|

JOHN RUBINO'SLATEST BOOK |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

NOW SHOWING

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Weekend Feb. 22nd, 2014

2014 THESIS: GLOBALIZATION TRAP

2014 THESIS: GLOBALIZATION TRAP

RELEASED Jaunary 15th, 2014 to our Regular and Trial Subscribers

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images: Understanding the Conclusions

| FEBRUARY | ||||||

| S | M | T | W | T | F | S |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |

KEY TO TIPPING POINTS |

| 1 - Risk Reversal |

| 2 - Japan Debt Deflation Spiral |

| 3- Bond Bubble |

| 4- EU Banking Crisis |

| 5- Sovereign Debt Crisis |

| 6 - China Hard Landing |

| 7 - Chronic Unemployment |

| 8 - Geo-Political Event |

| 9 - Global Governance Failure |

| 10 - Chronic Global Fiscal ImBalances |

| 11 - Shrinking Revenue Growth Rate |

| 12 - Iran Nuclear Threat |

| 13 - Growing Social Unrest |

| 14 - US Banking Crisis II |

| 15 - Residential Real Estate - Phase II |

| 16 - Commercial Real Estate |

| 17 - Credit Contraction II |

| 18- State & Local Government |

| 19 - US Stock Market Valuations |

| 20 - Slowing Retail & Consumer Sales |

| 21 - China - Japan Regional Conflict |

| 22 - Public Sentiment & Confidence |

| 23 - US Reserve Currency |

| 24 - Central & Eastern Europe |

| 25 - Oil Price Pressures |

| 26 - Rising Inflation Pressures & Interest Pressures |

| 27 - Food Price Pressures |

| 28 - Global Output Gap |

| 29 - Corruption |

| 30 - Pension - Entitlement Crisis |

| 31 - Corporate Bankruptcies |

| 32- Finance & Insurance Balance Sheet Write-Offs |

| 33 - Resource Shortage |

| 34 - US Reserve Currency |

| 35- Government Backstop Insurance |

| 36 - US Dollar Weakness |

| 37 - Cyber Attack or Complexity Failure |

| 38 - Terrorist Event |

| 39 - Financial Crisis Programs Expiration |

| 40 - Natural Physical Disaster |

| 41 - Pandemic / Epidemic |

Reading the right books?

No Time?

![]()

We have analyzed & included

these in our latest research papers!

Our Macro Co-Host

John Rubino's Just Released Book

Our Macro Co-Host

Charles Hugh Smith's Latest Books

Our Macro Partner

Richard Duncan Latest Books

![]()

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

TODAY'S TIPPING POINTS

| THIS WEEKS TIPPING POINTS | MACRO NEWS | MARKET | 2013 THEMES |

SINCE NOVEMBER THINGS HAVE BEEN GOING SOUTH - FAST!

"BEST OF THE WEEK " |

Posting Date |

Labels & Tags | TIPPING POINT or 2013 THESIS THEME | ||||||||||

HOTTEST TIPPING POINTS |

Theme Groupings |

||||||||||||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro |

|||||||||||||

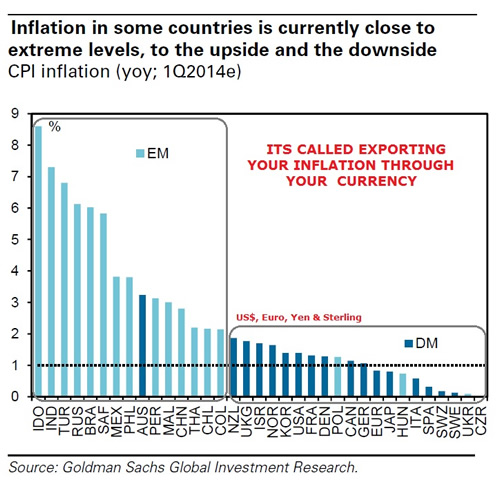

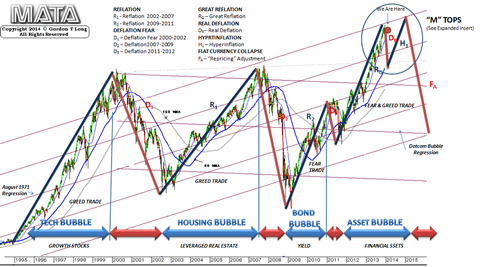

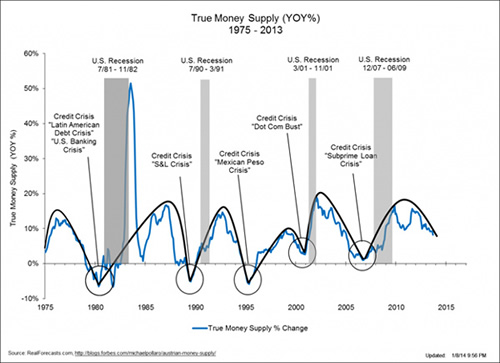

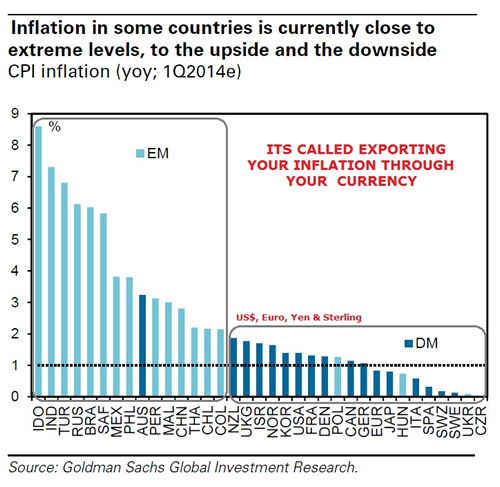

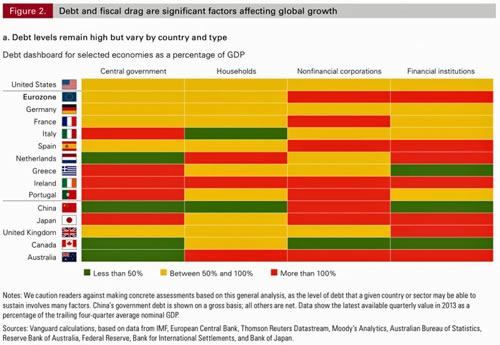

THE ECONOMIC ROADMAP AHEAD: It Isn't That Complicated! Global Economics is not as complicated as the Ivy trained Keynesian economists would have you believe. As Goldman Sachs gleefully illustrates, the world is presently divided into two financially warring camps.

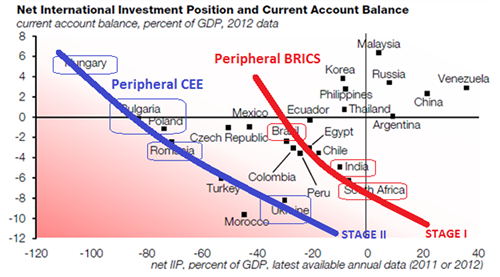

DON'T BE CONFUSED BY THE MIS-DIRECTING LABELS It actually is not an "Emerging Markets" problem but rather a "Peripheral Nations" problem. The Peripheral nations are those nations who are not yet fully "Industrial" nations but rather still "Resource" nations. Industrial nations consume Resources and hence "Resource" nations are very dependent on the economies of the "Industrial" economies and are desperately trying to get there because it historically offered higher levels of employment (a big political problem in Resource nations), higher value add product pricing and economic stability (versus the roller coaster commodity cycles). THE EMERGING MARKETS HAVE BECOME THE ECONOMY But something has quietly happened over the last decade other than continuous financial turmoil and "bubble" economics. The willingness of the Emerging Markets (Peripheral Nations) to accept the currency that is being endlessly printed to finance economies, that consume more than they produce, has allowed an over expansion and over-reach by these EM's trying to become Industrial nations.

EXCESS CAPACITY & INSUFFICIENT AGGREGRATE DEMAND As a consequence t oday we are left with Output Gaps in the DM's and Current Account payment deficits in the Peripheral nations.

A PATHWAY TO A GLOBALIZATION TRAP All of this has placed the world on a destructive path towards what can best be termed a "Globalaization Trap" and eventually a global fiat currency crisis. The roadmap is easy to discern and quite evident if you actually study the sign posts without wearing Keynesian filtering glasses and a dose of common sense

PROFOUND IMPLICATIONS TO GLOBAL FINANCIAL MARKETS The roadmap has profound implications for the financial markets as ecomomies of both the Developed and Emerging Economies move through an almost preordained cycle shown and labeled in the chart below.

For more detail signup for your FREE copy of the GordonTLong 2013 THESIS PAPER |

02-22-14 | GLOBAL MACRO |

|||||||||||

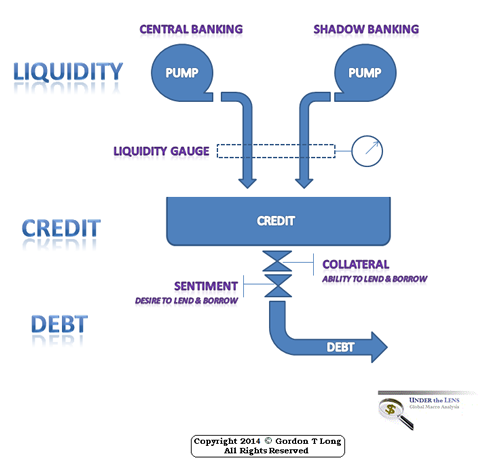

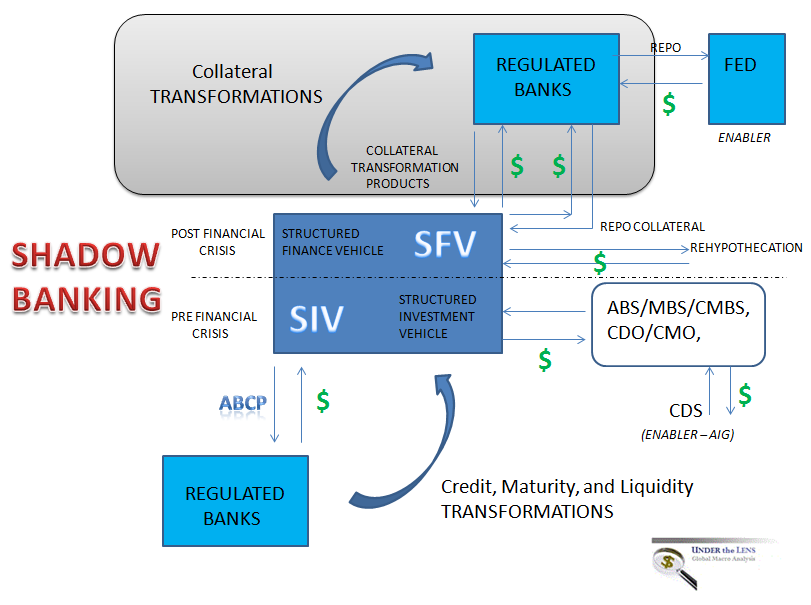

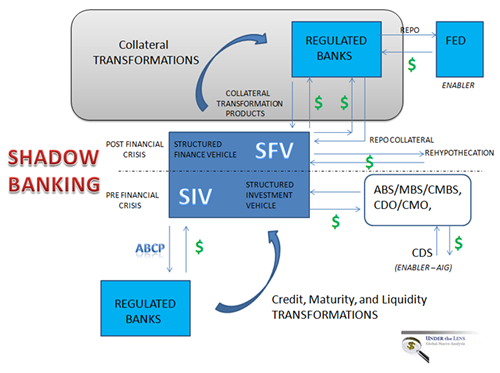

THE SHADOW BANKING STEALTH MUTATION According to the latest study by the Financial Stability Board (FSB) the unregulated $72 Trillion Global Shadow Banking System is now larger than the global regulated banking system. How could an unregulated and opaque industry, which is larger than the entire world’s GDP operate with such little attention? Even the FSB is not a government entity and operates under the auspices of an entity with a highly checkered and mysterious background - The Bank of International Settlements in Basel Switzerland. The FSB has had only two Chairmen since its inception who were able to see the full extent of the operations of this global industry: Mario Draghi who is now head of the European Central Bank (ECB) and Mark Carney who is now the Governor of the Bank of England (BOE). Ben Bernanke’s wrote academically on the subject before being quickly catapulted to the Chairmanship of the Federal Reserve. Sounds like these are important qualifications if you are to run the world's financial apparatus.

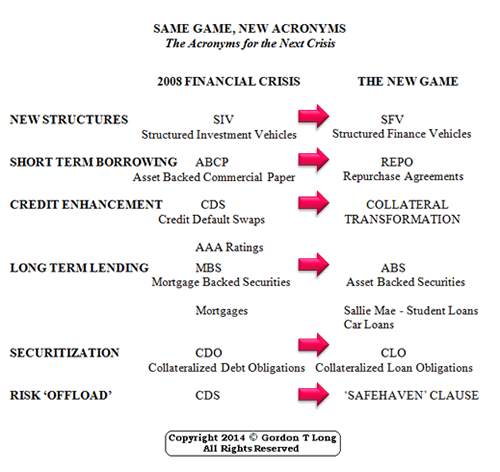

A tipping point for the 2008 Financial Crisis was short term lending problems associated with Asset Backed Commercial Paper (ABCP) liquidity which was used to fund the Shadow Banks Structures Investment Vehicles (SIVs). It was this short term funding that was used to buy what is after the fact now euphemistically referred to as 'toxic waste' (CDOs et al). Dodd-Frank has done absolutely nothing to change any of this despite the CCP (Central Counter Party) exchange, if it is ever implemented. What has changed is that the Shadow Banking System by necessity, and with policy makers turning a blind eyed, morphed into something far more dangerous.

THE NEW SHADOW BANKING STRUCTURE

CONCLUSIONS The Shadow Banking System is almost completely unregulated.

The global GDP is smaller than the Shadow Banking System and less than 10% of the SWAPS market. Until we can answer these questions we should conclude that risk is mispriced and price discovery for global financial markets is obscured! For more detail signup for your FREE copy of the GordonTLong 2013 THESIS PAPER |

02-21-14 | GLOBAL MACRO |

|||||||||||

|

|||||||||||||

| THESIS & THEMES | |||||||||||||

|

STATISM - Obama Administration Embeds "Government Researchers" To Monitor Media Organizations Obama Administration Embeds "Government Researchers" To Monitor Media Organizations 02-20-14 Mike Krieger of Liberty Blitzkrieg blog,via ZH Last week, I highlighted the fact that the latest Press Freedom Index showcased a 13 point plunge in America’s press freedom to an embarrassing #46 position in the global ranking. If the authoritarians in the Obama Administration have their way, this country is set to fall much further in next year’s index. Incredibly, the Federal Communications Commission (FCC) is set to roll out something called the Critical Information Needs study, which will embed government “researchers” into media organizations around the nation to make sure they are doing their job properly. No this isn’t “conspiracy theory.” It is so real, and represents such a threat to the First Amendment, that a current FCC commissioner, Ajit Pai, recently wrote an Op-Ed in the Wall Street Journal, warning Americans of this scheme. He writes:

The purpose of the CIN, according to the FCC, is to ferret out information from television and radio broadcasters about “the process by which stories are selected” and how often stations cover “critical information needs,” along with “perceived station bias” and “perceived responsiveness to underserved populations.” I have no idea what country I am living in at this point.

I am simply speechless. |

02-22-14 | THESIS | |||||||||||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - February 16th - February 23rd | |||||||||||||

| RISK REVERSAL | 1 | ||||||||||||

| JAPAN - DEBT DEFLATION | 2 | ||||||||||||

| BOND BUBBLE | 3 | ||||||||||||

EU BANKING CRISIS |

4 |

||||||||||||

ECB - Goodbye To Europe's Sterilized Monetization - Hello QE Wave Goodbye To Europe's Sterilized Monetization 02-18-14 Zero Hedge Nearly two months ago, when we commented on the recent string of unprecedented failures by the ECB to sterilize its legacy bond buying operation, the SMP, we commented that "judging by the feverish pace of purchases of every peripheral bond available, is this merely just another indication how little the ECB cares about sterilization, and is just a hint at an upcoming full-blown and unsterilized bond monetization about to be launched by Mario Draghi?" Sure enough at the subsequent February 6 ECB meeting Mario Draghi hinted as much when he said that among the things the ECB was looking at was precisely the "de"sterilizing of the SMP program. However, one stumbling block was getting the Bundebsbank's tacit approval to proceed with this plan which would make the ECB's bond monetization mirror that of the Fed where bonds are purchased on an unsterilized basis. And, as expected, overnight the Bundesbank threw in the towel on sterilization, meaning that the SMP will no longer be sterilized with an announcement divulging just this likely as soon as the next ECB meeting. From the WSJ:

One implication, of course, is on European money-market rates which have been volatile in recent months and the result would be at least some short-term anchoring.

A bigger question is whether now that sterilization is effectively history, will this open the gates for full-blown QE which the market has been largely anticipating for months, roughly since November when we penned "Next From The ECB: Here Comes QE, According To BNP" and which argued that in order to deal with Europe's record low loan creation the ECB would have no choice but to step in and do just what the Fed has been doing to battle the same scourge: monetize assets outright in hopes of offsetting the monetary pipeline blocks that have haunted Europe for the past 5 years. Of course, that will not work and will merely send European stocks to recorder highs, even if the recent surge in Europe has been largely driven by the market pricing in of just this outcome. Another question is when will ECB unsterilized interventions finally impact the soaring EUR whose relentless rise is crushing European corporate revenue and profit lines. For now, the EUR does not appear too concerned. |

01-18-14 | EU MONETARY ECB |

4- EU Banking Crisis | ||||||||||

| SOVEREIGN DEBT CRISIS [Euope Crisis Tracker] | 5 | ||||||||||||

ECB - Bond Narkets Weigh Risks of Eurozone QE Bond markets weigh risks of eurozone QE 02-18-14 EURO2DAY At last, after resisting for so long, the European Central Bank looks closer to implementing its own version of quantitative easing to spark growth across the eurozone. WILL IT DISLOCATE THE BOND MARKETS ?

THE "WHAT EVER IT TAKES" PROMISE

POTENTIAL PERIPHERAL SPREAD WIDENING

BOND BUYING BREAD DOWN

LEGALITY OF OMT For others, issues over the legality of a bond buying programme is a greater concern. The German constitutional court has asked the European Court of Justice to make a ruling on outright monetary transactions, which Mr Draghi introduced as a backstop to the eurozone in the summer of 2012. Although outright monetary transactions would involve buying government bonds, it is not the same as QE as it would be introduced in "the event of a run on one or more of the debt markets". The ECB could successfully argue that QE, which involves buying a range of bonds to lift inflation, was within their remit as it is designed to bring about price stability. But, the legal wrangling is still creating confusion. One bond investor at a big German asset management group says: "I think the legal situation complicates everything. Markets don't like uncertainty. It is that simple. The lawyers don't seem to care about this. It is very frustrating." He thinks QE is inevitable, whatever the lawyers say, possibly as early as the second quarter of this year. The ECB will have little choice but to follow other central banks and join the QE club if low inflation persists, he says. Harvinder Sian, co-head of European rates research at RBS, agrees: "The risks are probably greater by not doing QE, than doing it - and it looks likely it will happen." But QE is not the endgame, he adds. "QE is another stage in the road to recovery for the eurozone. But it is a policy that highlights the problems in the region. With the amount of public debt that most economies are still carrying, the eurozone crisis is far from over. |

01-18-14 | MACRO RISK |

5- Sovereign Debt Crisis | ||||||||||

| CHINA BUBBLE | 6 | ||||||||||||

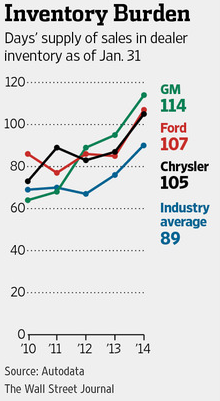

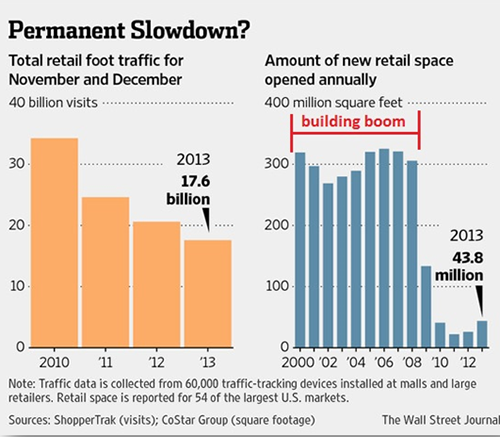

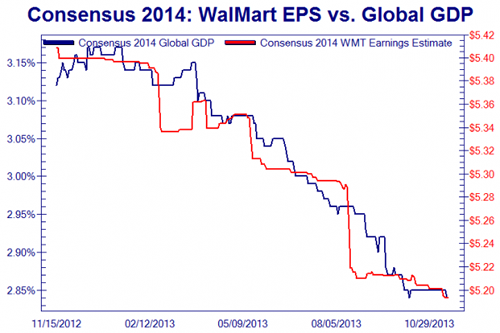

RETAIL CRE - Financial Crisis II Coming The US just released US Retail Sales and the details warn of an alarming problem. 2008 may have been a crisis brought on by US Residential Real Estate but 2014-2015 may be another round brought on by US Retail Commercial Real Estate. The Fed, Banks, Insurance companies, REITS and most importantly, the Shadow Banking sector are well aware of this. JOBS versus SALES - More than Hiring for Christmas Sales This graphic is based on just published US Retail Sales numbers: The chart above — from Neil Dutta, head of U.S. economics at Renaissance Macro — does an excellent job of illustrating that recent retail sales data just don't square with recent jobs data. "Something has to give. There is a widening disconnect. Either retailers stick with it and stay confident on the expectations that sales will improve, or they will be forced to cut employment dramatically." THE BIGGER PICTURE Then I read that Bill Ackrman is dumping all his Commercial Real Estate Holding: What Does Bill Ackman Know About The Future Of Commercial Real Estate? A man that knows JP Penney and the Malls! But .... ITS MORE THAN JUST A "MALL" PROBLEM

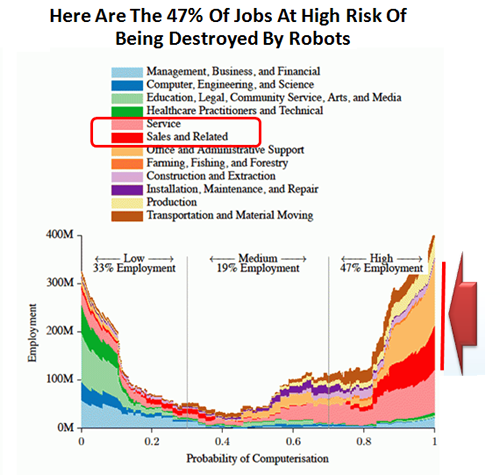

MACRO ON: THE RETAIL CRE DOMINO

the looming domino they see in the US Retail CRE (Commercial Real Estate) space due to the advancement of online and robotic technologies. The rapidly advancing ramifications are both startling and alarming.

EXAMPLES OF EXPLODING RETAIL SERVICE AUTOMATION - Will reduce Employment and Square Footage

AN 'OVER-STORED' AMERICA The Retail building boom in America has created yet another bubble - The Stealth Retail CRE Bubble.

SHADOW BANK FINANCING The Shadow Banking system has 'morphed' since the 2008 financial crisis. Gordon T Long in the video below explains why Commercial Real Estate financing is presently seriously exposed to a crisis in short term funding disruptions, in a similar fashion to Residential Real Estate prior to the 2008 crisis. He shows the new instruments that are now being used and why they will be the new acronyms of the next financial crisis.

MACRO ON: LOOMING US RETAIL IMPLOSION: An Urgent Re-Think Required

There is a looming US Retail implosion on the horizon and a complete re-think of the foundation of a 70% US Consumption Economy is urgently required. For thirty years analysts have predicted the demise of the US consumer. They were so consistently wrong that the mantra "Don't Bet Against the US Consumer" became a staple of investor wisdom, similar in reliability to "Don't Fight the Fed!". The US Consumer as the engine of global growth has powering global credit creation and expansion as a result of the corresponding growth in US deficits . Now at 70% of the US economy, as compared to 50-55% for other developed economies and less than 35% for emerging economies, the question is no longer a matter of is it sustainable, but rather what will be the fallout now the inevitable has finally arrived?

It is clear the US consumer is tapped out a result of the US middle class being 'gutted' with job lose, low salaries, exploding healthcare & educations costs and pensions now an endangered species. However, our Monetary, Fiscal and Public Policies are only making matters worse.

THE BOTTOM LINE A US Recession threat could briong the whole US Retail CRE House of Cards down

|

01-17-14 | US-INDICATORS-CONSUMPTION-RETAIL | 20 - Slowing Retail & Consumer Sales | ||||||||||

| TO TOP | |||||||||||||

| MACRO News Items of Importance - This Week | |||||||||||||

GLOBAL MACRO REPORTS & ANALYSIS |

|||||||||||||

SWAPS - SEFS Implementation Begins Swaps market prepares for its big bang 02-18-14 EURO2DAY The US swaps market is expected to begin a shift away from the predominance of telephone trading this week as it joins the 21st century in a move towards more tightly regulated electronic trading venues. The changes are being ushered in by global regulators in the wake of the financial crisis, and come into effect on Tuesday, as trading of over-the-counter derivatives moves on to so-called swap execution facilities - Sefs. Long viewed as a shadowy area of the financial market, OTC swaps trading has been dominated by large global banks and investors since its inception in the 1980s, but the collapse of some banks in 2008 revealed serious shortcomings within this bilateral system. The efforts of regulators led by the US Commodity Futures Trading Commission has been to open up the swaps market to greater competition and price transparency. Last year, the credit risk between buyers and sellers of standard swaps was mutualised via centralised clearing houses, setting the foundation for rapid paced transactions on Sefs. While Sefs facilitate electronic and voice based transactions, many in the industry expect the share of computer driven transactions will quickly escalate from their current very low level. The biggest concern facing the market is whether banks, investors, clearing houses and operators of Sefs are really ready for showtime. Jamie Cawley, chief executive officer at Javelin Capital Markets says the mandated era of swaps trading on Sefs, "will be a bit more dramatic than people think". He adds: "A number of market participants recognised long ago the inevitability of Sefs coming and have prepared for this. Others, however have not." Ahead of a hard Sef deadline, the CFTC has announced a number of temporary measures aimed at providing relief from possible last minute problems that could hamper an orderly start for Sefs. Lee Olesky, chief executive officer at Tradeweb says: "It's hard to measure readiness collectively across the market, there will be bumps in the road as the market makes the transition to Sef trading." Meanwhile there has been a scramble among some clients to sign up for Sef access, particularly at Bloomberg, whose data terminal is ubiquitous across trading floors. "We are seeing quite a sizeable chunk of people coming on to the platform," said Ben Macdonald, president of Bloomberg's Sef. "The Sef is part of the terminal and it's very integrated into our clients' work flow." For interdealer brokers used to high commissions from executing billions worth of notional derivatives over the telephone on behalf of banks amid a raucous trading floor atmosphere, the winds of change are certainly blowing. Michael Spencer, chief executive of ICAP, the biggest interdealer broker and which began in the 1980s with a specific focus on the then fledgling interest rate swaps market, is under no illusions that the old ways of doing business are ending. "The market in interest rate swaps is still predominantly voice brokered but it's not where we see it in the longer run," he says. ICAP, which already has large electronic franchises in Treasury and currency trading, is expected to be more able than many of its rivals to weather the increasingly competitive landscape, as the likes of Bloomberg, Tradeweb, MarketAxess, the CME Group and a host of start-ups vie for a slice of the swaps market. As swaps begin trading on Sefs, an early shakeout is expected among the 20-or-so competing platforms. Rick McVey, chief executive of MarketAxess, says the proliferation of venues, all interpreting the rules differently, will cause problems for dealers and investors. The high cost of running a venue will also be significant, he adds. "By the end of the year we will be down to around seven venues," he predicts. Mr Olesky says, based on the current size of the swap market, that it is hard to see demand for more than several Sefs across different asset classes. Tradeweb, which has been facilitating US electronic derivatives transactions for more than eight years, is looking to provide investors with a variety of ways to trade swaps on a Sef, from streaming prices, anonymous order books, to a request for quote function. "We are not picking a particular model, the market will evolve," says Mr Olesky. "We have prepared ourselves for a number of outcomes and protocols given the different types of customers in the market." Mr Cawley said: "Sef volumes will increase and it remains to be seen whether customers and dealers use voice or trade electronically on Sefs, but the market will be forever changed |

01-18-14 | GLOBAL RISK |

GLOBAL MACRO |

||||||||||

US ECONOMIC REPORTS & ANALYSIS |

|||||||||||||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||||||||||||

| Market | |||||||||||||

| TECHNICALS & MARKET |

|

||||||||||||

| COMMODITY CORNER - HARD ASSETS | PORTFOLIO | ||||||||||||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||||||||||||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||||||||||||

| THESIS | |||||||||||||

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|||||||||||

|

STATISM - Gets its Authority from Collectivism and INITIALLY its Enforcement from Political Correctness The Twisted Motives Behind Political Correctness 02-19-14 Brandon Smith of Alt-Market.com, via ZH As I have confessed in the past, in my early years I found myself active in the Democratic Party and the general liberal methodology. I had no understanding of the concept of the false left/right paradigm. I had no inkling of the dangers of globalism and central banking. I had no concept of decentralization or non-participation. I had never even heard of libertarianism. I knew only that George W. Bush was a criminal (and I was right), but the problem went far deeper than the GOP. I was astoundingly ignorant of the bigger picture. However, what I did have going for me was an almost violent sense of nonconformity. I hated collectivists, yet I found myself surrounded by them while working within the leftist culture. It was the insanity of self-proclaimed “liberals” that taught me the true nature of the facade of politics. When I realized that the Democrats were essentially the same corrupt entity as the neoconservatives, everything in my life changed. One aspect of liberalism with which I am now very familiar is political correctness. I didn’t understand it at the time, not until I stepped outside the cultism of it and looked in from a wiser place. It always bothered me, but I couldn’t quite grasp why until later. Then, it hit me like a revelation. Political correctness was not a political ideology. No, it was a religion, a full-fledged spiritual con, a New Age ghetto of frothing mishmash that is sociological voodoo. And the leftists were eating it up like steak night at an all-you-can-eat buffet. These people were rationally retarded. Every idea they proposed they merely parroted from books and articles they had read. They were like malfunctioning automatons trapped in a cycle of discontented social criticism. Their desperation to invent meaning in the midst of their irrelevant lives made me feel ill. If they could not find a legitimate cause to champion, they would create one out of thin air and defend it relentlessly, regardless of how shallow it truly was. When I outline my analysis of economic destabilization within the United States or I write about the rise of the police state, I am driven by a fundamental sense of concrete concern. There are indeed real problems in the world, swirling in a storm of obvious factual conflicts. But the warriors of the PC culture don’t see any of it. Rather, they fantasize about injustices that don’t exist, trespasses that are ultimately fictional. They imagine themselves champions of some greater purpose that, in the end, doesn’t matter. Recently, I read a news story about a “transgendered teen” in Maine. When the boy was in the fifth grade, he decided to dress as a girl and demanded to use the girl’s bathroom at his public school, despite having the biological apparatus of a male. This story was international news, folks! Why? I can’t say, except that the mainstream media have made a point to focus on “gender optional” issues as if they represent some kind of civil rights uprising. The issue perfectly illustrates the disturbing nature of politically correct culture. Teachers at the school did not deny the student the use of restroom facilities. In fact, they allowed him to use the teacher’s bathrooms to avoid any confusion. The Maine Supreme Judicial Court, on the other hand, had other ideas. It ruled that the school’s refusal to allow the boy to use the girl’s facilities constituted a violation of the State’s anti-discrimination law. The ruling has been heralded as a massive victory for the politically correct narrative. Now, let me make one thing clear: I could not care less about this boy’s sexual orientation (if he even has one). I do think the very idea that a fifth-grader at about the age of 10 is sexually conscious enough to develop a sense of gender dissuasion is absurd. Children who haven’t even experienced puberty yet, proclaiming they are transgendered? Utter nonsense. I find it far more likely that the student’s PC-obsessed parents influenced him to come to such a decision despite his naivety. That said, a person’s sexual proclivities are not my concern. In fact, I have no interest whatsoever in the infatuations of any individual. That is a personal matter. I do not judge such people on their attractions. I do, though, judge people on how they handle their infatuations. What happens when someone wears his sexuality on his shoulder like a fashion accessory? Why is that even necessary? Is it not rather mentally backward for any person to base his public persona solely on his carnal compulsions? Do I dance around on the sidewalk bellowing to strangers how much I love the curves of women? Do I require a sociopolitical legal apparatus to vindicate my existence? Do I feel the need to shame gay people into publicly embracing my straight man’s libido? No, I do not. The PC culture demands that we, as individuals, openly accept the sexual orientations of anyone and everyone; otherwise, we are labeled prejudiced monsters. It is not enough that we object in a logical manner. No, we must fall to our knees and thank the stars for the very existence of gender chameleons. In the end, the psychological gender position of any particular person does not overrule his biological features. A child with a penis is a boy. Period. He will never be a girl. Ever. Not without surgical aid. And even then, he will never have the ability to give birth, which is the very hallmark of femininity. (Sorry, feminists, but that’s how it goes.) A boy, no matter his mental orientation, does not belong in a girl’s lavatory. The privacy rights of the girls outweigh the gender confusion of the boy. If I were a girl (why not play some gender games since everyone else is), I would beat the living hell out of any boy gallivanting in a dress in a bathroom I was using and make sure he never dared come back. And, by extension, if I were a rather mischievous boy with an aptitude as a peeping tom, why not dress up in a tutu in the hopes of getting a glimpse of the forbidden while being legally protected by the State? The warped conflicts that arise, though, are not the creation of the child in question. A fifth-grader has no concept of gender rights or political correctness. This issue was a creation of the PC cult and its acolytes. These people don’t actually care about the children they involve in their legal dramas. They exploit them, with every intent to abandon them once they have chiseled their agenda into the gray matter of every American. What truly motivates these people? Why do they do what they do? I think my experience with leftists makes me a well-positioned observer of the psychology of the culture. Here are the hidden thought processes I have witnessed while dealing directly with the PC army. PC Elitism One of the unfortunate side effects of religion is that proponents often use it as a means to feel superior to others. I have seen it in Christianity as much as I have seen it in any other belief system. It is the primary reason why I refuse to subscribe to organized and establishment-sanctioned spiritualism. Religion should be a personal experience first and foremost, not an easy way to fit in with the collective. Communing with others who share one’s beliefs should be secondary. Hypocritically, politically correct adherents often criticize Christians for their collectivist elitism while suffering from the same problem themselves. PC culture allows participants to pretend as though they have some greater understanding of the world, an elevated knowledge of life that makes them superior to the uninitiated. It is important to understand that when a person pursues the methodology of zealotry, he doesn’t do it to make the world a better place; he does it to feel better about his place in the world. The politically correct are so violent in the assertion of their ideals because they crave the subjugation of the mainstream and a recognition of their “rightness.” They don’t want people to “accept” their beliefs as tolerable. They want people to adore their beliefs as supreme. They want every man, woman and child to reinforce their ideals without question. The malfunction of this philosophy is that zealots are never finished. They must always find new ways to feel superior to others. So they continuously engineer new taboos and new sins, no matter how ridiculous, so that they can forever look down upon the laymen. Because of this, there will never be an end to PC law. It will go on forever, labeling numerous social interactions and stances as “aberrant” — never satiated and never satisfied. PC Futurism The young are always searching for ways to feel wiser than the old. This is just the natural way of things, at least in America. Now, I know from ample experience that age does not necessarily denote intelligence. I’ve met plenty of idiotic people who had decades of time to learn from their mistakes but didn’t. But the young, many of whom lack time and struggle, have a terrible tendency to either pretend that they have “seen it all.” Or they pretend that the very atmosphere of the day somehow gives them a greater insight than generations past. The reality is that most of them know very little of import. This attitude comes from a philosophy called “futurism” (popular with the Nazis and the Soviets), which holds that all the beliefs and discoveries of the past mean nothing compared to the beliefs and discoveries of the present. This ideology is alluring to the young, because it gives them a way to feel intellectually dominant over older and more “ignorant” people who are “behind the times.” Political correctness is basically an appendage of futurism. By labeling elders as social bigots and products of a barbaric era who don’t understand the “lingo” of the PC elite, liberalism draws in and collectivizes the fledgling left. Younger generations are given a cultural avenue toward high priesthood, a right of passage usually reserved for the aged. They get to skip ahead past all the trials and tribulations of life and announce their deep awareness of the so-called greater good. The values of forefathers past become archaic scrawlings of racist and prejudiced cavemen who could never appreciate the “brilliance” of today’s academia. The inherent freedoms of natural law that have existed since time began are nothing more than obstacles to them, standing in the way of a new and better world where they have somehow outsmarted human instinct and centuries of history. PC Collectivism The very foundation of political correctness is solidified in a desire for the perpetual reinforcement of one’s worldview. PC people need every other person around them to sing the praises of their pure virtues. If I happen to disagree with the idea of gender bending, for instance, as some kind of socially persecuted subculture that needs overt government protection, then I am, of course, labeled a hateful Neanderthal. If I stand in opposition to the concept of victim group status in general, in which the state demands that designated “minorities” be given special treatment regardless of the status of the individual, then I become a racist political fossil ignorant of the bigger picture. You see, if you disagree with PC culture in any way (even if that way is rational), you cannot win. To refute political correctness is to refute the god of the New Age; and to refute their god, even with concrete logic, is blasphemy. This kind of blind faith in political correctness lends itself entirely to collectivism. The average person begins to think that without a viable appreciation of the philosophy, he may be left out or cast aside. Most people do not know how to function without the approval of others. Therefore, even if a father happens to have a healthy skepticism over the idea of a make-up wearing fifth-grade boy waltzing into his daughter’s school bathroom, he is likely to keep his mouth shut, because to speak out would be a risk to his position within the group, or the community. PC Control The prevalence of PC philosophy is not subtle. I have always found it interesting that political correctness seems to consistently support the demands of the state. Our system smothers children with it in public school, our workplaces are rife with the propaganda for fear of lawsuits and colleges are veritable breeding grounds for the PC oligarchy. Politically correct culture goes out of its way to constantly test others to make sure they are also true believers. This is exactly what is going on in the following interview with Jerry Seinfeld, who, to his credit, dashes the nonsense to the ground. �

The truth is some discrimination is healthy, and some discord is needed for a society to remain balanced. As long as we don’t allow our disagreements to end in the physical harm of others, then those disagreements are our natural-born right. If you are a racist (this goes for non-whites as well), that’s fine. Just don’t act out your racism in a violent way around me, or I will have to put you down permanently. If you have a distaste of homosexuality (or asexuality, as seems popular nowadays), then whatever, I don’t care. You shouldn’t have to have organizations like GLAAD (formerly the Gay & Lesbian Alliance Against Defamation) in your face attempting to force you to put on a smile for gaydom, coordinate man-on-man heavy-petting protests in your favorite restaurant (Chick-fil-A) while you’re trying to eat a damn sandwich, push boys into the girl’s bathroom, or trying to shut down your favorite TV shows because the stars happen to share your views (“Duck Dynasty”). Now, PC proponents will argue that the very existence of bigotry does harm to society as a whole, and it must be educated out of individuals. Frankly, I see that kind of utopian fascism as a far greater threat to society as a whole than bigotry ever will be. Look at where we are today because of the PC nightmare! We have a Nation on the verge of industrial and economic collapse, partly because companies are forced by law or persuaded by government subsidies to hire people with victim group status, even if they are unqualified, while ignoring highly qualified people who just happen to have lighter skin. We have children not even old enough to discover their own inherent character being clinically diagnosed with “gender dysphoria” by a psychiatric community of quacks, which conjured most PC terminology out of thin air. We have boys who are told that they are stunted for acting out their natural male impulses and girls who are told that true femininity is weakness and that they should act more masculine. We have a mainstream culture that coddles and infantilizes young adults, young girls who think promiscuity is the key to womanhood and that motherhood is disgusting (which I find rather ironic), and young men who have no testicular fortitude and no clue how to take charge of their own lives. The American family unit has been completely destroyed. We have women who are ashamed to set aside careers to raise children because feminism frowns upon “breeders” who bring down the whole gender. We have men who abandon their children and refuse to take responsibility. And we have a weak-minded population addicted to collective affirmation and unwilling to think outside the box for fear of being shunned and shamed. Honestly, I can’t see a single redeeming quality to political correctness other than the fact that those people who espouse it do so loudly and obnoxiously, making it easier for me to identify and avoid them or to take special note of them as an obvious zombie threat in an America swiftly declining into mundane oblivion.

|

01-20-14 | THESIS | |||||||||||

|

2013 2014 |

|||||||||||||

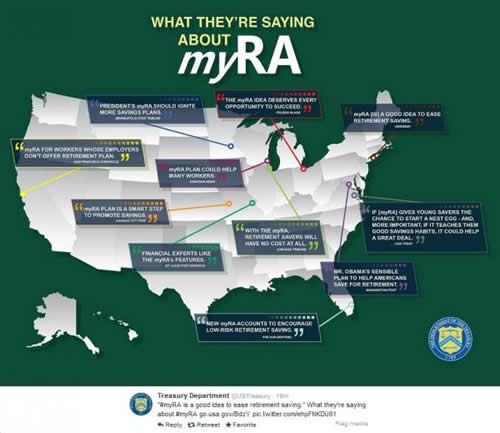

FINANCIAL REPRESSION - The myRA Propaganda Begins "We Are From The Government And We Are Here To Offer You A No Risk, Guaranteed Return Investment Product" 02-18-14 Zero Hedge And just like that, the MyRA propaganda goes full Goebbels retard. Unfortunately, due to time differences, neither Pravda, nor Izvestia or Moskovskij Komsomolets could reply with affirmative comments due to time constraints. From the US Treasury:

|

01-19-14 | THESIS 2012 | |||||||||||

2011 2012 2013 2014 |

|||||||||||||

| THEMES | |||||||||||||

| FLOWS -FRIDAY FLOWS | THEME | ||||||||||||

|

|||||||||||||

|

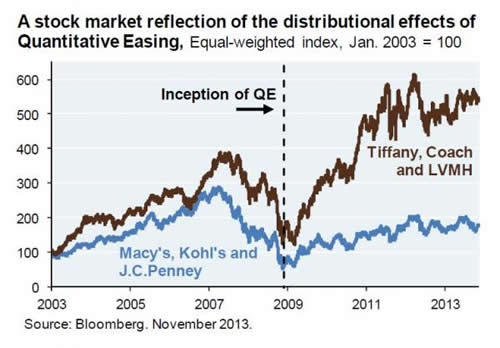

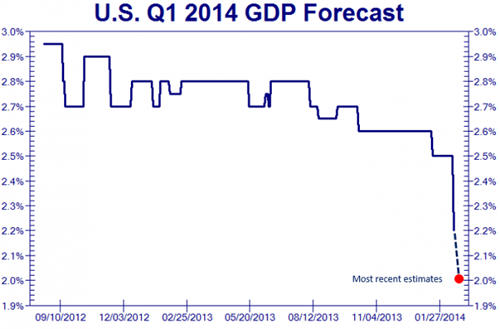

FLOWS: Shrinking Government Deficits A Potential Recession Problem Back To Normal – But Worse Richard Duncan 02-15-14 The Congressional Budget Office (CBO) has just published its projections for the US budget deficit and economic outlook for the next ten years. This annual document is a very important source of information for anyone who wants to understand how the economy is likely to evolve over the next decade. This year, “The Budget And Economic Outlook: 2014 to 2024” is 175 pages long. In this blog, I will highlight some of the most interesting and important aspects of this report. The Budget Crisis Is Over

The Wars Are Over (Almost)

Much Slower Economic Growth Ahead

In closing, I would like to warn the reader that I believe this CBO report overstates the current health and future outlook for both the budget and the economy. Quantitative Easing became the driving force for the economy in 2013. QE pushed up asset prices and created a wealth effect that allowed Americans to spend more. That increase in consumption made the economy grow and generated higher tax revenues, making the budget deficit lower than it otherwise would have been. If QE ends this year, as the Fed has indicated, the economy could go back into recession. That would cause the budget deficit to be much larger than currently projected. So, keep that in mind. The CBO’s forecasts generally prove to be too optimistic. Nevertheless, the Budget And Economic Outlook is a very useful document. I plan to discuss its implications in greater detail in the next issue of Macro Watch.

|

|||||||||||||

| SHADOW BANKING -LIQUIDITY / CREDIT ENGINE | THEME | ||||||||||||

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||||||||||||

| ECHO BOOM - PERIPHERAL PROBLEM | THEME | ||||||||||||

INFLATION IS EXTREME - Both Ways

|

|||||||||||||

| PRODUCTIVITY PARADOX -NATURE OF WORK | THEME | ||||||||||||

| STANDARD OF LIVING -EMPLOYMENT CRISIS | THEME | ||||||||||||

| CORPORATOCRACY -CRONY CAPITALSIM | THEME |  |

|||||||||||

CORRUPTION & MALFEASANCE -MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|||||||||||

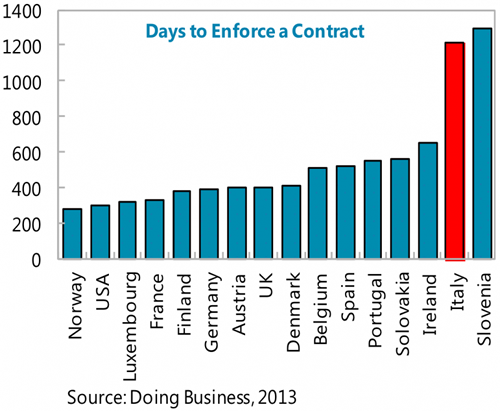

RULE OF LAW Slips With Economic Problems or is IT a Cause of the Economic Problems as Crony Capitalism Takes Hold?

|

|||||||||||||

CORRUPTION & MALFEASANCE : Breathtaking" Corruption In Europe "02-10-14 Pater Tenebrarum of Acting-Man blog, via ZH A recent article at the BBC discusses the findings of a report by EU Home Affairs commissioner Cecilia Malmstroem on corruption in the EU. According to the report, the cost of corruption in the EU amounts to €120 billion annually. We would submit that it is likely far more than that (in fact, even Ms. Malmstroem herself concurs with this assessment). This is of course what one gets when one installs vast, byzantine bureaucracies and issues a veritable flood of rules and regulations every year. More and more people are needed to administer this unwieldy nightmare of red tape, and naturally the quality of the hires declines over time due to the sheer numbers required. Moreover, many small to medium sized businesses would probably not be able to survive if they didn't occasionally bribe officials. Big business considers bribes a perfectly normal cost of business anyway, especially when the business concerned involves milking tax cows. As you will see further below, the defense business – or better the war racket – is especially prone to corruption. Tax payers of course end up paying every cent. Another sector that is apparently subject to widespread corruption is health care – which should be no surprise, since health care provision is an almost fully socialistic enterprise in Europe. Bribes may well mean the difference between life and death in some instances. You will probably also not be overly surprised to learn that there was VAT fraud amounting to €5 billion in the bizarre and totally ineffective and useless 'carbon credits' market, which has turned into a boondoggle of amazing proportions. There's simply no other way of making a mint in that market we suppose. From the BBC:

(emphasis added) And that is merely what they actually know about. Remember, there are known unknowns and unknown unknowns here as well, and they probably dwarf what is actually known. One gets an inkling of how big the problem may really be when considering the case of Greece.

The EU corruption map according to the official report – via BBC. Bribes Exceeding Greek Official's Memory Storage CapacityGreece is of course a special case in terms of official corruption. If you ever wondered how the country could go bankrupt in such short order after joining the euro zone, wonder no longer. Here are a few excerpts from a recent article in the NYT about a lower level official in the defense ministry who received so many bribes that he cannot even remember them all anymore. The amounts involved are astonishing:

One certainly wonders what more powerful officials were able to skim off. Unfortunately, corruption is so widespread and reportedly involves the highest echelons of the bureaucracy and the body politic in Greece, so that one must expect that we will never find out. No wonder there is a lot of tax evasion in Greece: who wants to hand over his hard earned money to such a gang of thieves? It is like paying off the mafia. Meanwhile, the companies paying the bribes are of course just as guilty, and many of them come from countries that are themselves ranked relatively low on the corruption scale – e.g. Germany and Sweden. It seems to be an 'opportunity makes thieves' type situation.

(emphasis added) Buying $68 billion worth of largely useless weaponry is certainly quite a feat for a country of slightly over 11 million inhabitants. The Saudis may well be able to top that on a per capita basis, but they have a lot of oil money and haven't required a bailout from anyone. Greece was not able to actually afford these expensive toys. Even if the weapons were in perfect working order, this buying spree wouldn't make any sense. Is Greece really going to fight a war with Turkey, a NATO partner? The very idea is absurd. Since we can rule this possibility out, what on earth are the weapons good for? We can hereby amend Randolph Bourne's famous saying: 'War is the health of the State – and its minions and suppliers'. |

01-20-14 | THEME | MALFEASANTS & CORRUPTION

|

||||||||||

| SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | THEME | ||||||||||||

COMING TO A THEATER NEAR YOU

|

01-19-14 | THEMES | |||||||||||

SOCIAL UNREST - Americans Are Angrier & More Frustrated Than Ever Americans Are Angrier & More Frustrated Than Ever: 19 Furious Facts 02-18-14 Michael Snyder of The American Dream blog via ZH Have you noticed that people are becoming angrier? You can see it everywhere – in our homes, in our schools, in our workplaces, in our television shows, in our movies, and certainly in Washington. In fact, many have said that there is an “epidemic” of anger in America today. And it is undeniably true. As you will see below, a whole host of surveys and opinion polls show that America has become a seething cauldron of anger and frustration unlike anything that we have ever seen before. As a nation, we are more divided than we have been in decades, and economic conditions continue to deteriorate. People are working harder than ever and Americans get less vacation days than anyone else in the world, but median household income keeps going down every year. Americans are dissatisfied with their relationships, their jobs, their communities and their political leaders. There is this growing sense that our country is steamrolling toward disaster, and yet there is very little agreement on what the solutions to our problems are. Instead, blaming others for our problems has become a new American pastime. The very fabric of our society is coming apart at the seams and the thin veneer of civilization that we all take for granted is beginning to disappear. What is America going to look like if we continue to go even farther down this road? The following statistics come from various surveys and opinion polls that have been conducted recently. Without a doubt, these numbers show that Americans are angrier and more frustrated than ever… #1 65 percent of Americans are dissatisfied “with the U.S. system of government and its effectiveness”. That is the highest level of dissatisfaction that Gallup has ever recorded. #2 66 percent of Americans are dissatisfied “with the size and power of federal government”. #3 70 percent of Americans do not have confidence that the government will “make progress on the important problems and issues facing the country in 2014.” #4 Only 8 percent of Americans believe that Congress is doing a “good” or “excellent” job. #5 Only 4 percent of Americans believe that it would “change Congress for the worse” if every member was voted out during the next election. #6 60 percent of Americans report feeling “angry or irritable”. Two years ago that number was at 50 percent. #7 53 percent of Americans believe that the Obama administration is “not competent in running the government”. #8 An all-time low 31 percent of Americans identify themselves as Democrats. #9 An all-time low 25 percent of Americans identify themselves as Republicans. #10 An all-time high 42 percent of Americans identify themselves as Independents. #11 Barack Obama’s daily job approval numbers have dipped down into the high thirties several times lately. #12 Only 38 percent of Americans approve of the way that Obama is handling the economy. #13 60 percent of Americans believe that the “economic system in this country unfairly favors the wealthy”. #14 70 percent of Americans do not “feel engaged or inspired at their jobs”. #15 Two-thirds of U.S. teens “admit to having anger attacks involving the destruction of property, threats of violence, or engaging in violence”. #16 36 percent of Americans admit that they have yelled at customer service agents during the past year. #17 73 percent of Americans believe that Obama’s efforts to “reform” the NSA “won’t make much difference in protecting people’s privacy”. #18 77 percent of Americans believe that the state of the economy is either “not so good” or “poor”. #19 65 percent of Americans are either “somewhat dissatisfied” or “very dissatisfied” with the direction of the country. Are you starting to get the picture? We have never seen anything like this in the United States during the post-World War II era. People are fundamentally unhappy, and that has tremendous implications for the future of our society. So what is causing all of this anger and frustration? Well, of course the economic struggles that tens of millions of Americans are experiencing on a daily basis play a huge role. The following is an excerpt from a recent local Fox News report…

And it is easy to understand why people are becoming increasingly frustrated with the incompetence and rampant corruption in Washington D.C.…

In addition, there are certainly other reasons why people are so angry these days as well…

So what do you believe? Why do you think that Americans are so angry and so frustrated these days? Is there anything we can do about it? And how bad will the anger and frustration in this country get when the economy completely collapses? |

02-19-14 | THEMES | SOCIAL UNREST |

||||||||||

| SECURITY-SURVEILLANCE COMPLEX -STATISM | THEME | ||||||||||||

| GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | THEME | ||||||||||||

| CENTRAL PLANINNG -SHIFTING ECONOMIC POWER | THEME | ||||||||||||

| CATALYSTS -FEAR & GREED | THEME | ||||||||||||

| GENERAL INTEREST |

|

||||||||||||

| TO TOP | |||||||||||||

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP