|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Mon. Feb. 9th , 2015

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

STRATEGIC MACRO INVESTMENT INSIGHTS

2015 THESIS: FIDUCIARY FAILURE

2015 THESIS: FIDUCIARY FAILURE

NOW AVAILABLE FREE to Trial Subscribers

174 Pages

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images: Understanding the Conclusions

![]()

| FEBRUARY | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |

KEY TO TIPPING POINTS |

| 1 - Risk Reversal |

| 2 - Japan Debt Deflation Spiral |

| 3- Bond Bubble |

| 4- EU Banking Crisis |

| 5- Sovereign Debt Crisis |

| 6 - China Hard Landing |

| 7 - Chronic Unemployment |

| 8 - Geo-Political Event |

| 9 - Global Governance Failure |

| 10 - Chronic Global Fiscal ImBalances |

| 11 - Shrinking Revenue Growth Rate |

| 12 - Iran Nuclear Threat |

| 13 - Growing Social Unrest |

| 14 - US Banking Crisis II |

| 15 - Residential Real Estate - Phase II |

| 16 - Commercial Real Estate |

| 17 - Credit Contraction II |

| 18- State & Local Government |

| 19 - US Stock Market Valuations |

| 20 - Slowing Retail & Consumer Sales |

| 21 - China - Japan Regional Conflict |

| 22 - Public Sentiment & Confidence |

| 23 - US Reserve Currency |

| 24 - Central & Eastern Europe |

| 25 - Oil Price Pressures |

| 26 - Rising Inflation Pressures & Interest Pressures |

| 27 - Food Price Pressures |

| 28 - Global Output Gap |

| 29 - Corruption |

| 30 - Pension - Entitlement Crisis |

| 31 - Corporate Bankruptcies |

| 32- Finance & Insurance Balance Sheet Write-Offs |

| 33 - Resource Shortage |

| 34 - US Reserve Currency |

| 35- Government Backstop Insurance |

| 36 - US Dollar Weakness |

| 37 - Cyber Attack or Complexity Failure |

| 38 - Terrorist Event |

| 39 - Financial Crisis Programs Expiration |

| 40 - Natural Physical Disaster |

| 41 - Pandemic / Epidemic |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

|

Scroll TWEETS for LATEST Analysis

Read More - OUR RESEARCH - Articles Below

HOTTEST TIPPING POINTS |

Theme Groupings |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

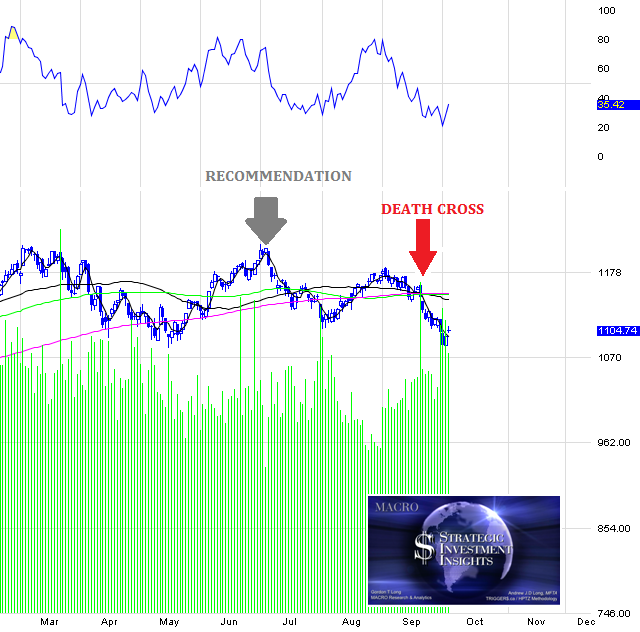

Investing in Macro Tipping Points

THESE ARE NOT RECOMMENDATIONS - THEY ARE MACRO COMMENTARY ONLY - Investments of any kind involve risk. Please read our complete risk disclaimer and terms of use below by clicking HERE |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"BEST OF THE WEEK " |

Posting Date |

Labels & Tags | TIPPING POINT or THEME / THESIS or INVESTMENT INSIGHT |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

CHECK OUT OUR PAGE DEDICATED TO FINANCIAL REPRESSION The Financial Repression AuthorityTM

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THESIS & THEMES | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

FINANCIAL REPRESSION - A Failure of Global Governanace

The following was taken from The Template For How the Next Crisis Will Unfold by Graham Summers at Phoenix Capital Research WHAT LIES AHEAD

This is the template for what’s coming. The following is the proof: EUROPE AS THE MODEL Europe is ground zero for the whole debt bomb implosion, not because it has the most debt but because it’s politically and economically on the least sound footing. Some 19 countries share the currency, all of them in varying degrees of socialism (the public sector accounts for roughly 1 in 3 employees in Germany’s allegedly “free market” economy), and varying shades of broke: even Germany a real Debt to GDP of over 200%. In this regard, Europe gives the rest of us a front-row seat to learn how things will unfold when the real stuff hits the fan and the political and financial elite are at risk of losing their power and wealth. We’ve been through this mess multiple times in the last three years. The most notable cases involved Spain and Cyprus. And the formula is as follows:

THE 'BANKIA" EXAMPLE Bankia was formed by merging seven bankrupt regional Spanish banks in 2010. The new bank was funded by Spain’s Government rescue fund… which received “preference shares” in return for over €4 billion in funding for the bank (all provided by taxpayers of course). These preference shares were shares that A) yielded 7.75% and B) would get paid before ordinary investors if Bankia failed again. So right away, the Spanish Government was taking taxpayer money to give itself preferential treatment over ordinary investors (including said taxpayers). Indeed, those investors who owned shares in the seven banks that merged to form Bankia lost their shirts. They were wiped out and lost everything when the new bank was created. Bankia was taken public in 2011. Spanish investment bankers convinced the Spanish public that the bank was a fantastic investment. Over 98% of the shares were sold to Spanish investors. One year later, Bankia was bankrupt again, and required the single largest bailout in Spain’s history: €19 billion. Spain took over the bank (again) and Bankia shares were frozen on the market (meaning you couldn’t sell them if you wanted to). When the bailout took place, Bankia shareholders were all but wiped out and forced to take huge losses as part of the deal. The vast majority of these were individual investors, NOT Wall Street or its European equivalent (Bankia currently faces a lawsuit for over 140,000 claims of mis-selling shares). So that’s two wipeouts in as many years. The bank was taken public a second time in May 2013. Once again Bankia shares promptly collapsed, losing 80% of their value in a matter of days. And once again, it was ordinary investors who got destroyed. Indeed, things were so awful that a police officer stabbed a Bankia banker who sold him over €300,000 worth of shares (the banker had convinced him it was a great investment). Today Bankia is tied up in a massive compensation lawsuit whereby it is to pay out between 200 and 250 million Euros to investors who bought it during its initial IPO. Of course, this payout is based on accounting standards that are at best massaged and at worst likely outright fraudulent (this is, again a bank that has wiped out investors three in times in three years), so who knows what will happen? While certain items relating to this story are unique, the morals to Bankia’s tale can be broadly applied across the board to the economy/ financial today. |

02-09-15 | THESIS GLOBAL GOVERNANCE |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Feb. 8th, 2015 - Feb. 14th, 2015 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RISK REVERSAL | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JAPAN - DEBT DEFLATION | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BOND BUBBLE | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

EU BANKING CRISIS |

4 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SOVEREIGN DEBT CRISIS [Euope Crisis Tracker] | 5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CHINA BUBBLE |

6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TO TOP | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MACRO News Items of Importance - This Week | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

GLOBAL MACRO REPORTS & ANALYSIS |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

US ECONOMIC REPORTS & ANALYSIS |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TECHNICALS & MARKET |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THESIS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

2013 2014 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2011 2012 2013 2014 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THEMES | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FLOWS -FRIDAY FLOWS | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SHADOW BANKING -LIQUIDITY / CREDIT ENGINE | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ECHO BOOM - PERIPHERAL PROBLEM | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PRODUCTIVITY PARADOX -NATURE OF WORK | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STANDARD OF LIVING -EMPLOYMENT CRISIS | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CORPORATOCRACY -CRONY CAPITALSIM | THEME |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CORRUPTION & MALFEASANCE -MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SOCIAL UNREST -INEQUALITY & A BROKEN SOCIAL CONTRACT | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SECURITY-SURVEILLANCE COMPLEX -STATISM | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CENTRAL PLANINNG -SHIFTING ECONOMIC POWER | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CATALYSTS -FEAR & GREED | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GENERAL INTEREST |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SII | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SII | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SII | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SII | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TO TOP | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP