|

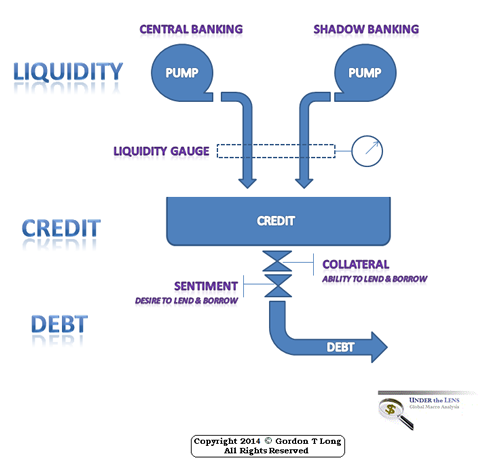

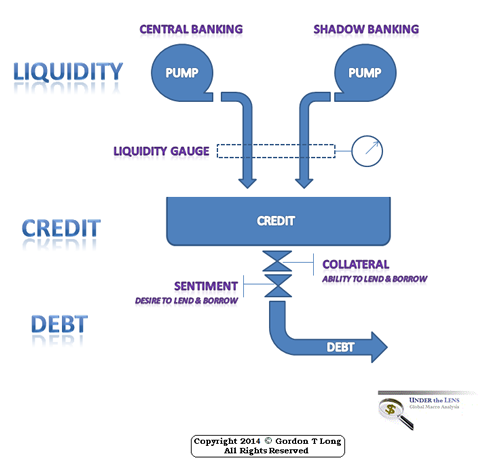

FLOWS: Liquidity, Credit and Debt

"Houston, We Have a Flow Problem!"

DRAMATICALLY SLOWING US FOREIGN FLOWS

READ MORE

"BEST OF THE WEEK "

|

Posting Date |

Labels & Tags |

TIPPING POINT or 2013 THESIS THEME |

HOTTEST TIPPING POINTS |

|

|

Theme Groupings |

MOST CRITICAL TIPPING POINT ARTICLES TODAY |

|

|

|

We post throughout the day as we do our Investment Research for:

LONGWave - UnderTheLens - Macro |

|

|

|

FRIDAY FLOWS

Liquidity, Credit & Debt

|

| FLOWS: Liquidity, Credit & Debt |

|

|

|

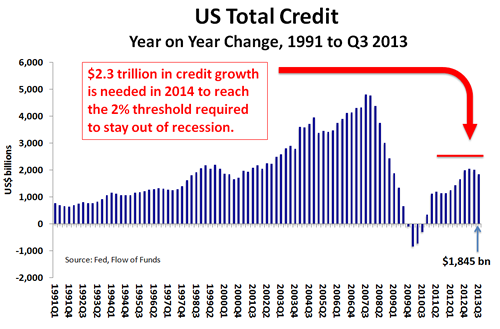

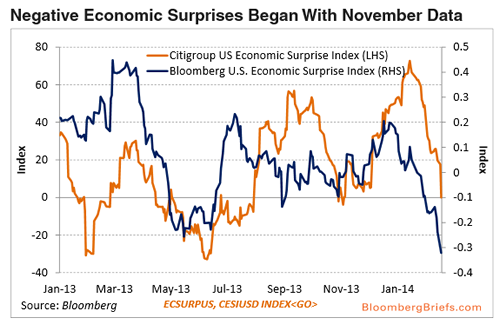

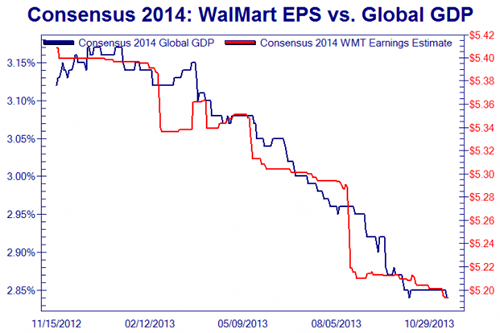

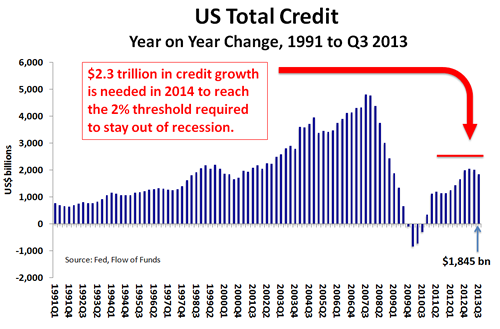

HALTING A COMING US RECESSION

Weak US Credit Growth Means…

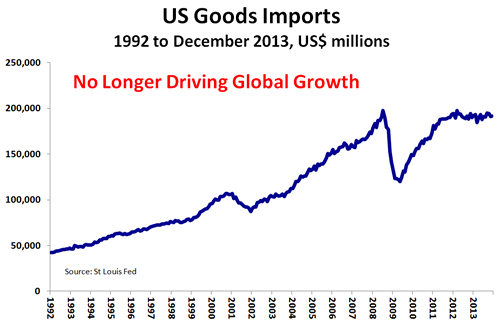

- Weak US Imports

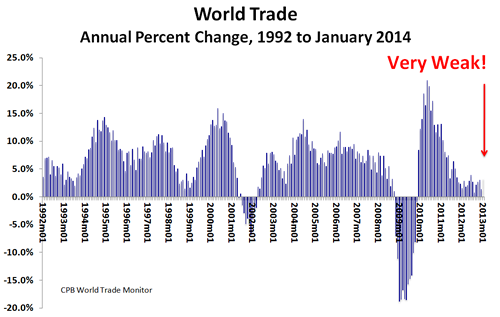

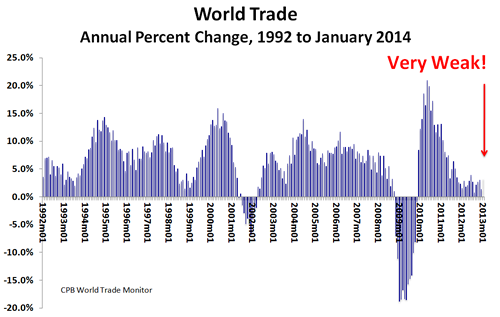

- Weak Global Trade

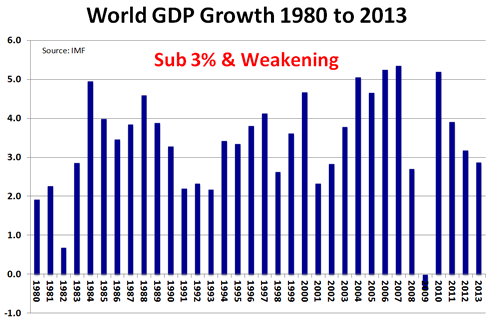

- Weak Global Economic Growth

…… And More Quantitative Easing

$2.3 TRILLION IN TOTAL US Y-o-Y CREDIT GROWTH REQUIRED

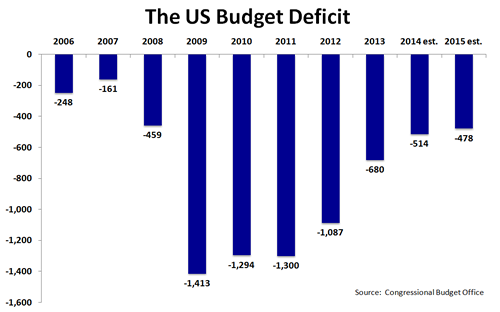

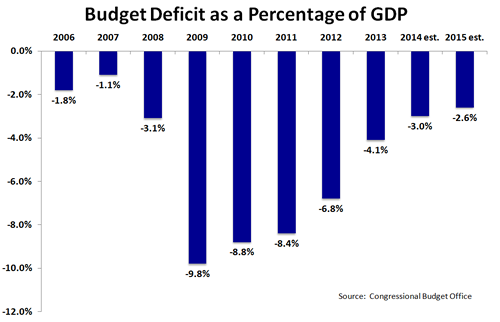

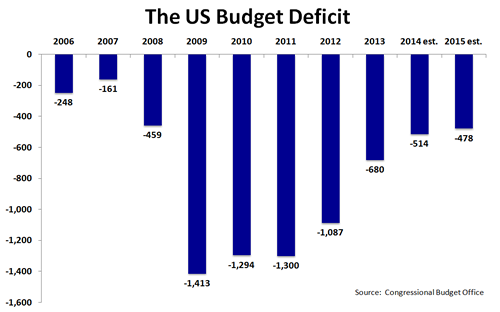

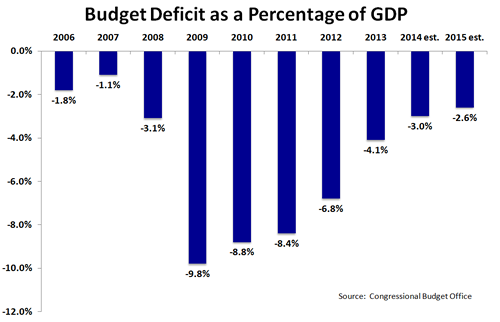

US BUDGET DEFICIT - GOOD NEWS IS BAD NEWS

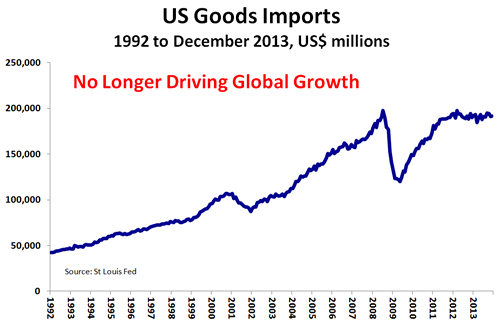

US IMPORTS - GOOD NEWS IS BAD NEWS

EXTREMELY WEEK WORLD TRADE - Houston We Have A Problem!

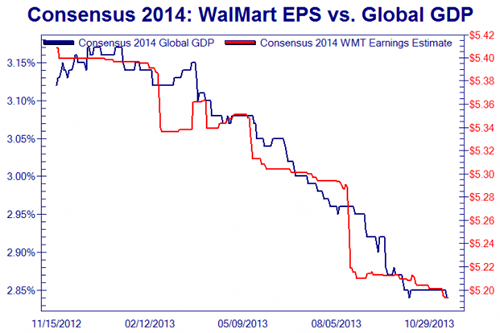

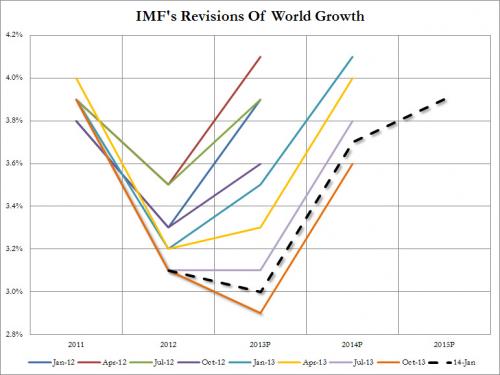

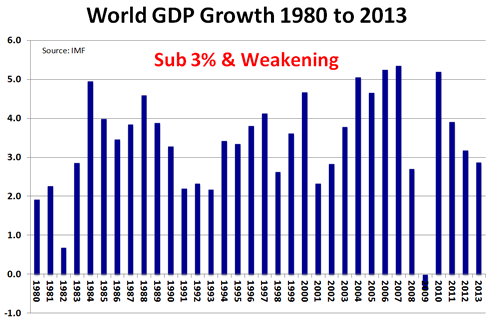

SUB 3% WORLD GDP GROWTH

CONCLUSION

Fed needs to increase liquidity rate $500B to $1T by 2nd half 2014 or the US experiences a recession and a dramatic correction in the US fiancial markets.

FLOWS: Liquidity, Credit and Debt

|

02-28-14 |

FLOWS |

FLOWS

|

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - February 23rd - March 2nd |

|

|

|

| RISK REVERSAL |

|

|

1 |

GLOBAL RISK - The World Economic Forum's 10 Global Risks of Highest Concern

|

Ten Global Risks of Highest Concern in 2014

| No. |

Global Risk |

| 1 |

Fiscal crises in key economies |

| 2 |

Structurally high unemployment/underemployment |

| 3 |

Water crises |

| 4 |

Severe income disparity |

| 5 |

Failure of climate change mitigation and adaptation |

| 6 |

Greater incidence of extreme weather events (e.g. floods, storms, fires) |

| 7 |

Global governance failure |

| 8 |

Food crises |

| 9 |

Failure of a major financial mechanism/institution |

| 10 |

Profound political and social instability |

Source: Global Risks Perception Survey 2013-2014. |

|

02-26-14 |

|

GLOBAL RISK |

Achieving Inclusive Growth

Inequality has become a global challenge that requires a wide range of policy actions – at the national, regional and global levels. But to address this problem effectively will require time, international coordination and patience.

At the 44th World Economic Forum Annual Meeting, how to achieve inclusive growth was front and centre from the start. In the opening session, Peter Kodwo Appiah Cardinal Turkson of Ghana, President, Pontifical Council for Justice and Peace, Vatican City State, read a special message by Pope Francis to participants. “I ask you to ensure that humanity is served by wealth, not ruled by it,” the leader of the Roman Catholic Church said.

Yet even before business, government and civil society leaders arrived at Davos-Klosters, the problem of inequality was at the top of their concerns. A survey of more than 1,500 experts from the World Economic Forum’s Network of Global Agenda Councils and Young Global Leaders and Global Shapers communities, which was published in the Outlook on the Global Agenda 2014 report, identified

- The widening income gap and

- Structural unemployment

as among the three main worries for world leaders this year.

“People always underestimate what Africa can be. By 2050, we will have a united Africa with one common market.”

Inequality has become a pervasive global problem – evident in developing and developed economies. On the eve of the Annual Meeting, Oxfam International released a briefing paper, which reported that:

nearly half of global wealth is owned by just 1% of the population and that the richest 85 people own the same as the bottom 3.5 billion, half the individuals in the world.

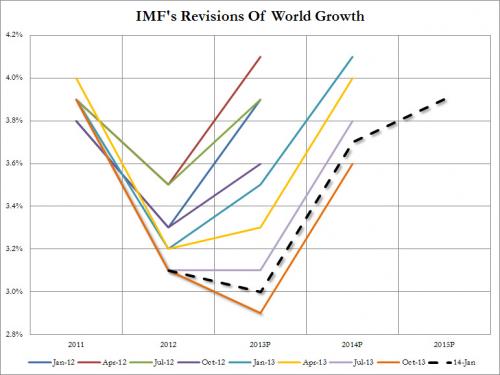

In considering strategies for inclusive growth, participants acknowledged that there were no quick fixes – even for such pressing problems of exclusion as youth unemployment. But there was general acceptance that with the US recovering, Europe starting to rebound and Japan apparently pulling itself out of deflation and stagnation, the sense of crisis is receding, giving economies more breathing space to tackle some thorny long-term concerns that hamper inclusion.

The question is whether the right reforms are put in place and there is sufficient collaboration among countries to address such challenges as the environment, the threat of another financial crisis, and the need for food, energy and water security. “This is a policy-sensitive year,” said Min Zhu, Deputy Managing Director, International Monetary Fund (IMF), Washington DC; World Economic Forum Foundation Board Member, in the Getting Back to Natural Growth session. “Restructuring and adjustment are essential.”

It is not sufficient for economies just to grow; the growth has to be inclusive, addressing disparities in income, age, gender, skills, access to technology, and opportunity. Africa’s economic growth may be accelerating, but “the concentration of wealth and power is excluding and locking out millions of people, which is driving insecurity and instability,” Winnie Byanyima, Executive Director, Oxfam International, United Kingdom, said during the session on Africa’s Next Billion.

So far, economic growth has been a race to the bottom. We need a race to the top so we have policies and regulation to protect human rights, the environment and reduce poverty.”

“The euro will remain a reliable and important currency and no one wants to change that.”

In the discussions on how to achieve inclusive growth, three long-term goals emerged as priorities:

- Creating jobs, particularly for young people,

- Promoting sustainability, and boosting economic resilience and

- Controlling the risks that may lead to another major financial crisis.

Participants agreed on a range of action points, all of which would require time to reap results.

I - A GLOBAL INFRASTRUCTURE DEFICIT

Consider the need to address the global deficit in infrastructure. The consulting company McKinsey & Company estimates that US$ 57 trillion will be required for infrastructure projects around the world from 2013 to 2030 – 36% more than the US$ 18 trillion actually spent globally on infrastructure over the past 18 years.

With interest rates low, company cash stockpiles high, economies rebounding and unemployment rates in many parts of the world still in double digits, now is the time to move on building, rebuilding and repairing facilities such as ports, airports, bridges and transport systems, said Lawrence H. Summers, Charles W. Eliot University Professor, Harvard University, USA, in The Future of Monetary Policy session. This will create jobs and drive inclusive growth. “It is tragic that we are bequeathing to our children a deficit in the form of massive deferred maintenance,” Summers observed.

II - GROWTH OF SMALL / MEDIUM ENTERPRISES (SME)

Promoting small and medium-sized enterprises, particularly through easing their access to financing, is another strategy for inclusive growth. SMEs are prime job creators, especially for young people and women. Investing in education, especially for girls and women, and in innovation are also important steps to take. In a session on Entrepreneurship, Education and Employment, Park Guen-hye, President of the Republic of Korea, said: “Creativity does not degrade the environment; it unlocks opportunities for sustainable growth. It is inherent to all people and therefore holds promise for inclusive growth.”

“To ensure sustainable health systems, we need to help communities build capabilities.”

The inclusive dividends of creativity and innovation will be limited without increased investment in education and R&D, especially in economies where post-crisis austerity measures cut budgets. But in several sessions, participants warned that private-sector companies continue to sit on stockpiles of cash, concerned about uncertainties in regulations in areas ranging from financial sector reforms to climate change.

III - GREATER CONFIDENCE IN GOVERNANACE

“What investors really need is greater confidence that governments won’t change the rules after the investment has been made,” Tony Abbott, Prime Minister of Australia, said in the Australia’s Vision for the G20 session. Unlocking private-sector investment will be crucial to fuelling inclusive growth. “It is ultimately the extent to which the private sector is catalysed and engaged that determines whether growth trajectories are efficient and sustainable,” wrote the authors of New Growth Models, a report released by the World Economic Forum at the Annual Meeting. Structural changes due to innovation and productivity gains take time to have an impact, several participants warned.

IV -GLOBAL TRADE & ANTI PROTECTIONISM

V - TAX SYSTEMS

VI - INTERNATIONAL FINANCIAL REGULATION

In his address to participants setting out Australia’s priorities for its G20 presidency this year, Abbott outlined additional pillars of a global strategy for inclusive growth – boosting global trade and tackling protectionism, strengthening tax systems to ensure fairness, and finalizing international post-crisis efforts to strengthen and sharpen financial regulation.

Ten Global Risks of Highest Concern in 2014

| No. |

Global Risk |

| 1 |

Fiscal crises in key economies |

| 2 |

Structurally high unemployment/underemployment |

| 3 |

Water crises |

| 4 |

Severe income disparity |

| 5 |

Failure of climate change mitigation and adaptation |

| 6 |

Greater incidence of extreme weather events (e.g. floods, storms, fires) |

| 7 |

Global governance failure |

| 8 |

Food crises |

| 9 |

Failure of a major financial mechanism/institution |

| 10 |

Profound political and social instability |

Source: Global Risks Perception Survey 2013-2014.

Making markets safer for consumers and bank customers is essential. But a lot of work remains to be done, including setting out a process winding down banks and ending the “too-big-to-fail” problem. “I worry about macroprudential complacency,” Summers remarked. “A much greater emphasis needs to be placed on making a system that is safe from ignorance and error. That means emphasis on capital requirements, liquidity and strengthening the robustness of the system.”

“New regulations are being launched, but there are different rules across countries. The finance industry has to face this challenge.”

Deeper international collaboration is necessary for the success of any coordinated efforts to drive inclusive growth. But with the global economic recovery strengthening, cooperation will be harder to achieve, especially as each country pursues its own strategy. There are other challenges. National politics could provide some turbulence, what with general elections this year in several major economies including Turkey, South Africa, India, Indonesia and Brazil. Social instability is a concern, especially in countries where youth unemployment is high and there is little patience to wait for long-term restructuring policies to play out.

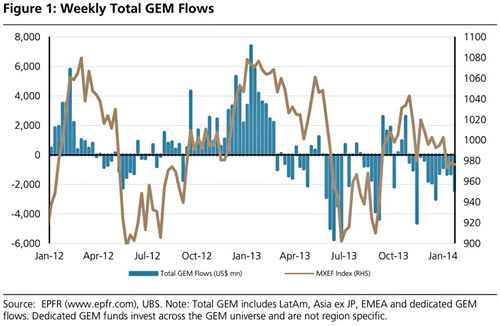

QE UNWINDING WORRIES

There are worries, especially in emerging economies, about the impact of the unwinding of quantitative easing and other exceptionally supportive monetary policy actions in the US and elsewhere. Alexandre Tombini, Governor of the Central Bank of Brazil, expressed concerns about volatility in capital markets and currencies due to the lack of coordination in the tapering.

“New risks include how tapering takes place, at which speed, how it is communicated and what spillover effects it has,”

Christine Lagarde, Managing Director, International Monetary Fund (IMF), Washington DC;World Economic Forum Foundation Board Member, in the Global Economic Outlook 2014 session.

TECHNOLOGY APPLICATION

Finally, how technology gets used will be a challenge. Innovations can lead to job losses through productivity gains. But the savings can also be used to fuel inclusion through investments that generate jobs and communications systems that link people together and bridge digital divides.

|

GLOBAL RISK - The World Economic Forum's 10 Global Risks of Highest Concern

|

Ten Global Risks of Highest Concern in 2014

| No. |

Global Risk |

| 1 |

Fiscal crises in key economies |

| 2 |

Structurally high unemployment/underemployment |

| 3 |

Water crises |

| 4 |

Severe income disparity |

| 5 |

Failure of climate change mitigation and adaptation |

| 6 |

Greater incidence of extreme weather events (e.g. floods, storms, fires) |

| 7 |

Global governance failure |

| 8 |

Food crises |

| 9 |

Failure of a major financial mechanism/institution |

| 10 |

Profound political and social instability |

Source: Global Risks Perception Survey 2013-2014. |

|

02-26-14 |

|

GLOBAL RISK |

| Three Risks in Focus

Of the many conceivable ways in which possible interconnections and interdependencies between global risks could play out systemically over the 10-year horizon considered by this report, three are explored in depth:

- Instabilities in an increasingly multipolar world: Changing demographics, growing middle classes and fiscal constraints will place increasing domestic demands on governments, deepening requirements for internal reform and shaping international relations. Set against the rise of regional powers, an era of greater economic pragmatism and national self-protection might increase inter-state friction and aggravate a global governance vacuum. This may hinder progress on cross-cutting, long-term challenges, and lead to increased inefficiencies and friction costs in strategically important sectors, such as healthcare, financial services and energy. Managing this risk will require flexibility, fresh thinking and multistakeholder communication.

- Generation lost? The generation coming of age in the 2010s faces high unemployment and precarious job situations, hampering their efforts to build a future and raising the risk of social unrest. In advanced economies, the large number of graduates from expensive and outmoded educational systems – graduating with high debts and mismatched skills – points to a need to adapt and integrate professional and academic education. In developing countries, an estimated two-thirds of the youth are not fulfilling their economic potential. The generation of digital natives is full of ambition to improve the world but feels disconnected from traditional politics; their ambition needs to be harnessed if systemic risks are to be addressed.

- Digital disintegration: So far, cyberspace has proved resilient to attacks, but the underlying dynamic of the online world has always been that it is easier to attack than defend. The world may be only one disruptive technology away from attackers gaining a runaway advantage, meaning the Internet would cease to be a trusted medium for communication or commerce. Fresh thinking at all levels on how to preserve, protect and govern the common good of a trusted cyberspace must be developed.

Collaborative multistakeholder action is needed. Wide variance in how risks are identified and managed still exists. Businesses, governments and civil society alike can improve how they approach risk by taking steps such as opening lines of communication with each other to build trust, systematically learning from others’ experiences, and finding ways to incentivize long-term thinking. By offering a framework for decision-makers to look at risks in a holistic manner, the Global Risks 2014 report aims to provide a platform for dialogue and to stimulate action.

CONCLUSIONS

This report has explored how a wide range of global risks – from the possibility of fiscal crisis in an important economy to the fallouts from new technologies, social tensions and changing geopolitical relations – could have long-lasting and far-reaching systemic impacts.

In exploring the global risks landscape for 2014, this report has highlighted the importance of several underlying themes in tackling global risks:

- Trust is necessary if stakeholders are to work together to tackle global risks, but trust is being undermined in some systemically important areas. For example, much of the younger generation lacks trust in traditional political institutions and leaders, while recent revelations about cyber espionage have undermined trust in the Internet in general and the governance of cyberspace in particular.

- Long-term thinking is a prerequisite for any approach to global risks. This report has explored strategies through which corporations and governments can attempt to incentivize a shift from short-term to long-term time horizons.

- Collaborative multistakeholder action is required as businesses, governments, or civil society alone do not have both the tools and the authority to tackle systemic risks. We hope that the mapping of global risks and their interconnections will provide a common base to better understand risks and their consequences, and for dialogue as a first step towards collective action.

- Global governance is key to addressing global risks such as climate change or cybersecurity, but new models are urgently needed as the world’s increasing multipolarity renders its current global governance structures unwieldy and outdated.

This report has aimed to increase awareness of and inspire action on the most important risks the world faces over the next 10 years, in the hope of addressing the most pressing of these challenges. The World Economic Forum will continue to provide a platform for leaders to work together on preparing for risks, mitigating them and strengthening resilience. |

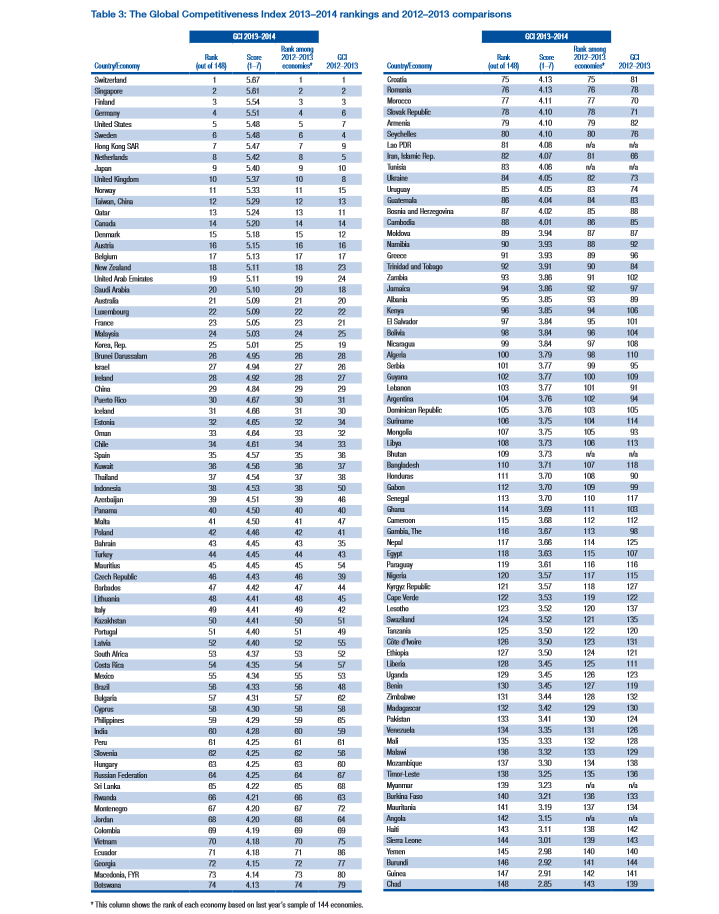

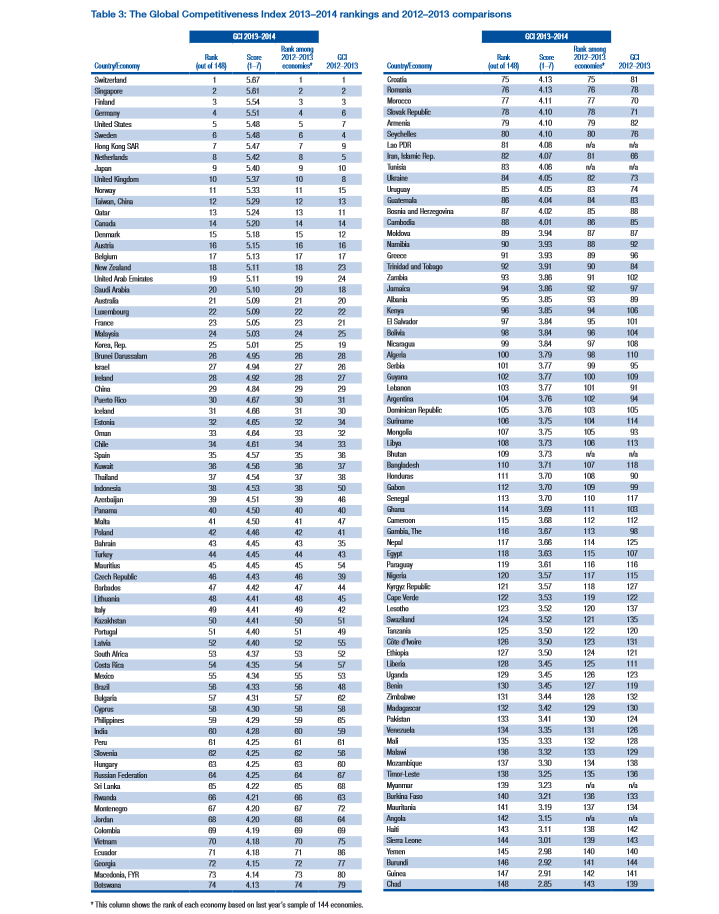

GLOBAL RISK -Global Competitive Rankings

|

Ten Global Risks of Highest Concern in 2014

| No. |

BRICS |

| 56 |

BRAZIL |

| 64 |

RUSSIA |

| 60 |

INDIA |

| 29 |

CHINA |

| 53 |

SOUTH AFRICA |

| |

FRAGILE 5 |

| 38 |

INDONESIA |

| 44 |

TURKEY |

| |

FORGOTTEN 5 |

| 59 |

PHILLIPPINES |

| 55 |

MEXICO |

| 24 |

MALAYSIA |

| 104 |

ARGENTINA |

| 134 |

VENEZUELA |

144 COUNTRIES |

|

02-26-14 |

|

GLOBAL RISK |

RANKING OF 144 GLOBAL COUNTRIES

|

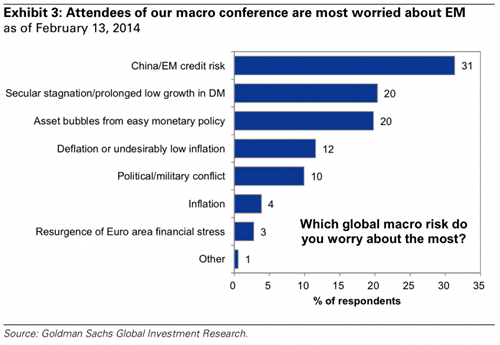

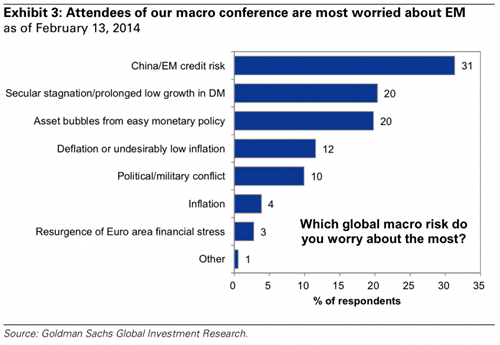

GLOBAL RISK - Credit Risk in China & Emerging Markets

GOLDMAN: Here's What Our Clients Worry About The Most 02-16-14 BI

Goldman Sachs met with and surveyed 2,000 clients in Hong Kong and Tokyo last week.

"Three items dominated among a list of global macro concerns," said Goldman's David Kostin in his US Weekly Kickstart note.

- "China/EM credit risks ranked at the top of the list with 31% of participants noting it as a leading concern.

- Fear of asset bubbles from easy monetary policy (20%) and

- secular stagnation or prolonged low growth (20%) also garnered large responses.

- Other issues cited less frequently included deflation or undesirably low inflation (12%), political/military conflict (10%), inflation (4%), and a resurgence of financial stress in Europe (3%)."

China has been making moves to reign in its loose credit markets, which most economists believe will slow the economy. However, the primary concern is that this will be disorderly, causing the economy to decelerate much more sharply than anyone expects.

|

02-26-14 |

GLOBAL

RISK

SA |

1 - Risk Reversal |

| JAPAN - DEBT DEFLATION |

|

|

2 |

| BOND BUBBLE |

|

|

3 |

EU BANKING CRISIS |

|

|

4 |

| SOVEREIGN DEBT CRISIS [Euope Crisis Tracker] |

|

|

5 |

| CHINA BUBBLE |

|

|

6 |

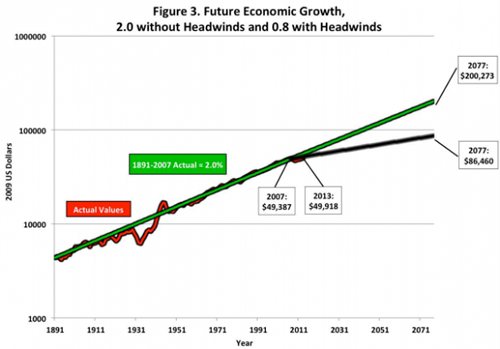

GLOBAL GROWTH - Will Slow Dramatically on a Percapital Basis

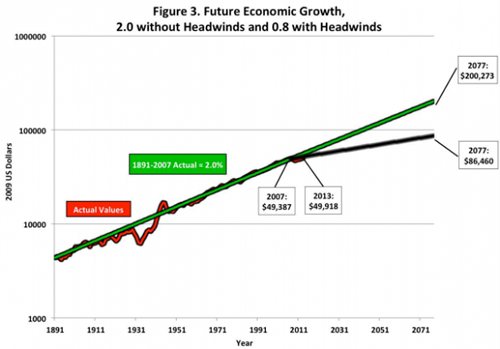

REPORT: NBER - NBER WORKING PAPER SERIESTHE DEMISE OF U.S. ECONOMIC GROWTH:RESTATEMENT, REBUTTAL, AND REFLECTIONS - February 2014

Global economy is slowing as the animal spirits exuberance of global central bank liquidity pump-priming has simply run its course and faces the reality of a debt-saturated, growth-stifled reality.

As the following publicly available paper notes, the years of 2.0% 'trend' growth for the US are over...

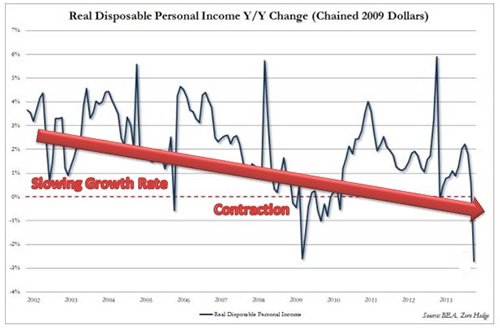

The United States achieved a 2.0 percent average annual growth rate of real GDP per capita between 1891 and 2007. This paper predicts that growth in the 25 to 40 years after 2007 will be much slower, particularly for the great majority of the population.

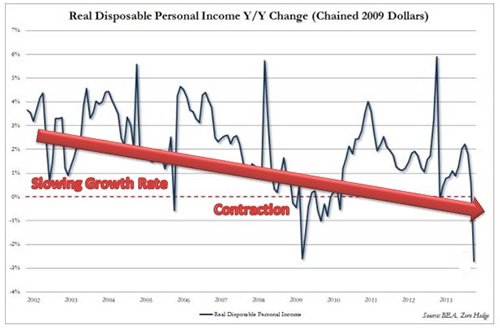

Future growth will be 1.3 percent per annum for labor productivity in the total economy, 0.9 percent for output per capita, 0.4 percent for real income per capita of the bottom 99 percent of the income distribution, and 0.2 percent for the real disposable income of that group.

The primary cause of this growth slowdown is a set of four headwinds, all of them widely recognized and uncontroversial.

- DEMOGRAPHICS: Demographic shifts will reduce hours worked per capita, due not just to the retirement of the baby boom generation but also as a result of an exit from the labor force both of youth and prime-age adults.

- EDUCATION: Educational attainment, a central driver of growth over the past century, stagnates at a plateau as the U.S. sinks lower in the world league tables of high school and college completion rates.

- INEQUALITY: Inequality continues to increase, resulting in real income growth for the bottom 99 percent of the income distribution that is fully half a point per year below the average growth of all incomes.

- DEBT BURDEN: A projected long-term increase in the ratio of debt to GDP at all levels of government will inevitably lead to more rapid growth in tax revenues and/or slower growth in transfer payments at some point within the next several decades.

There is no need to forecast any slowdown in the pace of future innovation for this gloomy forecast to come true, because that slowdown already occurred four decades ago. In the eight decades before 1972 labor productivity grew at an average rate 0.8 percent per year faster than in the four decades since 1972. While no forecast of a future slowdown of innovation is needed, skepticism is offered here, particularly about the techno-optimists who currently believe that we are at a point of inflection leading to faster technological change. The paper offers several historical examples showing that the future of technology can be forecast 50 or even 100 years in advance and assesses widely discussed innovations anticipated to occur over the next few decades, including:

- medical research,

- small robots,

- 3-D printing,

- big data,

- driverless vehicles, and

- oil-gas frackin

REPORT: NBER by zerohedge

NBER

�

|

02-25-14 |

|

11 - Shrinking Revenue Growth Rate |

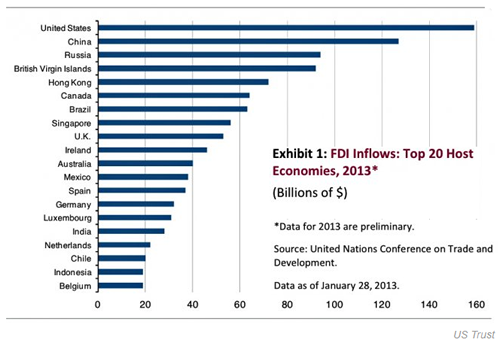

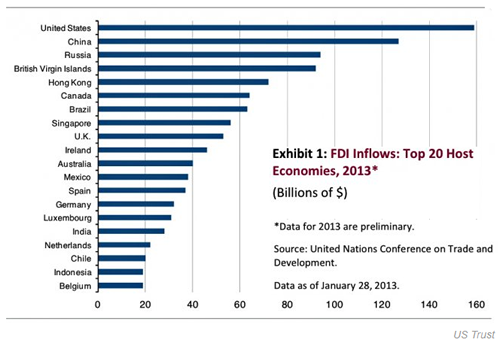

US FDI - It is worse than US FDI Simply Slowed - It Shrank!!!

The Top Destinations For Foreign Investment Dollars 02-01-14 BI

It might not be surprising to learn that the U.S. is the top destination for foreign direct investment (FDI). According to new United Nations data cited by U.S. Trust's Joseph Quinlan, the U.S. accounted for $159 billion of inflows of the global total of $1.46 trillion of flows in 2013. This is down from $168 billion in 2012.

-$1.46B

THIS MUST GROW NOT GO NEGATIVE - IT IS NOT ABOUT THE ABSOLUTE AMOUNT BUT RATHER THE RATE OF CHANGE AND WHETHER IT IS POSITIVE OR NEGATIVE IN THE ABSOLUTE

This came as the U.S. economy accelerated through the year? |

02-24-14 |

|

23 - US Reserve Currency |

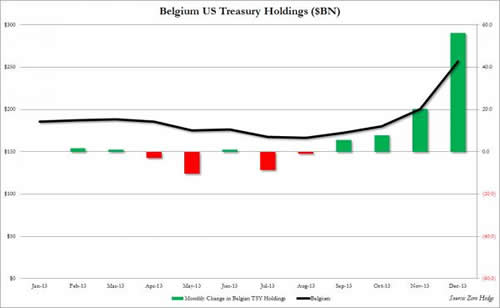

US TREASURIES - EU to the Rescue?

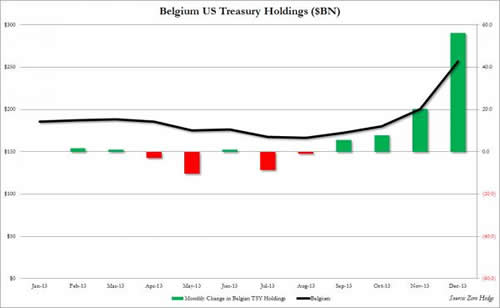

China Sold Second-Largest Amount Ever Of US Treasurys In December: And Guess Who Comes To The Rescue 02-18-14 Zero Hedge

The chart below shows holdings of Chinese Treasurys in a nutshell:

Chinese Treasury holdings plunged by the most in two years, after China offloaded some $48 billion in paper, bringing its total to only $1268.9 billion, down from $1316.7 billion, and back to a level last seen in March 2013!

This was the second largest dump by China in history with the sole exception of December 2011.

That this happened at a time when Chinese FX reserves soared to all time highs and not investing in US paper should be quite troubling to anyone who follows the nuanced game theory between the US and its largest external creditor, and the signals China sends to the world when it comes to its confidence in the US.

Yet what was truly surprising is that despite the plunge in Chinese holdings, and

Japanese holdings also dropped by $4 billion in December,

... is that total foreign holdings of US Treasurys increased in December, from $5716.9 billion to 5794.9 billion.

Why? Because of this country. Guess which one it is without looking at legend.

That's right: at a time when America's two largest foreign creditors, China and Japan, went on a buyers strike, the entity that came to the US rescue was Belgium, which as most know is simply another name for... Europe: the continent that has just a modest amount of its own excess debt to worry about.

One wonders what favors were (and are) being exchanged behind the scenes in order to preserve the semblance that "all is well"? |

02-24-14 |

|

23 - US Reserve Currency |

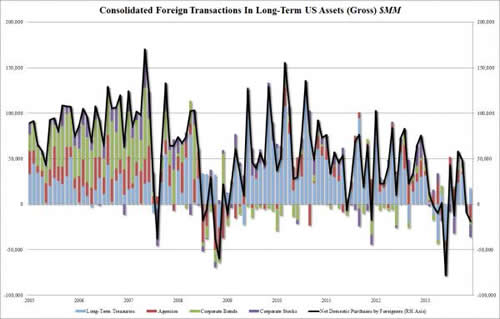

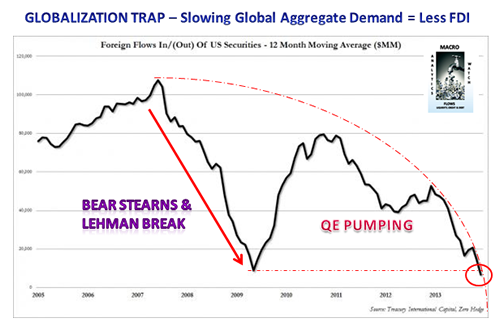

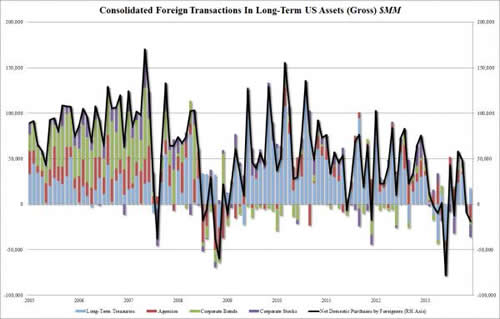

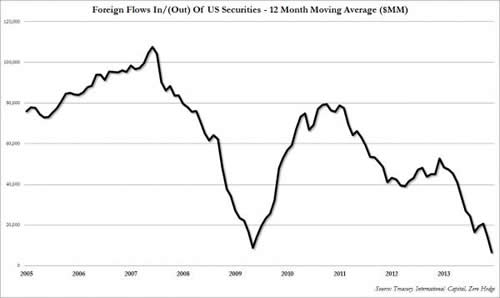

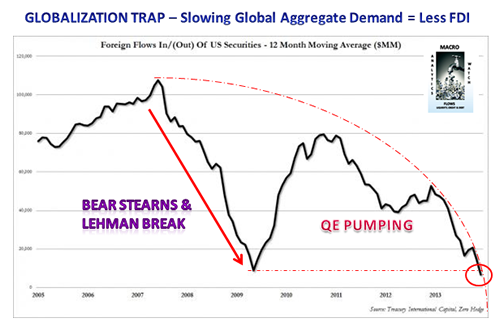

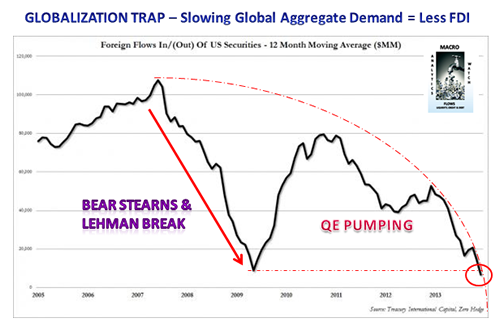

GLOBALIZATION TRAP - Foreign Purchases Suggest Slowing Global Economies with less Easy Credit to Invest

Scary Chart Of The Day: Average Foreign Purchases Of US Securities Take Out Lehman Low 02-18-14 Zero Hedge

For whatever reason China sold the second biggest amount of US Treasurys in December. However, that was only part of the story. In fact, while the two largest US foreign creditors were net sellers, total foreign bond holdings actually rose in the last month of 2013 and as the chart below confirms, when it comes to Long-Term Treasury paper, foreigners were actually buyers of some $18 billion in Treasurys.

It is everything else that they sold in the month when the S&P hit its all time high: specifically, foreigners were net sellers of

- Agency securities ($15.4 billion),

- Corporate Bonds ($7.5 billion) and

- Corporate Equities ($13.7 billion)

.. something which hardly fits with the narrative of the record stock market high generating confidence in even more buying down the line.

In the chart above it is the black line - gross purchases of US long-term securities - that is the most troubling, as its trend is hardly anyone's friend.

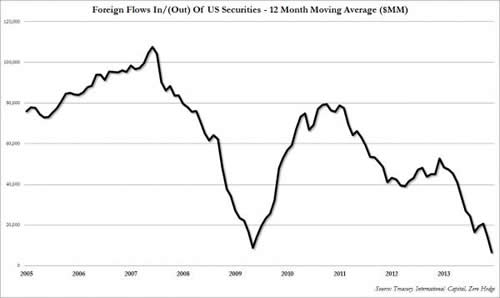

So what happens when one smooths out the line to normalize for monthly fluctuations? This:

The chart is very disturbing: it shows that as the S&P rises higher and higher (on ever declining volumes), foreigners are buying fewer and fewer US securities. In fact, on a 12 Month Moving Average basis, foreigners bought less long-term US securities than they did when Lehman crashed!

Luckily we live in a New Normal when price is no longer determined by simple supply and demand (and certainly not from retail investors who have long since given up on the fraudulent, broken US capital "markets") but Fed jawboning of

- A record $2.5 trillion in bank excess reserves,

- Corporate buybacks and

- HFT algos spurring momentum ignition and buying because others are buying.

And so we have come full circle, because while, understandably, nobody had any appetite for US securities around the Lehman crash until the Fed stepped in and singlehandedly took over the US capital markets it was unclear if there even would be a US capital markets. Now five years later the S&P has risen to a level nearly three times the March 2009 lows thanks entirely to the Fed's $4.1 trillion balance sheet backstop, the interest in US securities is... lower than it was in the days just after Lehman!

Source: TIC |

02-24-14 |

|

23 - US Reserve Currency |

| TO TOP |

| |

| MACRO News Items of Importance - This Week |

GLOBAL MACRO REPORTS & ANALYSIS |

|

|

|

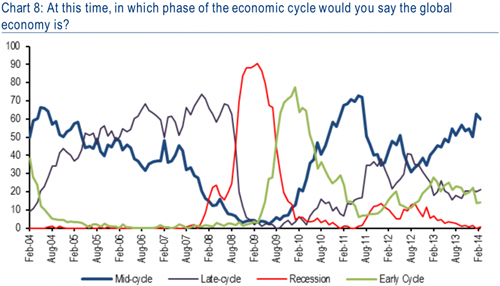

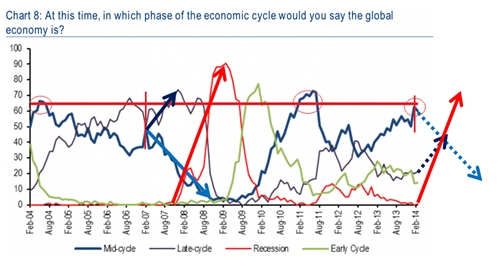

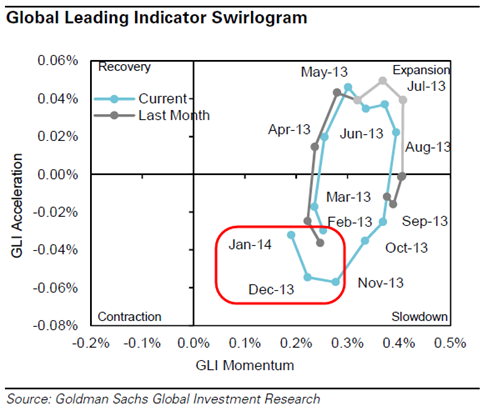

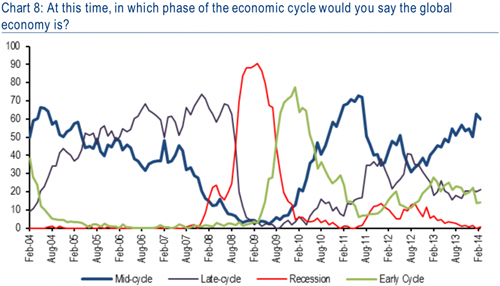

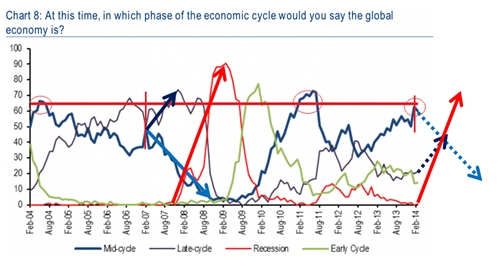

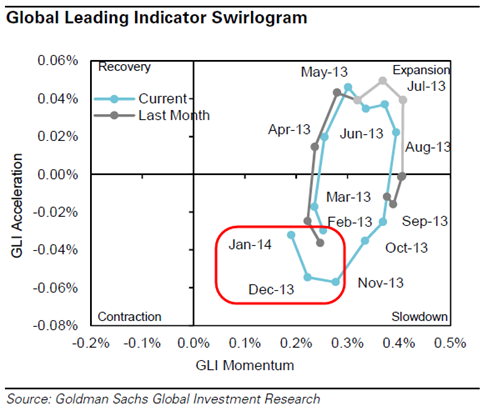

GLOBAL ECONOMIC CYCLE - Consensus Says Mid-Cycle

Here's Where Investors Think We Are In The Global Economic Cycle Right Now 02-21-14 BI

The chart below, taken from a survey of:

- 222 fund managers responsible for a collective

- $591 billion in assets under management

- Conducted by BofA Merrill Lynch between Feb. 7 and Feb. 13, 2014,

shows where investors think we are in the global economic cycle right now.

It also shows where survey respondents thought the global economy was in January 2008. At the time, more people thought the global economy was either in a mid-cycle or a late-cycle stage, and very few thought we were in a recession.

"With respect to the economic cycle, 60% of investors think the global economy is currently in mid-cycle," says Michael Hartnett, chief investment strategist at BofA Merrill Lynch.

OUR VIEW

WE WILL SOON BE WORRYING ABOUT

THE "R" WORD

A Recession is in the Cards Unless

"TAPER" Reversed! (or the ECB Starts QE)

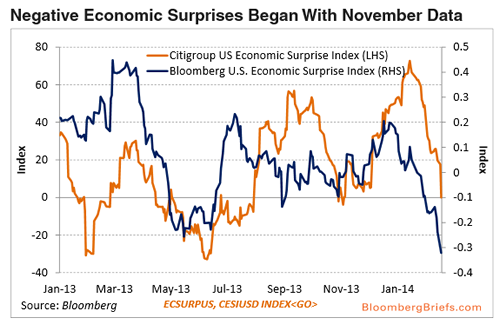

WHY ... JUST A FEW OF OUR REASONS!

If it Looks like a Duck, Quacks like a Duck...

|

02-26-14 |

GLOBAL

RISK

SA |

GLOBAL MACRO |

G-20 MEETING - To add over $2 trillion more in economic activity

G-20 Agrees To Grow Global Economy By $2 Trillion, Has No Idea How To Actually Achieve It 02-23-14 Zero Hedge

"We will develop ambitious but realistic policies with the aim to lift our collective GDP by more than 2 percent above the trajectory implied by current policies over the coming 5 years,"

"We are putting a number to it for the first time -- putting a real number to what we are trying to achieve,"

"We want to add over $2 trillion more in economic activity and tens of millions of new jobs."

There is only one problem: the G-20 has absolutely no idea how to actually achieve its goal of boosting global output by more than the world's eighth largest economy Russia produces in a year. Nor does it have any measures to prod and punish any laggards from this most grand of central planning schemes.

From Reuters:

There was no road map on how nations intend to get there or repercussions if they never arrive. The aim was to come up with the goal now, then have each country develop an action plan and a growth strategy for delivery at a November summit of G20 leaders in Brisbane.

"Each country will bring its own plan for economic growth," said Hockey. "Each country has to do the heavy lifting."

Agreeing on any goal is a step forward for the group that has failed in the past to agree on fiscal and current account targets. And it was a sea change from recent meetings where the debate was still on where their focus should lie: on growth or budget austerity

|

02-25-14 |

|

GLOBAL MACRO |

US ECONOMIC REPORTS & ANALYSIS |

|

|

|

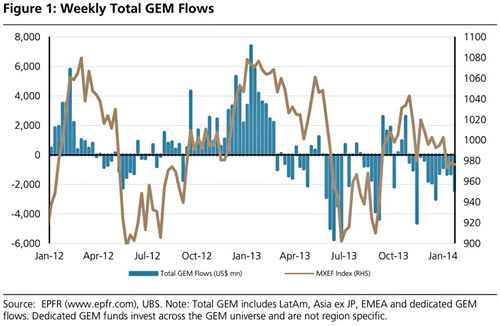

DRAMATICALLY SLOWING US FOREIGN FLOWS

"Houston, We Have a Problem!"

|

02-24-14 |

|

|

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES |

|

|

|

|

|

|

|

| Market |

| TECHNICALS & MARKET |

|

|

|

| COMMODITY CORNER - HARD ASSETS |

|

PORTFOLIO |

|

| COMMODITY CORNER - AGRI-COMPLEX |

|

PORTFOLIO |

|

| SECURITY-SURVEILANCE COMPLEX |

|

PORTFOLIO |

|

|

|

|

|

| THESIS |

| 2014 - GLOBALIZATION TRAP |

2014 |

|

|

2013 - STATISM |

2013-1H

2013-2H |

|

|

2012 - FINANCIAL REPRESSION |

2012

2013

2014 |

|

|

2011 - BEGGAR-THY-NEIGHBOR -- CURRENCY WARS |

2011

2012

2013

2014 |

|

|

2010 - EXTEND & PRETEND |

|

|

|

| THEMES |

| FLOWS -FRIDAY FLOWS |

|

THEME |

|

| SHADOW BANKING -LIQUIDITY / CREDIT ENGINE |

|

THEME |

|

| CRACKUP BOOM - ASSET BUBBLE |

|

THEME |

|

| ECHO BOOM - PERIPHERAL PROBLEM |

|

THEME |

|

| PRODUCTIVITY PARADOX -NATURE OF WORK |

|

THEME |

|

| STANDARD OF LIVING -EMPLOYMENT CRISIS |

|

THEME |

|

STANDARD OF LIVING - 10 Stories From The Cold, Hard Streets Of America

10 Stories From The Cold, Hard Streets Of America That Will Break Your Heart 02-24-14 Michael Snyder of The Economic Collapse blog,

If the economy is really "getting better", then why have millions upon millions of formerly middle class Americans been pushed to the point of utter despair?

The stories that you are about to read are absolutely heartbreaking. I don't know how anyone can read them without getting chills. In America today, if you lose a good job, there is a good chance that you won't be able to find a decent job and will plunge into the abyss of depression and desperation that so many millions of other Americans have fallen into.

As I wrote about earlier this month, the U.S. economy is definitely not getting any better. For example, if you assume that the percentage of Americans that want to work is about at the long term average, then the official unemployment rate in the United States would be above 11 percent. And compared to six years ago, 1,154,000 fewer Americans are working today even though our population has gotten significantly larger since then. Behind all of these numbers are real flesh and blood people, and you are about to hear from some of them.

The following are 10 stories from the cold, hard streets of America that will break your heart...

#1 A 34-year-old man named Rocco...

"While my wife goes to work, I’ve been staying at home to conserve fuel. I’ve been losing weight from eating less, so my family has more on their plates. It feels like the government and big business expect more and more while trying to give back as little as possible. Soon my internet connection will be shut off and since most companies don’t offer paper applications, how will I find work then? Walking around for miles a day, asking for an application that may or may not be available?"

#2 Homeless people wasting away in "Obamavilles" on the outskirts of Baltimore, Maryland...

A sheet of plastic laid over a clothesline. A mini-fortress of milk crates stacked under a tree. A thin mattress on a flimsy crate lying in a dark tunnel.

On the edge of Baltimore's woodlands, dozens of the city's transients live in makeshift homes which they consider safer than homeless shelters.

You can see some incredible photos of how these homeless people are living right here.

#3 A 50-year-old woman in Pennsylvania named Karen...

"My husband only makes 10 dollars an hour and drives 30 miles round trip, so it’s taking all we have just to keep the Jeep filled with gas. We stopped going to church and all to save gas. We are homebodies now, afraid to use what gas we have. We save two kids from getting put in foster care just to be hit like this. It’s just a constant trap they try to keep you from receiving any help! I’m so disgusted when my 12-year-old asks me why we don’t have snacks anymore, or why are we eating so much rice, etc."

#4 The following is an excerpt from a comment that was recently left by one of my readers...

"I live right at ground zero. South West Virginia and let me tell you things are bad and getting worse by the day. We don't do drugs but have family members hooked on meth and or pills or both. Many of these pills are prescribed by local doctors either Suboxone to get you off the opiates, a total joke by the way and tons of Xanax why would anyone need 120 Xanax a month how can you even be expected to function. These pills get traded for cash sex and other items, same goes for the SNAP cards. We have family members going to jail repeatedly for the same crimes making meth, selling pills and stealing anything that's not nailed down. People who are 30 years old look like they are 55 years old. The jobs here are awful

- walmat,

- gas stations,

- fast food etc.

- Most of our whole county is on the government dole."

#5 A 55-year-old man from California named Randy Carpadus...

"I was working as a firefighter for the state of California and was laid off in April 2012, right at the beginning of fire season. At my age, I'm not going to be picked up by another fire department. They want younger guys.

I've applied for everything from truck driver, to sales, to nonprofit work. I've sent out almost 400 resumes, and I've gotten nothing. I've done whatever I could to make ends meet.

Through some connections, I got a temp job as a truck driver in Napa Valley -- a 3-hour commute from where I live. I lived in my car and worked during grape harvest."

#6 In this tough economic environment, debt collectors are becoming even more aggressive. Just check out the kind of harassment that one woman named Jennifer Posey has been put through...

"This is Jimmy Lee calling from CheckCare. Just letting you know we're in full force," he said. The man had a thick Southern accent that stretched the word "you" into a two-syllable accusation. "We're going to have warrants out for your arrest in Columbus, Ga.," the man threatened. "We know you have an apartment on the canal in Clearwater."

It was when he mentioned her home in Florida that Posey began to feel anxious. "We're hurting you," he continued. "We're hurting your family, your son's family, your cousin's family. Whatever we can do to get you to pay."

Forty minutes later, her phone rang again. "What about that 12-, 13-year-old child you're trying to raise?" the voice sneered.

#7 A 50-year-old woman from New York named Sharon Ritchie...

"I am constantly told I am 'overqualified.' I've also been told to dumb down my resume, but I can't just erase 30 years of experience.

You can only stand the word 'no' so many times. There are times that I cry at night wondering what happened, and at times I have thought about suicide.

But, I keep on going, hoping the cycle will break."

#8 In response to my recent article about Appalachia, a reader named Rob shared the following...

"I am from rural south central KY (Brodhead, Rockcastle County) and I can tell you that most of the things described above are exactly how it is here. There are so many people on drugs it's crazy. First it was the meth, which was more of a problem back in 2002-2007, then the pain pills really started becoming a huge problem, OxyContin and perc 30's (roxicet) obtained from Florida and Georgia doctors. The pain pills are something that you can't just walk away from after doing them for a while; they cause people to steal from family, sell everything they own, and/or prostitute themselves in order to avoid opiate withdrawal."

#9 A 30-year-old man from California named Alejandro...

"I need to provide for my son who is diagnosed with autism and my baby girl. I’ve sold a bunch of my belongings to try and put food on the table, to buy clothes for my kids, to pay rent and utilities and to put gas in my vehicle to go job hunting. Not having money for necessities takes a toll on my mind. Depression has kicked in. It really takes a toll on one’s self-esteem and confidence to move forward.I’ve applied to countless amounts of jobs, only to not even get a call back. I’ve gone from construction site to construction site, only to be told they are not hiring. Finally, I got at least a positive call back from a company telling me they will call me to work in a couple of weeks. I am crossing my fingers and praying. There are millions of people in my situation or even worse."

#10 An excerpt from a heartbreaking letter that an unemployed woman named Paula Bray sent to Barack Obama...

Dear Mr. President,

I write to you today because I have nowhere else to turn. I lost my full time job in September 2012. I have only been able to find part-time employment -- 16 hours each week at $12 per hour -- but I don't work that every week. For the month of December, my net pay was $365. My husband and I now live in an RV at a campground because of my job loss. Our monthly rent is $455 and that doesn't include utilities. We were given this 27-ft. 1983 RV when I lost my job.

This is America today. We have no running water; we use a hose to fill jugs. We have no shower but the campground does. We have a toilet but it only works when the sewer line doesn't freeze -- if it freezes, we use the campground's restrooms. At night, in my bed, when it's cold out, my blanket can freeze to the wall of the RV. We don't have a stove or an oven, just a microwave, so regular-food cooking is out. Recently we found a small toaster oven on sale so we can bake a little now because eating only microwaved food just wasn't working for us. We don't have a refrigerator, just an icebox (a block of ice cost about $1.89). It keeps things relatively cold. If it's freezing outside, we just put things on the picnic table.

Sadly, this is just the beginning.

The economic despair that we are witnessing right now is just a taste of the horrible economic nightmare that is going to unfold in the United States during the coming years.

And already there are signs that things are starting to take another turn for the worse. In recent months, we have seen a whole host of retail chains announce store closings. In fact, one of my readers wrote to me the other day and told me about a home appliance chain known as "American TV" that is going out of business in the Midwest. When these stores shut down, close to another 1000 Americans will soon be out of work...

“While this is a sad moment it is also a proud moment. It’s a moment to be proud of our efforts and to be proud of what we have delivered to the community”, said Doug Reuhl, President and CEO of American since 1988. “Words cannot adequately express how grateful we are to our millions of loyal customers, and to the incredible, dedicated family of employees that we have been blessed with over our 60 years of business”.

Advanced notice of the business closing has been given to the 989 employees affected in eleven locations. Employees will be compensated, with benefits, through the notification period, and the majority will continue employment through the closing process.

But if you listen to the mainstream media, you would think that happy days are here again for America. Just check out some of the bizarre headlines that I have collected in recent weeks...

Most Americans will buy into this propaganda and will never see the next major economic crisis coming until it is too late to do anything about it. |

02-25-14 |

THEME |

|

| CORPORATOCRACY -CRONY CAPITALSIM |

|

THEME |

|

CORRUPTION & MALFEASANCE -MORAL DECAY - DESPERATION, SHORTAGES. |

|

THEME |

|

| SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT |

|

THEME |

|

| SECURITY-SURVEILLANCE COMPLEX -STATISM |

|

THEME |

|

| GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY |

|

THEME |

|

| CENTRAL PLANINNG -SHIFTING ECONOMIC POWER |

|

THEME |

|

| CATALYSTS -FEAR & GREED |

|

THEME |

|

| GENERAL INTEREST |

|

|

|

| TO TOP |

Tipping Points Life Cycle - Explained

Click on image to enlarge

|

YOUR SOURCE FOR THE LATEST

GLOBAL MACRO ANALYTIC

THINKING & RESEARCH

|

�

|

2014 THESIS: GLOBALIZATION TRAP

2014 THESIS: GLOBALIZATION TRAP

Aliko Dangote

Aliko Dangote Wolfgang Schäuble

Wolfgang Schäuble Joseph Jimenez

Joseph Jimenez Jiang Jianqing

Jiang Jianqing