|

JOHN RUBINO'SLATEST BOOK |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Fri. Feb. 6th , 2015

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

STRATEGIC MACRO INVESTMENT INSIGHTS

2014 THESIS: GLOBALIZATION TRAP

2014 THESIS: GLOBALIZATION TRAP

NOW AVAILABLE FREE to Trial Subscribers

185 Pages

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images: Understanding the Conclusions

![]()

| JANIUARY | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

KEY TO TIPPING POINTS |

| 1 - Risk Reversal |

| 2 - Japan Debt Deflation Spiral |

| 3- Bond Bubble |

| 4- EU Banking Crisis |

| 5- Sovereign Debt Crisis |

| 6 - China Hard Landing |

| 7 - Chronic Unemployment |

| 8 - Geo-Political Event |

| 9 - Global Governance Failure |

| 10 - Chronic Global Fiscal ImBalances |

| 11 - Shrinking Revenue Growth Rate |

| 12 - Iran Nuclear Threat |

| 13 - Growing Social Unrest |

| 14 - US Banking Crisis II |

| 15 - Residential Real Estate - Phase II |

| 16 - Commercial Real Estate |

| 17 - Credit Contraction II |

| 18- State & Local Government |

| 19 - US Stock Market Valuations |

| 20 - Slowing Retail & Consumer Sales |

| 21 - China - Japan Regional Conflict |

| 22 - Public Sentiment & Confidence |

| 23 - US Reserve Currency |

| 24 - Central & Eastern Europe |

| 25 - Oil Price Pressures |

| 26 - Rising Inflation Pressures & Interest Pressures |

| 27 - Food Price Pressures |

| 28 - Global Output Gap |

| 29 - Corruption |

| 30 - Pension - Entitlement Crisis |

| 31 - Corporate Bankruptcies |

| 32- Finance & Insurance Balance Sheet Write-Offs |

| 33 - Resource Shortage |

| 34 - US Reserve Currency |

| 35- Government Backstop Insurance |

| 36 - US Dollar Weakness |

| 37 - Cyber Attack or Complexity Failure |

| 38 - Terrorist Event |

| 39 - Financial Crisis Programs Expiration |

| 40 - Natural Physical Disaster |

| 41 - Pandemic / Epidemic |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

|

Scroll TWEETS for LATEST Analysis

Read More - OUR RESEARCH - Articles Below

HOTTEST TIPPING POINTS |

Theme Groupings |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Investing in Macro Tipping Points

THESE ARE NOT RECOMMENDATIONS - THEY ARE MACRO COMMENTARY ONLY - Investments of any kind involve risk. Please read our complete risk disclaimer and terms of use below by clicking HERE |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"BEST OF THE WEEK " |

Posting Date |

Labels & Tags | TIPPING POINT or THEME / THESIS or INVESTMENT INSIGHT |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

FLOWS - Liquidity, Credit and Debt The ECB’s Bazooka Should Send European Stocks Higher 02-01-15 Richard Duncan The European Central Bank (ECB) unveiled a monetary bazooka at its press conference on January 22nd by announcing it will begin buying Euro 60 billion worth of bonds every month from March 2015 to September 2016 – or even longer if necessary to push inflation expectations back toward its 2% target. This launch of ECB Quantitative Easing (ECB QE) is a very important development that is likely to push European stock markets significantly higher. It may also revive Europe’s weak economy - at least temporarily over the next couple of years. Here’s how the ECB expects this policy to work. First, it will cause the Euro to depreciate against the US Dollar. In fact, the Euro has already fallen by 16% against the Dollar as investors were led to anticipate this development over the last six months. The lower Euro will boost industrial production in Europe by making European products less expensive outside Europe, thereby boosting exports, and by making goods made outside Europe more expensive for Europeans, thereby deterring imports. Similarly, the weaker Euro will attract many more tourists to Europe, while discouraging Europeans from travelling abroad. Next, when the ECB buys Euro 60 billion worth of bonds each month, it will push up the price of those bonds and thereby push down their yields (i.e. the rate of interest they pay investors). This will push down interest rates not only on government bonds, but also on corporate bonds and mortgages, which should encourage more borrowing, investing and home buying. Third, as the ECB buys Euro 60 billion worth of bonds each month, whomever they buy the bonds from will have Euro 60 billion in cash that they will have to invest in other Euro-denominated assets such as stocks. That means stock prices are likely to rise, making investors “wealthier”, thereby allowing them to consume more. Higher consumption will mean more economic growth. Central bankers refer to this process as “portfolio rebalancing” leading to a positive “wealth effect”. Make no mistake, the creation and investment of Euro 60 billion a month (Euro 1.1 trillion over 19 months) is a very big deal. The yields on European government debt have already collapsed to new historic lows over the last two weeks even before the program’s implementation begins. The yield on 10-year German government bonds fell to 0.27% on January 30th, lower, astonishingly, than even the 0.30% offered on 10-year Japanese government bonds. Even the yields on 10-year government bonds in Spain and Italy, where government finances are considered to be weak, have fallen to only 1.45% and 1.58%, respectively. Such ultra low returns on “risk free” government bonds will force investors to move into riskier assets in search of higher income. That move will make more money available for riskier investments, which could boost economic growth. The problem with this, of course, is that many of those riskier investments are likely to fail. When they do, rather than providing investors with a higher return, they will destroy the investor’s capital instead. As in the United States, credit growth drove economic growth in Europe for decades until 2008 when it stopped expanding. The success of ECB QE over the longer run, therefore, will depend on whether it causes credit in Europe to begin growing again. Unfortunately, the prospects of that occurring are less than promising. The level of credit (i.e. debt) is already too high relative to income in Europe – just as it is everywhere else in the world. Always remember, the crisis in the global economy boils down to just one thing: globally, there is too much debt relative to income. This crisis will not end until the wages of the middle and lower income groups begins to increase again.

If you are a subscriber to my video-newsletter, Macro Watch, log in and learn how the crisis in the global economy will affect you. If not, join here: http://www.gordontlong.com/RichardDuncan/Macrowatch.htm For a 50% subscription discount, hit the “Click Here to Subscribe Now” tab and use the coupon code: flows

|

02-06-15 | THEMES FLOWS |

FLOWS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

FLOWS - Liquidity, Credit and Debt Downdraft Hits Emerging-Market Capital Flows - Bloomberg The tap for world investment flows to developing nations has been turned off recently. Bloomberg's high-frequency proxy measure of capital flows to emerging market (EM) economies has fallen to its lowest level since the Global Financial Crisis. Data compiled by the Institute of International Finance and EPFR Global on EM capital flows show a similar picture. The decline in EM capital flows can be attributed to a number of factors.

Treading Cautiously: Risk Aversion Behind Recent Pullback EM GDP growth for both 2015 and 2016 — from 4.9 percent to 4.3 percent and from 5.2 percent to 4.7 percent, respectively. The IMF projects that the GDP growth differential between the EM economies and the U.S. economy will be a mere 0.7 percentage points in 2015, down from a 2.5 percentage point difference in 2013. The narrowing growth gap is apparently leading investors to reallocate their capital away from emerging markets. EPFR reports that the share of investor assets in dedicated mature market mutual funds and exchange traded funds (ETFs) has risen from 82 percent in 2011 to 87 percent today, while the share of investor assets in dedicated EM mutual funds and ETFs has dropped from 18 percent to 13 percent over the same period. Because EM capital flows tend to be driven by the relative expected returns on EM assets and strategies, a composite index that tracks those returns and strategies, such as the Bloomberg EM Capital Flow Proxy, should be able to capture the broad trend in EM capital flows. Since EM asset price performance data is available in real-time, there is a great advantage for fund managers who can gauge EM capital flows based on high-frequency data rather than actual capital flows available on a less timely basis (either monthly or quarterly). Looking ahead, fund managers will want to pay close attention to how EM capital flows are behaving. Further asset allocation shifts away from EM financial assets and strategies and toward U.S. financial assets can have a pronounced impact on trends in U.S. interest rates and equity prices as well as the U.S. dollar.

|

02-05-15 | THEMES FLOWS |

FLOWS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

FLOWS - Liquidity, Credit and Debt 2015 Could Be A Tough Year For Stocks 01-15-15 Richard Duncan As promised last time, today I’m going to write something gloomy about the stock market. Everyone knows what happens when you stop blowing air into a balloon. It deflates. Well, that’s what’s happening now to the global economic bubble. It’s starting to deflate.

These are all warning signals that the stock market could be headed toward a steep tumble. It’s not difficult to understand. The Fed was printing a lot of money and using it to buy financial assets. That pushed up their price and created “wealth” that drove the global economy. Now the Fed has stopped printing money and buying financial assets, so asset prices are falling, wealth is being destroyed and the global economy is weakening rapidly. During 2013, the Fed printed just over $1 trillion through its Quantitative Easing program and the S&P 500 Index rose 30%. Last year, the Fed printed $455 billion and the S&P rose 11%. This year, we are told the Fed won’t print any money. If it doesn’t, not only will stocks not rise during 2015, they will probably fall – and perhaps quite sharply. Until very recently, the stock market had been on a tear. After a brief panic attack in October, it recovered quickly and set a series of new record highs during November and December. Moreover, the unemployment rate has fallen sharply, consumer sentiment is strongly positive and the economy just grew at an annualized rate of 5% during the third quarter, its strongest performance in 10 years. So, why my gloomy outlook for stocks in 2015? Can’t stocks rise without the help of the Fed? I don’t think they can. Stocks are not rising because the economy is strong. The economy is strong because stocks are rising. And stocks are rising because the Fed bought $1.5 trillion worth of financial assets with freshly printed money during the last two years. That pushed up Household Sector Net Worth by $ 13 trillion (or by 19%). It is easier to inflate asset prices than to keep them inflated, however. I expect stocks will now begin to follow commodities down. Stock market valuations are already stretched. The S & P 500 Cyclically Adjusted Price Earnings (CAPE) ratio is currently 26.8 times, a 61% premium to its long term average. Moreover, earnings are now under pressure and are being revised down since the strong dollar and falling commodity prices both hurt corporate profits. Finally, the market expects the Fed to begin increasing interest rates in the middle of this year. If interest rates rise, the price of stocks and other assets are very likely to fall. However, there is a real possibility that interest rates will keep falling rather than move higher. The yield on the 10-year US government bond has fallen 40 basis points to as low as 1.78% over the last two weeks. If the global economy continues to weaken, these yields could fall significantly further. The yields on 10-year German and Japanese government bonds fell to new record lows of 43 basis points and 25 basis points, respectively, this week. Normally, lower interest rates should support economic growth and asset prices. However, rates as low as these must be telling us that something is terribly wrong with the global economy. As I have written many times, I don’t believe the Fed will allow the global economy (our global raft filled with credit) to deflate. So long as they have the tools to prevent it – or, at least, to postpone it - the Fed will not allow the global economy to collapse back into severe recession. To prevent that, I believe the Fed will respond with a new round of Quantitative Easing, QE 4. When they do, asset prices will reflate and the global economy will strengthen again - for a while. So, while the stock market may be in for a very rough ride during the next couple of quarters, it will still probably end the year with gains – as the result of QE 4. The Fed has been driving the economy by inflating asset prices. I can’t see why they would stop now.

If you are a subscriber to my video-newsletter, Macro Watch, log in and learn how the crisis in the global economy will affect you. If not, join here: http://www.gordontlong.com/RichardDuncan/Macrowatch.htm For a 50% subscription discount, hit the “Click Here to Subscribe Now” tab and use the coupon code: flows

|

02-05-15 | THEMES FLOWS |

FLOWS |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Feb. 1st, 2015 - Feb. 7th, 2015 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RISK REVERSAL | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JAPAN - DEBT DEFLATION | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BOND BUBBLE | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

02-03-15 | DRIVERS | 3- Bond Bubble | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

GLOBAL RISK - Debt Bubble QE IS PRIMARILY ABOUT ENSURING SOVEREIGNS DEBT YIELDS ARE LOW ENOUGH TO KEEP GOVERNMENTS SOLVENT |

02-03-15 | DRIVERS | 3- Bond Bubble | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The $100 Trillion Global Debt Ponzi Scheme 02-02-15

Phoenix Capital Research's blog

If you are an investor, your big concern should not be about stocks… but what happens when the bond bubble goes bust. For 30+ years, Western countries have been papering over the decline in living standards by issuing debt. In its simplest rendering, sovereign nations spent more than they could collect in taxes, so they issued debt (borrowed money) to fund their various welfare schemes. 47% of American households receive some kind of Gov't Benefit This was usually sold as a “temporary” issue. But as politicians have shown us time and again, overspending is never a temporary issue. Today, a whopping 47% of American households receive some kind of Government benefit. This is not temporary… this is endemic. All of this is spending is being financed by borrowed money… hence, the bond bubble, the biggest bubble in financial history: an incredible $100 trillion monster that is now growing by trillions of dollars every few months. We do not write that point for effect. The US alone issued over $1 trillion in NEW debt in an eight week period towards the end of 2014. The reasons it did this? Because it didn't have the money to pay off the debt that is coming due from the past… so it simply issued NEW debt to raise the money to pay back the OLD debt. $100 TRILLION SOVEREIGN DEBT BUBBLE Sounds a lot like a Ponzi scheme… but the US is not alone in this regard. Globally, the sovereign debt bubble is over $100 trillion in size. Just about every major nation on the planet is sporting a Debt to GDP ratio of 100%+ and that is just including “on the balance sheet” debts… not unfunded liabilities like Medicare or Social Security. This is why the Fed and every other Central Bank on earth is terrified of interest rates rising; because anything even resembling the normalization of interest rates would mean entire countries going bust. Remember when interest rates move, they tend to move quickly. Consider Italy. It was considered one of the pillars of the EU since it adopted the Euro in 1999. Because of this, the markets were happy to allow Italy to borrow at stable rates with the yield on the ten year Italy government bond well below 5% for most of the last decade. Then, in the span of a few weeks, everything came unhinged and the yields on Italy government bonds spiked, rising over 7%: the dreaded level at which a country is considered to be insolvent and set for default. It was only through extraordinary lending mechanisms from the European Central bank (the LTRO 1 and LTRO 2 programs to the tune of hundreds of billions of Euros… for an economy that is €2 trillion in size) that Italy was saved from potential systemic collapse. Again, Italy went from being a former pillar of Europe to insolvent in a matter of weeks… all because interest rates spiked a mere 2% higher than usual. Since 2008 they’ve spent $11 trillion buying assets Italy is not alone here. Western nations in general are in a similar state. This is why QE has been such a popular monetary tool for the Central Banks (since 2008 they’ve spent $11 trillion buying assets, usually sovereign bonds). QE was never meant to create jobs or generate economic growth… it was a desperate ploy by Central Banks to put a floor under the bond market so rates wouldn’t rise. Every 1% increase in interest rates means between $150-$175 billion more in interest payments It’s also why Central Banks have kept interest rates at zero or even negative: again, they cannot afford to have rates rise. In the US, every 1% increase in interest rates means between $150-$175 billion more in interest payments on our debt per year. Forget stocks, forget your concerns about this or that valuation metric, the REAL issue is what happens when the Bond Bubble pops. When that happens it won’t be individual banks going bust, it will be ENTIRE NATIONS. |

02-03-15 | DRIVERS | 3- Bond Bubble | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Backstop of Modern Finance Is About to Implode 02-03-15 Phoenix Capital Research's blog The biggest question for investors today is that whether or not rates will rise in 2015. The Fed may raise rates a token amount this year, but the move will be largely symbolic. With over $100 trillion in bonds and over $555 TRILLION in interest rate derivatives trading based on interest rates, the Fed will not be normalizing rates at any point in the future. Indeed, former Fed Chairman Ben Bernanke admitted this in private during a closed-door luncheon with several hedge funds last year. Bernanke’s exact words were that rates would not normalize anytime during his “lifetime.” So the Fed may raise rates from 0.25% to say 0.3% or possibly even 0.5%. But we won’t be entering a hawkish period for the Fed by any means. The reason is very simple… any normalization of rates would implode the bond market. The fact is that much of the globe, particularly the developed west, is up to its eyeballs in debt. Mind, you, this is based solely on official public debt numbers. If you include unfunded liabilities, then the US, most of Europe, Japan, and even China are sporting Debt to GDP ratios well over 300%. In the US, a 1% increase in interest rates means over $100 billion more in interest rate payments. The US is already running a deficit (meaning that it spends more than it takes in via taxes) and has been for most of the last 20 years. Of course, the deficit could become larger to service the increase in interest payments, but with the US already having to resort to issuing NEW debt to cover OLD debt that is coming due, this is a slippery slope. The US issued over $1 trillion in new debt in an 8-week period for precisely this purpose. The reality is as follows:

|

02-03-15 | DRIVERS | 3- Bond Bubble | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

GLOBAL RISK - What does NIRP Tell US About GLobal Risk of Deflation? 16% Of Global Government Bonds Now Have A Negative Yield: Here Is Who's Buying It 01-31-15 JP Morgan via ZH A week ago many were surprised to learn that in his attempt to "fight deflation", the ECB's Mario Draghi unleashed the biggest deflationary wave of all time, when in the aftermath of the ECB's NIRP policy, and subsequently QE, an unprecedented €1.4 trillion in European debt with a maturity of more than 1 year traded down to subzero, as in negative, yields. But what happens if one expands the Eurozone NIRP universe to include the debt of other countries including Japan, Denmark, Sweden, Switzerland and so on? Conveniently, JPM has done the analysis and finds that a mindblowing $3.6 trillion of government debt traded with a negative yield as recently as last week. This represents 16% of the JPM Global Government Bond Index, or in other words nearly a fifth of all global government debt is now trading with a negative yield, meaning investors pay sovereigns, using other people's money of course, for the privilege of buying their issuance! JPM's full take:

The logical follow up question: as the entire world appears slowly but surely headed to a uniform NIRP platform, where every single sovereign's debt will have a negative yield thanks to one or more central banks' guarantees that said debt will be monetized no matter what (those curious what happens when there is even a faint doubt if a given nation's Treasurys won't be backstopped and purchased by a central bank, just look at what happened to Greek bonds this past week), why do investors keep dumping their cash in securities that have a negative carry? Here again courtesy of JPM's Nikolaos Panigirtzoglou, are six investor classes which, even with US stocks trading at the low, low forward GAAP PE of a modest 20x, prefer to incentivise governments around the globe to issue even "moar" debt, in the process making a global debt crisis that much worse, as the stock of government debt rises to truly catastrophic proportions.

Of note: in their infinite wisdom, regulators continue to keep government debt at a "zero risk weighting", which is perhaps the biggest self-fulifilling prophecy ever and one which is only valid as long as the weakest link in the "central banks are infallible" chain holds. Because a few more episodes like the SNB's shocking, and confidence-crushing, reversal in January, and the faith in central banker omnipotence will slowly but surely start to evaporate, and as it goes, it will also reveal just how much risk there truly is in this biggest "frontrun-the-central-banks" bandwagon trade of all time. In the meantime, prepare for much more laughter as well as sheer horror, as such until recently Onionesque market dislocations as negative interest rate mortgages (now available in Denmark, soon everywhere else) become an ubiquitous feature of a broken financial system now clearly in its terminal phase, where prudent behavior is punished outright, while spending money one doesn't have, and will never be able to repay, becomes the most rewarded activity. |

02-03-15 | DRIVERS | 3- Bond Bubble | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In Denmark You Are Now Paid To Take Out A Mortgage 01-30-15 ZH With NIRP raging in the Eurozone and over €1.5 trillion in European government bonds trading with negative yields, many were wondering when any of this perverted bond generosity will spill over to other debtors, not just Europe's insolvent governments (who can only print negative interest debt because of the ECB's backstop that it will buy any piece of garbage for sale in the doomed monetary union). In fact just earlier today we, rhetorically, asked a logical - in as much as nothing is logical in the new normal - question: Little did we know that just minutes after our tweet, we would learn that at least one place is already paying homeowners to take out a mortgage. That's right - the negative rate mortgage is now a reality. Thanks of Mario Draghi's generosity with "other generations' slavery", and following 3 consecutive rate cuts by the Danish Central Bank, a local bank - Nordea Credit - is now offering a mortgage with a negative interest rate! This means, according to DR.dk, that Nordea have had to pay instead of charging interest to to a handful of customers, says housing economist at Nordea Kredit, Lise Nytoft Bergmann for Finance. From DR, google-translated:

This is just the beginning: according the Danish media outlet, as a result of variable-refinancing, as recently as a week from now "a greater share of customers could have a negative rate."

And just like that, first in Denmark, and soon everywhere else in Europe, a situation has now emerged where savers who pay the bank to hold their cash courtesy of negative deposit rates, are directly funding the negative interest rate paid to those who wish to take out debt. In fact, the more debt the greater the saver-subsidized windfall. That all this will end in blood and a lot of tears is clear to anyone but the most tenured economists, however in the meantime, we can't wait to take advantage of the humorous opportunities that Europe (and soon Japan and the US) will provide in the coming months, as spending profligacy will be directly subsidized and funded by the insolvent monetary system, while responsible behavior and well-paid labor will be punished, first with negative rates and soon thereafter: with threats, both theoretical and practical, of bodily harm. h/t @AndreasBay |

02-03-15 | DRIVERS | 3- Bond Bubble | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

EU BANKING CRISIS |

4 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SOVEREIGN DEBT CRISIS [Euope Crisis Tracker] | 5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CHINA BUBBLE |

6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TO TOP | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MACRO News Items of Importance - This Week | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

GLOBAL MACRO REPORTS & ANALYSIS |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

US ECONOMIC REPORTS & ANALYSIS |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TECHNICALS & MARKET |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

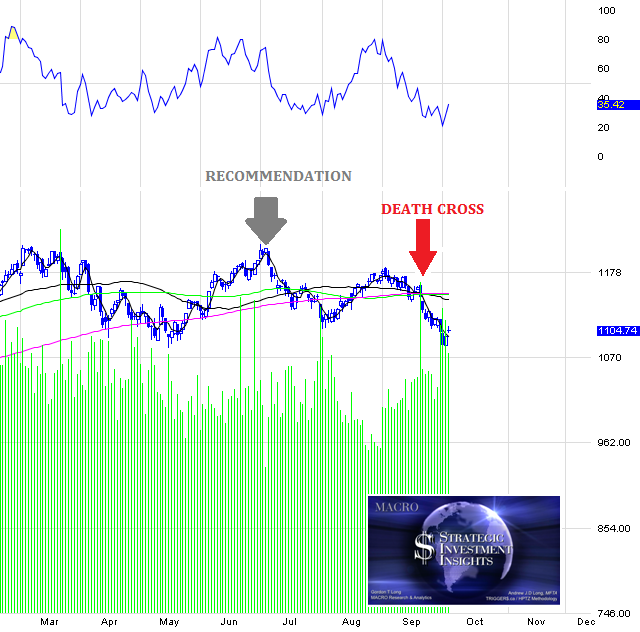

WEEKLY TECHNICALS - Driver$ EQUITY MARKET DRIVER: Currencies Looking For Near Term Weakness Weakness Stemming From EURUSD "Bounce"

Likely "Bounce" to 1.19 from low of 1.125 or a 5.8% Rise Potential Short Squeeze Increasing

REACTING: Commodities

WE ARE IN A MAJOR CYCLICAL TREND

TREND - Slowing Global Economy

|

02-04-15 | DRIVERS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THESIS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

2013 2014 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2011 2012 2013 2014 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THEMES | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FLOWS -FRIDAY FLOWS | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SHADOW BANKING -LIQUIDITY / CREDIT ENGINE | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ECHO BOOM - PERIPHERAL PROBLEM | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PRODUCTIVITY PARADOX -NATURE OF WORK | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STANDARD OF LIVING -EMPLOYMENT CRISIS | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CORPORATOCRACY -CRONY CAPITALSIM | THEME |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CORRUPTION & MALFEASANCE -MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SOCIAL UNREST -INEQUALITY & A BROKEN SOCIAL CONTRACT | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SECURITY-SURVEILLANCE COMPLEX -STATISM | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CENTRAL PLANINNG -SHIFTING ECONOMIC POWER | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CATALYSTS -FEAR & GREED | THEME | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GENERAL INTEREST |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STRATEGIC INVESTMENT INSIGHTS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SII | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SII | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SII | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SII | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TO TOP | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP