|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Thurs. July 2nd, 2015

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

![]()

| JUNE | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 |

| 28 | 29 | 30 | 1 | 2 | 3 | 4 |

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar Weakness |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

TIPPING POINTS |

|||

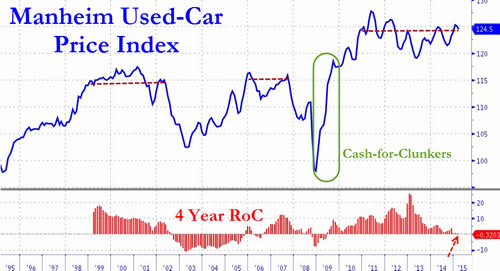

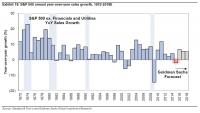

SUB-PRIME ECONOMY -Auto Loans Just as Used Car prices start to roll over again... (for the first time since the financial crisis, 4-year price changes - average term then - are now negative)

Worse yet, the most popular compact car prices are down 5.2% YoY and mid-size down 1.9% YoY. As Goldman notes,

|

07-02-15 |

SUB-PRIME ECONOMY |

|

| 07-02-15 |

SUB-PRIME ECONOMY |

|

|

Tyler Durden on 06/24/2015 20:30 -0400

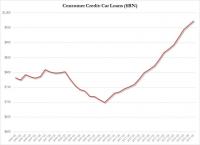

Auto Loans In "Untested" Territory Blackstone Warns As Subprime ABS Sales AccelerateEarlier this month, we gave readers a snapshot of the US auto market on the way to explaining why it was that car sales hit a 10-year high in May. To recap:

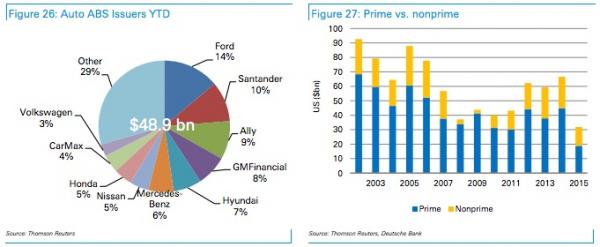

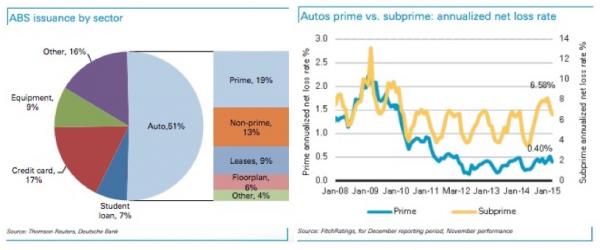

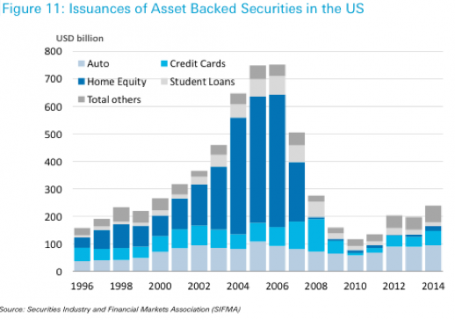

We went on to note that despite the worrying statistics shown above, optimists (like Experian) will likely point to the fact that the average FICO score for borrowers financing new cars fell only slighty from 714 to 713 Y/Y while the same Y/Y scores for those financing used vehicles actually rose from 641 in Q1 2014 to 643 in Q1 2015. While that's all well and good, there's every indication that those figures are likely to deteriorate significantly going forward. Why? Because Wall Street's securitization machine is involved. in the consumer ABS space (which encompasses paper backed by student loans, credit cards, equipment, auto loans, and other, more esoteric types of consumer credit), auto loan-backed issuance accounts for half of the market and a quarter of auto ABS is backed by loans to subprime borrowers. Put simply, those subprime borrowers are getting subprimey-er. In other words, the same dynamic that prevailed in the US housing market prior to the collapse is at play in the auto loan market. Lenders are competing for borrowers as lucrative securitization fees beckon, and this competition is directly responsible for loose underwriting standards. Bloomberg has more on the interplay between auto ABS issuance and “stretched” auto loan terms:

Here's a visual overview of the auto loan-backed ABS market (note the resurrgence of subprime as a percentage of total issuance post-2009 and the rising net loss rates):

* * * The takeaway here is simple: under pressure to keep the US auto sales miracle alive and feed Wall Street's securitization machine (which is itself driven by demand from yield-starved investors) along the way, lenders are lowering their underwriting standards and extending loans to underqualified borrowers. Particularly alarming is the fact that even as average loan terms hit record highs, average monthly payments are not only not falling, but are in fact also sitting at all-time highs. This cannot and will not end well. |

|||

Submitted by Tyler Durden on 02/21/2015 20:14 -0400 Subprime Car Loan Bubble 2.0 Full FrontalWith the total balance of auto loans for new and used vehicles approaching $1 trillion in the U.S., the folks at Experian want you to know that no matter what the numbers say, there’s no speculative bubble forming in the industry. Just ask Melinda Zabritski, the group’s director of automotive finance, who is quick to dismiss the growing chorus of Chicken Littles who are concerned about subprime auto lending:

That would be great if it were true. Of course the reality is that, according to the NY Times, early delinquencies (i.e. borrowers who have missed a payment within 8 months of origination) are at their highest level since 2008:

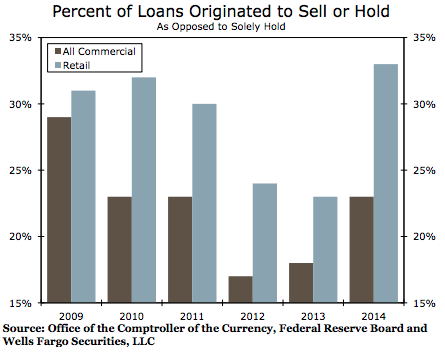

Combine that with the fact that the percentage of total auto loan originations made to subprime borrowers surged to 27% in 2013 (the highest level since 2006), the same year that 1.1 million U.S. households took out auto title loans (i.e. the new home equity loan), and you’ve got a rather strong argument for the contention that anything we learned in 2008 about the perils of loose lending standards has now been completely forgotten. Reinforcing this point is Wells Fargo, who notes that things are now officially back to “normal,” where “normal” is amusingly defined by the conditions that prevailed in 2006:

Of course the bad news is that Americans are again overextended at just the wrong time:

The prudent thing to do, from a lender’s perspective, is to tighten standards when it appears borrowers are exhibiting a propensity to take on an undue amount of risk. Instead, standards are actually falling as risk-taking increases:

And, not surprisingly, recklessness is most prevalent in the two categories that have combined to underpin consumer credit growth post-crisis:

Most disturbing of all, lenders seem to have reverted to their pre-crisis mindset: “If we can sell the loan, who cares about the creditworthiness of the borrower?” In 2014, a third of all firms originated retail loans with the intent to sell or hold the loan (as opposed to the sole intention to hold the loan). This trend indicates that some firms could be extending loans that they consider less creditworthy and could be eager to get these higher-risk loans off of their balance sheets. As a reminder, ABS issuance hit its highest level since the crisis last year with student and auto loans accounting for the lion’s share. That's no coincidence. |

|||

"BEST OF THE WEEK " MOST CRITICAL TIPPING POINT & THEMES ARTICLES THIS WEEK June 28th, 2015 - July 4th, 2015 |

|||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

GEO-POLITICAL EVENT RISK - Greece, Puerto Rico, China and France Greece Will Default To IMF Tomorrow, Government Official SaysTyler Durden on 06/29/2015Earlier today, as the exchange between Greece and its creditors got increasingly belligerent, Estonian Prime Minister Taavi said that "Greece’s debt would still remain outstanding and creditors would expect this money back." So did this latest antagonism change the Greek mind? According to a flash headline by the WSJ released moments ago, not all. In fact, Greece just made it official that it would default to the IMF in just over 24 hours: "Greece won't pay IMF tranche due Tuesday, government official says"

Puerto Rico Announces Bond Payment "Moratorium" Tyler Durden on 06/29/2015 Tyler Durden on 06/29/2015

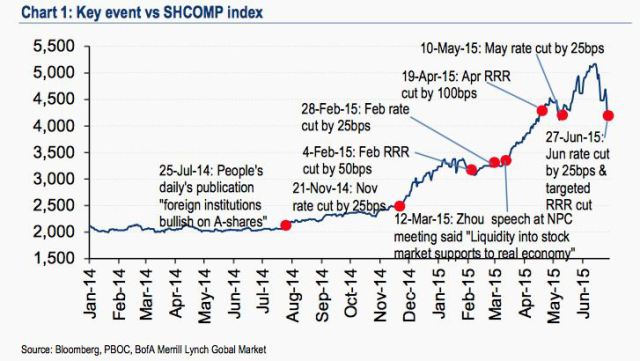

Having concluded last night that Puerto Rico debt is "unpayable," and that his government could not continue to borrow money to address budget deficits while asking its residents, already struggling with high rates of poverty and crime, to shoulder most of the burden through tax increases and pension cuts, Padilla confirmed tonight that: PUERTO RICO TO SEEK "NEGOTIATED MORATORIUM", 'YEARS' OF POSTPONEMENT IN DEBT PAYMENTS. Likening his state's situation to that of Detroit and New York City (though not Greece), Padilla concluded, the economic situation is "extremely difficult," which is odd because just a few years ago when they issued that bond - everything was awesome? Strap In! China Is Crashing Again Tyler Durden on 06/29/2015 Tyler Durden on 06/29/2015

In the last 2 days, PBOC has thrown everything at the ponzi-fest they call a rational market. An RRR cut, a Benchmark rate cut, a rev repo rate cut, a CNY50 Bn rev repo injection, a stamp duty cut, IPO halts (cut supply), and last but not least permission to speculate with a reassurance that shares on a solid foundation. The outcome of all this policy-panic - CHINEXT (China's Nasdaq) is down another 6% today (down 25% in 3 days) and aside from CSI-300 futures, all other major Chinese indices are in free-fall. Add to that the fact that industrial metals are collapsing with steel rebar limit down and it appears Central Bank Omnipotence is under threat. French Economy In "Dire Straits", "Worse Than Anyone Can Imagine", Leaked NSA Cable Reveals Tyler Durden on 06/29/2015 Tyler Durden on 06/29/2015

Moscovici who served as French finance minister until 2014 and then became European commissioner for Economic and Financial Affairs, Taxation and Customs, used some very colorful language, i.e., the French economic situation was "worse than anyone [could] imagine and drastic measures [would] have to be taken in the next two years”. |

06-30-15 | GLOBAL RISK | 3 - Geo-Political Event |

| 06-30-15 | GLOBAL RISK | 3 - Geo-Political Event | |

| Posted by Cliff Küle at 6/30/2015 04:53:00 PM | |||

16 Facts1. On Monday, the Dow fell by 350 points. That was the biggest one day decline that we have seen in two years.

|

|||

| 06-30-15 | GLOBAL RISK | 3 - Geo-Political Event | |

| Posted by Cliff Küle at 6/30/2015 05:58:00 AM | |||

The Euro CrisisAlasdair Macleod sees the criticality of the Greek crisis as being central to the solvency of the European Central Bank (ECB) itself & therefore confidence in the euro currency .. "The ECB's balance sheet, which is heavily dependent on Eurozone bond prices not collapsing, is itself extremely vulnerable to the knock-on effects from Greece. As the situation at the ECB becomes clear to financial markets, the euro's legitimacy as a currency may be questioned, given it is no more than an artificial construct in circulation for only thirteen years. In conclusion, the upsetting of the Greek applecart risks destabilizing the euro itself, and a sub-par rate to the U.S. dollar beckons."

|

|||

| 06-30-15 | GLOBAL RISK | 3 - Geo-Political Event | |

| Posted by Cliff Küle at 6/30/2015 05:56:00 AM | |||

Europeans Rush to Gold Coins as Bank of Greece Stops SalesBloomberg reports that European investors are increasing their purchases of gold as Greece's crisis intensifies .. "Investors are searching for a safe haven after Greece imposed capital controls, closed banks and stopped selling gold coins to the public until at least July 6."

|

|||

| CHINA BUBBLE | 4 | ||

Early China Strength Fades Fast As Margin Debt Plunges Most In 3 YearsWed, 01 Jul 2015 05:16:47 GMTFollowing the much-celebrated (and massive 13% swing low-to-high) bounce yesterday at the hands of a desperate PBOC, the morning session ended with an early boost fading. Shanghai margin debt has now suffered the longest streak of declines in 3 years and as BofAML warned they "doubt that this marks the end of the de-leveraging process in the stock market given that much of the leveraged positions are yet to unwind." With both Manufacturing and Services PMIs printing above 50, stimulus is now clearly aimed at maintaining the bubble but as BofAML concludes, "after this adverse experience, we expect many investors will be much more cautious before investing into the stock market, we will be surprised to see a return of the unbridled enthusiasm of investors any time soon."

Not the follow through everyone was hoping and praying for after Greece defaulted... To summarize:

* * * Longer term, the psychological damage from the two-week long sharp market decline may linger for a while. This means that any market rebound will unlikely be strong in our view.

|

|||

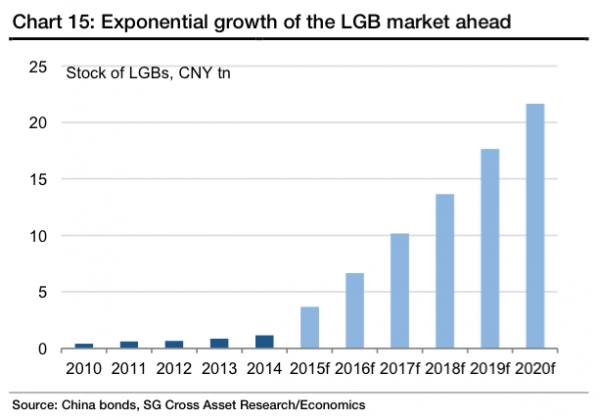

Chinese QE Calls Officially Begin: Bond Swap "Sucks Liquidity", "Contributes To Stock Slump", Broker ClaimsPosted:Wed, 01 Jul 2015 00:40:00 GMTOn Monday, we highlighted what we called an “insane” debt chart and explained what it means for the PBoC. Here’s a recap:

As a reminder, we've long said China's LGB refi initiative would eventually form the backbone of Chinese QE. Here is what we said in March when the program was in its infancy: "It seems as though one way to address the local government debt problem would be for the PBoC to simply purchase a portion of the local debt pile and we wonder if indeed this will ultimately be the form that QE will take in China." Similarly, UBS has suggested that when all is said and done, the PBoC will end up buying the new munis outright. From a March client note:

And so, here we are barely a month into the new LGB debt swap initiative (which, you're reminded, hasalready morphed into a Chinese LTRO program after the PBoC, recognizing that banks would be generally unwilling to take a 300bps hit in the swap, promised to allow participating banks to pledge the new munis for cash loans which can then be re-lent in the real economy at 6-7%) and the calls have begun for outright QE. Here's Bloomberg:

Note that this rather hyperbolic appeal for implementing full-on QE in China checks all the boxes: there's a reference to bond market illiquidy, an assertion about constraints on bank balance sheets (which, with credit creation stalling in China, is a big deal), and most importantly, a contention that somehow, the LGB debt swap program is contributing to the implosion of China's all-important equity bubble. A few more 'independent' assessments like these is likely all the PBoC will need to justify joining the global QE parade.

|

|||

How China Lost an Entire Spain in 17 DaysPosted:Tue, 30 Jun 2015 22:58:45 GMTBy EconMatters Concerned about a tumbling equity market, PBOC moved to cut both interest rates and the reserve requirement ratio for banks over the weekend. However, increasingly wary of a market bubble in China, investors still sent Shanghai Composite spiraling down another 3.3% on Monday after the dramatic 7.4% plunge last Friday despite the support from the central bank.

Investors are also unnerve by the latest development of Greece just days before a total default and Grexit out of EU, and the news that Puerto Rico could become another Greece of the U.S. facing a financial crisis and cannot pay back its $70 billion in municipal debt. Read: China's $370 Billion Margin Call VIX Spike MarketWatch reported that VIX spiked 33% to above 18, the highest since February, implying that investors are very nervous about the chaos going around. Beijing Targets Soft Landing? If you think U.S. stocks are lofty trading at an average of 16 times last year's earnings, the average Chinese stock is now trading at 30 times earnings. Analysts at HSBC think the China's central bank was trying to engineer a "soft landing" for stocks. But this could be a difficult balancing act trying to shore up investors' confidence while keeping a lid on the speculative fever among Chinese retailer investors (Remember those Chinese housewives who bought up 300 tons of gold and made Goldman Sachs swallow their gold selling recommendation?) Read: Is China Under The Skyscraper Curse? $1.3 trillion, an Entire Spain, in 17 Days

Size Does Matter Only time will tell if Beijing's able to turn the situation (i.e. slowing economy with a bubbling equity market) around. But if the world's biggest trading nation suddenly has a crisis of some sort, it would be a catastrophe of a different scale. Size does matter when it comes to financial collapse, and China could do far worse damage than any Grexit or PIIGS debt default. Chart Source: Quartz |

|||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| STUDY - FUNDAMNENTALS | |||

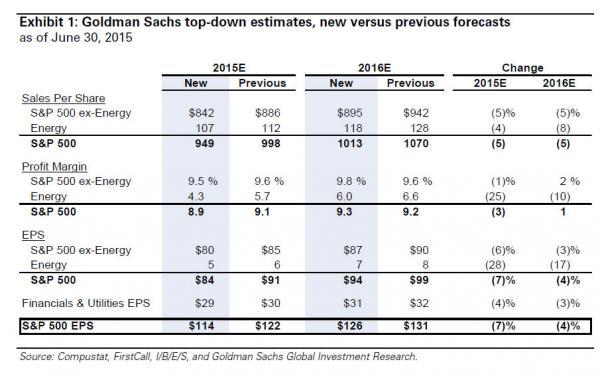

FUNDAMENTALS -The Truth "Slipped Out" Under Cover of Political Turmoil Goldman Just Crushed The "Strong Fundamentals" Lie; Cuts EPS, GDP, Revenue And Profit Forecasts Tyler Durden on 06/30/2015 Tyler Durden on 06/30/2015

To summarize: the first revenue drop for the S&P in 5 years, a major downward revision in EPS now expecting just 1% increase in 2015 EPS, a 25% cut to GDP forecasts, a machete taken to corporate profits and 10 Yields, and not to mention double digit sales declines for some of the most prominent tech companies in the world. And that, in a nutshell, is the "strong fundamentals" that everyone's been talking about. SEE BELOW FOR EXPANDED ARTICLE DETAIL

Gross Says Hold Cash, Prepare For "Nightmare Panic Selling" Submitted by Tyler Durden on 06/30/2015 - 15:21 Submitted by Tyler Durden on 06/30/2015 - 15:21

That an ETF can satisfy redemption with underlying bonds or shares, only raises the nightmare possibility of a disillusioned and uninformed public throwing in the towel once again after they receive thousands of individual odd lot pieces under such circumstances.

|

07-01-15 | STUDY | |

| 07-01-15 | STUDY | ||

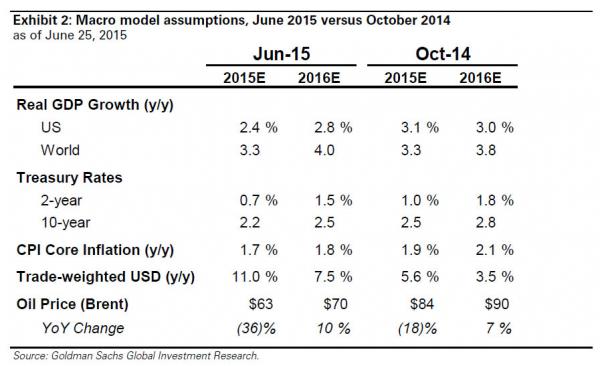

Goldman Just Crushed The "Strong Fundamentals" Lie; Cuts EPS, GDP, Revenue And Profit ForecastsPosted:Wed, 01 Jul 2015 02:15:06 GMTIn the past week, the one recurring theme among the permabullish parade on financial propaganda TV has been to ignore the closed stock market and banks in suddenly imploding Greece, the situation in Puerto Rico, the recent plunge in US stocks which are now unchanged for the year, and what may be the beginning of the end of the Chinese bubble and instead focus on the "strong" US fundamentals, especially among tech stocks - the only shiny spot an an otherwise dreary landscape (and definitely ignore the energy companies; nobody wants to talk about those). So we decided to take a look at just what this "strength" looks like. Well, we already saw the collapse in hedge fund hotel Micron Technology, which plunged 30% after it slashed its guidance last week. Alas that may be just the beginning. Here are the year-over-year revenue "growth" estimates for some of the biggest tech companies in Q2:

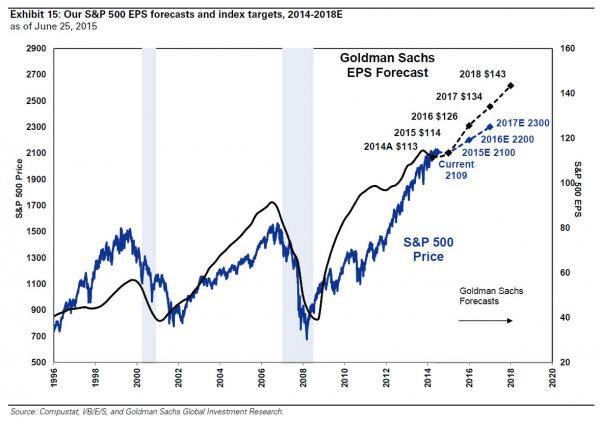

And that is the best sector among the "strong fundamentals" story. In fact, the only bright light in the entire tech space may well be AAPL whose sales are expected to grow 29%. We wish Tim Cook lot of strength if the recent Chinese market crash has dampened discretionary spending and demand for AAPL gizmoes in China. He will need it. But what's worse is that while reality will clearly be a disaster, there is always hype and always hope that the great rebound is just around the corner, if not in Q2 then Q3, or Q4, etc. This time even the hype is be over because none other than the most influential bank on Wall Street, the one all other sellside "strategists" religiously imitate, Goldman Sachs, just slashed its EPS and S&P500 year end price forecast for both 2015 and 2016. Here is Goldman with its explanation why it is lowering S&P 500 EPS:

However...

So earnings are bad and getting worse, but for Goldman that is not a reason to cut its S&P forecast simply because the economy is weaker than expected and also getting worse which means the rate hike originally forecast to take place in June is now set to take place in December, and thus boost P/E multiples (it won't of course but that will be Greece's fault).

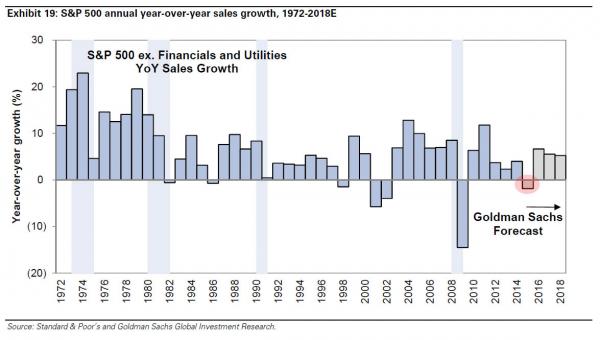

So... the combination of deteriorating earnings and an even bigger slowdown in the economy ends up being a wash and keeping the S&P year end price target at 2100. Ah, the magic of financial Goldman's financial gibberish. So aside from Goldman's 21x forward multiple (because 114 non-GAAP is about 100 GAAP which means Goldman is expecting a 21 Price to GAAP Earnings multiple) simply due to the Fed's hike delay from June to December, is there any good news? No. In fact, this is what Goldman's David Kostin has to say: "Macro headwinds diminish 2015 earnings growth prospects. S&P 500 sales will fall by 2% in 2015, the first annual decline in five years. Margins will slip to 8.9%. Energy is a drag on both sales and margins." Let's just focus on the "near-term" slip before we worry about the "long-term rebound." And before the intrepid questions of "this is only due to energy" arise, here is Goldman explaining that the weakness was broad, and impacted every single sector.

But wait, there's more: because in addition to its EPS forecast, Goldman also slashed its GDP and the 10Y yield forecast as well.

So ok, Goldman had a 25% error in its forecast in just under 9 months. Does that mean that the vampire squid is even remotely remorseful or concerned about the credibility of its 2017 and 2018 (yes, 2018) forecasts? Not at all: those are expected to remain completely unchanged on the back of some of the highest EPS gains in recent history. In fact, putting in context, Goldman now expects just 1% EPS growth in 2015 which will then magically soar to 11% in 2016 before "stabilizing" to a "modest" 7% annual EPS growth rate.

With just a little hyperbole, we can say that the only way S&P EPS will grow at that pace is if the S&P ends up buying back half its float. But while one can double seasonally adjust non-GAAP BS until a massive loss becomes a huge profit, one item can not be fabricated: sales. It is here that Goldman has far less to say for obvious reasons.

Yes you read that right "sales per share", because if buybacks can boost Non-GAAP earnings, why not revenues too. If there is a silver lining on the horizon it is one: "We forecast Health Care will grow sales faster than consensus expects." The corporations thank you Obamacare. * * * So to summarize: the first revenue drop for the S&P in 5 years, a major downward revision in EPS now expecting just 1% increase in 2015 EPS, a 25% cut to GDP forecasts, a machete taken to corporate profits and 10 Yields, and not to mention double digit sales declines for some of the most prominent tech companies in the world. And that, in a nutshell, is the "strong fundamentals" that everyone's been talking about.

|

|||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THEMES | |||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

FINANCIAL REPRESSION Is Financial Repression Here to Stay?

The First Chairman of the UK's Financial Services Authority Howard Davies writes an essay on financial repression .. "Maybe it is unreasonable for investors to expect positive rates on safe assets in the future. Perhaps we should expect to pay central banks and governments to keep our money safe, with positive returns offered only in return for some element of risk." .. Davies worries about the consequences of financial repression on the economy .. he sees distortions from the prudential regulation adopted in reaction to the financial crisis - "The question for regulators is whether, in responding to the financial crisis, they have created perverse incentives that are working against a recovery in long-term private-sector investment."

BCA Research Chief Economist Martin Barnes: "Financial Repression is Here to Stay" BCA Research's Chief Economist Martin Barnes sees financial repression as "here to stay" for the long-term, given the challenges of low economic growth & high debt globally .. Barnes has written a special report to explain why debt burdens are moe likely to rise than fall over the short & long run given demogaphic trends & the low odds of another economic boom .. BCA Research: "If governments cannot easily bring debt ratios down to more sustainable levels, then the obvious solution is to make high debt levels easier to live with. This can be done be keeping real borrowing costs down and by regulatory pressures that encourage financial institutions to hold more government securities. In other words, financial repression is the inevitable result of a world of low growth and stubbornly high debt. Martin argues that central banks are not overt supporters of financial repression, but they certainly are enablers because they have no other options other than to keep rates depressed if they cannot meet their growth and/or inflation targets. A world of financial repression is an uncomfortable world for investors as it implies continued distortions in asset prices, and it is bound to breed excesses that ultimately will threaten financial stability." LINK HERE to the Article & Link to Report

The Era of Financial Repression: Norway's Sovereign Wealth Fund says Monetary Policy is a Risk to Watch

“Monetary policy does affect pricing in today’s market to such an extent that monetary policy itself has been a risk you have to watch .. Investors are focused more on monetary policy changes than has been generally the case, than at any time, as far as I can remember .. As anything that moves prices is a risk that has to be monitored, here the effects of monetary policy affect prices dramatically .. It’s of course always been the case with long rates, and now more significantly with the currency. That’s just a fact of the current market." - Yngve Slyngstad, chief executive officer of Norway’s $890 billion sovereign-wealth fund "Financial repression is not a conspiracy theory, it is rather a collective set of macroprudential policies focused on controlling and reducing excessive government debt through 4 pillars - negative interest rates, inflation, ring-fencing regulations and obfuscation - to effectively transfer purchasing power from private savings." - The Financial Repression Authority

|

06-29-15 | ||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME |  |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP