|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Mon. Oct. 26th, 2015

Follow Our Updates

onTWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

ARCHIVES

| OCTOBER | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar Weakness |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?We have analyzed & included

these in our latest research papers Macro videos!

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

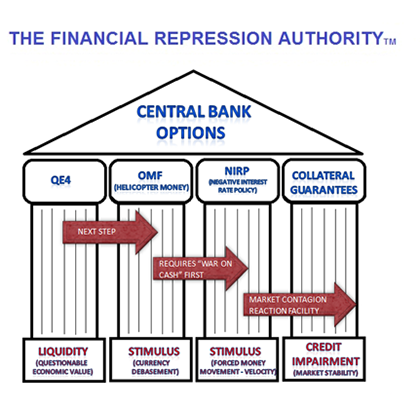

FINANCIAL REPRESSION INVESTING BASED ON THE AUSTRIAN SCHOOL OF ECONOMICS FRA Co-Founder Gordon T. Long discusses the Austrian School of Economics with John Butler and how its methodologies can be applied to the current global economy. John Butler has 18 years’ experience in the global financial industry, having worked for European and US investment banks in London, New York and Germany. Prior to launching the Amphora Commodities Alpha Fund he was Managing Director and Head of the Index Strategies Group at Deutsche Bank in London, where he was responsible for the development and marketing of proprietary, systematic quantitative strategies for global interest rate markets. Prior to joining DB in 2007, John was Managing Director and Head of European Interest Rate Strategy at Lehman Brothers in London, where he and his team were voted #1 in the Institutional Investor research survey. In addition to other research, he publishes the Amphora Report newsletter which appears on several major financial websites THE AUSTRIAN SCHOOL OF ECONOMICS “It is the no free lunch school of economics.” The Austrian school believes that economics systems are ultimately information systems. Some of those systems use information more efficiently and effectively than others, and in particular systems of which authorities of various kinds meddle with the market. Authorities may do this by extracting capital from the market via tax rates or even by manipulating the money of that market through some sort of artificial interest rate policy. “From the Austrian schools point of view, anything that impedes the free price information flow of an economic system will result in a sub optimal economic outcome.” Without the rule of law, without the ability to strongly enforce property rights, without the ability to prosecute fraud, and various other legal frameworks; the Austrian economic model cannot work. “Our goal is to make sure economic information flows as efficiently as possible within a solid legal structure.” HOW THE AUSTRIAN SCHOOL CAN BE APPLIED IN INVESTING Austrianism teaches us that the future is unpredictable. The economy is made up of the billions of people in the world, with each person making transactions almost every day. Each decision is an individual’s choice, and each decision, even the decision not to spend your money has some effect on the economy. “Austrian school provides you a way to identify distortions, a powerful way that is caused by a fiscal and monetary policy set such as interest rate or fiscal policy manipulation. Austrians are able to look at these policies and be able to see how they are impacting the investment environment. This gives you a sense of where the distortions are. In theory you get an idea of where you should be overweight and underweight from an investor’s point of view.” CURRENT EVENTS AMPHORA IS FOCUSED ON “Currently we are seeing a general overvaluation of risky assets that has been caused by truly an unprecedented set of highly expansionary monetary and fiscal policies throughout most of the world.” Income growth has not kept up; assets are expensive relative to incomes. So the correct strategy is not simply to short assets, which is dangerous; but if indeed they do look for ways to stimulate aggregate demand more directly rather than through the banking system. The correct strategies to have today are those that will perform if incomes begin to catch up to asset prices, it could be asset prices declining towards incomes or vice versa. It is impossible to know which one is going to happen, but it is highly likely looking forward that a conversion of the two will happen. POSSIBILITY OF NEGATIVE NOMINAL INTEREST RATES “Policy makers have become almost pathological; they have a relentless attitude to make their policies work.” “Problem with this is, once you get to this point, you can no longer question your original set of assumption. Austrian school of economics knows that the original sets of Keynesian assumptions that have gone into forming this unconventional and aggressive policy mix are themselves flawed. We are on this course where if it were left to run itself, policy makers will operation in these counter-productive directions because they will not question whether their assumptions are wrong.” “Banning cash will prevent people from making even the simplest transaction in their own neighborhoods; it will lead to complete riot and chaos.” “Putting a ban on cash is a terrible idea. It is terrible for them and for the economy as a whole. Sadly, with the way things are going, policy makers are going to teach everyone a very hard lesson about blindly accept anything the bureaucracy tells you to do.” CENTRAL BANKS ROLE IF ASSET CORRECTION OCCURRED “If you do get a major correction in asset markets that causes collateral problems in financial markets, the policy makers are out of options. The only thing they could do is begin capital controls” Prevent investors being able to freely liquidate or withdraw funds from their existing investments. This of course is very anti-capitalist, very inti-market. It goes directly against everything that a free enterprise economy should stand for; but when you follow these policies you will eventually get to a dead end. Abstract written by Karan Singh [email protected]

LELAND MILLER Talks QUALITY OF CHINA'S ECONOMIC REPORTING FRA Co-Founder Gordon T. Long interviews Leland miller, the president of the china beige book international and discusses financial repression in the context of the Chinese economy. He describes himself as a Lifelong china watcher who decided to do something about the complete lack of data in china. “One of the things that the china beige book plans to do is to give people a real picture of not just the growth dynamics, but also the labor market, the credit dynamics, the macro implications of Chinese growth, indications of future Chinese demand, implications of commodity markets around the world, we try to give the people a much better picture on what’s actually happening instead of just relying on official data and press release”. FINANCIAL REPRESSION Leland describes the Chinese reform as a reversal of financial repression and this repression in the context of the Chinese economy is the oppression of consumers and households by state organizations through its economic systems. “It means reversing this long time economic model, where the state will profit through the economic system at the expense of the consumers and household, and one of the things that the new leadership is intent on doing in order to create consumption is to empower consumers, so they spend more and stop empowering state organizations which are fuelling the overcapacity and the massive debt bubble”. What should investor know about china? He explains the biggest misconception concerning the Chinese economy is believing the GDP tells you much about how china is doing. “It is a broad, blunt indicator that doesn’t measure productive growth or credit dynamics”. On some of the challenges of getting reliable data in china, Leland explains that he and his team had to ask Chinese firms and consumers on ground what is happening in the country, and set up a number of polling units across sectors in order to get reliable and accurate information. Economic trends in china “For years we have been talking about the Chinese slowdown; it’s inevitable, despite the fact that the economy has been slowing”. He goes on to explain that although the market sentiment has gone from optimism to “Armageddon” in recent months, the actual data is at odds with these sentiments. As a result of china’s economic slowdown, there is great vulnerability among emerging markets. Now, the reason for this is that for years these markets have relied on china’s demand without factoring the likelihood of a decline or certainty of a decline in china’s demand. On China’s view of America, Leland has this to say “The Chinese look at America as a model that they are interested in taking pieces from; they like the dynamism of the economy and the global status. On one hand, they see us as a model to learn a lot of things from but also as a serious threat that is looking to constrain their inevitable and ultimate rise”. Abstract written by chukwuma uwaga [email protected]

|

10-26-15 | THESIS | |

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Oct 25th, 2015 - Oct 31st, 2015 | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

| STANDARD OF LIVING - SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP