak Oil advocates have missed key points. Peak oil advocates are a diverse group, so I cannot really claim all of them have the same views. One common view is that just because oil, or coal, or natural gas seems to be available with current technology, it will in fact be extracted. This is closely related to the view that “Hubbert’s Peak” gives a reasonable model for future oil extraction. In this model, it is assumed that about 50% of extraction occurs after the peak in oil consumption takes place. Even Hubbert did not claim this–his charts always showed another fuel, such as nuclear, rising in great quantity before fossil fuels dropped in supply. In the absence of a perfect substitute, the drop-off can be expected to be very steep. This happens because population rises as fossil fuel use grows. As fossil fuel use declines, citizens suddenly become much poorer. Government services must be cut way back, and government may even collapse. There is likely to be huge job loss, making it difficult to afford goods. There may be fighting over what limited supplies are available.What Hubbert’s curve shows is something like an upper limit for production, if the economy continues to function as it currently does, despite the disruption that loss of energy supplies would likely bring. A closely related issue is the belief that high oil prices will allow some oil to be produced indefinitely. Salvation can therefore be guaranteed by using less oil. First of all, the belief that oil prices can rise high enough is being tested right now. The fact that oil prices aren’t high enough is causing oil companies to cut back on new projects, instead returning money to shareholders as dividends. If the economy starts shrinking because of lower oil extraction, a collapse in credit is likely to lead to even lower prices, and a major cutback in production. 4. Excessive faith in substitution. A common theme by everyone from economists to peak oilers to politicians is that substitution will save us. There are several key points that advocates miss. One is that if a financial crash is immediately ahead, our ability to substitute disappears, practically overnight (or at least, within a few years). Another key point is that today’s real shortage is of investment capital, in the form of oil and other natural resources needed to manufacture the new natural gas powered cars and the fueling stations they need. A similar shortage of investment capital plagues plans to change to electric cars. Wage-earners of modest means cannot afford high-priced plug in vehicles, especially if the change-over is so fast that the value of their current vehicle drops to $0. Another key point is that the alternatives we looking at are limited in supply as well. We use far more oil than natural gas; trying to substitute natural gas for oil will lead to a shortfall in natural gas supplies quickly. Ramping up electric cars, solar, and wind will lead to a shortage of the rare earth minerals and other minerals needed in their production. While more of these minerals can be accessed by using lower quality ore, doing so leads to precisely the investment capital shortfall that is our problem to begin with. Another key point is that electricity does not substitute for oil, because of the huge need for investment capital (which is what is in short supply) to facilitate the change. There is also a timing issue. Another key point is that intermittent electricity does not substitute for electricity whose supply can be easily regulated. What intermittent electricity substitutes for is the fossil fuel used to make electricity whose supply is more easily regulated. This substitution (in theory) extends the life of our fossil fuel supplies. This theory is only true if we believe that coal and natural gas extraction is only limited by the amount those materials in the ground, and the level of our technology. (This is the assumption underlying IEA and EIA estimates of future fossil use.) If the limit on coal and natural gas extraction is really a limit on investment capital (including oil), and this investment capital limit may manifest itself as a debt limit, then the situation is different. In such a case, high investment in intermittent renewables can expected to drive economies that build them toward collapse more quickly, because of their high front-end investment capital requirements and low short-term returns. 5. Excessive faith in Energy Return on Energy Investment (EROI) or Life Cycle Analysis (LCA) analyses. Low EROI returns and poor LCA returns are part of our problem, but they are not the whole problem. They do not consider timing–something that is critical, if our problem is with inadequate investment capital availably, and the need for high returns quickly. EROI analyses also make assumptions about substitutability–something that is generally not possible for oil, for reasons described above. While EROI and LCA studies can provide worthwhile insights, it is easy to assume that they have more predictive value than they really do. They are not designed to tell when Limits to Growth will hit, for example. 6. Governments funding leads to excessive research in the wrong directions and lack of research in the right direction. Governments are in denial that Limits to Growth, or even oil supply, might be a problem. Governments rely on economists who seem to be clueless regarding what is happening. Researchers base their analyses on what prior researchers have done. They tend to “follow the research grant money,” working on whatever fad is likely to provide funding. None of this leads to research in areas where our real problems lie. 7. Individual citizens are easily misled by news stories claiming an abundance of oil. Citizens don’t realize that the reason oil is abundant is because oil prices are high, debt is widely available, and interest rates are low. Furthermore, part of the reason oil appears abundant is because low-wage citizens still cannot afford products made with oil, even at its current price level. Low employment and wages feed back in the form of low oil demand, which looks like excessive oil supply. What the economy really needs is low-priced oil, something that is not available. Citizens also don’t realize that recent push to export crude oil doesn’t mean there is a surplus of crude oil. It means that refinery space for the type of oil in question is more available overseas. The stories consumers read about growing oil supplies are made even more believable by forecasts showing that oil and other energy supply will rise for many years in the future. These forecasts are made possible by assuming the limit on the amount of oil extracted is the amount of oil in the ground. In fact, the limit is likely to be a financial (debt) limit that comes much sooner. See my post, Why EIA, IEA, and Randers’ 2052 Energy Forecasts are Wrong. 8. Unwillingness to believe the original Limits to Growth models. Recent studies, such as those by Hall and Day and by Turner, indicate that the world economy is, in fact, following a trajectory quite similar to that foretold by the base model of Limits to Growth. In my view, the main deficiencies of the 1972 Limits to Growth models are (a) The researchers did not include the financial system to any extent. In particular, the models left out the role of debt. This omission tends to move the actual date of collapse sooner, and make it more severe. (b) The original model did not look at individual resources, such as oil, separately. Thus, the models gave indications for average or total resource limits, even though oil limits, by themselves, could bring down the economy more quickly. I have noticed comments in the literature indicating that the Limits to Growth study has been superseded by more recent analyses. For example, the article Entropy and Economics by Avery, when talking about the Limits to Growth study says, “ Today, the more accurate Hubbert Peak model is used instead to predict rate of use of a scarce resource as a function of time.” There is no reason to believe that the Hubbert Peak model is more accurate! The original study used actual resource flows to predict when we might expect a problem with investment capital. Hubbert Peak models overlook financial limits, such as lack of debt availability, so overstate likely future oil flows. Because of this, they are not appropriate for forecasts after the world peak is hit. Another place I have seen similar wrong thinking is in the current World3 model, which has been used in recent Limits to Growth analyses, including possibly Jorgen Randers’ 2052. This model assumes a Hubbert Peak model for oil, gas, and coal. The World3 model also assumes maximum substitution among fuel types, something that seems impossible if we are facing a debt crisis in the near term. 9. Nearly everyone would like a happy story to tell. Every organization from Association for the Study of Peak Oil groups to sustainability groups to political groups would like to have a solution to go with the problem they are aware of. Business who might possibly have a chance of selling a “green” product would like to say, “Buy our product and your problems will be solved.” News media seem to tell only the stories that their advertisers would like to hear. This combination of folks who are trying to put the best possible “spin” on the story leads to little interest in researching and telling the true story. Conclusion Wrong thinking and wishful thinking seems to abound, when it comes to overlooking near term limits to growth. Part of this may be intentional, but part of this lies with the inherent difficulty of understanding such a complex problem. There is a tendency to believe that newer analyses must be better. That is not necessarily the case. When it comes to determining when Limits to Growth will be reached, analyses need to be focused on the details that seemed to cause collapse in the 1972 study–slow economic growth caused by the many conflicting needs for investment capital. The question is: when do we reach the point that oil supply is growing too slowly to produce the level of economic growth needed to keep our current debt system from crashing? It seems to me that we are already near such a point of collapse. Most people have not realized how vulnerable our economic system is to crashing in a time of low oil supply growth. |

02-08-14 | THESIS |

GLOBAL- ZATION TRAP

|

|||||||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - February 2nd - February 9th | ||||||||||

| RISK REVERSAL | 1 | |||||||||

| JAPAN - DEBT DEFLATION | 2 | |||||||||

| BOND BUBBLE | 3 | |||||||||

EU BANKING CRISIS |

4 |

|||||||||

| SOVEREIGN DEBT CRISIS [Euope Crisis Tracker] | 5 | |||||||||

| CHINA BUBBLE | 6 | |||||||||

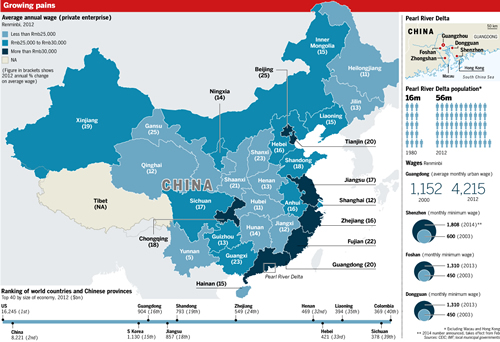

CHINA - Skilled Labor Shortages & Losing Labor Cost Advantage

China: Delta blues 01-22-14 Demetri Sevastopulo, Financial Times Shoppers will have to pay more as the world’s factory comes under wage and labour strain

Gerhard Flatz, the general manager of an Austrian factory in China that makes high-end skiwear for European brands, has a problem. He cannot find enough skilled seamstresses even though top performers can earn $1,500 a month, about eight times the local minimum wage in Heshan. “China has a shortage of skilled labour,” says Mr Flatz during a tour of the Heshan factory southwest of Guangzhou. As he walks past the pattern room where his most talented employees work, the garrulous Austrian explains that he is careful not to reveal their names to prevent poaching. “This is like the NSA”, he says with a smile, referring to the most secretive branch of the US intelligence services. Heshan is just one of the many cities in Guangdong that has transformed the province into the factory of the world. Shenzhen, the home to companies such as Huawei and Tencent, is another. When Christina Zhang moved to Shenzhen in 1983, the rural fishing county was a far cry from the booming city it has become in the three decades since Deng Xiaoping created China’s first special economic zone. “Most of the area was paddy fields,” says Ms Zhang, who works at PCH International, a logistics company. “I learnt how to ride my bicycle on Shennan Road. There were no cars [but] now it is the main road.” Since Deng launched his economic reforms in 1979, Shenzhen has changed from a tiny county of 30,000 people across the border from Hong Kong to a metropolis of 10m with one of the highest per-capita incomes in China. Shenzhen, Guangzhou, Dongguan, Foshan and other regional cities form the heart of the Pearl River Delta, a region of 56m that is vital to the world economy because it produces everything from bicycles to jeans and sex toys to iPads. Dongguan alone made about 30 per cent of the toys delivered over Christmas around the globe. Yao Kang, deputy Communist party secretary of the city, says it also makes 20 per cent of the sweaters and 10 per cent of the running shoes worn by consumers. As locals say: “When there is a traffic jam in Dongguan, the world runs out of supplies.” Underscoring its phenomenal growth, Guangdong last week estimated that its economy grew 8.5 per cent to Rmb6.33tn ($1.05tn) in 2013, which would sandwich it between South Korea and Indonesia. The PRD has managed to produce cheap goods for so long because millions of migrants have been willing to work in factories making products they can rarely afford. In Shenzhen, authorities plan to raise its minimum wage by 13 per cent to Rmb1,808 next month. Although the city has the highest minimum wage in China, it would take a worker two months to earn enough to buy an iPad Air. But the system is coming under strain in ways that affect everyone from London shoppers to young Chinese in Guangdong: workers are harder to find, wages are rising rapidly, raw material and land prices are going up, the renminbi is getting stronger and other regions are becoming increasingly attractive for manufacturing. The obvious challenge to the region is labour costs, with wages in Guangdong rising at double-digit rates each year. That is unlikely to change since China is targeting nationwide annual increases of 13 per cent in its 2011-15 five-year plan, as part of a push to spur consumption and reduce the economy’s dependence on investment. Roger Lee, chief executive of TAL, a Hong Kong company with 11 factories in Asia that produces clothes for dozens of global brands, says wages have doubled over the past five years. In 2008 its Dongguan factories made clothes at half the cost of its facilities in Malaysia and Thailand but that gap has since disappeared. Crystal Group, one of Asia’s largest apparel companies with 11,000 workers in Dongguan, says organic costs – including wages and the strengthening renminbi – have risen 10-12 per cent a year over the past five years. As a result, it has been forced to shift production of commodity items such as polo shirts and underwear elsewhere. “Our strategy is to produce them in cheaper countries like Vietnam or Cambodia,” says Dennis Wong, executive director. “That is why we are still surviving.” While some companies such as Crystal are shifting production to southeast Asia, others are moving to cheaper parts of China. Samsonite, the luggage maker that outsources about 65 per cent of its production to Chinese companies, has seen many of its vendors move to provinces around Shanghai in the Yangtze River Delta. “About 80 or 90 per cent of the people we were working with were based in southern China,” says Tim Parker, chief executive of Samsonite. “Now probably the majority we purchase comes from eastern China”. . . . Despite rising labour costs, any decision to leave the delta is not easy for foreign companies and their local manufacturers. Its ecosystem – everything from clusters of suppliers to road and rail infrastructure to access to ports in Shenzhen and Hong Kong – is hard to match elsewhere without sparking other cost increases. Nick Debnam, Asia head of consumer markets at KPMG, says textile manufacturers, for example, can shift lower-skilled production to countries such as Bangladesh and Cambodia relatively easily, although wages in those countries are also rising. But other industries, such as toy manufacturing, which is concentrated in south China, are less mobile as they rely on concentrated clusters of suppliers. “There are so many ancillary bits and pieces that need to be in place, it is difficult to move the whole thing lock, stock and barrel out of China,” says Mr Debnam. For companies that are contemplating moving inland in China instead of overseas, the decision is no easier. Mr Lee of TAL says his company conducted a study five years ago that concluded that moving inland would cut labour costs by 15 per cent but that the level of infrastructure would not be as good as in Guangdong. For manufacturers that cannot easily relocate, one solution is to automate more. Samsonite’s Mr Parker says his Chinese vendors are doing exactly that. He says there is plenty of scope since many Chinese factories use far more basic equipment than, for example, those the suitcase maker employs in its own facility in Belgium. “In China . . . you will find a totally different set-up and it is driven . . . by the relatively low cost of labour,” says Mr Parker. “That’s all changing because as the costs of labour increase, so some of our more enterprising suppliers are beginning to invest in more . . . sophisticated sewing equipment in order to reduce the labour content.” Some local governments, such as Dongguan, are trying to accelerate that process with subsidies. Mr Yao, the deputy party secretary, points to the knitting town of Dalang as a successful example, saying that its factories used the government funds to buy 40,000 computerised knitting machines, reducing the need for 200,000 workers. While manufacturers juggle solutions to rising labour costs, the trend is expected to get worse for various reasons. Rising wages are partly due to local governments raising the minimum levels. In its 2011-15 economic plan, Guangdong is targeting a 40 per cent rise. But the driving cause is factories being forced to pay more to attract workers amid an increasingly tight labour market. Several factors explain the scarcity of workers but the main reason is demographics. As a result of its one-child policy, China’s working-age population – people between the ages of 15 and 59 – fell by 3.45m to 937m in 2012, in what was the first decline in many years. The labour squeeze is exacerbated in the PRD as migrant workers now have greater opportunities in their home provinces. These new opportunities are a result of central government policies aimed at promoting inland development to reduce the income gap with rich coastal regions. The “go-west” strategy is creating jobs in the interior that are particularly attractive to women who in the past left their children and moved to Guangdong for factory jobs. Another reason manufacturers are having to pay more is that workers are increasingly picky about jobs, since they have more choices as the PRD labour market shifts in their favour. Young workers are also less willing than earlier generations of migrants to toil in factories. The explosive growth in smartphones and Weibo and Weixin – known as WeChat in English – one of the most popular social media services in China, has further empowered workers by making it easier for them to learn about other factories that may have better conditions. Factories say finding female workers is increasingly difficult. The one-child policy, coupled with the general preference for male children, has skewed the gender balance, reducing the number of female workers. But young women also increasingly prefer service industry jobs over more arduous production line work. . . . The demographic and economic trends that are sparking higher wages in the PRD are forcing multinationals to raise prices, put more pressure on their suppliers to cut costs or simply accept lower profits. But some manufacturers, such as KTC in Heshan, say a more serious issue than rising wages – which can be absorbed at a cost – is the difficulty in finding enough workers with the right skills to allow production to continue. KTC has opened a factory in Laos but, as in the case of Crystal Group, the workers there make less complicated garments than in Heshan because they do not have the same skills as their Chinese peers. Top Form, a Hong Kong lingerie maker, faces a similar problem. Kevin Wong, executive director, says it closed a factory in Shenzhen and opened one in Cambodia in 2011. Mr Wong says that although wages in the southeast Asian nation are one quarter of the level in Shenzhen, that was not the main reason for the move. “It was never the labour cost. Once you don’t have the people, the overhead just kills you,” says Mr Wong, explaining that it was becoming impossible to find enough workers in Shenzhen. Regardless of the industry, the challenges in the PRD are forcing all manufacturers to find cost-cutting solutions, with the most extreme one being relocation from China. But Mr Debnam says talk of multinationals abandoning China are overblown, and that many companies do not follow through on their repeated threats to leave China. “People think that the cost issues in China and the labour issues in China will inevitably force low value-added production out of China, but it is still there,” says Mr Debnam. Given the scale of manufacturing in the PRD, the region is likely to remain the world’s factory for a long time. But manufacturers in the region and consumers buying the products face a pricier future. William Fung, chairman of Li & Fung, the big global sourcing company that procures products for everyone from Walmart to Target, says rising labour and raw material costs mean the model that served China and the world for 30 years has changed for good. “The era where China subsidised the world’s standard of living – by giving them really affordable goods from 1979-2009 – is basically over,” says Mr Fung. “People will pay what other people will probably say is a proper price.” ------------------------------------------- Policy: Keep the cage but change the bird Manufacturers are not alone in worrying about cost pressures in the Pearl River Delta. Guangdong is also promoting policies that it hopes will prevent it from losing economic competitiveness. In what Wang Yang, the former Communist party secretary of Guangdong, referred to as “Teng Long Huan Niao” – “Keep the cage, but change the bird” – the province wants to replace inefficient low-cost and labour-intensive manufacturing with more high-tech and service companies and “greener” manufacturing. As part of that push, it is developing several new economic zones to attract knowledge-based industries. They include Qianhai in Shenzhen, which it hopes to turn into a financial centre, and Nansha port in Guangzhou. Guangdong is also talking to Hong Kong and Macau about creating a big free-trade zone with the two Chinese special administrative regions. In Guangzhou, Jim Barber, president of UPS International, said the zone would provide an important boost to the region by facilitating cross-border trade and logistics. The proposal has taken on greater urgency since the central government unveiled a free-trade zone in Shanghai that is expected to provide a boost to the Yangtze River Delta, one of the main competitors to the PRD in China. Xiao Geng, a PRD expert at the Fung Global Institute in Hong Kong, says the delta needs to push ahead with integration to facilitate knowledge-based industries. But he says it is moving too slowly, mainly because of the fragmented nature of the region, which includes many local governments in addition to Hong Kong and Macau. Guangdong officials are worried about losing economic ground to Jiangsu – an increasingly prosperous Yangtze River Delta province – particularly since Hu Chunhua, the Guangdong party secretary, is a possible candidate to replace Xi Jinping as president roughly a decade from now. The PRD received a boost in 2012 when Mr Xi chose to make his first trip as the new Communist party leader to Shenzhen, following in the footsteps of Deng Xiaoping’s southern tour three decades before. “We came here to show that we’ll unswervingly push forward reform and opening up,” Mr Xi said.

