|

JOHN RUBINO'SLATEST BOOK |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Tue. Aug. 18th, 2015

Follow Our Updates

onTWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

ANNUAL THESIS PAPERS

FREE (With Password)

THESIS 2010-Extended & Pretend

THESIS 2011-Currency Wars

THESIS 2012-Financial Repression

THESIS 2013-Statism

THESIS 2014-Globalization Trap

THESIS 2015-Fiduciary Failure

NEWS DEVELOPMENT UPDATES:

FINANCIAL REPRESSION

FIDUCIARY FAILURE

WHAT WE ARE RESEARCHING

2015 THEMES

SUB-PRIME ECONOMY

PENSION POVERITY

WAR ON CASH

ECHO BOOM

PRODUCTIVITY PARADOX

FLOWS - LIQUIDITY, CREDIT & DEBT

GLOBAL GOVERNANCE

- COMING NWO

WHAT WE ARE WATCHING

(A) Active, (C) Closed

MATA

Q3 '15- Chinese Market Crash

(A)

Q3 '15-

GMTP

Q3 '15- Greek Negotiations

(A)

Q3 '15- Puerto Rico Bond Default

MMC

OUR STRATEGIC INVESTMENT INSIGHTS (SII)

NEGATIVE-US RETAIL

NEGATIVE-ENERGY SECTOR

NEGATIVE-YEN

NEGATIVE-EURYEN

NEGATIVE-MONOLINES

POSITIVE-US DOLLAR

ARCHIVES

| AUGUST | ||||||

| S | M | T | W | T | F | S |

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 | 31 | |||||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar Weakness |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?We have analyzed & included

these in our latest research papers Macro videos!

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

TODAY'S TIPPING POINTS

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

China Stocks Crash, More Than Half Of Market Halted Limit Down; PBOC Loss Of Control Spooks Global Assets Submitted by Tyler Durden on 08/18/2015 - 08:09 Submitted by Tyler Durden on 08/18/2015 - 08:09

Just hours after the PBOC announced a modestly "revalued" fixing in the CNY, which curiously led to weaker trading in the onshore Yuan for most of the day before a forceful last minute intervention by the central bank pushed it back down to 6.39 it was the local stock market spinning plate - which had been relatively stable during the entire FX devaluation process - that China lost control over, and after 7 days of margin debt increases the Shanghai Composite plunged by 6.2% in late trade, tumbling 245 points to 3748, just 240 points above its recent trough on July 8, a closing level some 27% off its June peak. Indonesia Impaled: Currency Crashes To 1998 Asian Crisis Low As Exports CraterOn Monday we laid out the rather dire road ahead for the world’s emerging economies in the face of China’s entry into the global currency wars. The path ahead is riddled with exported deflation and decreased trade competitiveness for a whole host of emerging economies [and] all of this is set against a backdrop of declining global growth and trade, a trend which many had assumed was merely cyclical, but which in fact may prove to be structural and endemic." Well don’t look now, but trade just collapsed for Indonesia as exports and imports plunged 19.2% and 28.4% (more than double to consensus estimate), respectively in July. Meanwhile, the rupiah is sitting near multi-decade lows. Asian Currency Crisis Continues As China Holds, Malaysia Folds, & Japan Heads For Quintuple Dip Recession Submitted by Tyler Durden on 08/16/2015 - 21:21 Submitted by Tyler Durden on 08/16/2015 - 21:21

Asia got off to an inauspicious start this evening with Japan printing a disappointing 1.6% drop in GDP - heading for its fifth recession in 6 years... so much for Abenomics, but, of course, Amari spewed forth some standard propaganda that he expects Japan to recover moderately (and Japanese stocks popped modestly assuming moar QQE). Then Malaysia continued its collapse with the Ringgit down another 1% hitting fresh 17-year lows and stocks dropping further, as the Asian Currency crisis continues. Heading into the China open, offshore Yuan signaled further devaluation but the CNY Fix printed very modestly stronger at 6.3969; and following last week's best gains in 2 months, Chinese stocks are plunging at the open after Chinese farmers extend their streak of margin debt increases. Finally, WTI Crude drifted back to a $41 handle in early futures trading. Futures Flat As Oil Drops To Fresh 6 Year Low; EM Currencies Crumble Under Continuing FX War Submitted by Tyler Durden on 08/17/2015 - 06:27 Submitted by Tyler Durden on 08/17/2015 - 06:27

It was a relatively quiet weekend out of China, where FX warfare has taken a back seat to evaluating the full damage from the Tianjin explosion which as we reported on Saturday has prompted the evacuation of a 3 km radius around the blast zone, and instead it was Japan that featured prominently in Sunday's headlines after its Q2 GDP tumbled by 1.6% (a number which would have been far worse had Japan used a correct deflator), and is now halfway to its fifth recession in the past 6 year, underscoring Abenomics complete success in desrtoying Japan's economy just to get a few rich people richer. Of course, economic disintegration is great news for stocks, and courtesy of the latest Yen collapse driven by the bad GDP data which has raised the likelihood of even more Japanese QE, the Nikkei closed 100 points, or 0.5% higher.

|

08-18-15 | TP - CHINA THEMES ECHO BOOM

|

4 - China Hard Landing |

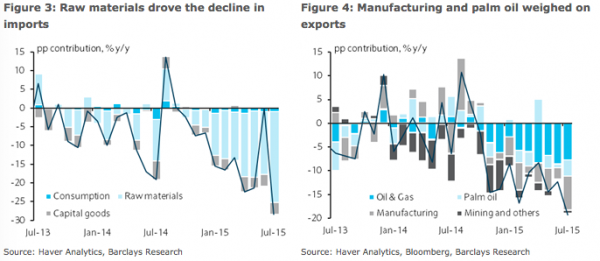

Submitted by Tyler Durden on 08/18/2015 07:53 Indonesia Impaled: Currency Crashes To 1998 Asian Crisis Low As Exports CraterOn Monday we laid out the rather dire road ahead for the world’s emerging economies in the face of China’s entry into the global currency wars. The path ahead is riddled with exported deflation and decreased trade competitiveness for a whole host of emerging economies [and] all of this is set against a backdrop of declining global growth and trade, a trend which many had assumed was merely cyclical, but which in fact may prove to be structural and endemic." Well don’t look now, but trade just collapsed for Indonesia as exports and imports plunged 19.2% and 28.4% (more than double to consensus estimate), respectively in July. Imports of raw materials dove 24%. Manufacturing and palm oil exports fell 7.1% and 2.4%, respectively, nearly tripling June’s declines. Oil and gas exports fell nearly 8%. Meanwhile, Bank of Indonesia kept its policy rate on hold at 7.5% and indeed the bank looks to be stuck in a dilemma similar to what we described earlier this month when we noted that "EM central bankers are grappling with slumping exports and FX-pass through inflation or, more simply, bankers are caught between a 'can’t cut to boost the economy' rock and a 'can’t hike to tame inflation' hard place. The rupiah, like the Malaysian ringgit, is trading near multi-decade lows and hit its weakest level since August 1998 earlier in the session.Depressed commodity prices and slumping demand from China aren’t helping. And neither is Beijing's devaluation of the yuan which means that suddenly, Indonesia has lost export competitiveness to China while anything China imports from Indonesia will now cost more. "We believe there is a strong case for the central bank remaining on hold this year," Barclays notes, adding that "BI is visibly more reluctant to weaken the IDR in the near term, to avoid stoking imported price pressures[and] the commodity drag due to weaker demand from China has not subsided." Similarly, Toru Nishihama, EM economist at Dai-ichi Life Research Institute says the "hurdle is higher for BI to cut rate due to the rupiah’s move even though inflation will slow toward year-end due to base effect from last year’s fuel price increase." Of course cuts, even if they do come, are now less effective in terms of boosting exports as the yuan devaluation puts upward pressure on regional NEER. In other words, there are no right answers. Just more pain and further pressure on the beleaguered economy and severely battered currency and further evidence that between China's entry into the global currency wars, depressed global commodity prices, the threat of an imminent Fed hike, and a generally lackluster environment for global demand and trade, the world's emerging markets face a perfect storm with no end in sight. |

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - August 16th, 2015 - August 22nd, 2015 | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market | |||

| TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

FINANCIAL REPRESSION The Unseen Consequences of Zero Interest Rate Policy Incrementum's Ronald-Peter Stöferle explains how central banks with a zero interest rate policy (ZIRP) in place are creating unintenddd consequences & associated adverse risks to investors & retirees .. it's financial repression .. "With artificial stimulus like ZIRP, we only end up with a situation in which governments, financial institutions, entrepreneurs, and consumers who should actually be declared insolvent all remain on artificial life support." .. with the unintended consequences being: 1. Conservative investors by nature come under increasing pressure with respect to their investments & take on excessive risks in light of the prospect that interest rates will remain low in the long term. This leads to capital misallocation & the emergence of bubbles. 2. The sweet poison of low interest rates leads to massive asset price inflation (stocks, bonds, works of art, real estate). 3. Structurally too low interest rates in industrialized nations due to carry trades lead to the emergence of asset price bubbles & contagion effects in emerging markets. 4. Changes in human behavior patterns occur, due to continually declining purchasing power. 5. As a result of the structurally too low level of interest rates, a 'culture of instant gratification' is created, which is among other things characterized by the fact that consumption is financed with credit instead of savings. 6. The medium of exchange and unit of account function of money increases in importance, while its role as a store of value declines. 7. Incentives for fiscal discipline decline. 8. Zombie banks are created: Low interest rates prevent the healthy process of creative destruction. 9. Banks are enabled to roll over potentially non-performing loans practically indefinitely & can thus lower their write-off requirements. 9. Newly created money is neither uniformly nor simultaneously distributed amongst the population

The Unintended Consequences of Financial Repression: "The Impossibility of Meeting Return Targets" Greenwich Associates conducted a study on German institutions .. some quotes from the study: “The low interest rate environment makes it impossible to meet return targets. We have not yet found a solution.” — German Public Pension Fund. “Low interest rates are a problem. As a reaction, we have globalized our investments and invested in higher risk asset classes.” — German Foundation “Primary challenge is the low interest rates. The only chance to avoid this is to do things you didn’t do before.” — German Insurer. For many institutions in Germany, “doing things they didn’t do before” means investing significant amounts of assets in something other than domestic & government bonds.

|

08-17-15 | ||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday Themes Post & a Friday Flows Post | |||

I - POLITICAL |

|||

| CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM | THEME | ||

- - CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | M | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MACRO w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MACRO w/ CHS |

III-FINANCIAL |

|||

| FLOWS -FRIDAY FLOWS | MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP