|

JOHN RUBINO'SLATEST BOOK |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Mon. Feb. 24th, 2014

2014 THESIS: GLOBALIZATION TRAP

2014 THESIS: GLOBALIZATION TRAP

AVAILABLE to Trial Subscribers

185 Pages

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images: Understanding the Conclusions

| FEBRUARY | ||||||

| S | M | T | W | T | F | S |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | |

KEY TO TIPPING POINTS |

| 1 - Risk Reversal |

| 2 - Japan Debt Deflation Spiral |

| 3- Bond Bubble |

| 4- EU Banking Crisis |

| 5- Sovereign Debt Crisis |

| 6 - China Hard Landing |

| 7 - Chronic Unemployment |

| 8 - Geo-Political Event |

| 9 - Global Governance Failure |

| 10 - Chronic Global Fiscal ImBalances |

| 11 - Shrinking Revenue Growth Rate |

| 12 - Iran Nuclear Threat |

| 13 - Growing Social Unrest |

| 14 - US Banking Crisis II |

| 15 - Residential Real Estate - Phase II |

| 16 - Commercial Real Estate |

| 17 - Credit Contraction II |

| 18- State & Local Government |

| 19 - US Stock Market Valuations |

| 20 - Slowing Retail & Consumer Sales |

| 21 - China - Japan Regional Conflict |

| 22 - Public Sentiment & Confidence |

| 23 - US Reserve Currency |

| 24 - Central & Eastern Europe |

| 25 - Oil Price Pressures |

| 26 - Rising Inflation Pressures & Interest Pressures |

| 27 - Food Price Pressures |

| 28 - Global Output Gap |

| 29 - Corruption |

| 30 - Pension - Entitlement Crisis |

| 31 - Corporate Bankruptcies |

| 32- Finance & Insurance Balance Sheet Write-Offs |

| 33 - Resource Shortage |

| 34 - US Reserve Currency |

| 35- Government Backstop Insurance |

| 36 - US Dollar Weakness |

| 37 - Cyber Attack or Complexity Failure |

| 38 - Terrorist Event |

| 39 - Financial Crisis Programs Expiration |

| 40 - Natural Physical Disaster |

| 41 - Pandemic / Epidemic |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

|

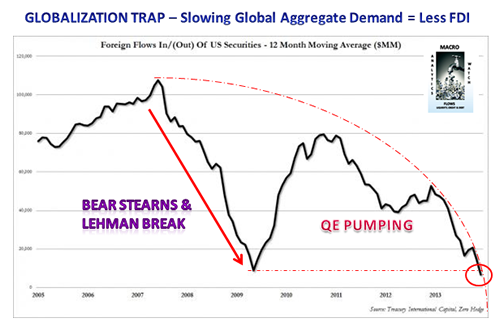

DRAMATICALLY SLOWING US FOREIGN FLOWS

"Houston, We Have a Problem!"

"BEST OF THE WEEK " |

Posting Date |

Labels & Tags | TIPPING POINT or 2013 THESIS THEME |

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro |

|||

US FDI - It is worse than US FDI Simply slowed - It Shrank!!! The Top Destinations For Foreign Investment Dollars 02-01-14 BI It might not be surprising to learn that the U.S. is the top destination for foreign direct investment (FDI). According to new United Nations data cited by U.S. Trust's Joseph Quinlan, the U.S. accounted for $159 billion of inflows of the global total of $1.46 trillion of flows in 2013. This is down from $168 billion in 2012.

This came as the U.S. economy accelerated through the year? |

02-24-14 | 23 - US Reserve Currency | |

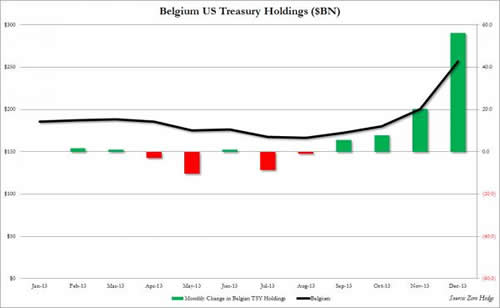

US TREASURIES - EU to the Rescue? China Sold Second-Largest Amount Ever Of US Treasurys In December: And Guess Who Comes To The Rescue 02-18-14 Zero Hedge The chart below shows holdings of Chinese Treasurys in a nutshell: Chinese Treasury holdings plunged by the most in two years, after China offloaded some $48 billion in paper, bringing its total to only $1268.9 billion, down from $1316.7 billion, and back to a level last seen in March 2013! This was the second largest dump by China in history with the sole exception of December 2011. That this happened at a time when Chinese FX reserves soared to all time highs and not investing in US paper should be quite troubling to anyone who follows the nuanced game theory between the US and its largest external creditor, and the signals China sends to the world when it comes to its confidence in the US. Yet what was truly surprising is that despite the plunge in Chinese holdings, and Japanese holdings also dropped by $4 billion in December, ... is that total foreign holdings of US Treasurys increased in December, from $5716.9 billion to 5794.9 billion. Why? Because of this country. Guess which one it is without looking at legend. That's right: at a time when America's two largest foreign creditors, China and Japan, went on a buyers strike, the entity that came to the US rescue was Belgium, which as most know is simply another name for... Europe: the continent that has just a modest amount of its own excess debt to worry about. One wonders what favors were (and are) being exchanged behind the scenes in order to preserve the semblance that "all is well"? |

02-24-14 | 23 - US Reserve Currency | |

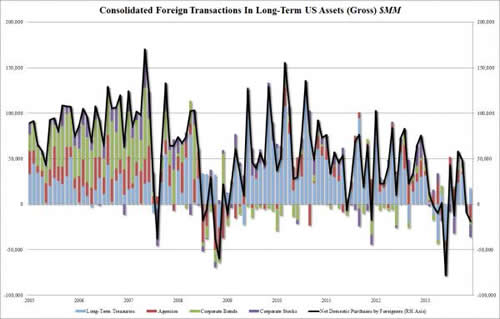

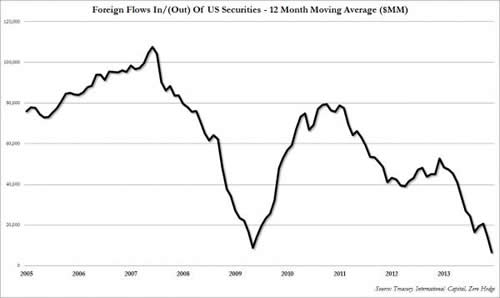

GLOBALIZATION TRAP - Foreign Purchases Suggest Slowing Global Economies with less Easy Credit to Invest Scary Chart Of The Day: Average Foreign Purchases Of US Securities Take Out Lehman Low 02-18-14 Zero Hedge For whatever reason China sold the second biggest amount of US Treasurys in December. However, that was only part of the story. In fact, while the two largest US foreign creditors were net sellers, total foreign bond holdings actually rose in the last month of 2013 and as the chart below confirms, when it comes to Long-Term Treasury paper, foreigners were actually buyers of some $18 billion in Treasurys. It is everything else that they sold in the month when the S&P hit its all time high: specifically, foreigners were net sellers of

.. something which hardly fits with the narrative of the record stock market high generating confidence in even more buying down the line. In the chart above it is the black line - gross purchases of US long-term securities - that is the most troubling, as its trend is hardly anyone's friend. So what happens when one smooths out the line to normalize for monthly fluctuations? This: The chart is very disturbing: it shows that as the S&P rises higher and higher (on ever declining volumes), foreigners are buying fewer and fewer US securities. In fact, on a 12 Month Moving Average basis, foreigners bought less long-term US securities than they did when Lehman crashed! Luckily we live in a New Normal when price is no longer determined by simple supply and demand (and certainly not from retail investors who have long since given up on the fraudulent, broken US capital "markets") but Fed jawboning of

And so we have come full circle, because while, understandably, nobody had any appetite for US securities around the Lehman crash until the Fed stepped in and singlehandedly took over the US capital markets it was unclear if there even would be a US capital markets. Now five years later the S&P has risen to a level nearly three times the March 2009 lows thanks entirely to the Fed's $4.1 trillion balance sheet backstop, the interest in US securities is... lower than it was in the days just after Lehman! Source: TIC |

02-24-14 | 23 - US Reserve Currency | |

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - February 23rd - March 2nd | |||

| RISK REVERSAL | 1 | ||

| JAPAN - DEBT DEFLATION | 2 | ||

| BOND BUBBLE | 3 | ||

EU BANKING CRISIS |

4 |

||

| SOVEREIGN DEBT CRISIS [Euope Crisis Tracker] | 5 | ||

| CHINA BUBBLE | 6 | ||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - HARD ASSETS | PORTFOLIO | ||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS | |||

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

2011 2012 2013 2014 |

|||

| THEMES | |||

| FLOWS -FRIDAY FLOWS | THEME | ||

| SHADOW BANKING -LIQUIDITY / CREDIT ENGINE | THEME | ||

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| ECHO BOOM - PERIPHERAL PROBLEM | THEME | ||

| PRODUCTIVITY PARADOX -NATURE OF WORK | THEME | ||

| STANDARD OF LIVING -EMPLOYMENT CRISIS | THEME | ||

| CORPORATOCRACY -CRONY CAPITALSIM | THEME |  |

|

CORRUPTION & MALFEASANCE -MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| SOCIAL UNREST -INEQUALITY & A BROKEN SOCIAL CONTRACT | THEME | ||

| SECURITY-SURVEILLANCE COMPLEX -STATISM | THEME | ||

| GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | THEME | ||

| CENTRAL PLANINNG -SHIFTING ECONOMIC POWER | THEME | ||

| CATALYSTS -FEAR & GREED | THEME | ||

| GENERAL INTEREST |

|

||

| TO TOP | |||

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP