|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Tue. Mar. 29th , 2016

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

![]()

| MARCH | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | ||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | 15 | 16 | 17 | 18 | 19 |

| 20 | 21 | 22 | 23 | 24 | 25 | 26 |

| 27 | 28 | 29 | 30 | 31 | ||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

20 - US Dollar |

03-29-16 | 20 |

|

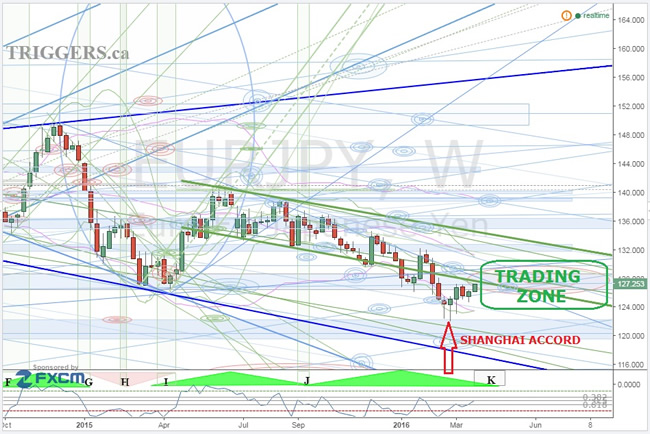

TRADING THE SHANGHAI ACCORD The YEN & EURO Will be Increased in Value Together => Flat

The USD WILL WEAKEN Against the Euro => EURUSD Will Rise

The USD WILL WEAKEN Against the Yen => USDJPY Will Fall |

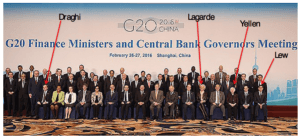

|||

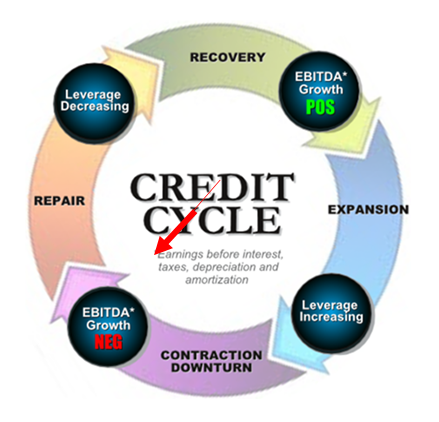

The Dollar Has Been ShanghaiedThe U.S. dollar has just been knocked down and forced to serve the interests of the world against the will of the American people. The dollar has been Shanghaied! The term “Shanghaied” refers to the 19th-century practice of sailors forced to serve against their will on vessels bound for Shanghai and other ports in China. Victims were often from West Coast port cities such as San Francisco, Portland and Seattle. Tactics used included kidnapping, beatings and forms of trickery. In the 19th century, trade between the U.S. and China was booming. But there were persistent shortages of able-bodied seamen to sail the cargo vessels. Each vessel had a boarding officer whose job it was to find the crews. Boarding officers were paid by the number of bodies they could round up before the vessel set sail. This pay was called “blood money” for good reason. The law at the time said the once a seamen “signed on” with a vessel, it was illegal to leave the ship until the journey was complete. Jumping ship at any point in the journey would result in imprisonment. A common tactic was to confront a seaman in a dark alley, knock him unconscious, forge his signature on the manifest and drag him aboard. The seamen would regain consciousness after the vessel left port. At that point, there was no choice but to finish the journey or jump ship when he could. Most finished the journey. Next stop — Shanghai! Based on the best information we’ve been able to obtain: It looks like the dollar has just been Shanghaied by the G-20 (the unelected, unaccountable group of 20 nations that collectively control the world monetary system) on Feb 26th, 2016 at the G-20 Meeting In Shanghai, China. This could be the most important financial development of 2016, with enormous implications for you and your portfolio. Once again, the city of Shanghai is the center of attention. This new effort to knock out the dollar was contrived in a secret meeting in Shanghai on Feb. 26. Who attended the meeting? The list of names reads like a rogues’ gallery of central planners and currency manipulators. Janet Yellen from the Fed, Christine Lagarde from the IMF, Mario Draghi from the ECB and U.S. Secretary of the Treasury Jack Lew were all there, along with their central bank and finance ministry counterparts from Japan, China and the other BRICS. Here’s the “class picture” of those who attended the G-20 conclave, with some of the main players identified. The main meeting of the G-20 finance ministers and central bank governors was no secret. It was conducted with much fanfare and publicity. Thousands of reporters descended on Shanghai to cover the proceedings. A side meeting of a core group consisting of the U.S., Europe, Japan, China and the IMF was a secret. This group really calls the shots. The U.S., Europe, Japan and China together represent over 70% of global GDP. The IMF acts as a kind of facilitator for these secret meetings, and an “enforcer” for whatever agreements are reached behind closed doors. The outcome of this secret side meeting was the biggest dollar take-down operation since the famous Plaza Accord of 1985. The Plaza Accord was orchestrated by James Baker, who was Ronald Reagan’s secretary of the Treasury at the time. The dollar had increased almost 50% between 1980–1985, and reached an all-time high that year. The strong dollar was hurting U.S. exports and jobs. The Plaza Accord was a coordinated effort by the U.S., France, West Germany, Japan and the U.K. to weaken the dollar. It worked. The dollar fell 30% over the next three years. The U.S. economy got a second wind, and the long Reagan-Bush expansion continued. Now the dollar is at a 10-year high on major indexes. It’s time to trash the dollar again. But the U.S. does not have the same skillful leadership we had in James Baker. This time, the big winner won’t be the U.S.; it will be China. The losers will be the same — Japan and Europe. Understanding these backroom machinations of the power elite requires some history and analysis. Here’s what you need to know: BERNANKE'S "ENRICH THY NEIGHBOR" DOCTRINE Currency manipulations are negative-sum games. One country can get a small temporary boost from devaluation, but trading partners are worse off, and the world is worse off. Ultimately, even the country that devalued first is worse off after others retaliate. However, a new theory of currency manipulation was created by Ben Bernanke. This theory says that if every country eases at the same time, everyone gets the benefit of easing, but exchange rates don’t change much because of the coordinated timing. Bernanke called this “enrich thy neighbor,” in contrast to the original “beggar thy neighbor” name given to currency wars in the 1930s. The concept of cooperation and coordination among the central banks can be carried several steps further. Several countries can ease or tighten at the same time in order to give one country some relative benefit by design. Central banks can give targeted relief to one country if they all cooperate in a secret plan. Central bank policy changes work through expectations as much as actions. In traditional policy, a central bank eases by cutting rates or tightens by raising rates. But it can also ease by raising expectations about a rate increase and then doing nothing. If markets price in a rate increase and the central bank does nothing, markets can rally on the news. This is like an invisible rate cut, based solely on changed expectations. Having multiple central banks manipulate expectations and coordinate policy behind the scenes is complex. These efforts are doomed to fail because of unintended consequences and exogenous shocks. But that won’t stop the big brains from trying. CHINESE "DESTABILIZING" DEVALUATION This brings us to China’s shock devaluation of the yuan last August. Because China had not managed expectations, this shock destabilized the global financial system. The IMF and the Fed were quite upset that China was not playing by the rules of the game. On the other hand, China did not care much about the rules, because their economy was sinking under bad debts and capital outflows. China acted in its best interests regardless of the global impact. With this background and the recent yuan shock in mind, the global financial powers descended on Shanghai in late February. The G-20 central bankers and finance ministers agreed that China needed help. It’s the world’s second-largest economy and it was falling fast. There was some danger it could take the world down with it. But further yuan devaluation was not possible (in the short run) because it was too destabilizing to markets. SHANGHAI ACCORD The solution is to weaken the yuan on a relative basis by strengthening the currencies of China’s major trading partners, Japan and Europe. In other words, if the yen and euro get stronger, that’s the same as making the yuan weaker, but without the shock of Chinese devaluation. Since this secret deal was worked out on Feb. 26, the first chance the central bankers had to put their plan into action was mid-March.

Yet how could Japan and Europe tighten without explicitly raising rates? They did it by raising expectations. Markets thought Draghi’s ECB “bazooka” would be long lasting. Markets expected Kuroda of the Bank of Japan to do more aggressive QE.

Both decisions acted like tightening relative to expectations. The euro and yen went up against the dollar immediately. Comparatively, the yuan went down with no explicit devaluation by China. This was the new Shanghai Accord in action. The dollar declined 30% after the coordinated action at the Plaza Accord in 1985. The dollar’s recent strength since the all-time low in 2011 is also shown. This is the period leading up to the new Shanghai Accord, also shown. Will the dollar now plunge 30%, as it did after 1985? It might. If that happens, the shock waves will be felt in every market in the world.

The Shanghai Accord will be a game changer depending on how hard the insiders push their new playbook. The Fed took a slightly different tack in this plan. Markets pay most attention to the yuan/dollar cross-rate; that’s the one the Chinese government manipulates. The yuan/euro and yuan/yen cross-rates just go where they go based on the euro/dollar and yen/dollar crosses. The dollar cross-rates are the ones markets pay most attention to. So the Fed weakened the dollar with their dovish comments at the March 16 meeting. (Again, by doing nothing and signaling slower tightening, they changed expectations, which is a form of ease.) With Europe and Japan tightening and the U.S. easing at the same time, nobody noticed that China effectively devalued, because the yuan/dollar cross-rate was unchanged. Neat! Europe is a larger trading partner to China than the U.S., so the yuan/euro cross-rate is actually more important to the Chinese economy. What happened under the Shanghai Accord was a coordinated devaluation that went unnoticed because China took no official action and the yuan/dollar cross-rate was unchanged. It was an invisible devaluation of the yuan. Japan and Europe were the losers in this round of currency manipulations. Japan was the winner in 2013 with Abenomics. Europe was the winner in 2014 with negative rates and Euro QE. Now it was the turn of China and the U.S. to get a lift. The U.S. and China are the world’s two largest economies. If they go down, the whole world goes down with them. Both economies were showing signs of weakness. It was time for Europe and Japan to give it up to China and the U.S. That’s the legacy of the Shanghai Accord. What’s next? There’s another secret G-20 meeting on April 16, 2016. This will take place on the sidelines of the IMF spring meeting in Washington, D.C. I’ll be in Washington then reporting from the front lines. At the April conclave, I expect the Big Four (Japan, U.S., the eurozone and China) to leave exchange rates alone for the time being. They’ll want time to evaluate their work following the Shanghai Accord before taking next steps. The Big Four may later want to run the Shanghai playbook again just to give China more breathing room. The Shanghai Accord seems like a success for the central banks. This means the Big Four will want to try it again to ease financial conditions in the U.S. and China. They won’t push it too far, because Japan and Europe are fragile. We’ll wait to see the indications and warnings before the April meeting. For now, a stronger yen and stronger euro are both in the cards. The consequences for Asia of a stronger yen and weaker yuan are not difficult to discern. Japanese corporate profits will be hurt two ways. Japanese exporters will be hurt because their products will be more expensive for foreign buyers. Japanese multinationals will be hurt when their overseas earnings are translated back into yen. It’s a double-whammy for the Japanese stock market. The Shanghai Accord happened in stealth, but it will go down in history as a major turning point in the international monetary system. |

|||

TIPPING POINTS, STUDIES, THESIS, THEMES & SII COVERAGE THIS WEEK PREVIOUSLY POSTED - (BELOW) |

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Mar 27th, 2016 to April 2nd, 2016 | |||

| TIPPING POINTS - This Week - Normally a Tuesday Focus | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market - WEDNESDAY STUDIES | |||

| STUDIES - MACRO pdf | |||

TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | |||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

|

2016 | THESIS 2016 |  |

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

Michael Pento: “Price discovery is essential, it is the nucleus of capitalism and we haven’t had it in decades!”FRA Co-founder Gordon T. Long is joined by Michael Pento in discussing topics from the government debt problem, the current boom in gold and the outlook of the dollar. Mr. Pento is the President and Founder of Pento Portfolio Strategies (PPS). PPS is a Registered Investment Advisory Firm that provides money management services and research for individual and institutional clients. Mr. Pento is a well-established specialist in the Austrian School of economics and a regular guest on CNBC, Bloomberg, FOX Business News and other national media outlets. His market analysis can also be read in most major financial publications, including the Wall Street Journal. He also acts as a Financial Columnist for Forbes, Contributor to thestreet.com and is a blogger at the Huffington Post. Prior to starting PPS, Mr. Pento served as a senior economist and vice president of the managed products division of another financial firm. There, he also led an external sales division that marketed their managed products to outside broker-dealers and registered investment advisors. Additionally, Mr. Pento has worked for an investment advisory firm where he helped create ETFs and UITs that were sold throughout Wall Street. Earlier in his career Mr. Pento spent two years on the floor of the New York Stock Exchange. He has carried series 7, 63, 65, 55 and Life and Health Insurance Licenses. Mr. Pento graduated from Rowan University in 1991. KEYNESIAN INTEREST RATE MANIPULATION “You cannot take interest rates down to zero percent and then into the negative territory, constantly increase the amount of something I like to call ‘quantitative counterfeiting’ and ultimately hope for a good ending. It’s just not possible.” They’re constantly pushing interest rates lower and lower and now to the point where if you’re going to loan money to somebody, you’re going to pay them to do it. The reason their doing this as a method to make their debt serviceable; they need to make ends-meat so they borrow at lower cost. We know there is going to be a collapse because markets have been aggravated and not allowed to function for years. “30% of all the worlds sovereign debt now has a negative sign in front of it, that’s $7 trillion.” Here’s the main issue, let’s consider Japan: There is -0.1% for the Japanese 10yr note, an all-time record low. You’re loaning money to Japan, a nation that has 250% debt-GDP and you’re loaning this money going out for 10 years. All for the deal that you’re going to lose money each and every year in nominal terms, and then they have an inflation target and assuming they meet it, Japanese authorities will eventually step in and all of a sudden begin fighting inflation. The only thing this can lead to is an enormous implosion. “Price discovery is essential, it is the nucleus of capitalism and we haven’t had it in decades.” SUSTAINING GOVERNMENT DEBT “As debt has increased, interest rates have gone lower; it is all that they can do.” When you base a nation’s growth, not on productivity and the size of the labour force, rather on market bubbles, furthermore when you consider there is 19-20 trillion in the US of outstanding debt; there is just no tax base that can finance this. Look what Draghi had to do, it was not enough to buy $60 billion euros a month, they went to 80 billion, and why just buy government debt when you can buy corporate debt? These practise make no sense, seemingly there is no rationally thinking individual that enforces decisions. We are stuck until we are hit with an inevitable implosion. The trigger will be when they reach their inflation targets and then become inflation fighters. There will be a period of time following this where you will see bond yield completely unravel, they will soar, and consequently stock prices and economic growth will plummet. CENTRAL BANK PATTERNS Local banks have their excess reserves at the central bank, and now the central banks rather than paying to keep the reserves, they are charging for the reserves. They are doing this so banks can go out looking for someone who cannot pay back in taking out a loan, else they will simply go buy more sovereign debt. “Have we become such children in this world where grown men and women cannot just come forth and admit they have made a mistake and admit there will be a year or two of a recession or depression followed by prosperity?” If you have so much debt which you cannot pay back, something has to change; the debt needs to be restructured. Debt is not fixed by artificially taking out interest rates and forcing individuals to take out more debt. We are not adjusting we just keep rolling the debt over and over. “Capitalist systems do not work unless you have a cleansing at some point of excess debt. It is a healthy and necessary part of growth.” THE GOLD BOOM Well now in a time where if you stick your money in a sovereign note in a bank, you either get nothing from it or even charged for doing so, gold is definitely lucrative now more than ever. Additionally the ratio between gold miners and gold has never been lower than it is now. As interest rates go more and more negative across the globe, more and more money will be put into gold because for every ounce of gold you’ll pull out just that, an ounce of gold. “The only escape is a deflationary depression on a global scale from the likes of which the world has never seen.” ADVICE FOR INVESTORS “Gold is going to be a winner no matter what happens, there is no losing scenario for gold.” To have 20-25% of my portfolio in mining shares which is high as far as Wall Street is concerned. So have gold, short in the market, and the only place being long is with energy. being long with energy as of late has proven to show great results. Forget base metals and in terms of energy it’s a great hedge in being short in the market. THE FUTURE OF THE DOLLAR “As I predicted, I have been on record in December of 2015 in saying the dollar will fall hard and it did. I knew it was going to happen because I knew the economic data wasn’t supportive of floor rate hikes and this is what the dollar was priced in. It is important to question not what the dollar is going to do against the Yen and Euro, but moreover intrinsically against gold. I believe all the currencies out there are going to lose their value, the reason being that the real money out there and it has been for thousands of years, is none other than gold. “ Abstract written by, Karan Singh [email protected] Video Editor: Min Jung Kim [email protected]

|

|||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday "Themes" Post & a Friday "Flows" Post | |||

I - POLITICAL |

|||

CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM

MACRO MAP - EVOLVING ERA OF CENTRAL PLANNING

|

G | THEME | |

| - - CRISIS OF TRUST - Era of Uncertainty | G | THEME | |

CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION - RESENTMENT. |

US | THEME PAGE |  |

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | G | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MA w/ CHS |

|

| 01-08-16 | THEME | MA w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MA w/ CHS |

III-FINANCIAL |

|||

|

FLOWS - Capital, Liqudity & Credit Flows

|

MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | 12-31-15 | THEME | |

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

|||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP