Soon after the Swiss shocked the world by abandoning their currency's peg to the euro, Hong Kong's Financial Secretary�John Tsang�hit the airwaves. His very clear message: the city's U.S. dollar peg would hold�firm. Tsang, however, has credibility issues. In recent years, he's cited Switzerland's commitment to capping its currency as�inspiring�his own. That sounded fine until Swiss National Bank President Thomas�Jordan unexpectedly freed the franc. Speculators very quickly drove the Hong Kong dollar toward the top of its trading band.

More importantly, Hong Kong's�32-year-old peg may now be fueling social discontent.�Last year's�Umbrella Revolution�had as much to do with surging inequality as democracy -- a problem captured most vividly by stratospheric property prices that have put homeownership out of reach for many citizens. Hong Kong's undervalued dollar has made that problem worse, by attracting tidal waves of Chinese money. (In 2013,�Hong Kong received $47 billion of direct-investment inflows from the�mainland, and another $342 billion from�the British Virgin Islands, a favorite haven among ultrarich Chinese.)�

Has the policy currency outlived its usefulness?�There are many reasons to think�Hong Kong won't go rogue the way Zurich did. Any decision to scrap the peg would be made in Beijing, where Hong Kong Chief Executive�Leung Chun-ying's political bosses reside. And at least some of the Communist Party elite care more about ready access to Hong Kong's property market than the anxieties of the city's middle class.

Hong Kong's financial regulators are themselves a decidedly risk-adverse bunch that sees the peg as a reassuring backstop. "It can be called a magic needle for calming the sea of the Hong Kong economy," Tsang said earlier this week. It's also worth noting the differences between Switzerland (which essentially was manipulating its currency) and Hong Kong's formal lock to a specific U.S. dollar value.

But the peg also limits the government's room to maneuver. Even with curbs introduced to cool demand, real-estate prices surged 12 percent in the first 11 months of 2014 to a�record. The city's 5.1 percent inflation rate is double the Asian average. While an undervalued currency isn't the sole culprit, it's surely one of the main factors driving up prices. Of course, the peg works both ways.�Capping the dollar helps exports, supporting economic growth. And amid talk China may begin devaluing the yuan, Hong Kong's capital-inflow challenges may recede in the short run. They're sure to return, though.

To ease�the strain, Hong Kong could try something drastic: pegging its dollar to the yuan. More realistically, it could adopt a gradualist course and link the dollar to a Singapore-like basket of currencies. Perhaps the highest-level call in recent months for the city to study its options came from�Peter Wong, Asia-Pacific CEO for HSBC. Along with the above-mentioned possibilities, Wong raised the idea of letting the Hong Kong dollar float, or even naming the yuan as legal tender.

In his 2013 book, "Street Smarts," investor Jim Rogers warned Friday's Swiss shock was coming. I checked with him this week and asked if Hong Kong might be next.

"It will happen, but I keep thinking it will be after the [yuan] is completely convertible."

Trouble is, there's no guarantee when that might happen, especially as China's growth slows and officials in Beijing worry about capital flight.

At the very least, the Swiss surprise should spur a public debate about the pros and cons of Hong Kong's peg. If scrapping it can help ameliorate�the city's socioeconomic tensions, perhaps it's�time for Hong Kong to shock the world, too.

|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

�

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros � |

�

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

��

"Currency Wars "

|

�

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

�

"EURO EXPERIMENT"

archives open EURO EXPERIMENT :� ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

�

"INNOVATION"

archives open |

�

"PRESERVE & PROTE CT"

archives open |

�

Thurs. Jan. 29th, 2015

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

�

STRATEGIC MACRO INVESTMENT INSIGHTS

2014 THESIS: GLOBALIZATION TRAP

2014 THESIS: GLOBALIZATION TRAP

NOW AVAILABLE FREE to Trial Subscribers

185 Pages

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images:� Understanding the Conclusions

![]()

| � | � | � | � | � |

| JANIUARY | ||||||

| S | M | T | W | T | F | S |

| � | � | � | � | 1 | 2 | 3 |

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 30 |

KEY TO TIPPING POINTS |

| 1 - Risk Reversal |

| 2 - Japan Debt Deflation Spiral |

| 3- Bond Bubble |

| 4- EU Banking Crisis |

| 5- Sovereign Debt Crisis |

| 6 - China Hard Landing |

| � |

| 7 - Chronic Unemployment |

| 8 - Geo-Political Event |

| 9 - Global Governance Failure |

| 10 - Chronic Global Fiscal ImBalances |

| 11 - Shrinking Revenue Growth Rate |

| 12 - Iran Nuclear Threat |

| 13 - Growing Social Unrest |

| 14 - US Banking Crisis II |

| 15 - Residential Real Estate - Phase II |

| 16 - Commercial Real Estate |

| 17 - Credit Contraction II |

| 18- State & Local Government |

| 19 - US Stock Market Valuations |

| � |

| 20 - Slowing Retail & Consumer Sales |

| 21 - China - Japan Regional Conflict |

| 22 - Public Sentiment & Confidence |

| 23 - US Reserve Currency |

| 24 - Central & Eastern Europe |

| 25 - Oil Price Pressures | 26 - Rising Inflation Pressures & Interest Pressures |

| 27 - Food Price Pressures |

| 28 - Global Output Gap |

| 29 - Corruption |

| 30 - Pension - Entitlement Crisis |

| � |

| 31 - Corporate Bankruptcies |

| 32- Finance & Insurance Balance Sheet Write-Offs |

| 33 - Resource Shortage |

| 34 - US Reserve Currency |

| 35- Government Backstop Insurance |

| 36 - US Dollar Weakness |

| 37 - Cyber Attack or Complexity Failure |

| 38 - Terrorist Event |

| 39 - Financial Crisis Programs Expiration |

| 40 - Natural Physical Disaster |

| 41 - Pandemic / Epidemic |

�

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

�

TODAY'S TIPPING POINTS

|

Scroll TWEETS for LATEST Analysis

�

Read More - OUR RESEARCH - Articles Below

HOTTEST TIPPING POINTS |

� | � | Theme Groupings |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Investing in Macro Tipping Points

THESE ARE NOT RECOMMENDATIONS - THEY ARE MACRO COMMENTARY ONLY - Investments of any kind involve risk.� Please read our complete risk disclaimer and terms of use below by clicking HERE |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"BEST OF THE WEEK " |

Posting Date |

Labels & Tags | TIPPING POINT or THEME / THESIS or INVESTMENT INSIGHT |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY � |

� | � | � � |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

CHECK OUT OUR PAGE DEDICATED TO FINANCIAL REPRESSION The Financial Repression AuthorityTM

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THESIS & THEMES | � | � | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

GLOBAL RISK - How Financial Repression Leads to Mispriced Risk HOW FINANCIAL REPRESSION LEADS TO MISPRICED RISK

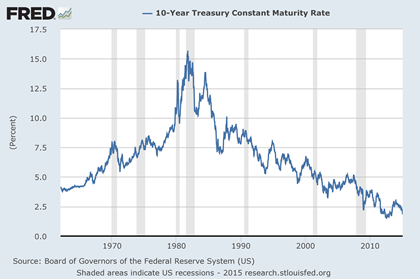

The Concept of "Real Risk Free" Total Returns CULTURE OF RISK The financial system is based on debt. US Treasuries, the benchmark for an allegedly “risk free” rate of return, is the asset against which all other assets are priced based on their relative riskiness. This “risk free” rate has been falling steadily for over 25 years.

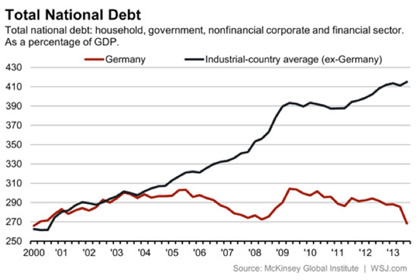

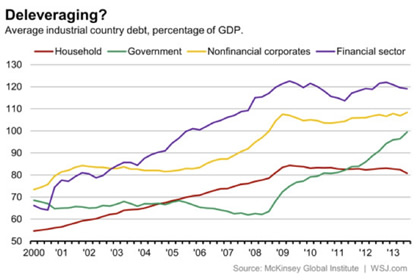

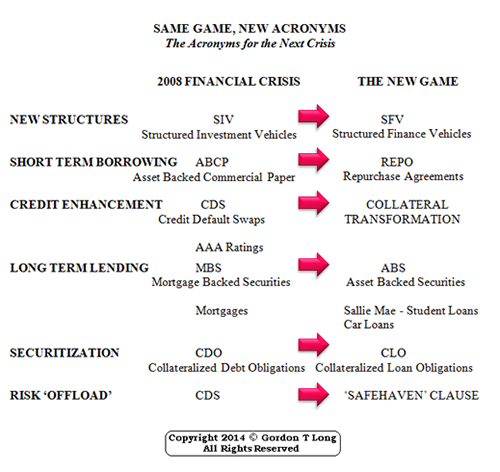

The�Wall Street Journal�estimates that a third of traders have never witness a rate hike. However, the real problem is far greater than this. Bonds have been in a bull market for over 30 years. Forget rate hikes… an entire generation of investors and money managers (anyone under the age of 55) has been investing in an era in which risk has generally gotten cheaper and cheaper. FINANCIALIZATION & RISE IN LEVERAGE This, in turn, has driven the rise in leverage in the financial system. As the risk-free rate fell, so did all other rates of return. Thus: investors turned to leverage or using borrowed money to try to gain greater rates of return on their capital. The ultimate example of this is the derivatives market, which is now over $700 trillion in size. This entire mess is backstopped by about $100 trillion (at most) in bonds posted as collateral. ASSETS CAN NO LONGER BE ALLOWED TO FALL - Deleveraging is Misinformation This formula of ever increasing leverage works relatively well when the underlying asset backstopping a trade is rising in value (think of the housing bubble, which worked fine as long as housing prices rose). However, if the asset ever loses value, you very quickly run into trouble because you need to post more as collateral to backstop your trade. If you can’t do this easily, the margin calls start coming and you can find yourself having to unwind a massive position in a hurry. This is how crashes occur. This is what caused 2008. Despite all of the rhetoric, the world has not deleveraged in any meaningful way. The only industrialized country to deleverage since 2008 is Germany.

This is not unique to sovereign nations either. As McKinsey recently noted, there has been no meaningful deleveraging in any sector of the global economy (the best we’ve got is households and financial firms which have basically flat-lined since 2008).

In the simplest of terms, the 2008 collapse occurred because of too much leverage fueled by cheap debt. This worked fine until the assets backstopping the leveraged trades fell in value, which brought about margin calls and a selling panic. REHYPOTHECATION The practice by banks and brokers of using, for their own purposes, assets that have been posted as collateral by their clients. In rehypothecation, securities that have been posted with a prime brokerage as collateral by a hedge fund are used by the brokerage to back its own transactions and trades. While rehypothecation was a common practice until 2007, hedge funds became much more wary about it in the wake of the Lehman Brothers collapse and subsequent credit crunch in 2008-09. That has all changed as has the re-emergence of Cov-Lite, PIK Loans et al. Since the Financial Crisis everyone has become even MORE leveraged than they were in 2008. And they did this against an ever-smaller pool of quality assets (the Fed and other Central Banks’ QE programs have actually�removed�high grade collateral from the financial markets).

Thus, we now have a financial system that is even�more�leveraged than in 2007… backstopped by even�less high quality collateral. And this time around, most industrialized sovereign nations themselves are bankrupt, meaning that when the bond bubble pops, the selling panic and liquidations will be even more extreme. Excerpts above taken from a note from Graham Summers, Phoenix Capital Research THE CONCEPT OF "RISK FREE"

As my MACRO Co-Host writes in The Surprising Consequences Of The Global Frenzy For Positive Yield As the dollar soars, so does the real yield on bonds denominated in dollars.

REAL RISK FREE TOTAL RETURN This is THE trick of FINANCIAL REPRESSION in financing the US Government Debt Savers lose but the US Government & International Banks win. � |

01-29-15 | � THESIS |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Jan 25th, 2015 - Jan 31st, 2015 | � | � | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RISK REVERSAL | � | � | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JAPAN - DEBT DEFLATION | � | � | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| BOND BUBBLE | � | � | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

EU BANKING CRISIS |

� | � | 4 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SOVEREIGN DEBT CRISIS [Euope Crisis Tracker] | � | � | 5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CHINA BUBBLE |

� | � | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

GLOBAL RISK - The Next "Peg" to Fall THE NEXT "PEG" TO FALL SINGAPORE DOLLAR PUTS ADDED PRESSURE ON CHINA Singapore's MAS announced a surprise shift in the slope of their policy band - implicitly loosening policy and so the Singapore Dollar dumped over 160 pips against the USD, the biggest drop in almost 3 years, tumbling to its weakest since Mid 2010. Interestingly, against the Japanese Yen this move merely roundtrips SGD strength from yesterday as one wonders who the real enemy in the competitive devaluation game is... The Sing Dollar weakened to 1.35 against the USD - the biggest single-day drop since Feb 2011... A big drop for the SGD... But against the JPY, it's a small move... Raising the question of just who the currency war is against... Charts: Bloomberg |

01-28-15 | CHINA � CURRENCY WARS � |

6 - China Hard Landing | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

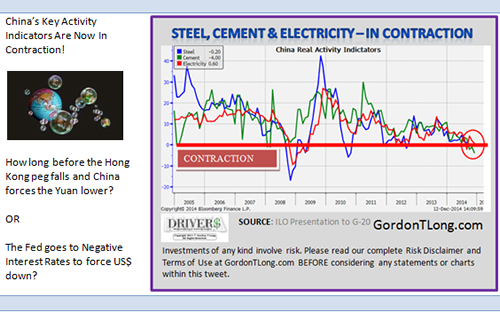

GLOBAL RISK - The Next "Peg" to Fall THE NEXT "PEG" TO FALL CHINA HAS ITS 'BACK TO THE WALL' WITH GLOBAL SLOWDOWN & COMPETITIVE DEVALUATIONS

� CHINA IS FACING A COMPETITIVE CURRENCY DISADVANTAGE! IF YOU WERE THE CHINESE WHAT WOULD YOU DO?

This has got to really p$%^ss off the Chinese! HAVE THEY ALREADY STARTED?

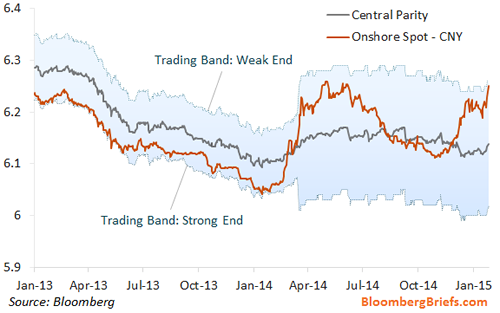

Chinese Currency Plunges To Peg Limit Against USDollar, Strongest Against Euro In 14 Years 01-27-15 ZH

Charts: Bloomberg WILL THE HONG DOLLAR FOLLOW SWITZERLAND? HONG KONG DOLLAR

THE STORY IS LIKELY NOT YET THE HONG KONG DOLLAR "It will happen, but I keep thinking it will be after the [yuan] is completely convertible." Jimmy Rogers Will Hong Kong's Peg Be�the Next to Fall? 01-21-15 BloombergView

Hong Kong Dollar Peg Doesn’t Fit in Swiss Hole 01-23-15 WSJ

|

01-27-15 | CHINA � CURRENCY WARS � |

6 - China Hard Landing | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TO TOP | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| MACRO News Items of Importance - This Week | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

GLOBAL MACRO REPORTS & ANALYSIS |

� | � | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

US ECONOMIC REPORTS & ANALYSIS |

� | � | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | � | � | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| � | � | � | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TECHNICALS & MARKET | � |

� | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

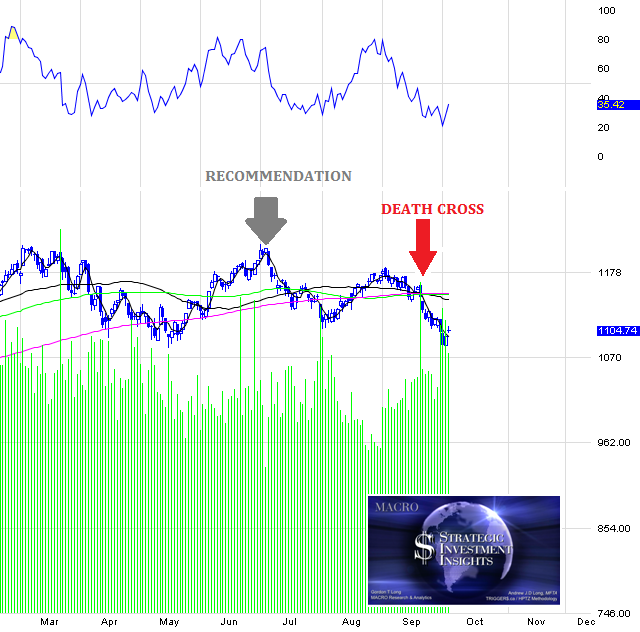

FLOWS - Liquidity, Credit & Debt THE RIGHT WAY TO LOOK AT THE MARKET "RATE OF CHANGE OF FLOWS"

RESULTS SINCE THE RATE OF CHANGE OF FLOWS "INFLECTION"

CHARTS: Annotated from Zero Hedge |

01-28-15 | THEMES FLOWS |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CURRENCIES - USD Strength Long USDJPY, aka the trade that is directly proportional to multiple expansion for the entire US stock market, and number of bankrupt Japanese corporations. This is what BofA's technical strategist MacNeill Curry has to say:

|

01-28-15 | DRIVERS USD |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| COMMODITY CORNER - AGRI-COMPLEX | � | PORTFOLIO | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SECURITY-SURVEILANCE COMPLEX | � | PORTFOLIO | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| � | � | � | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THESIS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

2013 2014 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

01-26-15 | THESIS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

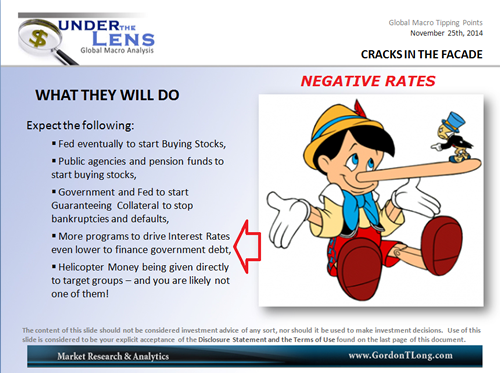

FINANCIAL REPRESSION - Negative Real Rates Coming Get Ready For Negative Interest Rates In The US 01-24-15 ZH

As The Wall Street Journal explains,

Treasury Secretray Lew pipes in...

*� *� * And Patrick Barron predicts (via Mises Canada)...

|

01-26-15 | THESIS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

� JAPANESE 2 YEAR GOES NEGATIVE

GERMAN 2 YEAR GOES NEGATIVE

� 30 YEAR HEADING STEADILY SOUTH

� |

01-26-15 | THESIS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2011 2012 2013 2014 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| � | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| THEMES | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| FLOWS -FRIDAY FLOWS | � | THEME | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SHADOW BANKING -LIQUIDITY / CREDIT ENGINE | � | THEME | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CRACKUP BOOM - ASSET BUBBLE | � | THEME | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ECHO BOOM - PERIPHERAL PROBLEM | � | THEME | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| PRODUCTIVITY PARADOX -NATURE OF WORK | � | THEME | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STANDARD OF LIVING -EMPLOYMENT CRISIS | � | THEME | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CORPORATOCRACY -CRONY CAPITALSIM | � | THEME |  |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CORRUPTION & MALFEASANCE -MORAL DECAY - DESPERATION, SHORTAGES. |

� | THEME |  |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SOCIAL UNREST -INEQUALITY & A BROKEN SOCIAL CONTRACT | � | THEME | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SECURITY-SURVEILLANCE COMPLEX -STATISM | � | THEME | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | � | THEME | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CENTRAL PLANINNG -SHIFTING ECONOMIC POWER | � | THEME | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CATALYSTS -FEAR & GREED | � | THEME | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GENERAL INTEREST | � |

� | � | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| STRATEGIC INVESTMENT INSIGHTS | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

� � � |

� | SII | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

� � � |

� | SII | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

� � � |

� | SII | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

� � � |

� | SII | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TO TOP | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| � | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tipping Points Life Cycle - Explained

Click on image to enlarge

���

���

TO TOP

�

�

�

�

�� TO TOP

�

�

With Fed mouthpiece Jon Hilsenrath warning -

With Fed mouthpiece Jon Hilsenrath warning -