|

02-03-14 | CHINA | 6 - China Hard Landing | |||||||

| TO TOP | ||||||||||

| MACRO News Items of Importance - This Week | ||||||||||

GLOBAL MACRO REPORTS & ANALYSIS |

||||||||||

GordonTLong.com MACRO SITUATIONAL ASSESSMENT (Expanded from Tuesday) Suddenly a world that seemed quite calm economically is having issues pop up all over the place.

PART I - THE 7 MACRO HIGHLIGHTS YOU NEED TO KNOW 1- CHINA IS SLOWING

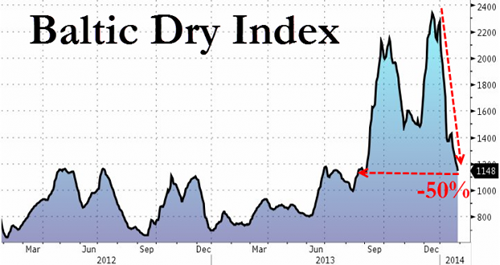

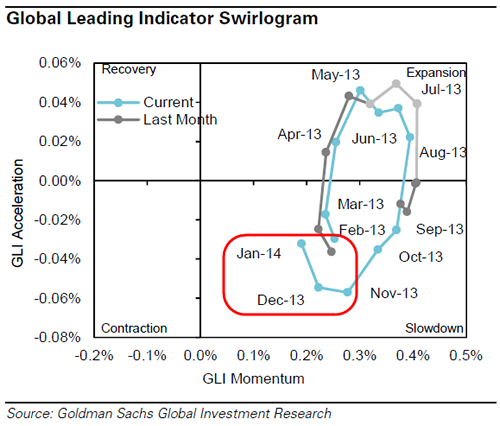

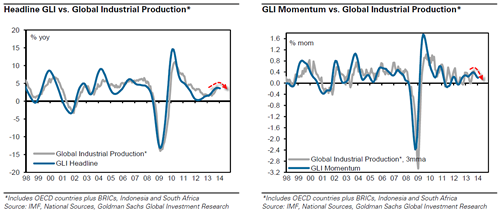

The Final HSBC Manufacturing PMI print dropped from 49.6 Flash to 49.5 - its biggest drop since June and lowest since July 2013 2- GLOBAL ECONOMY IS SLOWING The Baltic Dry Index has now plunged 51% from late December highs. Has collapsed to 5-month lows. "The January Final GLI places the global industrial cycle clearly in the ‘Slowdown’ phase, with positive but decreasing Momentum. The recent growth deceleration now looks more serious than in previous months." - Goldman Warns Global Slowdown Getting "More Serious"

3- ABENOMICS IS NOT WORKING

4- Explaining January's Volatility In One Chart

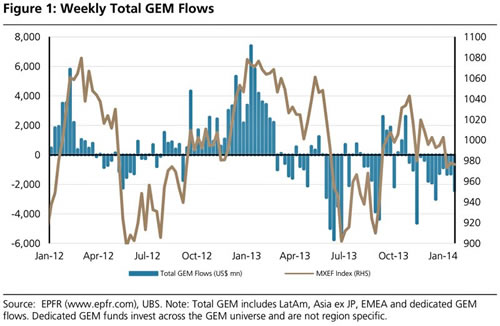

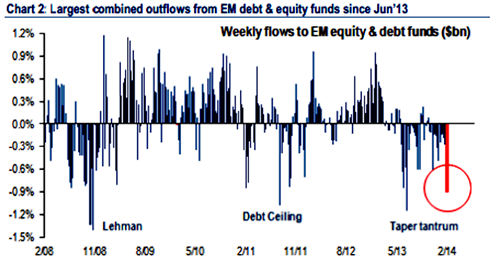

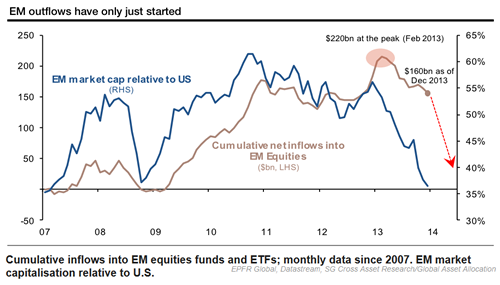

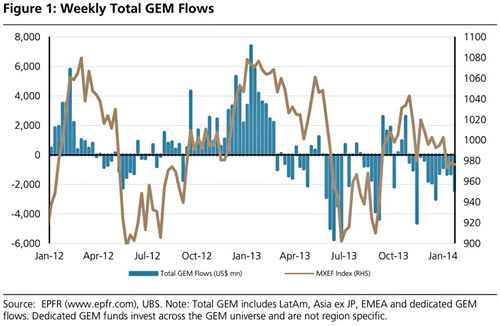

Massive Outflow From Emerging Markets

5- EU BANK WORRIES ABOUT EM EXPOSURES

6- US RECOVERY WEAK

ISM Manufacturing dropped by its most since 2008 to levels not seen since May, missed by the most on record, and new orders collapsed at the fastest pace since December 1980. Real Disposable Income Plummets Most In 40 Years When real disposable personal income drops by 0.2% from a month earlier, and plummets by 2.7% from a year ago, the biggest collapse since the semi-depression in 1974, something is wrong with the US consumer. 7- BOE TIGHTENING PRESSURES

PART II - THE 2014 MARKETS STORY IN SEVEN CHARTS Turmoil, panic, retreat: it’s not been a pretty start to the year for emerging market currencies and stock markets. Here, in seven charts, is the story of 2014 so far. 1. The Equity Context As the base of the turmoil is the reverse of the post-crisis trend in capital flows, which began last summer on talk of the Fed taper. Money is leaving the emerging markets and returning to Europe. EPFR Global, which tracks investment flows, estimates that emerging market equity outflows hit $12.2bn in January. 2. Widespread hit Whilst individual countries have been hit harder than others, the sell-off is widespread, with the MSCI Emerging Market Index now at its lowest level since last summer. S&P Dow Jones analyst Howard Silverblatt calculates that 17 out of 20 emerging markets fell in January.

The biggest year-to-date faller in the currency market – down over 18 per cent against the dollar – after the government decided devaluation was preferable to further declines in foreign reserves. At one point – you can see where on the chart – the government allowed the currency to fall 15 per cent in a single day.

Turkey’s political turbulence (this week a criminal investigation was opened into police officers involved in the detention of government-connected figures in an anti-corruption sweep) has rocked markets.

Whilst the lira rallied following the rate hike, relief was only temporary.

Like other big commodity exporters (such as Russia and Brazil) Chile has been hit on fears of a slow down in China – the ultimate destination for many of it exporters. China’s manufacturing activity slipped to its lowest level in six months, extenuating fears of weaker growth – and demand.

6. Caution on the Russian Ruble The Russian Ruble was the second biggest losers in January after the peso. However, it has recovered slightly after the finance ministry scrapped a debt sale. A sign perhaps investors think the losses were overdone?

Hit by fears that strikes in the mining industry would would undermine one of its key exports – and sources of foreign exchange – the rand has been under severe pressure.

Top emerging market currency losers year to date against the US dollar (spot price) (Source: Bloomberg) |

02-04-14 | MACRO OUTLOOK

MATA A02 |

MACRO |

|||||||

US ECONOMIC REPORTS & ANALYSIS |

||||||||||

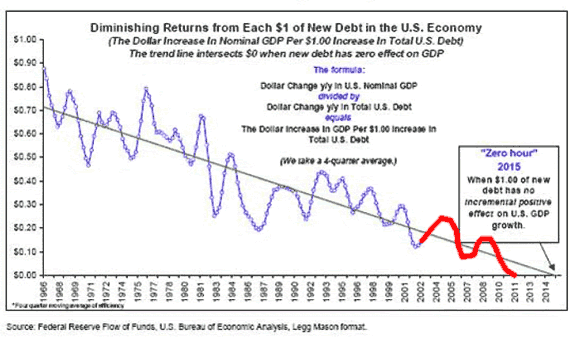

DIMINISHING RETURNS ON GOVERNMENT DEBT & FISCAL DEFICIT STIMULUS SPENDING

|

02-06-14 | |||||||||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | ||||||||||

| Market | ||||||||||

| TECHNICALS & MARKET |

|

|||||||||

| 02-07-14 | ||||||||||

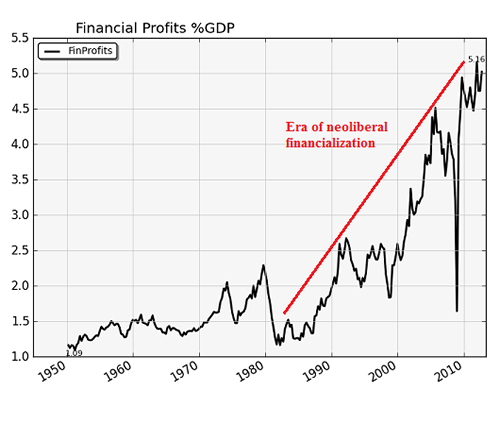

BEAR MARKET BEGAN WITH THE END OF THE TECH BUBBLE |

01-05-14 | |||||||||

DOES THIS LOOK SUSTAINABLE?

|

01-04-14 | FUND- MENTALS |

||||||||

| COMMODITY CORNER - HARD ASSETS | PORTFOLIO | |||||||||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | |||||||||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | |||||||||

| THESIS Themes | ||||||||||

| 2014 - GLOBALIZATION TRAP | ||||||||||

2013 - STATISM |

||||||||||

2012 - FINANCIAL REPRESSION |

||||||||||

|

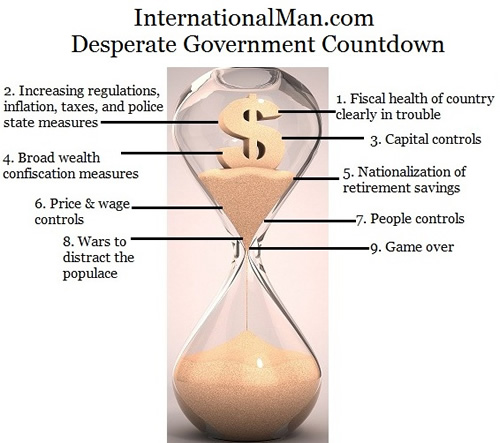

The Countdown To The Nationalization Of Retirement Savings Has Begun 02-05-14 Nick Giambruno via Casey Research's International Man, via ZH

Simply put, the new myRA program put forward by Obama is at best a sucker's deal… or worse, it's a first step toward the nationalization of private retirement savings. (Note: If you haven't yet heard of myRA, I'd strongly suggest you read this excellent overview by my colleague Dan Steinhart.) Even before the new myRA program was announced, there had been whispers about the need for the US government to assume some risk for US retirement accounts. That's code for forced conversion of private retirement assets into government bonds. With foreigners not buying as many Treasuries and the Fed tapering, the US government has been searching for new buyers of its unwanted debt. And this is where the new myRA program comes in. In short, it's ostensibly a new way for people to save for retirement. Of course, you can only invest in government-approved investments—like Treasuries—which probably won't even come close to keeping up with the real rate of inflation. It's like Jim Grant says: "return-free risk." In reality, a myRA doesn't really provide any significant new benefits over existing options. To me it just looks like a way for the US government to pass the hot potato on to unsuspecting Americans in exchange for their retirement savings. The net effect is the funneling of more capital to Treasury securities and thus helping the US government finance itself. You'd be much better off using a precious metals IRA to save for retirement than participating in the government's latest Ponzi scheme. There are other protective strategies as well, such as internationalizing your retirement savings into assets that are hard, if not impossible, to confiscate on a whim—like foreign real estate and physical gold held abroad. More on that below. Retirement Savings Are Always Juicy TargetsAs bad as it is to deceive naïve Americans into trading their hard-earned retirement savings for garbage (i.e., Treasury securities), the myRA program potentially represents something far worse… the first step toward the nationalization of existing private retirement accounts. I believe myRA is a way to nudge the American people into gradually becoming more accustomed to government involvement in their private retirement savings. It's incorrect to assume nationalization couldn't happen in the US or your home country. History shows us that it's standard operating procedure for a government in dire financial straits. In just the past six years, it's happened in some form in Argentina, Poland, Portugal, Hungary, and numerous other countries. To me it's self-evident that most Western governments (including the US) have current debt loads and future spending commitments that all but guarantee that eventually—and likely someday soon—they will try to unscrupulously grab as much wealth as they can. And retirement savings are a juicy target—low-hanging fruit for a desperate government. Naturally, politicians will try to slickly sell the idea to the public as something "for their own good" or as "protection from market instability." This is how similar programs were sold to skeptical publics in the past. In reality, governments take these actions not to "reduce the risk" to your retirement savings or whatever propaganda they happen to come up with, but rather to obtain financing—by forcefully dumping their unwanted debt onto seniors and savers. Below are several ways it has happened or could happen. Of course, there could always be some sort of new, creative proposal that was previously unthinkable. No matter the method, however, the end result is always the same—the siphoning off of purchasing power from your retirement savings.

In order to be more effective, forced conversations probably wouldn't happen until after official capital controls have been instituted. Once in place, capital controls would make it very difficult, if not impossible, for you to avoid the wealth confiscation that is sure to follow… like a sheep that has just been penned in for a shearing. Since FATCA and other regulatory burdens already amount to a soft form of capital controls, it's absolutely essential that you start implementing protective measures now. It's like I have always said: internationalization is your ultimate insurance against the measures of a desperate government. In the case that the government makes a grab for retirement savings, it's much better to be a year or two early rather than a minute too late. Internationalize Your Retirement SavingsIt's much more difficult for the government to convert your retirement assets if they're outside of its immediate reach. If you have a standard IRA from a large US financial institution, it would only take a decree from the US government and Poof!: your dividend-paying stocks and corporate bonds could instantly be transformed into government bonds. Obviously, this is much harder for the government to do if your retirement assets are sufficiently internationalized. For example, you can structure your IRA to invest in foreign real estate, open an offshore bank or brokerage account, own certain types of physical gold stored abroad, and invest in other foreign and nontraditional assets. In my view, owning an apartment in Switzerland and some physical gold coins stored in a safe deposit box in Singapore beats the cookie-cutter mutual funds shoved down your throat by traditional IRA custodians any day. If and when there's some sort of decree to convert or otherwise confiscate the assets in your retirement account, your internationalized assets ensure that your savings won't vanish at the stroke of a pen. There are important details and a couple of restrictions that you'll need to be aware of, but they amount to minor issues, especially when weighed against the risk of leaving your retirement savings within the immediate reach of a government desperate for cash. After placing a juicy steak in front of a salivating German shepherd, it's only a matter of time before he makes a grab for it. The US government with its $17 trillion debt load is the salivating German shepherd, and the $20 trillion in retirement savings is the juicy steak. Internationalizing your IRA has always been a prudent and pragmatic thing to do. And now that the US government has now officially set its sights on retirement savings, it's truly urgent. You'll find all the details on how it to get set up, along with trusted professionals who specialize in internationalizing IRAs in our Going Global publication. |

02-06-14 | THESIS | ||||||||

2011 - BEGGAR-THY-NEIGHBOR -- CURRENCY WARS |

||||||||||

2010 - EXTEND & PRETEND |

||||||||||

| THEMES | ||||||||||

| FLOWS -FRIDAY FLOWS | ||||||||||

A Synopsis

INTRODUCTION

VIDEO 2 - SITUATIONAL ANALYSIS: US ECONOMY

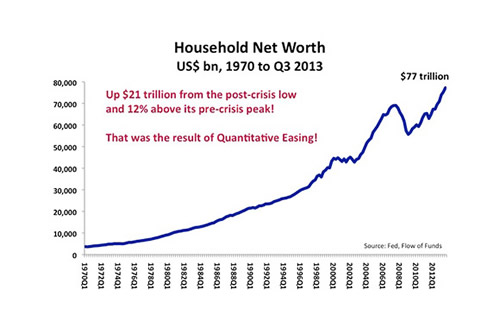

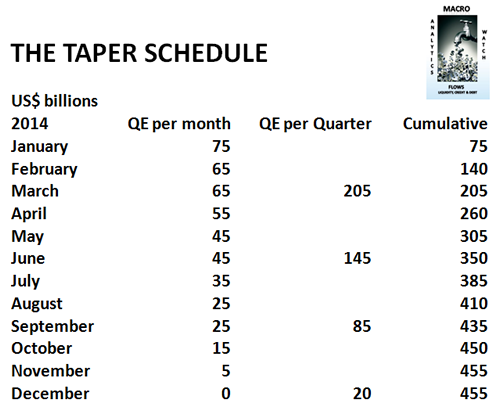

VIDEO 3 - CREDIT GROWTH TRENDS LIQUIDITY DRIVERS ASSET PRICES CREDIT DRIVES ECONOMIC GROWTH DEBT (LEVERAGE) DRIVES PROFITS

VIDEO 4 - The Fed & Liquidity

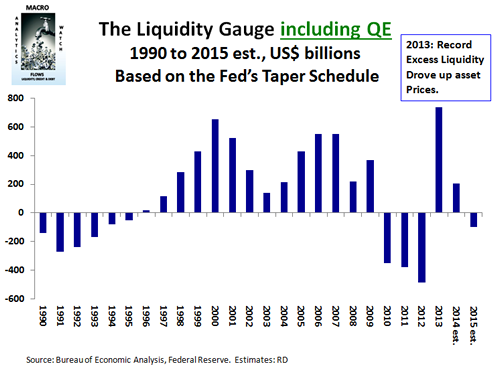

VIDEO 5 - GLOBAL LIQUIDITY GAUGE

VIDEO 6 - GLOBAL DEFLATION

So, that’s Macro Watch: First Quarter 2014.

I hope you will consider subscribing. The price is US$500 per year, but I am offering the Gordon T Long Community a 20% discount. To subscribe for US$400 per year, click on the following link and use the coupon code “flows”.

|

02-07-14 | FLOWS | ||||||||

| SHADOW BANKING -LIQUIDITY / CREDIT ENGINE | ||||||||||

| CRACKUP BOOM - ASSET BUBBLE | ||||||||||

| ECHO BOOM - PERIPHERAL PROBLEM | ||||||||||

FLOWS: Liquidity, Credit and Debt

|

02-03-14 | THEME | ECHO BOOM |

|||||||

| PRODUCTIVITY PARADOX -NATURE OF WORK | ||||||||||

| SECURITY-SURVEILLANCE COMPLEX -STATISM | ||||||||||

| GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | ||||||||||

| CENTRAL PLANINNG -SHIFTING ECONOMIC POWER | ||||||||||

| STANDARD OF LIVING -EMPLOYMENT CRISIS | ||||||||||

Jobs Moved to Asia |

02-03-14 | THEME | STANDARD OF LIVING |

|||||||

| CORPORATOCRACY -CRONY CAPITALSIM | ||||||||||

CORRUPTION & MALFEASANCE -MORAL DECAY - DESPERATION, SHORTAGES.. |

||||||||||

| SOCIAL UNREST -INEQUALITY & A BROKEN SOCIAL CONTRACT | ||||||||||

| CATALYSTS -FEAR & GREED | ||||||||||

| GENERAL INTEREST |

|

|||||||||

| TO TOP | ||||||||||

|

||||||||||

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP

4. Pain for Turkey

4. Pain for Turkey

Macro Watch: This week I would like to give you a quick overview of what you will find in this issue of Macro Watch and to encourage you to subscribe. This time, there are six videos.

Macro Watch: This week I would like to give you a quick overview of what you will find in this issue of Macro Watch and to encourage you to subscribe. This time, there are six videos.