|

JOHN RUBINO'SLATEST BOOK |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

"MELT-UP MONITOR " Meltup Monitor: FLOWS - The Currency Cartel Carry Cycle - 09 Dec 2013 Meltup Monitor: FLOWS - Liquidity, Credit & Debt - 04 Dec 2013 Meltup Monitor: Euro Pressure Going Critical - 28- Nov 2013 Meltup Monitor: A Regression-to-the-Exponential Mean Required - 25 Nov 2013

|

"DOW 20,000 " Lance Roberts Charles Hugh Smith John Rubino Bert Dohman & Ty Andros

|

HELD OVER

Currency Wars

Euro Experiment

Sultans of Swap

Extend & Pretend

Preserve & Protect

Innovation

Showings Below

"Currency Wars "

|

"SULTANS OF SWAP" archives open ACT II ACT III ALSO Sultans of Swap: Fearing the Gearing! Sultans of Swap: BP Potentially More Devistating than Lehman! |

"EURO EXPERIMENT"

archives open EURO EXPERIMENT : ECB's LTRO Won't Stop Collateral Contagion!

EURO EXPERIMENT: |

"INNOVATION"

archives open |

"PRESERVE & PROTE CT"

archives open |

Fri. Apr. 4th, 2014

Follow Our Updates

on TWITTER

https://twitter.com/GordonTLong

AND FOR EVEN MORE TWITTER COVERAGE

STRATEGIC MACRO INVESTMENT INSIGHTS

2014 THESIS: GLOBALIZATION TRAP

2014 THESIS: GLOBALIZATION TRAP

NOW AVAILABLE FREE to Trial Subscribers

185 Pages

What Are Tipping Poinits?

Understanding Abstraction & Synthesis

Global-Macro in Images: Understanding the Conclusions

| MARCH | ||||||

| S | M | T | W | T | F | S |

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 | 29 |

| 30 | 31 | |||||

| 1 | 2 | 3 | 4 | 5 | ||

KEY TO TIPPING POINTS |

| 1 - Risk Reversal |

| 2 - Japan Debt Deflation Spiral |

| 3- Bond Bubble |

| 4- EU Banking Crisis |

| 5- Sovereign Debt Crisis |

| 6 - China Hard Landing |

| 7 - Chronic Unemployment |

| 8 - Geo-Political Event |

| 9 - Global Governance Failure |

| 10 - Chronic Global Fiscal ImBalances |

| 11 - Shrinking Revenue Growth Rate |

| 12 - Iran Nuclear Threat |

| 13 - Growing Social Unrest |

| 14 - US Banking Crisis II |

| 15 - Residential Real Estate - Phase II |

| 16 - Commercial Real Estate |

| 17 - Credit Contraction II |

| 18- State & Local Government |

| 19 - US Stock Market Valuations |

| 20 - Slowing Retail & Consumer Sales |

| 21 - China - Japan Regional Conflict |

| 22 - Public Sentiment & Confidence |

| 23 - US Reserve Currency |

| 24 - Central & Eastern Europe |

| 25 - Oil Price Pressures |

| 26 - Rising Inflation Pressures & Interest Pressures |

| 27 - Food Price Pressures |

| 28 - Global Output Gap |

| 29 - Corruption |

| 30 - Pension - Entitlement Crisis |

| 31 - Corporate Bankruptcies |

| 32- Finance & Insurance Balance Sheet Write-Offs |

| 33 - Resource Shortage |

| 34 - US Reserve Currency |

| 35- Government Backstop Insurance |

| 36 - US Dollar Weakness |

| 37 - Cyber Attack or Complexity Failure |

| 38 - Terrorist Event |

| 39 - Financial Crisis Programs Expiration |

| 40 - Natural Physical Disaster |

| 41 - Pandemic / Epidemic |

Reading the right books?

No Time?

We have analyzed & included

these in our latest research papers Macro videos!

![]()

OUR MACRO ANALYTIC

CO-HOSTS

John Rubino's Just Released Book

Charles Hugh Smith's Latest Books

Our Macro Watch Partner

Richard Duncan Latest Books

MACRO ANALYTIC

GUESTS

F William Engdahl

OTHERS OF NOTE

Book Review- Five Thumbs Up

for Steve Greenhut's

Plunder!

|

Scroll TWEETS for latest Analysis

Read More - OUR RESEARCH - Articles Below

HOTTEST TIPPING POINTS |

Theme Groupings |

||||||||||||||||

|

|||||||||||||||||

We post throughout the day as we do our Investment Research for: LONGWave - UnderTheLens - Macro |

|||||||||||||||||

"BEST OF THE WEEK " |

Posting Date |

Labels & Tags | TIPPING POINT or THEME / THESIS or INVESTMENT INSIGHT |

||||||||||||||

|

|||||||||||||||||

|

|||||||||||||||||

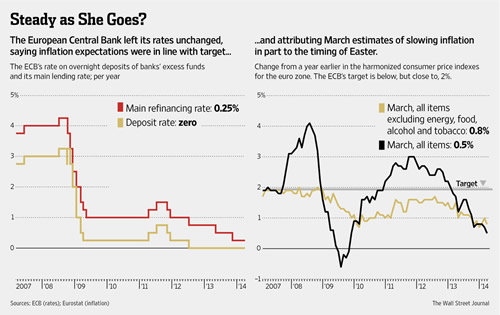

ECB APRIL MEETING - No Easing

SIGNALS:

No ECB easing despite fear of stagnation Danske Bank

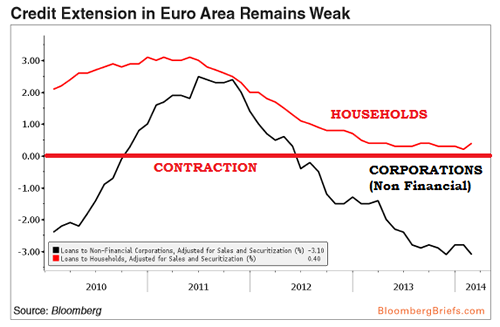

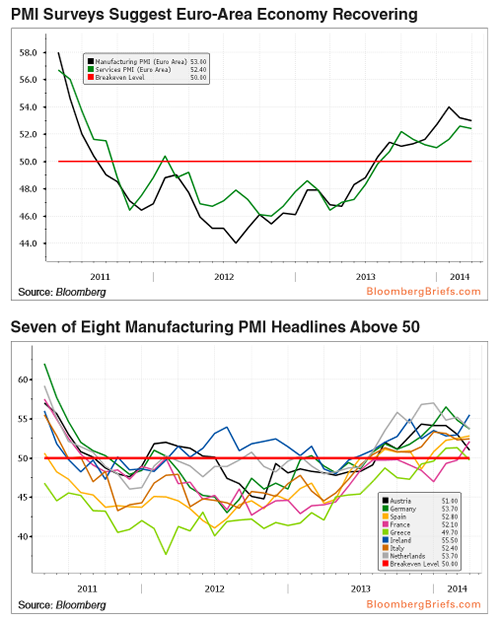

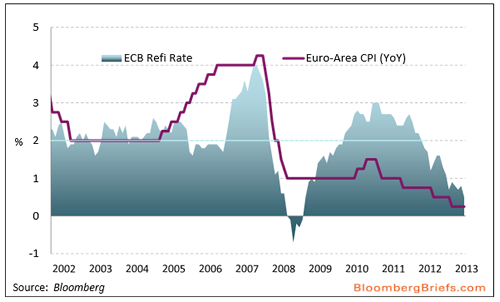

Mario Draghi’s biggest fear for the euro area is protracted stagnation. Nevertheless, the ECB did not ease today. An interesting part of today’s ECB meeting was that the Governing Council discussed a quantitative easing (QE) programme. Last month , Draghi slightly opened the door for this, as he mentioned QE while listing a number of easing measures. Today , he was much more direct and said the Council is ‘unanimous on unconventional tools’. The ECB also discussed negative deposit rates as well as

Hence, it seemed that Draghi tried to use his old strategy of verbal intervention but it had only a marginal market influence. Could it be that markets are starting to get tired of soft words and now want action? At the latest meeting , Draghi focused on the recovery and how things had start ed to look better but today focus was back on inflation. The message from Draghi seems to be that another negative surprise on inflation w ou l d lead to more easing , as this is very likely to change the ECB’ s outlook for inflation. So far , it i s too early for the ECB to conclude whether the outlook has changed and i t maintained its wait - and - see approach. In our view , the ECB is too optimistic on inflation and we will get more negative surprises. Based on Drag hi’s communication today, we expect th is to lead to further easing. In our view the timing is still very unsure. We think the ECB’s inflation forecast is too optimistic for Q2 but in coming months base effects are likely to lead to higher inflation, which would buy the ECB some time. Hence , it could be that the ECB will remain on hold until H2. Moreover, the tool is also very uncertain. Although the Governing Council is now considering a QE programme , it looks as though it has not found a preferred tool to use in fighting low inflation. As expectations going into today’s meeting were lighter than previous meetings in 2014, the disappointment o f unchanged policy has not had a great influence o n the fixed income market. German 10Y moved marginally during the E CB meeting and most selling pressure was observed at the front of the Euribor and Eonia curve, as we now h av e confirmation of unchanged liquidity dynamics in the next maintenance period , including the usual volatile period of Easter. However, as QE was a m ore explicit subject at today’s meeting , peripheral spreads are tighter on the day. Draghi: ECB Open to Further Easing 04-03-14 WSJ Euro Weakens After Central Bank Chief Says Officials Discussed Possibility of Asset Purchases

FRANKFURT—The European Central Bank opened the door Thursday to the kind of extraordinary stimulus measures it has long resisted, even as its counterparts in the U.S. and elsewhere are winding down theirs, reflecting mounting fears about threats to Europe's economic recovery. President Mario Draghi's revelation that the central bank had discussed negative interest rates and large-scale bond purchases—if needed to keep persistently low inflation from undermining growth—caught financial markets by surprise. The ECB, as expected, held its main lending rate at the record low of 0.25%, where it has been since November. But the euro weakened at the ratcheting up of the rhetoric concerning the possibility of action as early as next month. Mr. Draghi said officials had discussed asset purchases, known as quantitative easing, as well as setting a negative rate on bank deposits parked at the ECB—moves that could help bolster the economic recovery and push up prices. The annual inflation rate in the euro zone is just 0.5%, far below the bank's target of just under 2%. "We don't exclude further monetary-policy easing," Mr. Draghi said at his monthly news conference. He also peppered his comments with much more aggressive language than he has used in recent month. The ECB is "resolute" in its determination to keep its easy-money policies in place, he said, and "to act swiftly if required." And whereas a handful of ECB members have signaled an openness to more action in recent days, Mr. Draghi put the weight of the full ECB behind it. He said the 24-member board—which includes Germany's ultracautious Bundesbank—was "unanimous in its commitment" to deploy "unconventional instruments" at its disposal if inflation stays too low for too long. After he spoke, Spanish and Italian government bonds extended their recent rallies, with Italy's 10-year bond yields falling to an eight-year low. Mr. Draghi "has elevated the threat level about further action," said Nick Matthews, economist at Nomura International. "I don't think you can be any more dovish without actually doing something," he said. "Dovish" is used to describe central bankers who are more worried about weak growth than they are about inflation. Mr. Draghi's comments suggest reducing interest rates would be a first step. A negative deposit rate—it is currently zero—would force financial institutions to pay to park their excess funds at the ECB, which may encourage them to lend more to the private sector. Denmark has deployed negative rates since 2012, but it would be largely unchartered territory for a major central bank such as the ECB. Quantitative easing is more complicated in the euro zone than in the U.S., where the Federal Reserve has deployed the policy and continues to do so, albeit at a scaled-back pace. Asset purchases in the U.S. filter quickly to its economy because relatively more borrowing there is done through the capital markets, Mr. Draghi noted. The Bank of England has accumulated about £375 billion ($622 billion) in government bonds since 2009, but hasn't made any new purchases since November 2012. The U.K. economy has expanded much more vigorously than the euro zone's in recent years, and inflation is significantly higher. But the euro zone has 18 national bond markets to deal with, making it hard to design a policy for the entire region. And the euro bloc is much more reliant on bank lending than the U.S., meaning that even if the ECB bought private and public debt, this may not be quickly transmitted to the economy. Still, the ECB had a "rich and ample discussion" on quantitative easing and other measures, Mr. Draghi said, and will continue to study it. Pressure on the ECB to act has grown since a report released Monday showed that inflation softened to just 0.5% in March, a more than four-year low. A surprisingly weak inflation figure of 0.7% in October triggered the ECB rate cut last November. But Mr. Draghi said the central bank wants more time this time to gauge the longer-term outlook. He noted that Easter occurs later this year than in 2013. That means typical price rises for such things as holiday-related travel will occur in April rather than March. Officials are also eyeing the effect of the relatively strong euro on consumer prices, he said. This sets up the April inflation report as a key one for the ECB, analysts said. ECB Vice President Vitor Constancio said on Tuesday that the central bank expects "that the low figure of inflation in March will be corrected" in April. If that fails to happen, however, the ECB may move as early as next month, Mr. Matthews said. The Organization for Economic Cooperation and Development reported Thursday that deflation risks in the euro area have risen, with Greece, Cyprus and Spain already suffering from it. The Paris-based think tank called on the ECB to consider "additional nonconventional measures" if the problem intensified. Typically, low inflation is a good thing. It keeps long-term interest rates anchored and provides a stable environment for households and business to spend and invest. But when it is too weak, consumers may put off purchases, hoping they will get a better deal if they wait. It also makes it harder for households, firms and governments to service their debts, because wages and tax revenue don't rise as much. These risks intensify when prices fall outright for a prolonged stretch, known as deflation. Japan has struggled with these effects for two decades. Mr. Draghi rejected, as he has numerous times before, fears of deflation in Europe. Still, even too-low inflation carries risks. The closer inflation is to zero, the easier it is for an adverse shock from the economy or geopolitical uncertainty to push the rate into negative territory. For this reason, major central banks such as the ECB and Fed aim to keep inflation around 2%.

Business surveys and consumer spending reports suggest the recovery gathered some pace during the first quarter, led by Europe's largest economy, Germany. Still, Mr. Draghi cited the economy as his biggest fear, and emphasized the need for government efforts to make labor markets more flexible. The longer high unemployment persists, the greater the chances that it will become structural rather than temporary, he said. "The protracted stagnation…even right now it's pretty severe," he said.

|

|||||||||||||||||

| MOST CRITICAL TIPPING POINT ARTICLES THIS WEEK - March 30th - April 6th, 2014 | |||||||||||||||||

| RISK REVERSAL | 1 | ||||||||||||||||

| JAPAN - DEBT DEFLATION | 2 | ||||||||||||||||

| BOND BUBBLE | 3 | ||||||||||||||||

EU BANKING CRISIS |

4 |

||||||||||||||||

| SOVEREIGN DEBT CRISIS [Euope Crisis Tracker] | 5 | ||||||||||||||||

| CHINA BUBBLE | 6 | ||||||||||||||||

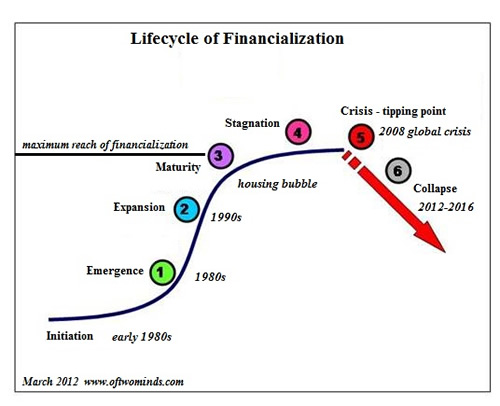

CHINA - What Happens After the Low-Hanging Fruit Has Been Picked? 04-02-14 Charles Hugh Smith Right now China is at the top of the S-Curve, and the problems of stagnation are still ahead.

What happens after all the low-hanging fruit has been picked? USA: Why the global financial meltdown occurred in 2008 HOUSING

CHINA:

I think we can shed some insightful analytic light by saying that the low-hanging fruit in China has all been plucked, and this creates an entirely new set of problems and challenges.

This pattern of rapid growth, maturity and stagnation can be seen in the S-Curve, a pattern that natural and human-made systems alike track.

In other words, all the low-hanging fruit of infrastructure have been picked. HOUSING

CREDIT EXPANSION & MARGINAL INVESTMENTS The other problem is that the low-hanging fruit have all been stripped via an unprecedented expansion of credit. Credit has a pernicious characteristic: it inevitably leads to diminishing returns as low-value,high-risk projects get funded in the rush to build anything and everything everywhere. In other words, once the high-value low-hanging fruit has been picked, the sensible, high-value investment opportunities have all been taken and all that's left is marginal malinvestments. 1- SUSTAINING ASSUMPTION: Every Building Project will be Filled

2- SUSTAINING ASSUMPTION: Expectations of Future Prosperity

3- SUSTAINING ASSUMPTION: Excess is Built Into the Culture Fabric

REALITIES Right now China is at the top of the S-Curve, and these problems of stagnation are still ahead. The most severe challenge in my view is not material or fiscal, it's psychological: when sky-high expectations crash to earth, social discord starts its own S-Curve of rapid growth. This year a total of 6.99 million students graduated with a master's, bachelor's or technical college degree in China, an increase of 190,000 from 2012. In contrast, the number of jobs available decreased by 15 percent compared with 2012, according to China Youth, a state-run youth newspaper. Combined, these statistics mean a large portion of graduates will not have a job coming out of school. |

6 - China Hard Landing | ||||||||||||||||

GLOBAL OUTLOOK -The Old World Order Is Over Mark Faber: The Old World Order Is Over 03-31-14 Via Callum Denness of Money Morning blog, In the gilded ballroom of Hyatt’s Savoy ballroom, World War D‘s opening speaker Dr Mark Faberdelivered a blunt message: the old world order is over. ‘The US reached a peak in prosperity and influence in the world in the 1950s or 1960s,’ said Faber. But since the 70s the superpower has been locked into a cycle of bubbles, busts and growing debt. Debt, and the way it has manipulated the global economy, was the main theme of Faber’s address. ‘There are some people who claim to be economists who will tell you debts do not matter,’ Faber told the packed ballroom. But the real story is different…. Faber explained the flaw at the heart of expansionary monetary policy (such as QE). ‘When you drop dollar bills into the economy…it won’t lift all prices and assets equally at the same time,’ he said. In the 60s and 70s, extra money flowing through the economy inflated wages; in the early 2000s, money printing inflated commodities. But, Faber points out, this price and asset growth is never equal. In other words, money printing creates more bubbles. Some assets go up, they overshoot, collapse and cause significant damage which necessitates, in the view of the US Federal Reserve, more money printing. It is a vicious cycle we’ve seen since the 70s: each time there was an economic problem, the Fed printed money and created more distortions. Bernanke’s tenure saw this trend continue, and when it came to assessing the former Fed chairman, Faber didn’t mince his words. ’He’s been a disaster,‘ Faber said drily. Faber pointed out that not only did Bernanke not notice the subprime disaster, he actually helped create it. ‘Under his tenure at the Federal Reserve and under his intellectual influence when working for Mr Greenspan they created the gigantic housing bubble,‘ he said. At the heart of this expansion in debt, and cycle of bubbles and busts is the reliance of the US economy on consumption. For the last century, policy makers have encouraged consumption on all levels of society including government, and discouraged savings. But according to Faber, Consumption doesn’t create a strong economy. ‘Wealth doesn’t come from consumerism, it comes from capital spending‘ And the problem for the US economy is that while debt has continued to rise, capital investment hasn’t. In fact, it’s been falling sharply for a long time. ‘If we have growing debts, there’s a difference in quality of those debts,‘ he said. Japan, South Korea and Taiwan used their debts to invest in factories, plants…investments that generated wealth. According to Faber however, the US has just acquired debt to fuel consumption. ‘Where’s the future income?‘ he asked. Faber used this as an opportunity to strike a note of caution for Australia, warning the room that one day Australia’s indebted housing sector won’t be able to borrow much more. It will then enter a period of contraction or very slow growth. That was his warning to Australia: then came the opportunity. ‘We live in a new word. We live in a world where the balance of power has shifted to emerging countries'. He was of course, talking about China. While China’s growth story is well known, Faber gave the audience an important geopolitical sub story. China’s massive growth triggered massive commodity export booms in emerging economies. China’s real success was exporting the products it produced back to emerging economies. This has created a significant shift in the global economy: exports from China to emerging countries are higher than exports to the US or Europe. ‘This is the new world, where the old world is largely bypassed, While most of the media debates whether the US will grow, Faber argues it will have no impact on the world, as China has a much greater influence now than the US. Faber is no bull on China however, and warned he would be very careful about investing there. Faber sees conditions at the present time as much worse than many people realise. There are also geopolitical concerns that are often left unexamined. Take oil. Oil consumption in China – most of which comes from the Middle East – will rise. ‘The Middle East in my opinion will go up in flames at some point, that will be an unpleasant event,‘ predicted Faber in his typically apocalyptic but still understated way. For Australia, he sees opportunities in the huge numbers of Chinese tourists travelling abroad, but he believes Australia has made a huge mistake by tolerating US bases on its continent. ‘China will not sit by and let themselves be bossed around by the US,‘ he said. His final message reiterated the failure of the US Federal Reserve. Corporate profits had been boosted by artificially low interest rates; wealth inequality is on the rise; and to compound it all, he says the Fed won’t raise interest rates anytime soon. Punctuated by flashes of humour and dire warnings, it was a sober message that the attentive audience lapped up |

04-02-14 | GLOBAL OUTLOOK | 10 - Chronic Global Fiscal ImBalances | ||||||||||||||

| TO TOP | |||||||||||||||||

| MACRO News Items of Importance - This Week | |||||||||||||||||

GLOBAL MACRO REPORTS & ANALYSIS |

|||||||||||||||||

UKRAINE - BRICS Back Russia On Crimea Why Did BRICS Back Russia On Crimea? 03-31-14 Zachary Zeck of The Diplomat, via ZH There’s been no shortage of reports and commentaries on the crisis in Ukraine and Crimea, and Russia’s role in it. Yet one of the more notable recent developments in the crisis has received surprisingly little attention. Namely, the BRICS grouping (Brazil, Russia, India, China, and South Africa) has unanimously and, in many ways, forcefully backed Russia’s position on Crimea. The Diplomat has reported on China’s cautious and India’s more enthusiastic backing of Russia before. However, the BRICS grouping as a whole has also stood by the Kremlin. Indeed, they made this quite clear during a BRICS foreign minister meeting that took place on the sidelines of the Nuclear Security Summit in The Hague last week. Just prior to the meeting, Australian Foreign Minister Julie Bishop suggested that Australia might ban Russia’s participation in the G20 summit it will be hosting later this year as a means of pressuring Vladimir Putin on Ukraine. The BRICS foreign ministers warned Australia against this course of action in the statement they released following their meeting last week. “The Ministers noted with concern the recent media statement on the forthcoming G20 Summit to be held in Brisbane in November 2014,” the statement said. “The custodianship of the G20 belongs to all Member States equally and no one Member State can unilaterally determine its nature and character.” The statement went on to say, “The escalation of hostile language, sanctions and counter-sanctions, and force does not contribute to a sustainable and peaceful solution, according to international law, including the principles and purposes of the United Nations Charter.”As Oliver Stuenkel at Post Western World noted, the statement as a whole, and in particular the G20 aspect of it, was a “clear sign that [the] West will not succeed in bringing the entire international community into line in its attempt to isolate Russia.” This was further reinforced later in the week when China, Brazil, India and South Africa (along with 54 other nations) all abstained from the UN General Assembly resolution criticizing the Crimea referendum. Another ten states joined Russia in voting against the non-binding resolution. In some ways, the other BRICS countries’ support for Russia is entirely predictable. Thegroup has always been somewhat constrained by the animosities that exist between certain members, as well as the general lack of shared purpose among such different and geographically dispersed nations. BRICS has often tried to overcome these internal challenges by unifying behind an anti-Western or at least post-Western position. In that sense, it’s no surprise that the group opposed Western attempts to isolate one of its own members. At the same time, this anti-Western stance has usually taken the form of BRICS opposition to Western attempts to place new limits on sovereignty. Since many of its members are former Western colonies or quasi-colonies, the BRICS are highly suspicious of Western claims that sovereignty can be trumped by so-called universal principles of the humanitarian and anti-proliferation variety. Thus, they have been highly critical of NATO’s decision to serve as the air wing of the anti-Qaddafi opposition that overthrew the Libyan government in 2011, as well as what they perceive as attempts by the West to now overthrow Bashar al-Assad in Syria. However, in the case of Ukraine, it was Russia that was violating the sanctity of another state’s sovereignty. Still, the BRICS grouping has backed Russia. It’s worth noting that the BRICS countries are supporting Russia at potentially great cost to themselves, given that they all face at least one potential secessionist movement within their own territories. India, for example, has a long history of fluid borders and today struggles with potential secessionist movements from Muslim populations as well as a potent security threat from the Maoist insurgency. China suffers most notably from Tibetans and Uyghurs aspiring to break away from the Han-dominated Chinese state. Even among Han China, however, regional divisions have long challenged central control in the vast country. Calls for secession from the Cape region in South Africa have grown in recent years, and Brazil has long faced a secessionist movement in its southern sub-region, which is dominated demographically by European immigrants. Russia, of course, faces a host of internal secessionist groups that may someday lead Moscow to regret its annexation of Crimea. The fact that BRICS supported Russia despite these concerns suggests that its anti-Western leanings may be more strongly held than most previously believed. Indeed, besides backing Russia in the foreign ministers’ statement, the rising powers also took time to harshly criticize the U.S. (not by name) for the cyber surveillance programs that were revealed by Edward Snowden. The BRICS and other non-Western powers’ support for Russia also suggests that forging anything like an international order will be extremely difficult, given the lack of shared principles to act as a foundation. Although the West generally celebrated the fact that the UN General Assembly approved the resolution condemning the Crimea referendum, the fact that 69 countries either abstained or voted against it should be a wake-up call. It increasingly appears that the Western dominated post-Cold War era is over. But as of yet, no new order exists to replace it. |

04-01-14 | GLOBAL-GEO-POLITICAL-GROUP-UKRAINE- | GLOBAL MACRO |

||||||||||||||

US ECONOMIC REPORTS & ANALYSIS |

|||||||||||||||||

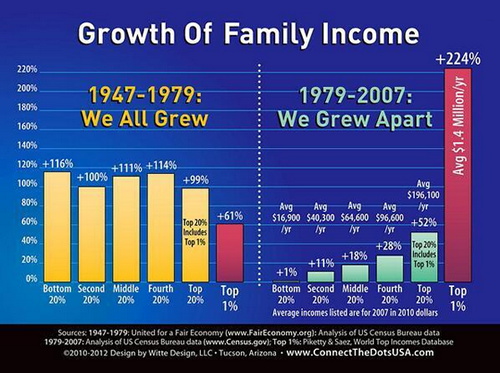

US ECONOMY - Golden Era of the 1950s/60s Was an Anomaly, Not the Default Setting The Golden Era of the 1950s/60s Was an Anomaly, Not the Default Setting 03-28-14 Charles Hugh Smith The 1950s/60s were not "NORMAL"--they were a one-off, extraordinary ANOMALY. Golden Era of the 1950s and 60s:

SITUATIONAL ANALYSIS The 1950s/60s was wasn't normal--it was a one-off anomaly, never to be repeated. Consider the backdrop of this Golden Era:

TRIFFINS PARADOX All those conditions went away as global competition heated up and the demand for dollars outstripped supply.

EXPORT LED TO IMPORT (CONSUMPTION) LED

You can't issue a reserve currency, export that currency in size and peg it to gold. LABOR ARBITRAGE In a global marketplace for goods and services, all sorts of things become tradable, including labor.

CHEAP ENERGY And very importantly, oil is no longer cheap. The primary fuel for industrial and consumerist economies is no longer cheap. That reality sets all sorts of constraints on growth that central states and banks have tried to get around by blowing credit bubbles. That works for a while and then ends very badly. The 1950s/60s were not "normal"--they were a one-off, extraordinary anomaly. |

04-03-14 | US PUBLIC POLICY

GEO POLITICAL GROUP' RESERVE CURRENCY GLOBAL IMBALANCE |

US ECONOMICS |

||||||||||||||

| CENTRAL BANKING MONETARY POLICIES, ACTIONS & ACTIVITIES | |||||||||||||||||

US MONETARY - Why "Tapering" Is a Mirage and the Fed May Be Loosening Instead Duration Risk: Why "Tapering" Is a Mirage and the Fed May Be Loosening Instead 06-27-14 Cris Sheridan FSN John Butler made an interesting comment in his recent interview with the Financial Sense Newshour. He said, when you look at the Fed’s balance sheet, one can argue that the Fed really isn’t pulling back on its stimulus to the markets at all. In fact, Butler explained, it may actually be loosening instead:

In case you don’t understand the above, what Butler is saying is that while the Fed is buying less and less debt each month in dollar terms, it is simultaneously buying a larger amount of long-dated bonds, which has the overall effect of keeping conditions loose. Here’s a recent chart from the St. Louis Fed showing how they’ve ramped up their purchase of long-dated Treasuries (ten years or more) over the last few years, while pulling back on shorter maturities:

With the above in mind, Butler stated that tapering "is something of a mirage…as long as the Fed continues to absorb more and more long-dated bonds, the banks will have an incentive to increase lending and leverage, notwithstanding the ‘taper’.” Via email, Butler explained in more detail why this is so:

In the FT article, Brian Sack, executive vice president of the Federal Reserve Bank of New York, explained how the Fed views this very process of increasing the duration risk of its portfolio as an important aspect of stimulus:

Later in the interview, Butler noted that the reason the market probably hasn't reacted that much to the "taper" so far is precisely for this reason:

|

03-31-14 | US MONETARY | CENTRAL BANKS |

||||||||||||||

| Market | |||||||||||||||||

| TECHNICALS & MARKET |

|

||||||||||||||||

Q1 EARNINGS - Scramble to Pre-Announce Earning Estmate Reductions

|

04-02-14 | Q1 EARNINGS | |||||||||||||||

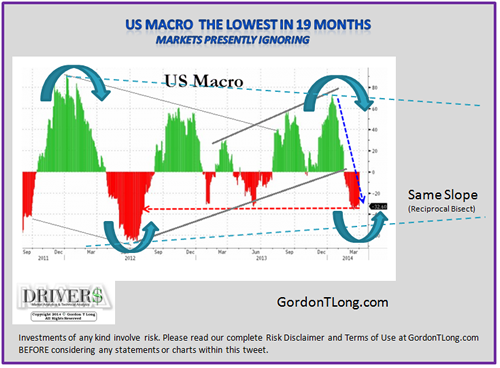

Q1 EARNINGS - GLOBAL GDP ESTIMATE TAKEN DOWN GDP estimates for 2014 of 2.78% which is a 15% shrinkage in expectations from one year ago.

US Q1 GDP ESTIMATE TAKEN DOWN DRAMATICALLY

US MACRO Top-down economic data has plunged to its lowest in 19 months

EARNINGS TAKEN DOWN BY 5%

MID-TERM PRESIDENTIL ELECTION CYCLE

|

04-01-14 | Q1 EARNINGS

INDICATORS GROWTH |

|||||||||||||||

| COMMODITY CORNER - HARD ASSETS | PORTFOLIO | ||||||||||||||||

GOLD - The Only Long Term "Buy and Hold" Asset in a Fiat Currency Regime. The chart below is in normalized terms courtesy of Bill King’s The King Report. According to King, Gold has risen 37.43 fold since 1967. That is more than twice the performance of the Dow over the same time period (18.45 fold). So much for the claim that stocks are a better investment than Gold long-term. Indeed, once Gold was no longer pegged to world currencies there was only a single period in which stocks outperformed the precious metal. That period was from 1997-2000 during the height of the Tech Bubble (the single biggest stock market bubble in over 100 years). In simple terms, as a long-term investment, Gold has been better than stocks.

|

04-02-14 | PRECIOUS METALS |

PRECIOUS METALS Read this Month's

|

||||||||||||||

| COMMODITY CORNER - AGRI-COMPLEX | PORTFOLIO | ||||||||||||||||

| SECURITY-SURVEILANCE COMPLEX | PORTFOLIO | ||||||||||||||||

| THESIS | |||||||||||||||||

| 2014 - GLOBALIZATION TRAP | 2014 |  |

|||||||||||||||

|

2013 2014 |

|||||||||||||||||

2011 2012 2013 2014 |

|||||||||||||||||

| THEMES | |||||||||||||||||

| FLOWS -FRIDAY FLOWS | THEME | ||||||||||||||||

| SHADOW BANKING -LIQUIDITY / CREDIT ENGINE | THEME | ||||||||||||||||

| CRACKUP BOOM - ASSET BUBBLE | THEME | ||||||||||||||||

| ECHO BOOM - PERIPHERAL PROBLEM | THEME | ||||||||||||||||

| PRODUCTIVITY PARADOX -NATURE OF WORK | THEME | ||||||||||||||||

| STANDARD OF LIVING -EMPLOYMENT CRISIS | THEME | ||||||||||||||||

| CORPORATOCRACY -CRONY CAPITALSIM | THEME |  |

|||||||||||||||

CORRUPTION & MALFEASANCE -MORAL DECAY - DESPERATION, SHORTAGES. |

THEME |  |

|||||||||||||||

| SOCIAL UNREST -INEQUALITY & A BROKEN SOCIAL CONTRACT | THEME | ||||||||||||||||

THE GLOABL ECONOMIC ENGINE - Has been Dismantled!

|

04-03-14 | THEMES

US PUBLIC_POLICY |

SOCIAL UNREST |

||||||||||||||

| SECURITY-SURVEILLANCE COMPLEX -STATISM | THEME | ||||||||||||||||

| GLOBAL FINANCIAL IMBALANCE - FRAGILITY, COMPLEXITY & INSTABILITY | THEME | ||||||||||||||||

| CENTRAL PLANINNG -SHIFTING ECONOMIC POWER | THEME | ||||||||||||||||

| CATALYSTS -FEAR & GREED | THEME | ||||||||||||||||

| GENERAL INTEREST |

|

||||||||||||||||

| TO TOP | |||||||||||||||||

Tipping Points Life Cycle - Explained

Click on image to enlarge

TO TOP

�

TO TOP