|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Tue. Nov 17th, 2015

Follow Our Updates

onTWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

ARCHIVES

| NOVEMBER | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | |||||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?We have analyzed & included

these in our latest research papers Macro videos!

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

| JAPAN - DEBT DEFLATION | 11-17-15 | 5 | |

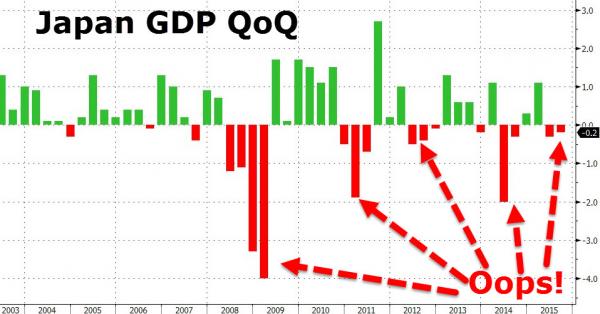

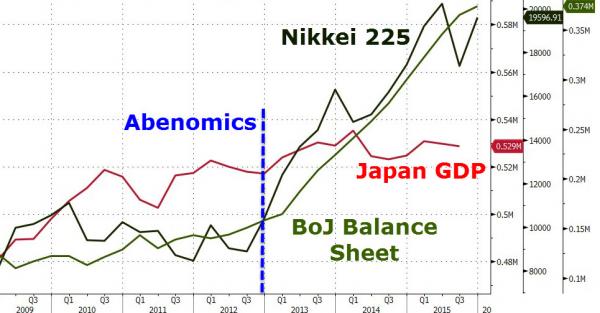

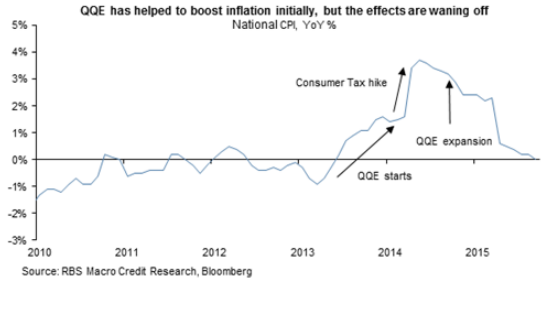

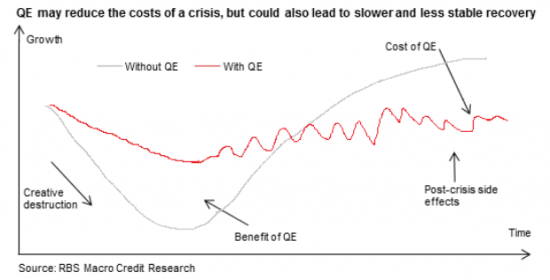

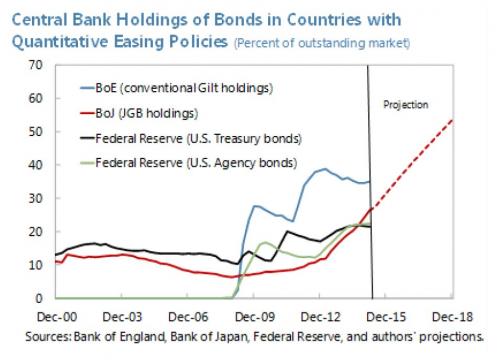

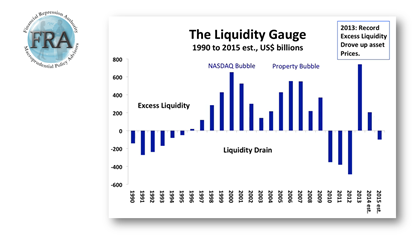

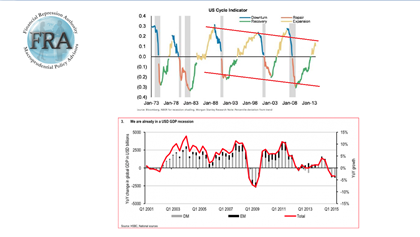

Submitted by Tyler Durden on 11/16/2015 Japan's Problems Will Not Be Solved By More QE, RBS WarnsOne thing that became abundantly clear about QE long ago even if it hasn’t yet dawned on Mario Draghi or Haruhiko Kuroda, is that the practice of monetizing anything and everything that isn’t tied down (or that you can’t pry from the cold dead hand of an institutional investor), is subject to the law of diminishing returns. Put simply: eventually it just stops working in terms of stimulating aggregate demand and/or boosting growth and inflation expectations. Unfortunately, the deleterious effects of QE are not subject to the same dynamic. That is, when you print another say, €750 million to monetize everything from periphery EGBs to SSAs to munis, you invariably impair market liquidity on the way to creating the conditions for dangerous bouts of volatility (see the great bund VaR shock for instance). Of course when you go full-Kuroda and simply corner the market for ETFs by stepping in to provide plunge protection at the first sign of Nikkei weakness, there’s no telling what kind of chaos you’ve set everyone up for once you step out of the market. Meanwhile, the mad dash to inflate the value of stocks and bonds has served to create enormous bubbles not only in those assets, but also in the things people who hold those assets are likely to buy when they get bored - like real estate and high end art. In short, the drug addiction analogy (as cliche as it now is) still holds up remarkably well. For a drug addict, the benefits (i.e. the high) diminishes the more the addiction grows, but the harmful effects on the body do not. It’s the same thing with QE. The initial “high” wears off, but the asset bubbles only grow. Nowhere is this more apparent than in Japan where just last night, we witnessed the unprecedented "quintuple recession": As if that wasn't bad enough, Japanese business spending dropped 1.3% QoQ - its worst drop since Q2 2014. Of course the Nikkei is doing just fine, surging right alongside the BoJ's balance sheet. In honor of Kuroda and his special brand of Peter Pan-inspired, neo-Keynesian madness, we present a bit of color from RBS' Alberto Gallo on Japan and QQE.:

Ok, so in other words: Kuroda isn't going to be able cure the country's structural problems which include the well worn issue of Japanese demographics as well the much maligned "deflationary mindset" which seems largely immune to the hum of the BoJ's prinitng press. Nevertheless, Japan is all-in and is apparently prepared to keep the pedal to the floor until 2018 when, as we've documented extensively, the game will officially be up (see here for instance). In the meantime, as Gallo rightly points out, you can expect an impaired secondary market for JGBs, asset bubbles, and rising inequality (all outcomes we've discussed at great length) as Kuroda triples, quadruples, and quintuples down on policies that now seem to be producing around one recession per QE iteration. Summed up...

|

|||

Bloomberg

Japan Falls Into Recession for Second Time Under 'Abenomics'

Japan’s economy contracted in the third quarter as business investment fell, confirming what many economists had predicted: The nation fell into its second recession since Prime Minister Shinzo Abe took office in December 2012. Gross domestic product declined an annualized 0.8 percent in the three months ended Sept. 30, following a revised 0.7 percent drop in the second quarter, meeting the common definition of a recession. Economists had estimated a 0.2 percent decline for the third quarter. Weakness in business investment and shrinking inventories drove the contraction as slow growth in China and a weak global outlook prompted Japanese companies to hold back on spending and production. While growth is expected to pick up in the current quarter, the GDP report could put pressure on Abe and Bank of Japan Governor Haruhiko Kuroda to boost fiscal and monetary stimulus. The BOJ holds a policy meeting later this week. “This report shows the increasing risk that Japan’s economy will continue its lackluster performance,” said Atsushi Takeda, an economist at Itochu Corp. in Tokyo.“The weakness in capital spending is becoming a bigger concern. Even though their plans are solid, companies aren’t confident about the resilience of economy at home and abroad.”

The reduced investment is a rebuff for Abe, who called on Japanese companies to put more of their record cash holdings into capital spending. From the previous quarter, business investment fell 1.3 percent in the July-September period, following a revised 1.2 percent contraction, according to the report. Abe has made bolstering the economy a priority and advocated for reflationary policies that weakened the yen and boosted corporate profits. Kuroda had said in September it wouldn’t be unusual for the economy to grow in the July-September quarter. Bank of Japan officials didn’t see the GDP report as likely to change their outlook for an improving trend in inflation, people familiar with discussions at the central bank said last week. Hiroaki Muto, chief economist at Tokai Tokyo Research Center Co., said that while he thinks the economy “might have hit the bottom” in the third quarter, there’s a strong chance that the government will compile an economic package to shore up growth. Yen StrengthensThe yen strengthened after the data was announced and was up 0.1 percent at 122.52 per dollar at 11:50 a.m. in Tokyo. Investors have purchased the yen as a haven following the terrorist attacks in Paris. The Topix stock index dropped 0.8 percent in the morning session amid a broad-based decline in Asian share markets. In a string of somber economic reports in the past few months, Kuroda’s core price gauge fell, household spending unexpectedly dropped, vehicle production declined, retail sales slipped and imports fell while exports stagnated. One bright spot: Industrial output advanced 1.1 percent in September from the previous month, yet wasn’t enough to make up for contractions in July and August. “The BOJ should act now if they are looking at economic fundamentals: prices are falling and economy isn’t growing, giving no sign for inflation expectations to rise,” said Itochu’s Takeda. “As for the question of whether they will act, it’s hard to say.” Economy MinisterAbe has told Economy Minister Akira Amari to compile measures this month to help achieve his goal of expanding Japan’s nominal GDP by 20 percent to 600 trillion yen over five years. Amari said Monday after the data that an extra budget may focus on addressing Japan’s demographic issues and to help alleviate the effects of the Trans Pacific Partnership trade pact and the government would take a flexible approach to fiscal and economic management. Amari also said GDP was likely expand in the current quarter. |

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Nov. 15th, 2015 - Nov 21st, 2015 | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

ROUND TABLE

Charles Hugh Smith is an American writer and blogger. He is the chief writer for the site "Of Two Minds", which started in 2005. His work has been featured on a number of highly acclaimed sites including: Zerohedge.com., The American Conservative and Peak Prosperity. Rick Ackerman has professional background including 12 years as a market maker on the floor of the Pacific Coast Exchange, three as an investigator with renowned San Francisco private eye Hal Lipset, seven as a reporter and newspaper editor, three as a columnist for the Sunday San Francisco Examiner, and two decades as a contributor to publications ranging from Barron’s to The Antiquarian Bookman to Fleet Street Letter and Utne Reader. Rick Ackerman is the editor of Rick’s Picks and a partner in Blue Fin Financial LLC, a commodity trading advisor.

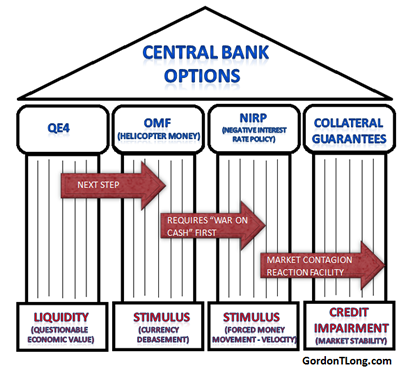

Co-founder of The Financial Repression Authority, Gordon T. Long has an in-depth discussion on the current financial situation with Charles Hugh Smith, of OfTwominds.com and with Rick Ackerman, trader and forecaster of Rickackerman.com. THE OUTLOOK ON QUANTITATIVE EASING Rick: “I’ve been shouting from the rooftops that the fed will never raise interest rates.” If you want to find out if QE is working the first person you have to go to is the retiree. The whole idea of stimulus should have been refuted simply by the fact that savers have been cheated for so long. Charles: They may go ahead and do the quarter point rates increase because they have built up so many expectations to that. They will need to do this to create the allusion that the economy is recovering or else it’s robust. Gordon: The market may be a key driving factor, not because of the wealth effect; but because of collateral. THE STATE OF JAPAN: Charles: “The Juggernaut of deflation is so huge now, that there isn’t going to be any time to react. Keep a shoebox full of cash because on that day we might wake up and the banks won’t be open, we will need that cash.” I don’t see the possibility of massive inflation. The only viable way of getting money into the system is to borrow it into existence. Japan, is a developed economy that has been in a deflationary setting for almost 25 years now. We can see what they’ve done and what effects it has. They have attempted to stimulate their economy by improving roads and infrastructure. But it has not worked. Japan refuses to cleanse their financial system to allow real investment so they have consequently brought in mal-investment with borrowed money. Rick: Japan had something over the last 20 years that we didn’t have, and that is us. Japan has a global economy to export into; we were the buyer of last resort. NEGATIVE INTEREST RATES Rick: “If you can extrapolate a somehow positive benefit from negative interest rates, where would this benefit be and how long would it last?” The idea is if people can no longer park money anywhere, they can only spend it or invest it, we have to ask, where are they going to invest or spend it? It’s inconceivable that money can find itself into somewhere in the economy that would promote growth and economic health. Charles: In a current example of negative interest rates we see what is happening with Sweden who is actively pursuing negative rates. The net result is that it is taking their housing bubble and inflating it even further. Basically it is pricing everybody out of housing and creating a credit bubble. COLLATERAL GUARANTEES Gordon: “It is in the cards, in the middle of the next crisis.” We have an approximately $500 trillion swaps market that is underpinned with collateral. So if bond prices were to drop it would be a horrendous situation. We were able to stop the 2008 crisis, we did not fix it we only stopped it. Now it will be a global issue, and the central banks will be forced to come in and pay attention to these collateral values. We have a huge pool of bond ETF’s that have exploded in the past few years, somebody has to sell these bonds but they are not easily transferred. The central banks will have to intervene in a massive way. I believe many people are betting on this, and are therefore taking risk adjusted positions. Rick: “We are really talking about a quadrillion dollar bubble.” Much of borrowing and leveraging shifted into rehypothecation. It occurred mostly in London markets that were more unregulated than US markets. So when we had the real estate bust in 2008 we needed something to pledge as collateral. When you look at the entire quadrillion dollar enchilada, somebody may say the actual size of the bubble is only several hundred trillion dollars. When in reality the gross amount is something everyone involved in the daisy chain thinks they have a claim on a particular asset. Charles: We must own real assets, and have no debt. Whatever financial wormhole we are going to go through,we must own the right tools, because the tools will still exist after we get through the wormhole. THE INDIRECT EXCHANGE: Regarding a recent show with Warren Buffet, and Ty Andros, Editor at Tedbits Newsletter, Warren Buffet so masterfully utilizes the indirect exchange. He takes paper, which is his entire insurance side of business and plows it back into real hard assets that will sustain themselves at a fair price. Buffet has don’t this so consistently for so many years and that is why balances; paper products (insurances, bonds, and structures against real assets). Buffet has certainly been a consistent winner without question. Rick: Buffet has also resisted the temptation of going after easy money. His money is not in Uber, Dropbox, and Instagram etc. It’s simple to see that it is not going to end well, not only for the companies but for the whole city, if I were to short any city in this country it would be San Francisco. Everything is so pumped up in that city because there are companies that hire these people that are extremely overvalued. Buffet has demonstrated amazing restraint and discipline for sticking with the nuts and bolts, instead of going after the alluring high attraction companies. He has found real businesses with real products that have a sustaining capability to survive during good times and bad. Charles: Raising the issue of risk, how do we deal with the kind of systemic global risk that we currently have? Risk is extremely misrepresented to the average middle class American. We are trying to help people make a realistic assessment of the global risk they are engaged in by having a 401k that is involved in these risky financial assets. Rick: “You can’t look at what’s in prospect as hypothetical, if you don’t think there is going to be a collapse then you don’t understand the problem.” There is no way we can continue to muddle on, for one its taking a lot more debt to create the dollars’ worth of GDP growth at the margin. We are really going to face a day of reckoning. The most important thing is for us to be resourceful and ready for when it comes. Charles: “This enormous supernova of debt is going to implode and whatever is left will not be a financial instrument.” Gordon: “Crisis is nothing more than change trying to happen.” We have so many global imbalances. We have political, economic, and financial systems that are not correct, we are still running from a Bretton Woods; post WWII model. And during this process, mal-investment, lack of price discovery and mispricing are rampant. But on the flip side, for those who have prepared themselves for this storm, I think the world is going to see its greatest years. The advancements in technology, and so many other endeavors is staggering. !5-25 years out will be an incredible time for the world but meanwhile we are going to go through some rough times, but there will be winners and there will be losers, and the winners are always the ones who prepare.

|

|||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

| STANDARD OF LIVING - SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP