|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Wed. Aug. 12th, 2015

Follow Our Updates

onTWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

ANNUAL THESIS PAPERS

FREE (With Password)

THESIS 2010-Extended & Pretend

THESIS 2011-Currency Wars

THESIS 2012-Financial Repression

THESIS 2013-Statism

THESIS 2014-Globalization Trap

THESIS 2015-Fiduciary Failure

NEWS DEVELOPMENT UPDATES:

FINANCIAL REPRESSION

WHAT WE ARE RESEARCHING

2015 THEMES

SUB-PRIME ECONOMY

PENSION POVERITY

WAR ON CASH

ECHO BOOM

PRODUCTIVITY PARADOX

GLOBAL GOVERNANCE

- COMING NWO

WHAT WE ARE WATCHING

(A) Active, (C) Closed

MATA

Q3 '15- Chinese Market Crash

(A)

Q3 '15-

GMTP

Q3 '15- Greek Negotiations

(A)

Q3 '15- Puerto Rico Bond Default

MMC

OUR STRATEGIC INVESTMENT INSIGHTS (SII)

NEGATIVE-US RETAIL

NEGATIVE-ENERGY SECTOR

NEGATIVE-YEN

NEGATIVE-EURYEN

NEGATIVE-MONOLINES

POSITIVE-US DOLLAR

ARCHIVES

| AUGUST | ||||||

| S | M | T | W | T | F | S |

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 | 31 | |||||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar Weakness |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?We have analyzed & included

these in our latest research papers Macro videos!

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

| STUDIES - MACRO pdf | |||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

CANARIES - Warnings Everywhere! The Investment Legends Are Preparing For a Crash Graham Summers, Phoenix Capital More and more insiders are warning of a potential systemic event. The first sign of real trouble concerned a number of investment legends choosing to close shop and return investors’ capital. Stanley Druckenmiller

Carl Icahn

Seth Klarman

Even the perma-bulls are speaking with their actions. Warren Buffett

Beyond the legends, institutional investors have been net sellers of stocks in 2014 and on into 2015. The same goes for hedge funds. Do you think they’d be doing this if they thought stocks were offering a lot of opportunities and value today? Ian Spreadbury - Fidelity And finally, we get to today, where one of the largest asset managers in the world at Fidelity stated that we are heading for a “systemic event... similar to 2008” and that owning precious metals and physical cash is a good idea. The punch line? This was a bond fund manager. One of the class of investors who have poo poo’d Gold and physical cash in the past because those assets pay next to or no dividend. And even HE is warning that it’s time to take safety and prepare. Smart investors should take note of this now. It is a MAJOR red flag to be watched closely.

|

08-12-15 | CANARIES | |

Via The Telegraph:

As The Telegraph notes, this is "an unusual" piece of advice coming from "a mainstream strategist" and it suggests the "serious people" are starting to realize that a certain tin foil hat fringe blog — which can already count LIBOR manipulation and HFT proliferation as examples of conspiracy theories turned world-changing conspiracy facts — may be correct to warn that if the current state of affairs persists for much longer, the "market" may one day be halted and simply never reopen. |

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - August 09th, 2015 - August 15th, 2015 | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

CHINA - Yuan Devaluation China Enters Currency War - Devalues Yuan By Most On Record Submitted by Tyler Durden on 08/10/2015 - 21:32 Submitted by Tyler Durden on 08/10/2015 - 21:32

As we first warned in March, and as became abundantly clear over the weekend when weaker than expected export data as well as the steepest decline in factory gate prices in six years underscored the extent to which the engine of global growth and trade has officially stalled, Beijing has no choice but to join the global currency wars, as the yuan's dollar peg will ultimately prove to be too painful going forward. And sure enough this evening the PBOC weakens the Yuan fix by the most on record. As the details sink in, the Chinese currency complex is collapsing... 12 month NDFs just hit a new 5 year lows against the USD. China's Historic Devaluation Sends Equity Futures, Oil, Bond Yields Sliding, Gold Spikes Submitted by Tyler Durden on 08/11/2015 - 06:48 Submitted by Tyler Durden on 08/11/2015 - 06:48

If yesterday it was the turn of the upside stop hunting algos to crush anyone who was even modestly bearishly positioned in what ended up being the biggest short squeeze of 2015, then today it is the downside trailing stops that are about to be taken out in what remains the most vicious rangebound market in years, in the aftermath of the Chinese currency devaluation which weakened the CNY reference rate against the USD by the most on record, in what some have said was an attempt by China to spark its flailing SDR inclusion chances, but what was really a long overdue reaction by an exporter country having pegged to the strongest currency in the world in the past year. China "Loses Battle Over Yuan", And Now The Global Currency War Begins Submitted by Tyler Durden on 08/11/2015 - 04:40 Submitted by Tyler Durden on 08/11/2015 - 04:40

Almost exactly seven months ago, on January 15, the Swiss National Bank shocked the world when it admitted defeat in a long-standing war to keep the Swiss Franc artificially weak, and after a desperate 3 year-long gamble, which included loading up the SNB's balance sheet with enough EUR-denominated garbage to almost equal the Swiss GDP, it finally gave up and on one cold, shocking January morning the EURCHF imploded, crushing countless carry-trade surfers. Fast forward to the morning of August 11 when in a virtually identical stunner, the PBOC itself admitted defeat in the currency battle, only unlike the SNB, the Chinese central bank had struggled to keep the Yuan propped up, at the cost of nearly $1 billion in daily foreign reserve outflows, which as this website noted first months ago, also included the dumping of a record amount of US government treasurys. Who Could Have Possibly Foreseen China's Shocking Devaluation? Submitted by Tyler Durden on 08/11/2015 - 03:46 Submitted by Tyler Durden on 08/11/2015 - 03:46

Well, pretty much anyone who is not an economist or Wall Street "strategist" because a mercantilist, export-dominated nation pegged to a currency that has appreciated by an unprecedented amount in the past year, is grounds for nothing short of disaster, or using the parlance of our times, a "hard-landing." Case in point: this is what we said just two days ago when the news of China's dramatic trade collapse hit in a post titled: "Chinese Trade Crashes, And Why A Yuan Devaluation Is Now Just A Matter Of Time"...

|

08-11-15 | CHINA | 4 - China Hard Landing |

| Posted by Bloomberg Brief | |||

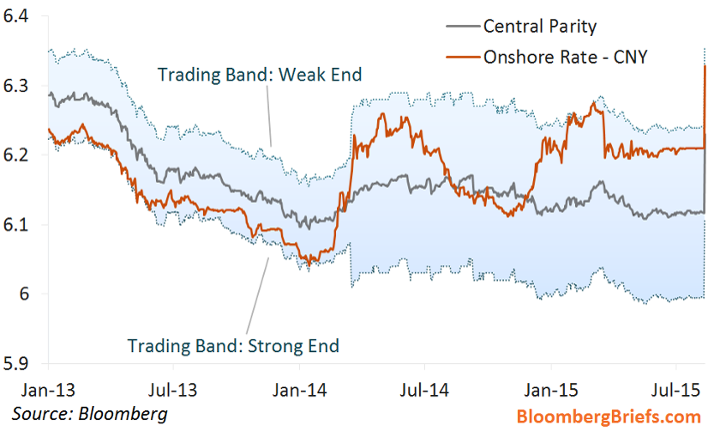

Devaluation Promises to Boost Exports, But Adds Stability Risk China's central bank has signaled a new stage in the management of the yuan and opened the door to depreciation to support export competitiveness. The People's Bank of China adjusted the yuan central parity — the daily fixing used to guide the market — down 1.9 percent today, the largest drop on record. The central bank also said that, going forward, the central parity will closely reflect the market price. That marks a significant shift in policy, as the central bank ends its eight-month resistance to market pressure for yuan depreciation. The direction of travel from the market is clear. At 6 a.m. New York time, the spot price had already fallen to 6.3250 to the dollar, from 6.2097 at Monday's close.

The PBOC's move reflects the depth of concern about China's growth, which threatens to fall below the government's 7 percent target for the year. Exports contracted 8.9 percent year on year in July as a 14 percent annual appreciation in the real effective exchange rate choked off demand. The timing likely also reflects concern that as the Fed moves toward a first rate hike, a peg to a rising dollar would mean continued appreciation of the yuan against the currency of trade rivals. Reviving flagging exports will require a significantly larger depreciation. Exports year to date have been flat from a year ago. Based on our calculations, a 10 percent depreciation against the dollar would take export growth back to 10 percent year on year, all else being equal. The risk is that depreciation triggers capital flight, dealing a blow to the stability of China's financial system. Our estimate is that a 1 percent yuan depreciation against the dollar would trigger about $40 billion in capital flight. The calculation from China's leaders is likely that, with $3.6 trillion in foreign exchange reserves, substantial bank deposits stashed in reserve at the PBOC, and controls on cross-border flows, they can manage any risks. Assuming a 10 Spot Price, Central Parity and Trading Band See this story on the Bloomberg terminal with additional charts here. percent depreciation triggered $400 billion in capital flight, they would still be left with FX reserves in excess of $3 trillion. Years of yuan appreciation increased the appeal of investment in China and had a broad positive impact on asset prices. Yuan depreciation will have the reverse effect. That's a negative for the struggling equity market and the nascent recovery in real estate — where speculative demand plays a major role. Depreciation will deal a blow to China's hopes for yuan inclusion in the IMF's SDR basket. It will decrease international investors' willingness to hold yuan, and will likely irk the IMF — which has only recently shifted away from its characterization of the currency as undervalued. There are also political economy considerations. President Xi Jinping is set to meet with President Obama in September. Competitive depreciation of the yuan will not make that conversation any easier. Neither will it improve Beijing's relations with regional rivals Tokyo and Seoul, who fear any gain for China's exporters comes at the expense of lower sales for their own firms. China likely views any international protests as a manageable second-order consideration. That's especially true as they can legitimately present depreciation as driven by the market, and other major central banks have adopted policies that promote exchange-rate depreciation. In terms of China's longer-term rebalancing agenda, we give the central bank credit for finding a policy that combines stimulus and reform. A weaker yuan will provide a boost to growth. A more market-set exchange rate is in line with the direction of travel set at the Third Plenum, and will promote more efficient allocation of productive resources. Looking at the historical data as a guide to the possible extent of coming moves, the biggest three-month yuan move on record was a 4.2 percent appreciation at the start of 2008. It would take a 14 depreciation to take the yuan back to mid-2014 levels, when its latest period of appreciation in real effective terms started.

|

|||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

FINANCIAL REPRESSION - UPDATE

The Disappearing Retirement Fund International Man's Jeff Thomas points to the unprecedented financial & economic challenges & crises in the indebted developed world .. Thomas is very pessimistic about the retirement situation for Americans, Canadians, Europeans .. he thinks their investments in their pension funds will diminish dramatically in value or disappear .. for example, on U.S. social security, "Ergo, each year, those working will need to be taxed more heavily if the system is to continue. Unfortunately, at some point, we reach the tipping point and the concept itself is no longer viable. After that point, benefits will be reduced and, possibly, eliminated altogether." .. in regard to private pension funds like 401Ks, Thomas sees the risks of a stock market crash as bringing down the value of these funds, even if the funds are so-called "diversified" .. but there's more - there are now new risks from governments desperately in search of funds to keep their operations & public pensions going .. "When governments find themselves on the verge of insolvency, they invariably react the same way: go back to the cash cow for a final milking. Each of the jurisdictions that is in trouble at present, has, in its playbook, the same collection of milking techniques. One of those will have a major impact on pensions: the requirement that pension plans must contain a percentage of government Treasuries .. Legislation will be created to ensure that a percentage be in Treasuries, which are 'guaranteed' .. Sounds good. And people will be grateful. Unfortunately, the body that is providing the guarantee is the same body that has created the economic crisis. And if the government is insolvent, the 'guarantee' will become just one more empty promise. Recently, the U.S. Supreme Court ruled that employers have a duty to protect workers invested in their 401(k) plans from mutual funds that perform poorly or are too expensive. By passing this ruling, the US government has the power to seize private pension funds “to protect pensioners”. It also has the authority to dictate how funds may be invested. The way is now paved for the requirement that 401(k)s be invested heavily in US Treasuries."

Financial Repression Will Intensify as Central Bank/Government Policy Options Become Limited Economist Satyajit Das sees increasing methods of financial repression being employed by governments as policy options become limited .. Introduced in 1973 by economists Edward Shaw & Ronald McKinnon, the term refers to measures implemented by governments to channel savings & funds to finance the public sector, lower its borrowing costs & liquidate debt .. Das sees new taxes, means testing, user pay surcharges all coming .. "Entitlement liabilities, such as retirement benefits, will be managed by increasing the allowable minimum retirement age, reducing benefit levels, linking to actual contribution by individuals over their working life, and eliminating inflation indexation. Many of these policies will be packaged as socially and ethically progressive initiatives, belying the financial imperatives." .. points out in a 2013 study, the McKinsey Global Institute found that between 2007 & 2012, interest rate & quantitative easing (QE) policies resulted in a net transfer to governments in the United States, Britain & the eurozone of $1.6 trillion (£1.03 trillion), through reduced debt-service costs & increased central bank profits - "The losses were borne by households, pension funds, insurers and foreign investors. Households in these countries together lost $630bn in net interest income, with the major losses being borne by older households with significant interest-bearing assets. Non-financial corporations in these countries also benefited by $710bn through lower debt service costs." .. Das also sees deliberate devaluation as another financial repression mechanism .. regulations are another mechanism: "Governments can legislate minimum mandatory holdings of government securities for banks, pension funds and insurance companies. New liquidity regulations already require increased holdings of government bonds by banks and insurers." .. wealth confiscation is yet another mechanism - seizing savings or pension fund assets like in 2013 when Spain drew €5bn (£3.5bn) from the state’s Social Security Reserve Fund, designed to guarantee pension payments in times of hardship .. nationalizations are yet another mechanism .. "Debt monetization and the resultant loss of purchasing power effectively represent a tax on holders of money and sovereign debt. They redistribute real resources from savers to borrowers and the issuer of the currency, resulting in diminution of wealth over time. This highlights the reliance on financial repression, explicitly seeking to reduce the value of savings. Ultimately, the policies being used to manage the crisis punish frugality and thrift, instead rewarding borrowing, profligacy, excess and waste."

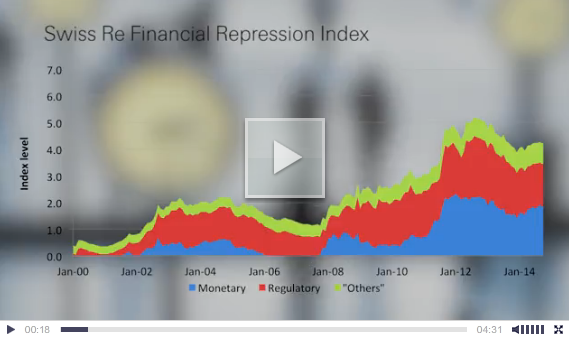

Germany Replacing Bank Cards and Eliminating Cash Withdrawals: Financial Repression Gone Mad Martin Armstrong: "The game is afoot to eliminate CASH .. Already we see the cancellation of such cards and the issuing of new debit cards. Why? The new cards cannot be used at an ATM outside of Germany to obtain cash. Any attempt to get cash can only be an advance on a credit card .. Little by little, these people are destroying everything that held the world economy together .. This will NEVER END NICELY for they can only think about their immediate needs with no comprehension of the future they are creating .. This is total insanity and we are losing absolutely everything that makes society function .. Once they eliminate CASH, they will have total control over who can buy or sell anything." 16 June 2015 Swiss Re Meeting: "Sounding the Alarm on Financial Repression" Swiss Re video highlights the recent meeting they held with experts voicing concerns about the ongoing use of unconventional policies .. financial repression is causing financial market distortions & poses a serious risk to financial stability .. These unconventional policies have pushed institutional investors into holding government debt. As a result they have less money available for productive investment, such as infrastructure projects .. "It means that there's a global search for yield. That possibly leads to a misallocation of resources," says Douglas Flint, Group Chairman of HSBC .. Jean-Claude Trichet, Chairman of the Group of Thirty affirms the risks. |

|||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP