|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Fri. June 6th, 2014

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

STRATEGIC MACRO INVESTMENT INSIGHTS

2014 THESIS: GLOBALIZATION TRAP

2014 THESIS: GLOBALIZATION TRAP

NOW AVAILABLE FREE to Trial Subscribers

185 Pages

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images: Understanding the Conclusions

| MAY | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |

| 1 | 2 | 3 | 4 | 5 | 6 | |

KEY TO TIPPING POINTS |

| 1 - Risk Reversal |

| 2 - Japan Debt Deflation Spiral |

| 3- Bond Bubble |

| 4- EU Banking Crisis |

| 5- Sovereign Debt Crisis |

| 6 - China Hard Landing |

| 7 - Chronic Unemployment |

| 8 - Geo-Political Event |

| 9 - Global Governance Failure |

| 10 - Chronic Global Fiscal ImBalances |

| 11 - Shrinking Revenue Growth Rate |

| 12 - Iran Nuclear Threat |

| 13 - Growing Social Unrest |

| 14 - US Banking Crisis II |

| 15 - Residential Real Estate - Phase II |

| 16 - Commercial Real Estate |

| 17 - Credit Contraction II |

| 18- State & Local Government |

| 19 - US Stock Market Valuations |

| 20 - Slowing Retail & Consumer Sales |

| 21 - China - Japan Regional Conflict |

| 22 - Public Sentiment & Confidence |

| 23 - US Reserve Currency |

| 24 - Central & Eastern Europe |

| 25 - Oil Price Pressures |

| 26 - Rising Inflation Pressures & Interest Pressures |

| 27 - Food Price Pressures |

| 28 - Global Output Gap |

| 29 - Corruption |

| 30 - Pension - Entitlement Crisis |

| 31 - Corporate Bankruptcies |

| 32- Finance & Insurance Balance Sheet Write-Offs |

| 33 - Resource Shortage |

| 34 - US Reserve Currency |

| 35- Government Backstop Insurance |

| 36 - US Dollar Weakness |

| 37 - Cyber Attack or Complexity Failure |

| 38 - Terrorist Event |

| 39 - Financial Crisis Programs Expiration |

| 40 - Natural Physical Disaster |

| 41 - Pandemic / Epidemic |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

|

Scroll TWEETS for LATEST Analysis

Read More - OUR RESEARCH - Articles Below

HOTTEST TIPPING POINTS |

Theme Groupings |

||||||||||||||||||||||

|

|||||||||||||||||||||||

THESE ARE NOT RECOMMENDATIONS - ONLY MACRO COMMENTARY - Investments of any kind involve risk. Please read our complete risk disclaimer and terms of use below by clicking HERE |

|||||||||||||||||||||||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro |

|||||||||||||||||||||||

"BEST OF THE WEEK " |

Posting Date |

Labels & Tags | TIPPING POINT or THEME / THESIS or INVESTMENT INSIGHT |

||||||||||||||||||||

|

|||||||||||||||||||||||

|

|||||||||||||||||||||||

FLOWS - Liquidiy, Credit & Debt The Most Important Number In The World - 05-30-14 Richard Duncan My finance professor at business school once told my class that the most important number in the world of finance is the yield (i.e. the interest rate) on the 10-year US government treasury bond. US government bonds are considered risk-free. The interest rate at which all other bonds can be sold is determined by this risk-free rate on US government bonds plus a risk premium, which depends on the credit worthiness of the debt issuers. Therefore, when the yield on the government bond rises, the interest rates on mortgages, corporate bonds, credit cards and student loans also rise. Similarly, when the yield on the government bond falls, the cost of all borrowing falls. Most financial analysts expected the government bond yield to rise significantly this year. Instead, it has fallen sharply. This week, it fell to 2.40%, an 11 month low. May will be the fifth month in a row that yields have fallen. In this blog, I would like to give you my explanation for why interest rates are falling. In business, everything has a price; and that price is determined by supply and demand. Interest rates are the price a borrower is willing to pay to borrow money. In the past, when gold was money, the supply of money did not change (or it changed very slowly). So, then, it was only changes in the demand for money that caused interest rates to rise and fall. For example, if the economy was growing rapidly, businesses would tend to borrow more to take advantage of the profitable investment opportunities the booming economy presented. The business sector’s increased demand to borrow money would cause the price of borrowing (interest rates) to rise. And, by the way, after some time, the higher interest rates would make investing less profitable, so the economy would slow again. Using another example, if the government borrowed a lot of money to finance a large budget deficit, that government demand for money would push up interest rates. Higher interest rates would make it less profitable for the business sector to borrow and invest. In such an instance, it was said that government borrowing was “Crowding Out” the business sector, and thereby damaging the economy’s growth prospects. These days, the situation is more complicated. Once the government stopped backing dollars with gold in 1968, the supply of money was no longer fixed because the government was free to create as much money as it thought desirable. So, now, it is both the demand for and the supply of money that determines interest rates. In other words, to understand why the interest rates on government bonds are now falling, we must consider not only how much money the government is borrowing, we must also consider how much money the government is supplying (i.e. creating) through Quantitative Easing (QE). When we look at it that way, it becomes immediately apparent why interest rates are currently falling. During this quarter (the second quarter of 2014), the government expects to have a large budget surplus of $78 billion. That means the government will not have to borrow any money at all on a net basis this quarter. Meanwhile, the Federal Reserve will create $145 billion through QE and inject it into the financial system by acquiring bonds. Therefore, the government supply of money will greatly exceed its demand for money this quarter. That, in my opinion, is why the yield on government bonds is falling. Falling interest rates help the economy expand by making investments more profitable and by causing property and stock prices to rise. Unfortunately, this favorable balance between the government demand for and supply of money will disappear during the third quarter. The government is expected to once again have a large quarterly budget deficit, which will require it to borrow more. However, the Fed, which is tapering its QE program, will supply a great deal less new money. Consequently, the balance between the government demand for and supply of money will once again turn unfavorable, and that is likely to cause government bond yields to start rising again. By the fourth quarter, when QE is scheduled to end altogether, the balance between the government’s demand for and supply of money will become very unfavorable. That could cause interest rates to move considerably higher. If so, business investment would suffer, property and stock prices would probably fall sharply and the economy would very likely move back toward recession. That is the scenario I consider most probable for the second half of this year. If it unfolds as I expect, I believe the Fed will be forced to launch a new round of Quantitative Easing, QE4, to prevent a severe new deflationary global economic downturn. If the Fed does inject additional liquidity through QE4, it would very likely push bond yields lower and stock prices and property prices higher again. In this new age of fiat money, Liquidity (or, in other words, the balance between the government’s demand for and supply of money) determines the direction in which stock prices, property prices and commodity prices move.

|

05-06-14 | THEMES FLOWS |

FLOWS |

||||||||||||||||||||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - June 1st,2 014 - Jine 8th, 2014 | |||||||||||||||||||||||

| RISK REVERSAL | 1 | ||||||||||||||||||||||

| JAPAN - DEBT DEFLATION | 2 | ||||||||||||||||||||||

| BOND BUBBLE | 3 | ||||||||||||||||||||||

EU BANKING CRISIS |

4 |

||||||||||||||||||||||

ECB MEETING - Rate Decision Congratulations Europe: you now get to pay your insolvent bank to keep your deposits for you. Today's cuts summarized and largely as expected:

And the ECB leave with the cryptic: "Further monetary policy measures to enhance the functioning of the monetary policy transmission mechanism will be communicated in a press release to be published at 3.30 p.m. CET today." The full announcement: |

06-05-14 | EU MONETARY | 4- EU Banking Crisis | ||||||||||||||||||||

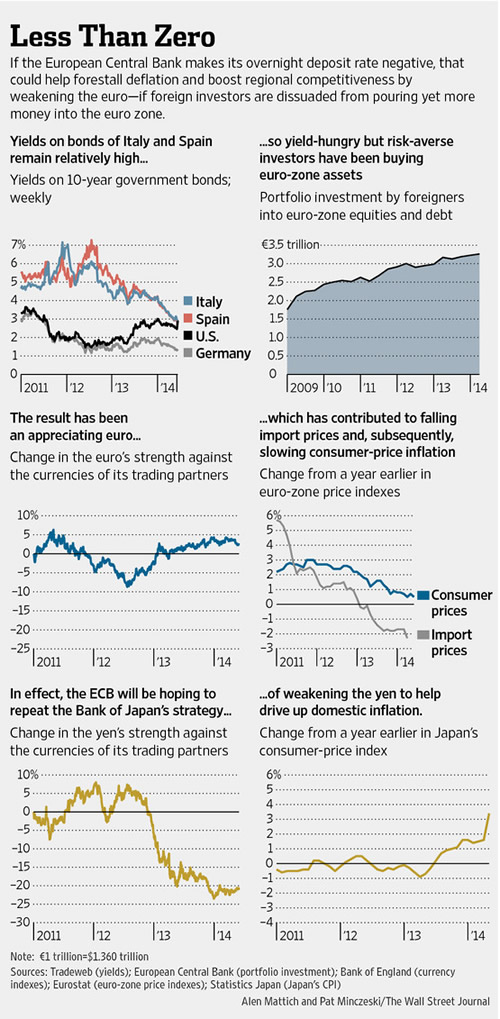

ECB MEETING - Rate Decision What Exactly is in the ECB’s Toolkit? 06-04-14 WSJ Thursday’s ECB meeting is shaping up to be one of the most important in recent years. The bank’s president, Mario Draghi, put financial markets on high alert for June action four weeks ago when he said the ECB was “comfortable acting next time.” Other officials have since struck a similar tone. Time is running out. Annual euro-zone inflation weakened last month to just 0.5%, far below the ECB’s target of just below 2%. Grim economic reports have led to widespread expectations that the ECB will unveil a package of stimulus measures Thursday but stop short of large-scale asset purchases. What will the European Central Bank do Thursday? The ECB is widely expected to reduce all three of its key interest rates, on deposits, normal bank loans and emergency lending by 10-15 basis points (though it could go a bit more on the emergency rate because that is the highest of the three). That would bring the main lending rate at which banks can tap the ECB for cash–currently 0.25%–close to zero. The deposit rate, currently zero, would turn negative (see the chart below to see why that’s necessary). The ECB may also extend its policy of making unlimited loans available to banks well into 2016 and unveil a targeted lending program to help steer money to the private sector. Is there anything else in the toolkit? Other possibilities include a suspension of its weekly absorption of bank funds–called sterilization–under a previous bond-purchase program. That would add as much as €165 billion to the banking system. It could also do more on the liquidity side by making cheap loans available at long maturities with no strings attached or announce their intention to buy some asset-backed securities at a later date. Which of these is the biggest deal? Of the likeliest measures, a negative deposit rate would probably have the biggest effect. No central bank as large as the ECB has tried this policy, which would effectively penalize banks for storing excess funds at the central bank. The most immediate effect would probably be on the euro. By making euro assets less attractive, a negative deposit rate should weaken the exchange rate, adding a little juice to exports and inflation (though a negative deposit rate is already largely priced into currency markets). The flip side is it could weaken bank profits or spur banks to try to recoup the added costs from customers. Why act now, hasn’t inflation been super low a long time? For a central bank with an inflation target of just below 2%, it is a bit head-scratching why the ECB hasn’t acted sooner. But Mario Draghi came as close to pre-committing as any central banker can do on May 8 when he said the ECB was “comfortable acting next time.” Since then, economic numbers have screamed for ECB stimulus. GDP expanded feebly during the first quarter and private-sector credit is still shrinking. With annual euro-zone inflation falling to 0.5% last month—and expected by some analysts to slide more this summer–the ECB would risk major damage to its credibility if it stood pat. What about QE? The ECB has so far refrained from large-scale asset purchases, or quantitative easing, that other big central banks such as the Federal Reserve, Bank of England and Bank of Japan have used to add to their balance sheets and reduce long-term interest rates. It’s more complicated to design such a program in the euro zone, which has 18 different public and private debt markets. Buying government bonds is taboo in Germany, and there isn’t a large pool of securitized private assets for the ECB to buy. But Mr. Draghi will probably keep this option firmly on the table.

The ECB’s Negative Deposit Rate 06-04-14 WSJ In a groundbreaking policy move for a major central bank, the European Central Bank is widely expected to introduce negative deposit rates at Thursday’s meeting.

|

06-05-14 | EU MONETARY | 4- EU Banking Crisis | ||||||||||||||||||||

| SOVEREIGN DEBT CRISIS [Euope Crisis Tracker] | 5 | ||||||||||||||||||||||

| CHINA BUBBLE | 6 | ||||||||||||||||||||||

| TO TOP | |||||||||||||||||||||||

| MACRO News Items of Importance - This Week | |||||||||||||||||||||||

GLOBAL MACRO REPORTS & ANALYSIS |

|||||||||||||||||||||||

US ECONOMIC REPORTS & ANALYSIS |

|||||||||||||||||||||||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||||||||||||||||||||||

| Market | |||||||||||||||||||||||

| TECHNICALS & MARKET |

|

||||||||||||||||||||||

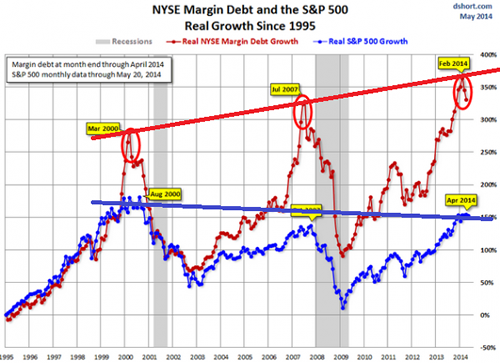

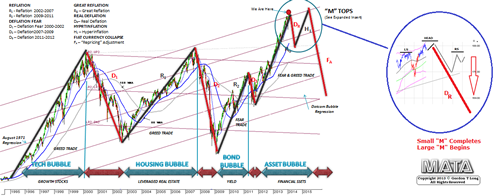

US ECONOMIC OUTLOOK WE HAVE NEVER SEEN ANYTHING LIKE THIS BEFORE!

Why?? The Short Answer: Cheap Money THE APPARENT GOOD NEWS

THE REALITY

THE CONSEQUENCES ARTIFICIAL GROWTH & UNSUSTAINABLE RATES & RETURNS THE INEVITABLE ADJUSTMENT IS EXTREMELY DISRUPTIVE & PAINFUL |

06-05-14 | FUNDMANENTALS | |||||||||||||||||||||

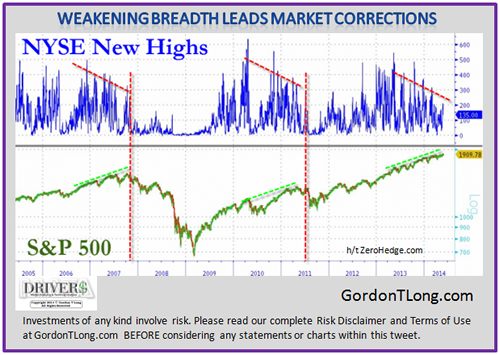

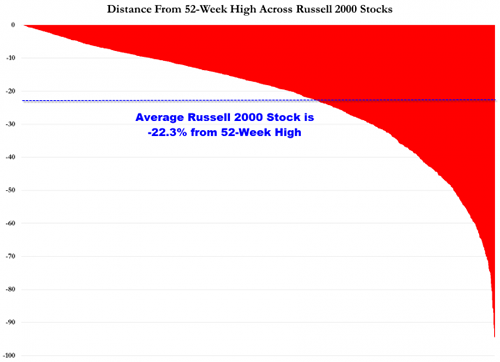

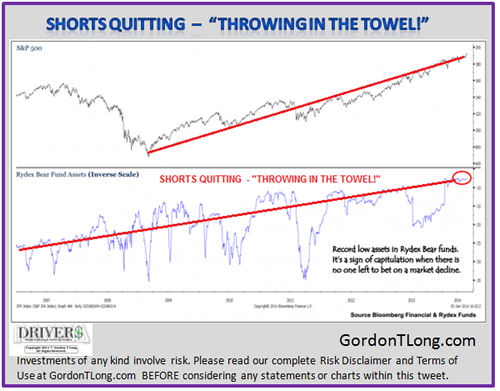

- Weakening Breadth Sending a Warning

|

06-04-14 | PATTERNS | |||||||||||||||||||||

US - Patterns Suggest ~ 16% Correction / Consolidation

THE MACRO ANALYSIS OVERLAY

|

06-03-14 | PATTERNS | |||||||||||||||||||||

US - Post Financial Crisis Investor Sentiment shows pattern nearing completion. Watch:

|

06-03-14 | SENTIMENT PATTERNS |

|||||||||||||||||||||

| COMMODITY CORNER - HARD ASSETS | PORTFOLIO | ||||||||||||||||||||||

GOLD - More Downside Left A ‘death cross’ is haunting gold 06-02-14 MarketWatch Talk of further declines for gold intensified Monday as analysts pointed out that moving price averages hit a so-called “death cross” last week. The 50-day moving average for gold GCQ4 +0.14% has now crossed below the slower-moving 200-day average, creating a “death cross,” said Fawad Razaqzada, technical analyst at Forex.com, in a note Monday. “This bearish technical development last occurred in mid-February of last year when the metal was trading at around $1,600,” he said. “Although it did not immediately lead to a selloff then, as gold had already fallen sharply in advance to the crossover, prices started to move lower once again a couple of months down the line.” The market saw the 50-day moving average cross the 200-day moving average on Friday, according to Ole Hansen, commodities strategist at Saxo Bank. “For the death cross to have any significance, the slope of the two moving averages both have to point lower, and this was the case on Friday’s cross,” he said. “From a purely technical perspective, this could indicate that deeper losses lie ahead.” August gold futures traded at $1,245.20 an ounce on Comex Monday afternoon, down about 80 cents for the session. Gold prices may have even reached a price ceiling already. Read about Monday’s Comex gold trading. In a note dated Monday, analysts at Citi Research pointed out that while gold rallied in February, supported by the restocking needs of the jewelers after Christmas and Chinese New Year, that caused gold to approach $1,400 an ounce. Exchange-traded fund holders saw an “opportunity to offload into the jewelry demand,” they said, and “that set a ‘ceiling’ of $1,400 an ounce, the apparent level at which ETF holders are willing to return as sellers.” “The threat is that those ETF holders may be lowering their ceiling constantly such that any jewelry-driven rise above $1350/oz may now trigger the same ETF sales,” they said. “The year is therefore turning out to be a tussle between jewelry-trade buying and ETF selling.” Gold holdings in the world’s largest gold-backed ETF, the SPDR Gold Trust GLD -0.06% , stood at 785.28 metric tons as of May 30, up from 776.89 metric tons on May 23, but they ended the month of February at 803.7. |

06-04-14 | GOLD | PRECIOUS METALS |

||||||||||||||||||||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||||||||||||||||||||||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||||||||||||||||||||||

| THESIS | |||||||||||||||||||||||

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|||||||||||||||||||||

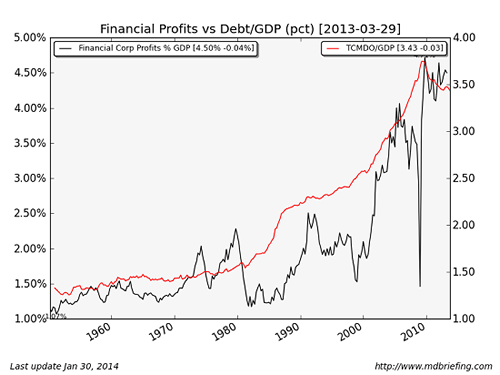

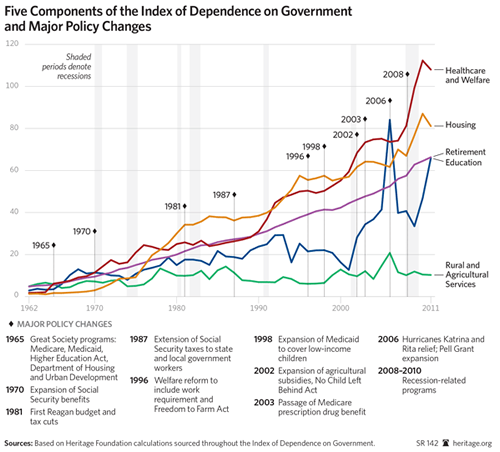

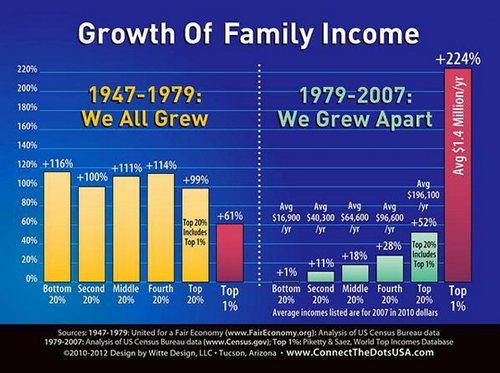

STATISM - Collectivism

IS THERE A CONNECTION BETWEEN THESE TWO GRAPHS?

YES - Cloward Piven Is Working! WHAT IS THE CLOWARD PIVEN STRATEGY

THE CORE OF THE STRATEGY •Create ever-growing constituencies DEPENDANT on the government for their livelihoods directly through entitlements, social safety nets and government suppliers in the private sectors!

•Regulate and tax the private sector into submission (healthcare, banking, small businesses, real estate, autos) and demise while legislating demand to their crony capitalist supporters.

•Politicize and control the allocation of credit (mortgages, student debt, consumer financial protection agency, Dodd Frank, etc.)

•Control the public schools and teach dependence, childlike trust in government and that you are ENTITLED to something for nothing (health care, food, pensions, disability insurance, shelter) and not taught to think for themselves versus conventional schooling of self reliance, ability to solve problems, logic, importance of hard work, reading, writing and arithmetic and the lessons of history.

•Have a main stream media report misinformation as FACTS for the useful idiots created by the public school monopoly.

•Create growth in government and its obligations that COMPOUND faster than economic growth and tax receipts.

•Debase the currency to impoverish the middle class and create desperation for growth, while removing the obligation to pay for their BENEFITS (47% of the country pays no fed taxes)

•“ When you rob Peter to pay Paul you can always count on Paul's support”

View Video "THE CLOWARD PIVEN STRATEGY" "THE NEW BILL OF RIGHTS" �

|

06-02-14 | THESIS | |||||||||||||||||||||

|

2013 2014 |

|||||||||||||||||||||||

2011 2012 2013 2014 |

|||||||||||||||||||||||

| THEMES | |||||||||||||||||||||||

| FLOWS -FRIDAY FLOWS | THEME | ||||||||||||||||||||||

| SHADOW BANKING -LIQUIDITY / CREDIT ENGINE | THEME | ||||||||||||||||||||||

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||||||||||||||||||||||

| ECHO BOOM - PERIPHERAL PROBLEM | THEME | ||||||||||||||||||||||

| PRODUCTIVITY PARADOX -NATURE OF WORK | THEME | ||||||||||||||||||||||

| STANDARD OF LIVING -EMPLOYMENT CRISIS | THEME | ||||||||||||||||||||||

| CORPORATOCRACY -CRONY CAPITALSIM | THEME |  |

|||||||||||||||||||||

CORRUPTION & MALFEASANCE -MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|||||||||||||||||||||

| SOCIAL UNREST -INEQUALITY & A BROKEN SOCIAL CONTRACT | THEME | ||||||||||||||||||||||

| SECURITY-SURVEILLANCE COMPLEX -STATISM | THEME | ||||||||||||||||||||||

| GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | THEME | ||||||||||||||||||||||

| CENTRAL PLANINNG -SHIFTING ECONOMIC POWER | THEME | ||||||||||||||||||||||

| CATALYSTS -FEAR & GREED | THEME | ||||||||||||||||||||||

| GENERAL INTEREST |

|

||||||||||||||||||||||

| TO TOP | |||||||||||||||||||||||

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP