|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

�

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros � |

�

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

��

"Currency Wars "

|

�

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

�

"EURO EXPERIMENT"

archives open EURO EXPERIMENT :� ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

�

"INNOVATION"

archives open |

�

"PRESERVE & PROTE CT"

archives open |

�

�

Wed. Nov. 25th, 2015

Follow Our Updates

onTWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

�

�

�

�

�

�

�

| � | � | � | � | � |

ARCHIVES�

| NOVEMBER | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | � | � | � | � | � |

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| � |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| � |

| 20 - US Dollar |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| � |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic | 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

�

Reading the right books?

No Time?We have analyzed & included

these in our latest research papers Macro videos!

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

�

�

TODAY'S TIPPING POINTS

|

�

�

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

� | � | Theme Groupings |

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

� |

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY � |

� | � | � |

EU BANKING CRISIS |

11-24-15 | � | 6 |

| Market - WEDNESDAY STUDIES | |||

| TECHNICALS & MARKET | � |

� | � |

| STUDIES - MACRO pdf | � | � | � |

STUDIES - Q3 EARNINGS |

11-25-15 | � | |

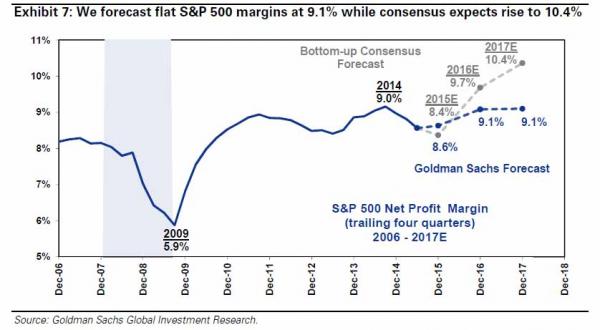

Submitted by Tyler Durden on 11/24/2015 Apple Accounted For 20% Of All U.S. Margin Expansion Since 2010 - Why This MattersEarlier we explained why Goldman believes that in 2016 the market, which is now about 1% higher than where it closed in 2014, will also go exactly nowhere. The reason for this pessimism can be summarized in three bullet points:

It is bullet iii) that is the most important, because here the divergence between Wall Street's hopium-driven margin euphoria is most visible. According to Goldman, "tech accounted for 50% of the overall S&P 500 expansion during the past five years (Apple is responsible for 20% of rise).�Tech sector now has margins (18%) that are twice the overall market." That tremendous tech, but mostly AAPL-driven, margin growth has now ended. So can this torrid surge in tech margins continue? Goldman's answer is a resounding no.

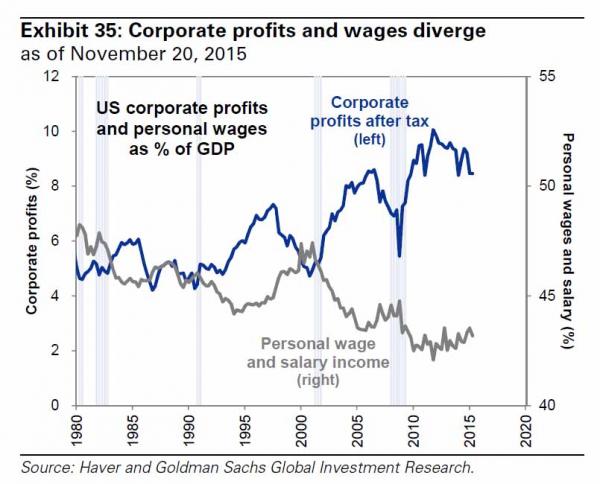

But perhaps the one chart that confirms that one can't have their wage rising cake and eat corporate profits too is the following: In other words, if the Fed is hiking "because it sees something about the economy" that few others do - i.e., rising wages - then by definition that means that profit margins will contract as growing wages take out ever bigger chunks of the corporate bottom line. So with sales declines set posied to accelerate due to the soaring dollar, central bank liquidity-driven multiple expansion no longer feasible and corporate margin growth set to resume its contractionary path again, we wonder where will the next leg higher in stocks come from. Unless, of course, the whole "the Fed is hiking because theS&P500 has topped out�economy is recovering" was just the latest economist consensus mirage. � |

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Nov. 22nd, 2015 - Nov 28th, 2015 | � | � | � |

| BOND BUBBLE | � | � | 1 |

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | � | � | 2 |

| GEO-POLITICAL EVENT | � | � | 3 |

| CHINA BUBBLE | � | � | 4 |

| JAPAN - DEBT DEFLATION | � | � | 5 |

EU BANKING CRISIS |

� | � | 6 |

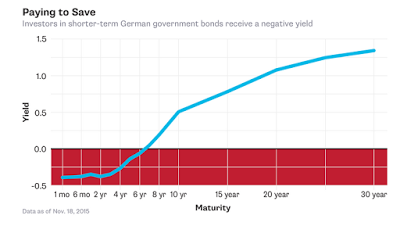

�Swiss Bank Hits Customers With Negative Interest Rates; Crazy? What About Velocity?Alternative Bank Schweiz (ABS), a small bank in Switzerland broke the negative interest rate on deposits barrier, CHARGING customers to cake their money. (emphasis in caps from the article). The Alternative Bank Schweiz wrote to customers telling them they would face a -0.125 per cent rate on their money from 2016 – and a -0.75 per cent rate on deposits above 100,000 Swiss francs.Less Than Zero Bloomberg offers a "quick take" on Less Than Zero. Imagine a bank that pays negative interest. Depositors are actually charged to keep their money in an account. Crazy as it sounds, several of Europe’s central banks have cut key interest rates below zero and kept them there for more than a year. For some, it’s a bid to reinvigorate an economy with other options exhausted. Others want to push foreigners to move their money somewhere else. Either way, it’s an unorthodox choice that has distorted financial markets and triggered warnings that the strategy could backfire. If negative interest rates work, however, they may mark the start of a new era for the world’s central banks.

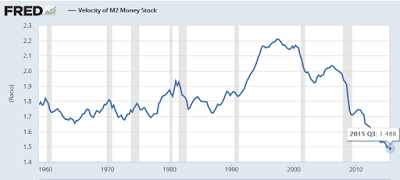

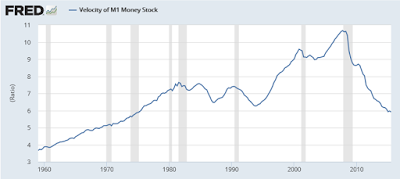

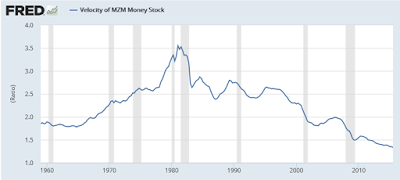

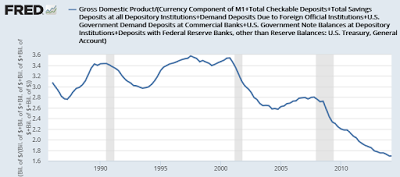

Economic Distortions M2 Velocity So is velocity 1.7, 5.9, 1.5, 1.3 or something else?

Conclusions

Curiously, economists are concerned about "falling velocity" as if it means something other than the central banks are printing money that sits as excess reserves. Inquiring minds may also be interested in the Frank Shostak's 2002 article Is Velocity Like Magic? Much of my understanding of velocity comes from that article. Mario Draghi on Velocity On November 20, Draghi Pledged to ‘Do What We Must’ to Boost Sluggish Inflation. Mario Draghi has dropped his clearest hint yet that the European Central Bank is about to inject more monetary stimulus into the eurozone economy, brushing aside staunch opposition from Germany’s powerful Bundesbank.Question for Draghi I laughed out loud at that last line. If QE increases velocity, then why is velocity declining in the US, in Europe, and in Japan? By the way, bank reserves do not circulate. Reserves are deposits that are not lent out. One can even argue that money does not really circulate per se, as it has to be held at all times by someone. Negative Interest Rates Crazy? Let's return to this statement by Bloomberg: "Crazy as it sounds, several of Europe’s central banks have cut key interest rates below zero and kept them there for more than a year". Desperation and Hubris

It's crazy to keep trying things that cannot possibly work, over and over again. |

|||

| STOCK MARKET VALUATIONS | 11-24-15 | � | 10 - US Stock Market Valuations |

�S&P 500 Earnings Slumped By Most in Six Years,Worse to ComeThird-quarter U.S. earnings look set to be the worst since 2009 and the trend remains negative through year-end. Profit fell 3.3 percent on a share-weighted basis in the latest quarter, based on data from about 96 percent of S&P 500 companies already reporting. This marks a second consecutive quarter of negative earnings growth. The energy sector saw the biggest damage, hurt by plummeting oil prices, with earnings dropping 57 percent in the third quarter, year on year. � Dollar strength is also hurting U.S. profits and revenues, according to Societe Generale. “The question for us is not are we in a U.S. profit recession, but how bad is it likely to get and what are the implications for the wider U.S. economy, and with that massive consensus long on the U.S. dollar,” SocGen quantitative analysts led by�Andrew Lapthorne�wrote in a Nov. 19 note. "We continue to be very concerned about U.S. profits. For over a year now excuse after excuse has been rolled out as to why U.S. profits are not actually as weak as the headline numbers imply, but the reality is the U.S. profits and revenues are declining and the strong U.S. dollar is a large part of the problem," they wrote. Decline and Fall: U.S. Earnings Seen Negative Through Q4

The negative trend is set to continue into the fourth quarter, with analysts expecting a 5 percent year-on-year decline in S&P 500 profits, according to data compiled by Bloomberg. In dollar terms, profits from S&P 500 companies have fallen by about $25 billion in the first three quarters of the year compared with the same period in 2014, while revenues have dropped by $287 billion. |

|||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

� | � | � |

US ECONOMIC REPORTS & ANALYSIS |

� | � | � |

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | � | � | � |

| � | � | � | |

| Market | |||

| TECHNICALS & MARKET | � |

� | � |

| COMMODITY CORNER - AGRI-COMPLEX | � | PORTFOLIO | � |

| SECURITY-SURVEILANCE COMPLEX | � | PORTFOLIO | � |

| � | � | � | |

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

� THE FED FLUNKS! My Austrian Economic Speech at the NY Federal Reserve � � Investing based on The Austrian school of Economics The infographic above shows some differences in Keynesian and Austrian views. Courtesy of The Austrian Insider. FRA Interview of Robert Wenzel by FRA Co-founder Gordon T Long. Across well-known literature, the Austrian school of economics has earned and put its indelible mark on the complicated world of economic analysis and theory. The school of thought varies significantly from the mainstream schools of economics like the classical, neoclassical and Keynesian schools of thought. In essence the Austrian school of thought believes in using logical thoughts to explain and solve economic problems rather than getting technical and going into mathematics to explain the same problems. “The key to understanding is that what you have with mainstream economists is that they look at things from a very mathematical, very empirical approach… unlike in physical sciences you cannot do that for the science of economics because you’re dealing so many variables like changes and desires” Unlike the mainstream none-Austrian economists, Wenzel believes that there’s a lot to be understood from the economy based on logical build up from solid premises. He goes on to mention that another key aspect to be understood is that Austrian economists believe that when the Fed injects money into certain sectors of the economy, it’s those sectors that turn to boom. According to Wenzel, when the Feds eventually start tightening this money supply it leads to a crash. On the current economy: “We’re in a period of accelerated money supply” Wenzel thinks there could be an increase in price inflation and the possibility of another dip in the price of oil. Explaining how we have inflation in some areas and deflation in others when we’ve been pumping money into the system, he explains it by outlining how it depends on how quickly people want to spend the money. “if there’s a great desire to hold money, you’re not going to see the inflation right away” When people don’t spend money what happens is you have money building up in cash balances which Wenzel terms “the desire to hold cash balances”. With this you see people reluctant to spend money and hence a low velocity of money. On the confusing environment of economics and how understanding the Austrian school can help to clear things up .... Understanding the business cycle and inflation comes about in terms of the Austrian school of thought. It definitely helps to clear a lot of things up but even more can be taken from this approach. The methodology additionally helps out in terms of having people analyzing the world through logic rather than attacking it solely with empirical data. On considering Quantitative easing and going into negative nominal rates .... QE is a method where the fed prints a lot of money and buys long durtion debt. The negative nominal rates idea is based on the Keynesian idea that it’s spending that helps the economy to grow, so the idea is to use negative rates to pressure people to spend their money. Wenzel calls this “a tax on holding money”. Asked if he sees Hyperinflation in the future: It could happen at some point. The Fed’s target of 2% could easily go up to three 3% with accelerated printing of money. At this point they might raise rates but if the inflation is at 5% and they raise rates from 12bp to 2% that still won’t be able to fight the inflation. However it may be too soon to say hyperinflation. The business cycle should be understood as a boom and bust cycle. “Whatever is going up now does not necessarily mean it will go up long term. The bust will occur but they will pump it up with new fed printing, which is eventually where the inflation comes in” �

� |

|||

2011 2012 2013 2014 |

|||

| � | � | ||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

� | � | � |

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | � | THEME | � |

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

� | THEME |  |

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | � |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | � |

II-ECONOMIC |

� | � | � |

| GLOBAL RISK | � | � | � |

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | � |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | � |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | � |

| - -GLOBAL GROWTH & JOBS CRISIS | � | � | � |

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | � | THEME | MACRO w/ CHS |

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

| STANDARD OF LIVING - SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

� | � | � |

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| � | |||

| CRACKUP BOOM - ASSET BUBBLE | � | THEME | � |

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | � |

| GENERAL INTEREST | � |

� | � |

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

� � � |

� | SII | |

� � � |

� | SII | |

� � � |

� | SII | |

� � � |

� | SII | |

| TO TOP | |||

| � | |||

�

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

���

���

TO TOP

�

�

�

�

�� TO TOP

�

