|

JOHN RUBINO'SLATEST BOOK |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Mon. Feb. 22nd , 2016

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

![]()

| FEBRUARY | ||||||

| S | M | T | W | T | F | S |

| 1 | 2 | 3 | 4 | 5 | 6 | |

| 7 | 8 | 9 | 10 | 11 | 12 | 13 |

| 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| 21 | 22 | 23 | 24 | 25 | 26 | 27 |

| 28 | 29 | |||||

KEY TO TIPPING POINTS |

| 1- Bond Bubble |

| 2 - Risk Reversal |

| 3 - Geo-Political Event |

| 4 - China Hard Landing |

| 5 - Japan Debt Deflation Spiral |

| 6- EU Banking Crisis |

| 7- Sovereign Debt Crisis |

| 8 - Shrinking Revenue Growth Rate |

| 9 - Chronic Unemployment |

| 10 - US Stock Market Valuations |

| 11 - Global Governance Failure |

| 12 - Chronic Global Fiscal ImBalances |

| 13 - Growing Social Unrest |

| 14 - Residential Real Estate - Phase II |

| 15 - Commercial Real Estate |

| 16 - Credit Contraction II |

| 17- State & Local Government |

| 18 - Slowing Retail & Consumer Sales |

| 19 - US Reserve Currency |

| 20 - US Dollar |

| 21 - Financial Crisis Programs Expiration |

| 22 - US Banking Crisis II |

| 23 - China - Japan Regional Conflict |

| 24 - Corruption |

| 25 - Public Sentiment & Confidence |

| 26 - Food Price Pressures |

| 27 - Global Output Gap |

| 28 - Pension - Entitlement Crisis |

| 29 - Central & Eastern Europe |

| 30 - Terrorist Event |

| 31 - Pandemic / Epidemic |

| 32 - Rising Inflation Pressures & Interest Pressures |

| 33 - Resource Shortage |

| 34 - Cyber Attack or Complexity Failure |

| 35 - Corporate Bankruptcies |

| 36 - Iran Nuclear Threat |

| 37- Finance & Insurance Balance Sheet Write-Offs |

| 38- Government Backstop Insurance |

| 39 - Oil Price Pressures |

| 40 - Natural Physical Disaster |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

|

Have your own site? Offer free content to your visitors with TRIGGER$ Public Edition!

Sell TRIGGER$ from your site and grow a monthly recurring income!

Contact [email protected] for more information - (free ad space for participating affiliates).

HOTTEST TIPPING POINTS |

Theme Groupings |

||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro

|

|||

|

MOST CRITICAL TIPPING POINT ARTICLES TODAY

|

|

||

TIPPING POINTS, STUDIES, THESIS, THEMES & SII COVERAGE THIS WEEK PREVIOUSLY POSTED - (BELOW)

|

|||

|

2013 2014 |

|||

Dr. Marc Faber: “They Will Bankrupt the World!”Dr. Marc Faber joins FRA Co-founder Gordon T. Long in an exciting discussion of monetary malpractice, negative interest rates, the influence of current geopolitical risk and much more. Dr Marc Faber was born in Zurich, Switzerland. He went to school in Geneva and Zurich and finished high school with the Matura. He studied Economics at the University of Zurich and, at the age of 24, obtained a PhD in Economics. Between 1970 and 1978, Dr Faber worked for White Weld & Company Limited in New York, Zurich and Hong Kong. Since 1973, he has lived in Hong Kong. From 1978 to February 1990, he was the Managing Director of Drexel Burnham Lambert (HK) Ltd. In June 1990, he set up his own business, MARC FABER LIMITED which acts as an investment advisor and fund manager. Dr Faber publishes a widely read monthly investment newsletter “The Gloom Boom & Doom Report” report which highlights unusual investment opportunities, and is the author of several books including “ TOMORROW’S GOLD – Asia’s Age of Discovery” which was first published in 2002 and highlights future investment opportunities around the world. “ TOMORROW’S GOLD ” was for several weeks on Amazon’s best seller list and is being translated into Japanese, Chinese, Korean, Thai and German. Dr. Faber is also a regular contributor to several leading financial publications around the world. A regular speaker at various investment seminars, Dr Faber is well known for his “contrarian” investment approach. He is also associated with a variety of funds and is a member of the Board of Directors of numerous companies. JAPANESE NEGATIVE INTEREST RATES AND THEIR GLOBAL IMPLICATIONS “It’s an experiment by few mad professors that occupy senior positions in central banks.” Over the last 5000 years of recorded human history, interest rates have never been as low as they are now. The time value of money is the natural state. It is the markets way of pricing today’s money and the future’s money. The higher the uncertainty of future money is, the higher the rate of interest will be. What central banks are doing at the present is incomprehensible to me, unless it means an expropriation of money. The central banks in their madness believe this will result in economic growth. But in reality it will force people to become insecure. For example if you received 6% on your money, and then rates become zero and in this case become negative which in other words you’re being penalized for your deposit. Does that rate make you save more or spend more? One thing I will never understand is despite us having democracies, somewhere, somehow, the system has given so much power to a bunch of well understood, unelected academics and most of them have never worked for the private sector for a day. The Fed, Bank of Japan, ECB are all likeminded people; they all believe money printing boosts economic activity and tight money is negative. “They will bankrupt the world.” We do not know how badly it will end, but an interesting thing to note is if you look at the 2008 financial crisis, which sector got the most bailout money? It was the banks and the fund managers. Then you look at the performance of their stocks, it is a disaster. Bailout money and money printing doesn’t help at all. In fact it has made matters worse for the average American. I side with Americans who support Bernie Sanders because he is expressing the views of ordinary people that the Wall Street guys and the banking lunatics have essentially cheated the people. “In every instance where they have negative interest rates, the exact opposite of the objective occurs.” This view of central banks to distort the free market and capitalist system is a view of the paternalist; some people that think they know better. They think they can steer the economy like how you would drive a car. FED RAISING RATES “As a working man it is hard to believe the world has handed so much power to a bunch of ignorant and arrogant people.” Firstly Janet Yellen was the president of the San Francisco Federal Reserve which is in charge of California, Arizona, Nevada and another state. In her district we had the biggest real estate bubbles ever. Now she is the Fed chairman and slashed interest rates. We have had eight years of zero interest rates, and now she increases it by a quarter of a percent which is meaningless. She should have increased rates when there was a strong recovery in 2010 and 2011 but she waited. She waited right until the world is entering a very deep recession. She will go down and have a front portrait in a museum as a central bank failure. IMPLICATIONS OF MONETARY MALPRACTICE “There are reasons to believe that central banks will go bust.” Systemically I think they have allowed the debt level to expand, particularly they have allowed government credit to expand as a percentage of the economy. You have to understand that when you try to supress individual risks in a system, eventually you end up with systemic risk. We will eventually have a huge crisis and investor will not know how to deal with it. People like Bernie Sanders are not blaming the Fed, they are blaming Wall Street. In other words they are blaming rich people for the hardship or ordinary people. The Fed essentially threw money at Wall Street and naturally they kept it for themselves. Yes, there is a trickle-down effect which makes them give their waiter a slightly larger tip; it is insignificant. ISSUES OF CURRENT GEOPOLITICAL RISK “Everything the US touched in the Middle East and Central Asia, from Afghanistan to Iraq, Syria, Egypt and Lebanon, it all turned into a complete disaster.” The Neocons had this brilliant idea to start making trouble in Ukraine, not understanding it is Russian territory and historically until the early 20th century Ukraine was part of Russia. Also not understanding that Crimea is of huge strategic importance to Russia, just like what California is to the US. Russia will never give up Crimea, I can promise you that. This is because it is a warm water port and they need it to have the access to the Mediterranean, without it they are at the mercy of America. The Europeans are equally as incompetent. Angela Merkel just follows the US without understanding she is hurting the business interest of Germany. Russia and Germany were historically, culturally and politically very close. The interventions are very poorly thought out. In the case of China, it is the second largest economy in the world with a population of 1.3 billion people. It is a highly advanced economy, especially in defense technology. A pivot to Asia by the US is seen by the Chinese as an aggression. It is a threat to the sovereignty and security of China which has created another set of geopolitical tensions. FEAR OF A COLLAPSING PETRODOLLAR Under Mr. Greenspan the central bank enjoyed a lot of prestige. He had done better than his predecessors; his only major mistake was deliberately creating the NASDAQ bubble. “However, Bernanke and Yellen are complete chaos. I don’t actually believe that they make the decisions; they are told by someone what they should do.” It is difficult to tell what people think but if you look into the Japanese negative interest rates, the intention was to weaken the Yen. Not that the weak currency helps anyone, but by slashing interest rates and having them below zero 10yr Japanese bond will cause you to lose money unless the Yen appreciates. The idea was to have negative interest rates cause the Yen weaken but it actually strengthened. INVESTMENT OPPORTUNITIES IN ASIA The area of Indochina is a boomtown. Not Thailand but Cambodia exports are rising at about 20%/annum. Vietnam has huge inflow of foreign direct investment, partly because the Taiwanese, Koreans and Japanese can invest in Vietnam and produce goods there. There are a lot of investments coming from China and South East Asia. The US is afraid of China gaining too much influence in that part of the world so they waste money there by trying to displace the Chinese. The Chinese will go to Cambodian government and say they are going to make a road or a bridge and in 6 months it will be built. Whereas the US will send a team of useless characters to go check out the scenery then come back in 3 months to check out more scenery and 5 years later nothing will have been done. All the while in this time the Chinese will have built roads, bridges, tunnels and all kinds of infrastructure. ADVICE FOR INVESTORS “My advice is to have a diversified portfolio. You have to have some equities, some bonds, real estate and precious metals.” In my view it will not end well. This era of artificially low and market distorting interest rate structure will end terribly. There is a popular notion now of ‘sell everything’ but this is a flawed idea. You sell everything and you have all this money now, what will you do? Deposit it in banks? What happens when the bank goes bankrupt? In practise it is very dangerous to have all your money with one bank.

Abstract written by, Karan Singh |

|||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - Feb 21st, 2016 to Feb 27th, 2016 | |||

| TIPPING POINTS - This Week - Normally a Tuesday Focus | |||

| BOND BUBBLE | 1 | ||

| RISK REVERSAL - WOULD BE MARKED BY: Slowing Momentum, Weakening Earnings, Falling Estimates | 2 | ||

| GEO-POLITICAL EVENT | 3 | ||

| CHINA BUBBLE | 4 | ||

| JAPAN - DEBT DEFLATION | 5 | ||

EU BANKING CRISIS |

6 |

||

| TO TOP | |||

| MACRO News Items of Importance - This Week | |||

GLOBAL MACRO REPORTS & ANALYSIS |

|||

US ECONOMIC REPORTS & ANALYSIS |

|||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||

| Market - WEDNESDAY STUDIES | |||

| STUDIES - MACRO pdf | |||

TECHNICALS & MARKET |

|

||

| COMMODITY CORNER - AGRI-COMPLEX | |||

| THESIS - Mondays Posts on Financial Repression & Posts on Thursday as Key Updates Occur | |||

|

2016 | THESIS 2016 |  |

| 2015 - FIDUCIARY FAILURE | 2015 | THESIS 2015 |  |

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|

|

2013 2014 |

|||

2011 2012 2013 2014 |

|||

| THEMES - Normally a Thursday "Themes" Post & a Friday "Flows" Post | |||

I - POLITICAL |

|||

CENTRAL PLANNING - SHIFTING ECONOMIC POWER - STATISM

MACRO MAP - EVOLVING ERA OF CENTRAL PLANNING

|

G | THEME | |

| - - CRISIS OF TRUST - Era of Uncertainty | G | THEME | |

CORRUPTION & MALFEASANCE - MORAL DECAY - DESPERATION - RESENTMENT. |

US | THEME PAGE |  |

| - - SECURITY-SURVEILLANCE COMPLEX - STATISM | G | THEME | |

| - - CATALYSTS - FEAR (POLITICALLY) & GREED (FINANCIALLY) | G | THEME | |

II-ECONOMIC |

|||

| GLOBAL RISK | |||

| - GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | G | THEME | |

| - - SOCIAL UNREST - INEQUALITY & A BROKEN SOCIAL CONTRACT | US | THEME | |

| - - ECHO BOOM - PERIPHERAL PROBLEM | M | THEME | |

| - -GLOBAL GROWTH & JOBS CRISIS | |||

| - - - PRODUCTIVITY PARADOX - NATURE OF WORK | THEME | MA w/ CHS |

|

| 01-08-16 | THEME | MA w/ CHS |

|

| - - - STANDARD OF LIVING - EMPLOYMENT CRISIS, SUB-PRIME ECONOMY | US | THEME | MA w/ CHS |

III-FINANCIAL |

|||

|

FLOWS - Liqudity, Credit & Debt

|

MATA RISK ON-OFF |

THEME | |

| CRACKUP BOOM - ASSET BUBBLE | 12-31-15 | THEME | |

| SHADOW BANKING - LIQUIDITY / CREDIT ENGINE | M | THEME | |

| GENERAL INTEREST |

|

||

| STRATEGIC INVESTMENT INSIGHTS - Weekend Coverage | |||

|

|||

|

SII | ||

|

SII | ||

|

SII | ||

|

SII | ||

|

02-20-16 | SII | |

| TO TOP | |||

Read More - OUR RESEARCH - Articles Below

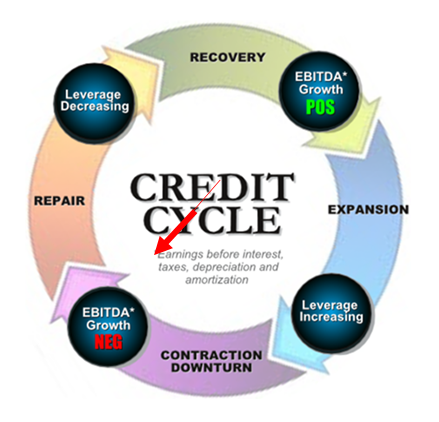

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP